view - Federal Tax Ombudsman Pakistan

advertisement

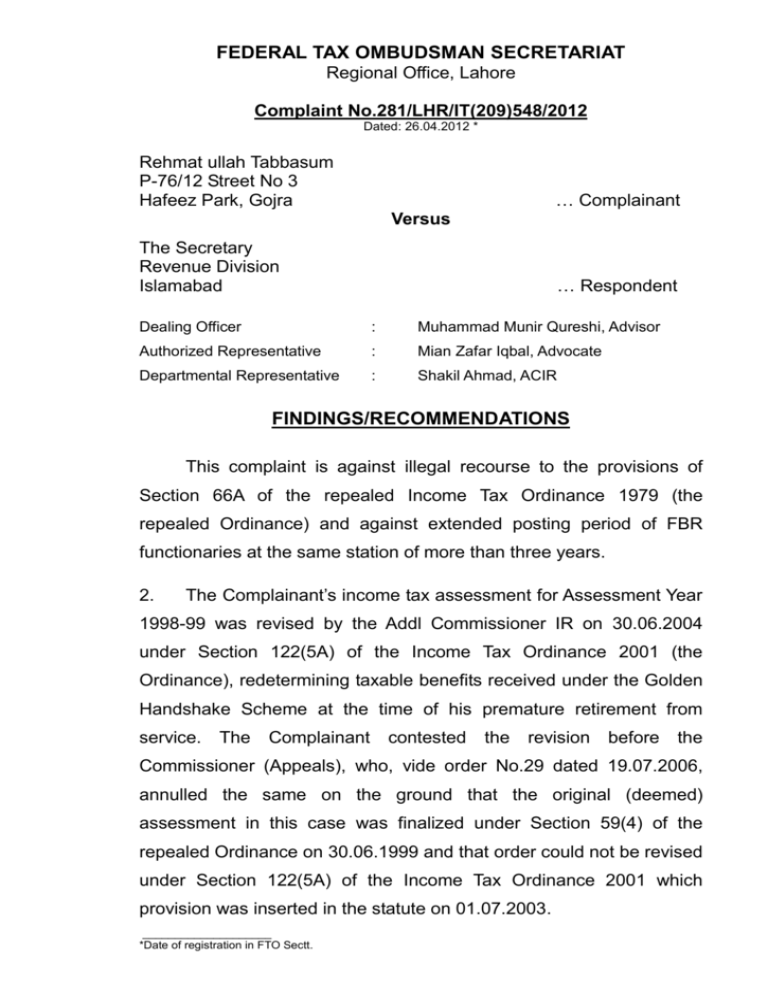

FEDERAL TAX OMBUDSMAN SECRETARIAT Regional Office, Lahore Complaint No.281/LHR/IT(209)548/2012 Dated: 26.04.2012 * Rehmat ullah Tabbasum P-76/12 Street No 3 Hafeez Park, Gojra … Complainant Versus The Secretary Revenue Division Islamabad … Respondent Dealing Officer : Muhammad Munir Qureshi, Advisor Authorized Representative : Mian Zafar Iqbal, Advocate Departmental Representative : Shakil Ahmad, ACIR FINDINGS/RECOMMENDATIONS This complaint is against illegal recourse to the provisions of Section 66A of the repealed Income Tax Ordinance 1979 (the repealed Ordinance) and against extended posting period of FBR functionaries at the same station of more than three years. 2. The Complainant’s income tax assessment for Assessment Year 1998-99 was revised by the Addl Commissioner IR on 30.06.2004 under Section 122(5A) of the Income Tax Ordinance 2001 (the Ordinance), redetermining taxable benefits received under the Golden Handshake Scheme at the time of his premature retirement from service. The Complainant contested the revision before the Commissioner (Appeals), who, vide order No.29 dated 19.07.2006, annulled the same on the ground that the original (deemed) assessment in this case was finalized under Section 59(4) of the repealed Ordinance on 30.06.1999 and that order could not be revised under Section 122(5A) of the Income Tax Ordinance 2001 which provision was inserted in the statute on 01.07.2003. ____________________ *Date of registration in FTO Sectt. 2 3. 281/LHR/IT(209)/548/2012 In Supreme Court’s judgment in the Eli Lily case reported as 2009 100 TAX 81 (SC Pak), it was held that all assessments pertaining to the period falling under the repealed Ordinance could only be made under the provisions of the repealed Ordinance. On receipt of this judgment by the Deptt in July 2009, a Show Cause Notice under Section 66A of the repealed Ordinance for assessment year 1998-99 was issued to the Complainant on 04.06.2011. The Complainant contends that on 04.06.2011 when the Show Cause Notice was issued under Section 66A, the four-year limitation stipulated in Section 66-A(2) of the repealed Ordinance for invoking the provisions of Section 66A had already expired on 30.06.2003. 4. The Complainant further argued that Mr Muhammad Azam, Addl Commissioner Inland Revenue, RTO, Faisalabad, who had issued corum nonjudice Show Cause Notice under Section 66A of the repealed Ordinance had remained posted in RTO Faisalabad for a protracted period in excess of three years which being against the Government policy was tantamount to maladministration under the FTO Ordinance. 5. When confronted, the Deptt filed a reply, raising a preliminary objection that as assessment of income was involved in this case, the provisions of Section 9(2)(b) of the FTO Ordinance were attracted and resultantly the Hon’ble FTO did not have any jurisdiction to hear the complaint. Furthermore, the Deptt also contended that as held by the Hon’ble FTO in a similar complaint case (C.No.255/LHR/IT(220) 528/2011 disposed of on 20.02.2012), interpretation of law was involved in order to make a determination as to whether the Show Cause Notice dated 04.06.2011 for assessment year 1998-99 was ‘time-barred’ or not. As interpretation of law was outside the FTOs jurisdiction, the complaint could not be taken up for investigation. On merits, the Deptt submitted that as the judgment of the Supreme Court 3 281/LHR/IT(209)/548/2012 was received in July 2009, the Deptt rightly took cognizance of the definitive findings recorded therein and issued Show Cause Notice for Assessment Year 1998-99 under Section 66A of the repealed Ordinance within the limitation period stipulated in Section 66 of the repealed Ordinance. 6. As regards the extended posting period in RTO Faisalabad of Mr Muhammad Azam, Addl Commissioner Inland Revenue, the Deptt denied any wrong doing. Copy of FBR Notification No.0509-IR-I/2011 dated 11.03.2011 was submitted to show that Mr Muhammad Azam, a BS-19 officer of Inland Revenue Services was posted to RTO Faisalabad from RTO Multan on 11.03.2011. 7. The Complainant contests the Departmental viewpoint with regard to the proceedings initiated under Section 66A of the repealed Ordinance and argues that any action of Departmental functionaries that was contrary to law was tantamount to maladministration as defined in Section 2(3) of the FTO Ordinance. 8. The Complainant further contends that assessment of income per se was not the moot point in this case. The key question was whether the Deptt was right in invoking the provisions of Section 66A of the repealed Ordinance for Assessment Year 1998-99, after the Supreme Court judgment in the Eli Lilly case was received by the Deptt in July 2009. The Complainant submits that no interpretation of law was required in his case as the Supreme Court had already interpreted the law succinctly in the Eli Lilly case and the same had been followed by the Appellate Tribunal Inland Revenue in ITA No.761/KB of 2010 (Assessment Year 2002-03) dated 23.12.2010, reported as 2012 105 TAX 26 (Trib.). The Tribunal held that there was nothing in the cited judgment of the Supreme Court that could be taken to mean that the limitation of time for action to be taken under Section 66A of the repealed Ordinance stood extended as a result of 4 281/LHR/IT(209)/548/2012 the said Supreme Court judgment. Thus any order passed beyond limitation provided under the law was without jurisdiction and liable to be set aside. The Complainant also contends that the ATIR in ITA. No.2052/LB/2006 (Assessment Year 1998-99) dated 10.02.2011, following the Lahore High Court judgment dated 17.02.2010 in PTR No.10 of 2009, decided the matter in identical terms. 9. As regards the Hon’ble FTO’s decision in C.No.255/LHR/IT(220) 528/2011 dated 20.02.2012, the Complainant submits that the two afore-mentioned ATIR judgments were not referred to before the Hon’ble FTO when the above cited complaint was taken up for disposal and therefore his decision in the said case could not be made a precedent in other complaints involving similar issues. As the relevant law had already been interpreted by the Supreme Court, the Hon’ble FTO was only required to follow the interpretation so made. 10. Both sides have been heard and cited case law perused. 11. After due consideration of all pertinent aspects, it is evident that on 04.06.2011, when the Show Cause Notice under Section 66A of the repealed Ordinance was issued, the four year limitation of time laid down in Section 66-A(2) of the repealed Ordinance to revise an assessment had expired. The assessing officer thus did not have jurisdiction to issue the Show Cause Notice under Section 66A of the repealed Ordinance for Assessment Year 1998-99. And resultantly, the said notice was void ab initio and a nullity in the eyes of law. 12. The departmental contentions that the complaint involves assessment and interpretation of law are misconceived. The FTO Office is concerned solely with the obvious failure of the Department to act within the law. 281/LHR/IT(209)/548/2012 5 Findings: 13. The Departmental recourse to the provisions of Section 66A of the repealed Ordinance in Assessment Year 1998-99 in the instant case being an act contrary to law is tantamount to maladministration under Section 2(3) of the FTO Ordinance. 14. The Complainant’s contention that Mr Muhammad Azam, Addl CIR, RTO Faisalabad, has remained posted at Faisalabad for a long period is also established. As per record supplied by the FBR, since getting his first posting at Faisalabad in 1995, he has served at the same station for almost 15 years (out of a total of 17 years). Recommendations: 15. FBR to direct the Commissioner to – (i) vacate the Show Cause Notice dated 04.06.2011 issued under Section 66A of the repealed Ordinance, as per law, by recourse to the provisions of Section 122A of the Income Tax Ordinance 2001, within 21 days; and (ii) 16. report compliance within 07 days thereafter. As regards the systemic issue of unduly and inappropriately long stays of certain tax officials at Faisalabad, leading to maladministration, the FBR has already been directed to take necessary corrective/remedial action, vide FTO Secretariat No.03/DC/Reg/2012 dated 15.02.2012. (Dr. Muhammad Shoaib Suddle) Federal Tax Ombudsman Dated: mmq/my