Bilingual Financial Workforce Certificate Program Syllabus

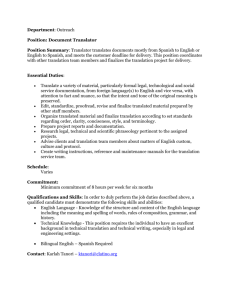

advertisement

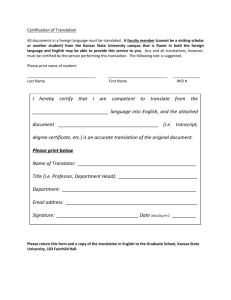

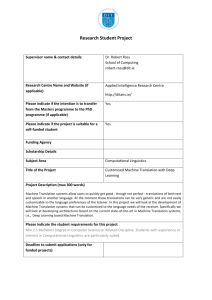

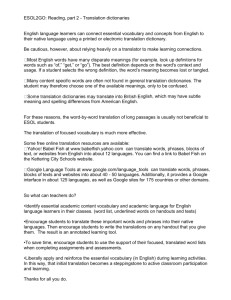

This program is funded in part by a Workforce Innovation in Regional Economic Development (WIRED) grant from the U.S. Department of Labor “This workforce solution was funded by a grant awarded under Workforce Innovation in Regional Economic Development (WIRED) as implemented by the U.S. Department of Labor’s Employment and Training Administration. The solution was created by the grantee and does not necessarily reflect the official position of the U.S. Department of Labor. The Department of Labor makes no guarantees, warranties, or assurances of any kind, express or implied, with respect to such information, including any information on linked sites and including, but not limited to, accuracy of the information or its completeness, timeliness, usefulness, adequacy, continued availability, or ownership. This solution is copyrighted by the institution that created it. Internal use by an organization and/or personal use by an individual for non-commercial purposes is permissible. All other uses require the prior authorization of the copyright owner.” Bilingual Financial Workforce Certificate Program Syllabus A Partnership between Kings College, Lackawanna College and Luzerne County Community College Program Director – Isabel Balsamo McGowan Hispanic Outreach Program, King’s College McGowan School of Business Office 206 (570) 208-5900 ext. 5466 – Fax: (570) 208-5989 Program Coordinator - Ivette Trent, M.Ed. Coordinator of the Multicultural Learning Center, Luzerne County Community College, Hazleton Center (570) 453-3140 - Fax: (570) 453-3144 Site Coordinator - Ann Marie Stelma, Ph.D. Vice President for Continuing Education Lackawanna College (570) 961-7813 - Fax: (570) 504-7978 Instructors - LCCC Hazleton Site: Alejandro Gallardo (570) 455-1536 King’s Wilkes-Barre Site: Elizabeth Schaffer (570) 242- 3766 Lackawanna Scranton Site: Michele Mascia (570) 646-6260 Industry Partners - Guard Insurance KNBT Prudential Certificate Program Description A. Description: This non-credit certificate program is based on an ESL delivery format specifically targeted to adult Latino English Language Learners at an advanced level (CASAS – 236+) who are seeking a career path in the financial services sector. The students will broaden their knowledge of the financial services industry by gaining enhanced vocabulary and comprehension of important terminology and concepts specific to the areas of customer service, basic computer applications, banking, insurance/claims, marketing, small business administration, the stock market, and translation techniques. Experts from these industries will present real life experiences to the students and they will work with the ESL instructors to offer suggestions on important topics that must be covered in order for students to be successful in these various industries. The industry experts will also collaborate with the instructors on creating assessment tools. When possible internship opportunities will be offered in the areas of interest to the students. B. Rationale: This certificate program is designed to educate bilingual adults in Northeastern Pennsylvania about various aspects of the financial services industry. Wall Street West hopes to increase employment potential for emerging Latino professionals and to improve employment opportunities for adult Latino English language learners. This will in turn build a stronger financial services sector in Northeaster Pennsylvania through a qualified bilingual workforce that is much needed in a region where the Latino/Hispanic population has been growing and is expected to continue growing in the coming years. Furthermore, the use of industry experts will work as both a role modeling to the students as we hope to have successful bilingual professionals from each industry, when possible, presenting information and also as a collaborative effort with the ESL instructors to advise on important topics, vocabulary and terminology to be covered and assessed in each module. Certificate Program Objectives and Learning Outcomes Students will: A. Define important concepts and vocabulary words specific to customer service, basic computer applications, banking, insurance/claims, marketing, small business administration, and the stock market/global economy in both English and Spanish. B. Describe major topics and procedures essential to the industries of customer service, basic computer applications, banking, insurance/claims, marketing, small business administration, the stock market and translation techniques in both English and Spanish. C. Calculate important computations and formulas necessary in industries such as banking, insurance/claims, marketing, small business administration and the stock market/global economy. D. Illustrate the proper use of computer applications such as Word, Excel, Access and PowerPoint and the proper use of translation techniques. E. Receive, interpret correctly, and respond accurately to basic verbal messages and other cues that are commonly heard in the financial services industries. F. Speak with some accuracy and with an understandable accent when using the basic English language functions needed to communicate effectively in the financial services sectors. G. Demonstrate appropriate social behaviors and knowledge of cross-cultural differences in working with other people in the financial services industries. H. Use a range of learning strategies to acquire and apply new knowledge of the language to increase skills in understanding and using spoken English. Program Requirements Classes will begin in early February 2009 and will end in late September 2009. Students will take courses which will be offered in three-week increments. Each three week module will consist of six hours of classroom instruction per week for a total of 18 classroom hours per each financial services sector. Successful completion of the entire program will require 144 hours of study and successful completion of the assessments. Attendance Policy Students are allowed 3 excused absences, however, when possible it is suggested that students who miss a class should attend another site to make up for that missed class. Students who have excessive absences will be dismissed from the program and will not receive their certificate. Required Textbooks: American Institute for Chartered Property Casualty Underwriters/Insurance Institute of America. Introduction to Property and Liability Insurance (2nd Ed.). Malvern, Pa. Brown, D. & Bentley, K. (2002). All About Stock Market Strategies: The Easy Way to Get Started. McGraw-Hill Companies Evenson, R. (2005). Customer Service Training 101: Quick and Easy Techniques that Get Great Results. AMACOM Books. Green, J. (2009). Starting Your Own Business Lites, E. & Thorpe, K. (2001) English for Global Business. The University of Michigan. Stolins, R., Fehl, A., Hakola, T., Murphy, J.& Toliver, P. (2008) Microsoft Office 2007: Brief Editon.. El Sobrante, CA.: Labrynth Learning. Webster’s Business Spanish/English Dictionary Websites http://www.kutztownsbdc.org/eLearningCourses/sba-marketing.asp http://nativeaccent.carnegiespeech.com http://www.keytrain.com Program Calendar 2009 Week Feb. 2nd – Feb. 7th Topic No Classes Feb. 9th – Feb. 14th Feb. 16th – Feb. 21th Customer Service Feb. 23rd – Feb. 28th Customer Service March 2nd – March 7th Customer Service March 9th – March 14th No Classes March 16th – March 21st March 23rd – March 28th Translation Basic Computer Applications March 30th – April 4th Basic Computer Applications Activities Student orientations Instructors meet with Industry experts in Customer Service sector Introduce vocabulary and important topics using the Customer Service 101 Textbook Customer Service Industry experts presentations Review vocabulary, pronunciation, issues and topics discussed Final assessment Instructors meet with Industry experts in Computer Applications Translation techniques Introduce vocabulary and basic computer skills using Microsoft 2007 Textbook KeyTrain Assessments Computer Industry experts presentations and instruction on Word, April 6th – April 11th April 13th – April 18th No Classes Basic Computer Applications Excel, Access, PowerPoint No Activities Review vocabulary, pronunciation and applications Final assessment April 20th – April 25th Banking April 27th – May 2nd Banking May 4th – May 9th Banking Instructors meet with industry experts on Banking Introduce Vocabulary, terminology and important topics in Banking using the Consumer Math textbook chapters on Banking Banking Industry experts presentations Review vocabulary, pronunciation, issues and topics discussed Final assessment May 11th – May 16th No Classes Instructors meet with Insurance industry experts No Activities May 18th – May 23rd Translation Translation Techniques May 25th – May 30th Insurance/claims June 1st – June 6th No Classes Introduce Vocabulary and terminology and important topics using Introduction to Property and Liability Insurance Textbook No Activities June 8th – June 13th Insurance/claims June 15th – June 20th Insurance/claims Insurance/Claims industry experts presentations and tours Review Vocabulary, pronunciation and special topics Final Assessment June 22nd – June 27th June 29th – July 3rd Translation Marketing July 7th – July 11th No Classes July 13th – July 18th Marketing July 20th – July 25th Marketing Instructors meet with Marketing Industry Experts Translation Techniques Online mini-course elearning courses/sbamarketing No Activities Marketing industry experts presentations Review Vocabulary, pronunciation and special topics Final Assessment July 27th – August 1st No Classes Instructors meet with Small Business Administration industry experts No Activities August 3rd – August 8th August 10th – August 15th No Classes Translation No Activities Translation Techniques August 17th – August 22nd Small Business Administration August 24th – August 29th Small Business Introduce vocabulary, terminology, pronunciation, issues and topics Small Business Administration August 31st – Sept. 5th Small Business Administration Administration industry experts presentations Native Accent Assessment Review Vocabulary, pronunciation and special topics Final Assessment Sept. 7th – Sept. 12th Sept. 14th – Sept. 19th No Classes Translation Sept. 21st – Sept. 26th Stock Market/ Global Economy Sept. 28th – Oct. 3rd Stock Market/ Global Economy Instructors meet with Stock Market/Global Economy industry experts No Activities Translation Techniques Work on Native Accent Program Introduce vocabulary, terminology, pronunciation, issues and topics using All About Stockmarket Strategies Textbook Stock Market/Global Economy industry experts presentations Work on Native Accent Program Oct. 5th - Oct. 10th Stock Market/ Global Economy Review Vocabulary, pronunciation and special topics Final Assessment Oct. 12th- Oct. 17th Translation Translation Techniques Assessment Work on Native Accent Program Oct. 19th – Oct. 24th October 25, 2009 Resume Workshop & Interview Strategies Workshop Bilingual Financial Workforce Certificate Resume writing Skills to successfully interview for jobs in the financial services sector ($50 fee for workshops due at registration for program) Work on Native Accent Program GRADUATION CEREMONY STUDENT LEARNING OUTCOMES for Bilingual Financial Workforce Certificate Program Student Learning Outcomes Upon successful completion of this course, students will have the skills to: I. Define important concepts and vocabulary words specific to customer service, basic computer applications, banking, insurance/claims, marketing, small business administration, and the stock market/global economy in both English and Spanish. J. Describe major topics and Expected Success Rate 80 % 80 % Evaluation of Student Learning Outcomes To evaluate the students ability in each of the above learning outcomes, the students will complete: Written assessments with matching exercises, fill in the blank exercises, multiple choice and short essays Active participation in classroom procedures essential to the industries of customer service, 80 % basic computer applications, banking, insurance/claims, marketing, small business administration, the stock market and translation techniques in both English and Spanish. discussions with instructor and industry experts K. Calculate important computations 80 % and formulas necessary in industries such as banking, insurance/claims, marketing, small business administration and the stock market/global economy. Written scenarios in which student will have to determine which formulas are to be used and make correct calculations. L. Illustrate the proper use of computer applications such as Word, Excel, Access and PowerPoint and the proper use of translation techniques. Create documents using Word, Excel, Access and PowerPoint that would be useful in the financial services sector 80 % Receive, interpret correctly, and respond accurately to basic verbal messages and other cues that are commonly heard in the financial services industries 80% Speak with some accuracy and with an understandable accent when using the basic English language functions needed to communicate effectively in the financial services sectors. 80% Role play translation techniques using vocabulary and terminology from the financial services industry Answer written and oral questions after listening to an audiotape or presentation pertaining to the financial services sector Actively participate in discussions in English regarding various aspects of the financial services industries. Role playing activities Work on Native Accent program Demonstrate appropriate social behaviors and knowledge of crosscultural differences in working with other people in the financial services industries Use a range of learning strategies to a acquire and apply new knowledge f of the language to increase skills in Understanding and using spoken English 80% Role playing activities 80 % Written short essays Role playing Active participation in discussions Written assignments Use Business English/Spanish Dictionary Complete Keytrain Assessment on Reading and Writing and work on program for a minimum of 30 hours Complete Native Accent assessment and work on program for a minimum of 20 hours.