doc

advertisement

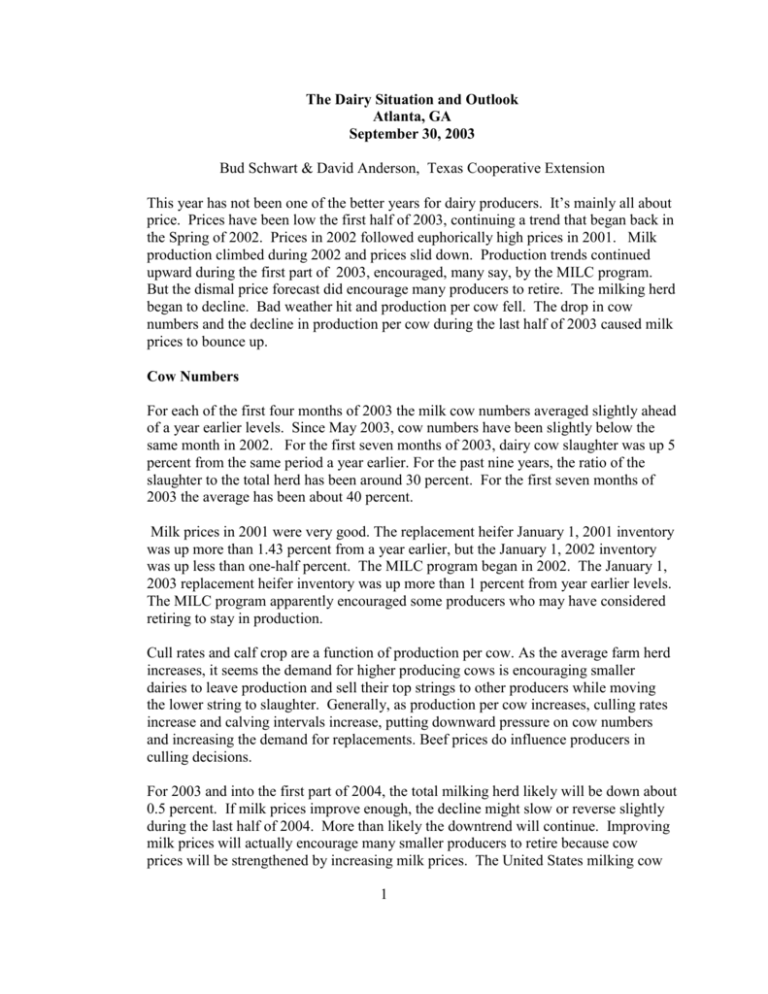

The Dairy Situation and Outlook Atlanta, GA September 30, 2003 Bud Schwart & David Anderson, Texas Cooperative Extension This year has not been one of the better years for dairy producers. It’s mainly all about price. Prices have been low the first half of 2003, continuing a trend that began back in the Spring of 2002. Prices in 2002 followed euphorically high prices in 2001. Milk production climbed during 2002 and prices slid down. Production trends continued upward during the first part of 2003, encouraged, many say, by the MILC program. But the dismal price forecast did encourage many producers to retire. The milking herd began to decline. Bad weather hit and production per cow fell. The drop in cow numbers and the decline in production per cow during the last half of 2003 caused milk prices to bounce up. Cow Numbers For each of the first four months of 2003 the milk cow numbers averaged slightly ahead of a year earlier levels. Since May 2003, cow numbers have been slightly below the same month in 2002. For the first seven months of 2003, dairy cow slaughter was up 5 percent from the same period a year earlier. For the past nine years, the ratio of the slaughter to the total herd has been around 30 percent. For the first seven months of 2003 the average has been about 40 percent. Milk prices in 2001 were very good. The replacement heifer January 1, 2001 inventory was up more than 1.43 percent from a year earlier, but the January 1, 2002 inventory was up less than one-half percent. The MILC program began in 2002. The January 1, 2003 replacement heifer inventory was up more than 1 percent from year earlier levels. The MILC program apparently encouraged some producers who may have considered retiring to stay in production. Cull rates and calf crop are a function of production per cow. As the average farm herd increases, it seems the demand for higher producing cows is encouraging smaller dairies to leave production and sell their top strings to other producers while moving the lower string to slaughter. Generally, as production per cow increases, culling rates increase and calving intervals increase, putting downward pressure on cow numbers and increasing the demand for replacements. Beef prices do influence producers in culling decisions. For 2003 and into the first part of 2004, the total milking herd likely will be down about 0.5 percent. If milk prices improve enough, the decline might slow or reverse slightly during the last half of 2004. More than likely the downtrend will continue. Improving milk prices will actually encourage many smaller producers to retire because cow prices will be strengthened by increasing milk prices. The United States milking cow 1 herd is declining about one percent per year, and this trend likely will continue for a while. The CWT program will help pull cow numbers down. Lenders are expected to tighten credit requirements,lending standards and market cash flows more closely. These actions will slow herd expansion plans for many dairy producers. The western state will continue to gain a larger share of the US milking herd, while the East, Cornbelt, Lake States, and South stabilize or decline in their respective shares. Much of this is environment driven. Texas Extension economists estimate the number of commercial dairy farms in the US is dropping about five percent per year, and the average dairy farm herd size is increasing about four percent per year. These trends likely will continue but at a faster pace in the next two to three years. Production per Cow The NASS, USDA September Twenty-State milk production report showed August production per cow down seven pounds from year earlier levels. The fifty state August production per cow was down one pound from year earlier levels. Most of this decline has been attributed to weather, upward creeping feed prices, and the power blackout. However, total milk production per cow for the first eight months of 2003 for all fifty states was up 59 pounds per cow from year earlier levels. The thirty, non-surveyed states contributed most of this increase. Many of these states have smaller producers who took advantage of MILC. In some areas, local feed prices jumped dramatically due to drought and poor crops. Milk feed ratios have declined, but there can be a substantial lag time before producers cut production per cow in response. Forward contracting and hedging of feed coupled with feed substitution and sourcing feed from many other areas dull the impacts of lower milk-feed ratios. There are reports from producers that they have adjusted feed rations because of low milk prices. Dairy Herd Improvement regional summaries from the Raleigh center, suggest that dairy producers are somewhat concerned with changing the amounts of forage and concentrate in the cow’s diet. In August 2000, cows on test in the center consumed about 35 pounds of silage and forages, and 17 pounds of concentrate and other feeds. In August 2001 those values were 36 pounds of silage and forages, and 16 pounds of concentrates and other feeds. In 2002 those values were 33 pounds and 15 pounds, and in 2003, 36 pounds and16 pounds. Feed costs per hundredweights of milk averaged $5.06 in 2000, $5.07 in 2001, $4.89 in 2002, and $4.18 in 2003. If present trends continue, US milk production per cow for 2003 will stabilize or increase less than one percent. Despite the weather problems, the feed price increases, and the stricter credit, the constant application of new technology and genetic improvement has pushed milk production per cow up 18 percent in ten years. These long-term trends will likely continue, after the temporary slowdown during 2004. 2 Total Production Milk production increases have slowed. The September 2003 NASS USDA milk production estimate shows the twenty state August milk production down 0.8 percent from year ago levels. August 2003 milk production for the fifty states was down a full one percent. The decline in the twenty state total production is due to the 0.3 percent decline in cow numbers, and the 0.4 percent decline in production per cow. The fifty state August total was down because of the 0.9 percent decline in cow numbers the slight drop in production per cow. If the cow number trends and the production per cow trends hold, then 2003 US milk production will be down slightly from 2002 levels. If the trend continues, then expect milk production in the first part of 2004 to be below year earlier levels. Total 2004 production could be down slightly from 2003 levels. Total milk production is off in the East, Midwest and the South. Only the Western states experienced increasing levels of production. These geographic trends will continue with largest share of the US production west of the Mississippi River. Product Supply and Use Milk supplies were tight during the summer of 2003. Cheese prices increased as cheese manufacturers bid milk away from other manufacturers. Shortages of milk pulled powder and butter into cheese plants. By mid summer 2003, cheese production was off three percent from year earlier levels. Cheese stocks are lower, butter stocks are expected to remain high and non fat dry milk stocks are expected to increase slightly. Per capital consumption of all dairy products has increased steadily in the last seven years. Most of this increase is due to increases in cheese consumption. Away from home dining, and the changing diets, tastes, and preferences have encouraged this trend in cheese consumption. Annual per capita cheese consumption was 6.4 pounds in 1945, and by 1975 it totaled 14.3 pounds. By 2001, annual per capita cheese consumption totaled 30 pounds. This trend is likely to continue. While cheese consumption has increased, whole milk consumption has declined. In 1945, annual per capital consumption of whole milk in the United states was 40.1 gallons, in 1975, 20.3 gallons, and in 2001, 7.4 gallons. This decline has been attributed to taste, fear of fat and cholesterol. This decline likely will continue. On the other hand, per capital consumption of skim milk totaled just onethird gallon in 1945. By 1975, the per capita consumption totaled 1.33 gallons, and by 2001, it totaled 7.33 gallons. This trend is probably due to the fact that skim and lowfat milk consumers realize the need for calcium and vitamin D, and like the flavor of skim and low-fat products better. This trend will likely continue. 3 In 1954, per capita yogurt consumption was 0.2 of a half pint, but by 2001, US per capita yogurt consumption totaled almost 13 half pints. Butter consumption followed the trend of whole milk. In 1945, U S per capita butter consumption totaled 11.7 pounds; by 2001, it was 4.5 pounds. Theses trends will continue. Low-fat milk products, yogurt, and cheese seem to fit our life style and are staples in either health conscious diets or away from home and ready to eat meals. In the August 2003 Outlook, ERS-USDA forecasts commercial disappearance at 173.4 billion pounds, up almost two percent from year earlier levels, and ERS forecasts 2004 disappearance at 177.5 billion pounds, up just over two percent from 2003 levels. One interesting bright spot on the dairy product scene is the new carbonated milk beverage being introduced by the soft drink industry. These products contain less than 6.5 percent milk solids allowing them to be classified as Class II products. Dairy producers want the products classified as Class I products to capture the higher Class I price; manufacturers want the lower class and the Class II price. Net USDA removals in conjunction with the price support program, are estimated by ERS to be 1.3 billion pounds for 2003, compared to 0.3 billion pounds in 2002, and 1.1 billion pounds in 2004. Removals will depend on milk production and producer price levels. ERS was not anticipating a slowdown in milk production for 2003 or 2004. Dairy surpluses are expected to remain at about current levels. The import and export market is expected to be fairly stable during the coming year according to the USDA. International and domestic prices were close enough to discourage imports of solids. Cheese imports are lower, because of tariffs. The EU has a tight domestic market so it will have less product to export. Drought in Australia and New Zealand may limit their exports. Butter demand is up somewhat because Russia wants to buy butter. DEIP exports will depend on surpluses. Milk and Feed Prices Cheese prices improved because of tighter supplies of milk so Class III prices improved. The improving Class III prices in the latter half of 2003, are pulling producer milk prices up. The August 2003 Class III price is up $2.03 from a month earlier and up $4.29 from year earlier levels. The sudden slide in milk production accelerated during the second half of 2003, and it may be enough to hold producer prices up through the next six months. But there is some skepticism that these higher price levels will hold through all of 2004 According to ERS, concentrate prices were at a five year high during the first part of 2003, and hay prices were rising for lower quality hay. Feed prices may improve modestly, because of the good feed-grain crop. 4 A word About Credit We did an informal survey of dairy lenders, both Farm Credit System and Commercial Banks. They were fairly candid. The low prices worry lenders. Many of their clients are experiencing negative cash flows, and their debt loads are creeping upward. Lenders will tighten up lending standards, and scrutinize both existing loans and new applications very carefully. This lender caution will slow down the flow of credit and could contribute to a downturn in milk output. Policy & Trade Issues The stated goal of the CWT program is to reduce market supplies by 1.2 billion pounds or 0.7% in order to increase price thirty-six cents or three percent. Removing cows and exporting product will keep some milk off the domestic market. The CWT program accepted bids that will remove an expected 669 million pounds of milk production. Some of the cooperatives want the MILC program killed before its scheduled expiration. The current budget deficit might make Congress sensitive to this desire. Removing the MILC incentive to remain in production could encourage more small producers to retire. There is no question that the MILC program has delayed the economic response to the low prices of the last two years. Finally compacts may surface again in discussions of dairy policy. Recent work at TAMU suggests that compacts negatively impact consumer prices. Further they may also encourage excess production in some areas of the country. Dairy imports are a sore point with dairy producers, but export quantities tend to exceed imports during many periods. The value of exports is less than imports however, indicating that the US is unloading low value commodity products such as nonfat dry milk powder. Generally, the US has been importing higher value products such as milk protein concentrates (MPC) and cheeses. These imports will slow down, but likely are not going away. Some dairy coops are now producing M PC’s domestically, and are also contracting with major exporters to manufacture and package product in the United States for sale under the exporter’s label. If domestic and international prices are relatively close, domestic product will be used. Summary So where do we come out on milk supplies and milk prices. In the short run the next six months, expect prices to average 3 percent higher than they did a year earlier. But unless there is a sustained drop in milk supplies because of feed or weather problems or there is an increase in the rate of decline in cow numbers, we cannot expect a long term sustained decline in milk production and a sustained increase in prices. Structural change will continue. Budget deficits will likely discourage any increases in dairy support levels and may actually force Congress to abandon or ,at least, not renew 5 the MILC program. Research at TAMU, suggests that compacts really do not help either the producer or consumer. 6 Federal orders will get scrutinized again, and there is always pressure to abolish them, or at the minium to weaken them. But Federal orders have become the major generator of market information, and the testing and audit programs conducted by the federal orders are a major deterrent to fluid milk adulteration. While orders regulate only fluid milk sales, it might be worthwhile to expand their audit and testing authority to all dairy products. Its ability to audit use keeps the market more transparent than it would be without these functions Technology, changing standards and labeling of dairy-based products will create more proprietary products and more contractual exchanges. At the retail level, it may evolve into the type of exchange that exists between retailers and current suppliers of beverages. At the farm level, the exchange may evolve into the type similar to that existing in potato chips or other specialities. In fact, a portion of the dairy production sector is functioning in that mode. Small cooperatives are developing that set stringent shipping requirement on a producer members, and then contract with bottlers and manufacturing plants to deliver raw milk meeting specific solids, cell count and quality standards. 7