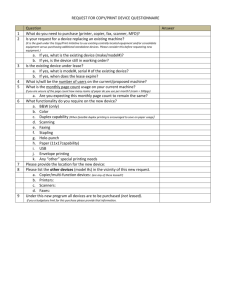

“leased lines” qualitative questionnaire

advertisement

“LEASED LINES” QUALITATIVE QUESTIONNAIRE 2 1. INTRODUCTION Definition of leased lines According to the EU directives (in particular directive 92/44/EEC of the Council dated 5 June 1992 regarding the application of open network provision to leased lines), “the concept of leased lines covers the offer of transparent transmission capacity between network termination points as a separate service and does not include on-demand switching or offers which form part of a switched service offered to the public”. According to the ETSI definition, leased lines are “telecommunications facilities provided by a public telecommunication network that provide defined transmission characteristics between network termination points and that do not include switching functions that the user can control”. Leased lines, as defined by the ETSI, are characterised by standards (analogue leased lines, narrow-band digital leased lines, 64 Kbit/s leased lines, etc.). In French law, leased lines are defined in article R. 9 of the Post and Telecommunications Code: “leased line shall mean the provision of carrying capacity between specific termination points in the public network by the public operator under a leasing agreement, for the benefit of a user but excluding any switching controlled by the said user”. It is important to note that when this definition was drafted, France Telecom enjoyed, by law, a monopoly on the fixed public telecommunications networks. For our examination of leased lines markets, we will use the broad definition of transmission capacities excluding any switching controlled by the customer, whether part of the services standardised by the ETSI (in particular the list of the minimum set) or not (e.g., Ethernet LAN interconnection, private corporate loops, point-to-multipoint capacities services). Moreover, switched data transmission services for multi-site networks aimed at final customers (sometimes also purchased by operators), will also be studied in this questionnaire, and may in fine be included in the leased lines market when there is a high degree of substitutability with “traditional” leased lines. These are X25, Frame Relay, ATM and IP data transmission services. 1.1. Instructions This questionnaire is intended for all players concerned by leased lines markets (retail and wholesale), i.e. operators and service providers selling services based on leased lines to final customers (businesses, public bodies) on the retail market and operators selling and buying leased lines on wholesale markets. ART is committed to ensuring that all those concerned have the opportunity to express themselves at this time and we invite you to share this questionnaire with anyone interested. Some parts of the questionnaire target specifically certain categories of players (operators selling or buying capacity services, service providers, businesses or public bodies who are customers of the operators) and are indicated as such. 1.2. Company or association questioned [1.2.1] Please give the address and telephone number of your company (or association), as well as the name of a contact person for the market review and the answers to the questionnaire (name, position, telephone number, e-mail). [1.2.2] What is your company’s (or association) position on leased lines markets (operator, service provider of services based on leased lines, user, etc.)? Please state your role (buyer, vendor) for each of the markets listed by the Commission. 1.3. Overview of the market Market figures were gathered in statistical surveys conducted by ART for the market observatory. At end 2001, the retail leased lines market represented a total of about 320 000 leased lines, including close to 200 000 digital leased lines. In 2001, sales of leased lines represented €1.4 billion, up 25% over the previous year. 3 At end 2001, the wholesale market represented a total of 80 000 lines, almost all digital, and sales of close to €1 billion, up 15% over the previous year. 1.4. Review of current regulation Since directive 92/44/EEC of the Council dated 5 June 1992 regarding the application of open network provision to leased lines, leased line offers to final customers have been subject to the conditions of the ONP (Open Network Provision) which, for leased lines, take the form of reinforced obligations and in particular: cost-oriented prices a cost accounting system to ensure that prices are cost oriented the publication of information on the conditions of provision and ending the provision of leased lines as well as their prices the mandatory provision of a harmonised minimum set of leased lines across the European area the establishment of quality of service indicators These obligations, and in particular that of the cost-orientation of prices apply to all lines provided by operators subject to ONP rules and not just to lines which must be provided under the harmonisation of offers. This directive was transposed into French law in articles D. 369 to D. 379 of the Post and Telecommunications Code by decree no. 93-961 dated 28 July 1993. These articles impose obligations on France Telecom, which was the sole operator authorised to operate a public telecommunications network when the directive and decree were published. Directive 97/51/EC dated 6 October 1997 modified the directive to adapt it to the competitive environment where more than one operator could provide leased lines. The new directive is almost identical to the previous one, except that: it requires that national regulatory authorities (NRAs) designate at least one powerful body on the leased lines market which is required to meet the obligations described all restrictions on the use of leased lines, the interconnection of leased lines to each other or the interconnection of leased lines to switched networks must be removed The other modifications concern primarily information deadlines and quality of service criteria. To date, current articles D. 370 and following (article D. 370 has been deleted) are still in force and France Telecom remains subject to the application of the ONP measures for leased lines. Leased lines provided by France Telecom are subject to approval following examination by ART, pursuant to article L. 36-7(5). A leased lines interconnection offer for licensed operators was introduced in the 2002 interconnection catalogue. The leased lines interconnection offer must respect the principle of cost orientation. 1.5. Scope of the survey for retail markets In this first part, we define the scope of the survey, and collect elements which can be used to delineate the retail leased lines market, in terms of the services offered, speeds and from a geographic perspective. Here, players can express their opinions on the boundaries of the retail market which they feel are relevant. 1.5.1. Primary means of entry Two categories of players are present and sell their products on the retail leased lines market: - operators having an access network to end-user sites, generally by deploying their own infrastructures serving their customers; the access technologies used are copper pairs, the wireless local loop, fibre optic lines and radio waves; in these cases, the infrastructures deployed are local and leased lines generally cover a short distance - operators having a backbone network for the transmission of calls over longer distances; for access to their customers’ sites, these operators can either connect directly to the sites, or buy connection solutions from other operators in the form of leased lines or unbundled copper pairs [1.5.1.1] 1.5.2. Based on this distinction, how are you positioned? Delineation of retail markets in terms of services Review of the European Commission’s recommendation 4 According to the European Commission’s recommendation on relevant markets, the retail leased lines market includes only a minimum set of leased lines of a speed of less than 2 Mbit/s described in article 18 and annex VII of the universal service directive. This includes: - 2-wire analogue leased lines - 4-wire analogue leased lines - 64 Kbit/s digital leased lines - 2048 Kbit/s digital leased lines In its market definition document published on 6 March, ART noted that the minimum set of leased lines defined in the universal service directive may seem restrictive in its delineation of leased lines markets and capacities still requiring regulation on the retail market, especially with regard to current obligations (price controls) which affect all leased lines, regardless of their speed, and the increase in competition in France since the market was opened to new entrant operators may still be insufficient to justify removal of obligations on the other categories of leased lines. Moreover, this minimum set does not include capacity services for which customers cannot control the switching functions which are used on the market as substitutes for the leased lines on the list. Scope of the survey On this issue, most contributors supported our initial analysis and suggested that, at the very least, the scope of ART’s preliminary review (at the questionnaire stage) be extended beyond the minimum set. So, it is in this sense that this questionnaire was drafted, which, as a result, also deals with: - retail leased lines which do not belong to the minimum set (whether their speed is greater or less than 2 Mbits/s), in order to determine whether the obligations on the wholesale market are sufficient for these lines - retail non-switched point-to-point and point-to-multipoint capacity services used to connect customer sites, which are different from "classic" leased lines as defined by ETSI standards but which are substitutable for them and which can therefore be considered as belonging to the same market - switched data transmission services for end-user multi-site networks to evaluate their degree of substitutability with traditional leased lines In the following questions, we ask players about the degree of substitutability between various offers. [1.5.2.1] In your opinion can virtual private networks (VPN) be substituted for leased lines? More precisely: - Is there a specific number of sites beyond which it would be useful to substitute a virtual private network (VPN) for a point-to-point leased lines network (starred or mesh)? - For contracts for over 2 Mbit/s, what is the current percentage of contracts for internal multi-site networks (in particular, VPN) and contracts for classic leased lines? How do you see these percentages changing in the future? [1.5.2.2] Switched data transmission services are not covered by the regulatory definition for leased lines; still, to a certain degree, they might be considered substitutable for leased lines (for multi-site companies); what do you think? [1.5.2.3] Ethernet products are not covered by the regulatory definition for leased lines; still, to a certain degree, they might be considered substitutable for leased lines (for multi-site companies); what do you think? [1.5.2.4] Are SDSL offers substitutable for leased lines offers used by companies? Please give the degree of substitutability in terms of interfaces, quality of service, geographic coverage and price. What is foreseeable development of this substitutability? [1.5.2.5] In your opinion, are analogue leased lines substitutable for digital leased lines? 1.5.3. Segmentation of the retail market by speeds offered On retail markets, substitutable leased lines and capacities are used to exchange calls among several sites of the final customer (capacity services and data transmission services for voice, data or images). The main criterion for segmentation is speed, a criterion which is also identified by the recommendation: speeds of leased lines can range from very low (2400 Kbit/s for certain data transmission applications) to very high speeds (up to 622 Mbit/s or even several Gbit/s). These needs for bandwidth are closely related to the type of services conveyed. In terms of use and type of application which can be used for the various speeds, one might think that it would be relevant to segment between the offers at speeds of less than 2 Mbit/s or 10 Mbit/s, and those at higher speeds, even if the exact delineation would still have to be determined. It is also important to note that this segmentation covers a technological segmentation between leased lines at speeds of less than 2 Mbit/s, primarily 5 provided using copper technology, and leased lines at speeds of greater than 2 Mbit/s (and speeds greater than 10 Mbit/s) which use fibre optics. Other types of segmentation could be applied, based on criteria such as the number and location of end-user sites, using the two following criteria: the distance (distance between the customer site and the operator’s point of presence (PoP) and the distance between customer sites), and the dispersion of the sites (which has an impact on connection topology: point-to-point, point-to-multipoint, private loop, corporate network). As for the offer, we can also identify two types of player: - operators specialising in speeds of between 64 Kbit/s and 2 Mbit/s using technologies such as the wireless local loop, cable networks, the traditional switched telephone network and DSL technologies - operators specialising in speeds of greater than 10 Mbit/s using fibre optics (from 10 Mbit/s for LAN interconnections, from 34 Mbit/s for leased lines) This specialisation of operators would support a segmentation according to speed. [1.5.3.1] 1.5.4. Does a delineation of retail markets in terms of speeds appear relevant? If yes, on the basis of what speed limit (2 or 10 Mbit/s or other)? If not, what elements would you use to establish another delineation? Definition of the retail market from a geographic perspective ART specifically addressed the question of a possible geographic segmentation of the retail leased lines market in its market definition consultation. We received diverging points of view on this point. For leased line services of speeds greater than 2 Mbit/s, responses to ART’s two surveys on the high-speed services market identified ten areas1 on which there is a certain degree of competition. ART also noted that because of their size and limited location, these infrastructures create competition only for local services. This led ART to determine: - a geographic perimeter with ten areas and the rest of the country for local leased lines at speeds greater than 2 Mbit/s - a national geographic perimeter for other services, i.e. regional and national leased lines at speeds greater than 2 Mbit/s and local leased lines at speeds less than 2 Mbit/s In this questionnaire, for services at speeds greater than 2 Mbit/s, we have chosen an initial division identical to that established from these surveys. We need this initial division in order to collect relevant data on the areas considered. However, this division which will not necessarily be definitively chosen. For leased line services at speeds of less than 2 Mbit/s, ART has chosen an initial geographic perimeter covering the entire country. We need this initial division in order to collect relevant data on the areas . However, this division which will not necessarily be definitively chosen. Nor will it affect the establishment of different regulations from one area to another. [1.5.4.1] 1.6. What are your comments on such a geographic division? Scope of the survey for wholesale markets Wholesale markets are characterised by the fact that at least one of the sites at the end of the lines is a point of presence (PoP) of an operator customer. There are three main configurations: a) leased lines connecting two PoPs of “operator A” who needs transmission capacities to deploy its own network; these leased lines may be provided by a third-party operator b) leased lines connecting the PoPs of “operator A” and “operator B” who require transmission capacities between their networks; the leased line is provided by one of the two operators or by a third-party operator 1 Paris, first ring of suburbs, the business districts, generally in city centres except for loops at the Satolas Airport for Lyon, Aix-en-Provence near Marseille and Sophia-Antipolis near Nice, the other nine largest French cities except for Toulon (Lyon, Marseille, Lille, Bordeaux, Toulouse, Nantes, Nice, Strasbourg, Grenoble). ART also added Montpellier as a city for the deployment of coporate metropolitan optical loops on the basis of certain public information. This information will be validated with operators in the survey. 6 leased lines connecting “operator A’s” PoP to the site of a final customer who calls on operator B; this leased line service may be considered a global service combining two separate services: a "termination" service in which operator B provides access to the final customer on one of its PoPs, and a service which is the segment between the PoP and operator A; this service is of the same nature as that mentioned in b). c) The Commission’s recommendation identifies two markets: the wholesale terminating segment market and wholesale trunk segment market. Unlike the retail market above, the recommendation does not provide any specific information on wholesale markets (in terms of speed, technical standards). 1.6.1. The wholesale terminating segment market The wholesale provision of terminating segments is considered to be the purchase, by certain operators, of capacity services to connect their final customers’ sites in order to provide them with telecommunications services on the retail market (voice telephone service, retail leased lines, Internet access, data transmission). The key question for delineation is where to establish a boundary between the "terminating segment" and the "trunk segment”. There are two ways in which we might do so: - consider that the terminating segment includes the entire line from the buying operator’s PoP to the end-user’s site; this definition is consistent with the end-to-end service provided by France Telecom in its retail offers (Transfix) - set a limit for the terminating segment; a distinction could be made between “LPT” private partial circuits, which would be included in the terminating segment, and “LA” (link between the operators’ POPs) which would be included in the trunk segment. This would resemble the definition established by the recommendation. Here, the terminating segment include be the link between the final customers’ sites and the first switch on France Telecom’s RTNM leased line network. At this stage, since this question has not been resolved, the questionnaires (and the quantitative questionnaire in particular) allow the use of either of these approaches. It is also important to remember that non-switched capacity services, which are not leased lines in the usual sense of the term and which may be used by operators to connect end-user sites, include services such as Turbo DSL. In its document of 6 March, ART explained the difficulty in fitting this service between the wholesale leased line market (trunk for the trunk part of TurboDSL, and terminating segments for the leaves) and the bitstream market. The responses we received from operators did not allow us to come to a decision. Because of this, the quantitative questionnaire has been written in such a way as to allow the inclusion of these services in both of these markets, in particular by distinguishing a “terminating segment” part for the leaves and a “trunk” part for the trunk. Since wholesale demand for leased lines on the terminating segment is directly influenced by the need to connect customer sites to provide retail services, we have chosen to use the same segmentation for wholesale markets as for retail markets both for speeds and geographic division. [1.6.1.1] What are your comments on this market definition and segmentation? [1.6.1.2] Are SDSL offers substitutable for leased lines offers used to connect corporate sites? Please give the degree of substitutability in terms of interfaces, quality of service, geographic coverage and price. Please give this degree of substitutability for new and existing contracts. What is foreseeable development of this substitutability? 1.6.2. The wholesale leased line market on the trunk segment The wholesale trunk market includes transmission capacities sold between operators which are used to connect their switches and distribution sites. There can be two types of capacity: - capacities purchased from another operator by an operator wanting to create its own network, regardless of the type of network (fixed, mobile, Internet) - capacities purchased to connect points between the networks of different operators; in this questionnaire, these services are called "operator connectivity services". The review must help us clearly define the second segment, and in particular determine whether it is really different from the first. 7 ART will also study connection links associated with switched interconnection offers or links between main distribution frames and switches, since these lines are often offered on the same infrastructures as the lines for the backbone. To do this, we may need to use the data provided by operators in the interconnection questionnaire. Also, since, by nature, these lines are also related to interconnection offers or access offers to the local loop of powerful operators, inseparable from these, they are studied as such under the interconnection market ("fixed" questionnaire, "related interconnection services" section). In terms of geography, the approach we have chosen at this stage is to identify some thirty cities where competition on the wholesale trunk market is different from the rest of the country. [1.6.2.1] What are your comments on this market definition and segmentation? 8 2. RETAIL LEASED LINES MARKET AND SUBSTITUTABLE CAPACITIES In the table below, we list the range of substitutable leased line and capacity services available on the retail market i.e. used solely to connect end-user sites (companies or administrations): 2-wire analogue leased lines 4-wire analogue leased lines Narrow-band digital leased lines as defined by ETSI (less than 19.2 Kbit/s) 64 Kbit/s leased lines and capacity services - of which 64 Kbit/s leased lines as defined by ETSI - of which 64 Kbit/s satellite capacities - of which 64 Kbit/s wireless local loop capacities - of which xDSL capacities of less than 64 Kbit/s n*64 Kbit/s leased lines and capacity services (less than 1920 Kbit/s) - of which n. 64 Kbit/s leased lines as defined by ETSI - of which n. 64 Kbit/s satellite capacities - of which n. 64 Kbit/s wireless local loop capacities - of which n. 64 Kbit/s xDSL capacities 2 Mbit/s leased lines and capacity services - of which 2048 Kbit/s leased lines as defined by ETSI - of which 2 Mbit/s satellite capacities - of which 2 Mbit/s wireless local loop capacities - of which 2 Mbit/s xDSL capacities 34 Mbit/s leased lines as defined by ETSI 155 Mbit/s leased lines as defined by ETSI 622 Mbit/s Leased lines as defined by ETSI Data conveyance services - of which ATM data transmission (including VPN) - of which IP data transmission (including VPN) - of which frame relay data transmission - of which X 25data transmission LAN interconnection and other capacity services (broadband multi-site service (SMHD) private loop, lines with backup sites, etc.) Other services: please list 2.1. Questions for offering operators The following questions are intended for operators providing leased line services (understood as being leased lines themselves, i.e. excluding telecommunications services provided on these leased lines). 2.1.1. The services offered [2.1.1.1] In general, which of the services in the list represent the most in terms of sales? [2.1.1.2] Of the services in the list, which ones can be considered to be in decline? Growing? For each service that is growing, please list the offers which in your opinion are reference offers on the market (giving the trade name of the service and that of the operator, as well as the "market price" for this service). [2.1.1.3] Using this list, please list the services you sell and describe their main characteristics (speeds, number of customers and sites, location of your connection POPs, interconnection areas). Please describe how your offer has changed since 1998. Please state whether you are interested, in terms of technology, in providing on the retail market (point-to-point or point-to-multipoint transmission between end-user 9 sites) each of these service categories (leased lines as defined by ETSI, other types of leased lines using WLL or satellite technology, other capacity services such as interconnection of LANs or private optical loops or internal multi-site data transmission networks)? What services are you unable to provide today? Why? [2.1.1.4] What are the prices of the services you provide (please complete the table below, depreciating access expenses over three years)? Please describe changes since 2001 and prospects for the next two years. In euros 5 km 10 km 30 km 100 km 2-wire analogue leased lines 4-wire analogue leased lines 64 Kbit/s digital leased lines 2048 Kbit/s digital leased lines 34 Mbit/s digital leased lines 155 Mbit/s digital leased lines [2.1.1.5] Please state whether your prices differ according to geographic areas (explain). How great are the price differences between areas? Is this due to differences in costs or competition? [2.1.1.6] Who are your customers? What are their characteristics (companies, national government bodies, municipal governments, etc., their size, sector of activity, number of sites, dispersion of sites, other)? Do certain categories of customers have specific needs (type of services, speeds)? On what condition would you decide to move into an area where you are not already present? [2.1.1.7] For multi-site internal networks for businesses or government bodies, for which of the following three configurations are you competitive in calls for tenders? Please provide your competitiveness "boundary values" in terms of number of sites, distance between your POPs and the sites to be connected, weight of purchases in number and in value of your total costs: - an internal starred network, possibly with several levels (national sites, regional sites, local sites): this is a common configuration for government bodies or the banking sector - a network with sites concentrated in major cities and one or two sites in city suburbs (generally, computing production sites): this is a common configuration in the banking sector - a network with a high number of sites spread out over the countryside or on the outskirts of small cities: this is a common configuration in the industrial sector [2.1.1.8] What are the most common contract durations? [2.1.1.9] What is the average discount applied to the base rate? What is the highest discount? On what elements are discounts based? [2.1.1.10] How do you market your offers? Please describe your sales network. [2.1.1.11] What is your gross margin on this market? Please break down along classes of speeds (less than 2/10 Mbit/s, more than 2/10 Mbit/s). 2.1.2. General appreciation of the operating conditions and development of the market [2.1.2.1] In general, for these distance classes, what has the average annual price change been in the past three years? [2.1.2.2] Do you expect any price decreases in the next three years? By how much? [2.1.2.3] Who are your competitors? What their competitive advantages, in your opinion (direct access to final customer, technological superiority, broad range of services offered, major financial resources, etc.)? What are your competitive advantages? [2.1.2.4] Could certain regulatory constraints hurt competition on the market (licensing times, licence fees, administrative waits to obtain rights of way, degree of right of way based on area, etc.) What is the impact for you? Are there other obstacles to your development on these markets? To what degree? 10 [2.1.2.5] Are you hampered in your development on these markets by financial (network deployments in new geographic areas, difficulties in establishing own connections, inability to obtain discounts) or other difficulties? [2.1.2.6] How competitive is this market? On what geographic areas are there more than one provider? How do the offers proposed meet or not meet your needs? Please respond for each speed. 2.2. Questions for buyers The following questions are intended for buyers and aim to understand their purchasing policy, their view of the operation and development of the market and their ability to benefit from competition on the market. 2.2.1. Services purchased and purchasing policy [2.2.1.1] Of the services listed above (page 8), which do your purchase and from which operators? What expenditure do each of them represent? [2.2.1.2] What are your purchasing criteria (price, speeds, geographic availability of the offer, quality of service, operator’s reputation, operator’s financial solidity, performance of customer service, etc.)? What is your main means of selection (calls for tenders, direct contacts, specialised firms)? Are there differences by class of speed (less than 2/10 Mbit/s, more than 2/10 Mbit/s)? If you use calls for tenders, do you break down your needs in order to increase competition, in particular in geographic terms? If not, why not (management costs, consider that competition is insufficient)? [2.2.1.3] Do you feel that you have sufficient information on the prices and conditions of service provision to make an informed choice? [2.2.1.4] In your opinion, what factors might prevent or discourage you from switching operators or services (technical aspects, costs of managing calls for tenders, contractual conditions, specific migration costs)? Please provide an estimate of the costs incurred in value and as a percentage of the value of the contract? [2.2.1.5] What services do you consider top priority? What is your appreciation of their prices (and price change)? On their geographic availability? On the availability of competing offers? [2.2.1.6] If different from above, what are the main characteristics of the offers you would like to obtain? 2.2.2. General appreciation on market development [2.2.2.1] Of the services listed, which, in your opinion, are those which might be considered to be in decline? Growing? [2.2.2.2] Do you consider the prices of international leased lines satisfactory? Are the prices of leased lines to the DOMs satisfactory? To Corsica? [2.2.2.3] In your opinion, has competition led to a decrease in prices and an improvement in the quality of service (technical and commercial)? Are there differences by class of speed (less than 2/10 Mbit/s, more than 2/10 Mbit/s) or geographic area? Do you consider the penalties sufficient motivation? [2.2.2.4] What is your general appreciation on the prices and quality of service of leased lines in France with respect to comparable countries? Do you have any studies or benchmarks that you would be willing to share with ART? 11 3. WHOLESALE TERMINATING SEGMENT MARKET The goal of this part of the questionnaire is to evaluate the operating conditions of the wholesale terminating segment market, i.e. the segment connecting the buying operator’s point of presence (PoP) to that of the operator having access to the end-user’s site. 3.1. Means and strategies of entry: own provision or buying leased lines from a third party The questions in this part aim to examine in detail the choice between building direct access to the subscriber and "buying" this access from other operators (wholesale terminating segment). This choice determines the size of the wholesale terminating segment market and, in part, the degree of competition on the retail leased lines market and on market areas for which leased lines represent a major share of added value (such as data transmission). Questions for all operators [3.1.1] What is your strategy for access to customer sites? Are there differences by classes of speed (less than 2/10 Mbit/s, more than 2/10 Mbit/s) or geographic area? [3.1.2] What are the main elements used in choosing between own provision and purchases from third parties (economic conditions, quality of service, independence, availability of dark fibre, other?) Is this a global or a case-by-case decision, based on the geographic location or market conditions (opportunity)? [3.1.3] Of the services you sell on the retail market (voice, Internet, leased lines, switched data transmission services) what is: - the share of the total cost of providing the service represented by connection costs for customer sites ? the share of the income? - the respective share of customer connections you provide using your own infrastructures / that you purchase from third party operators, as a number of connections and as a level of expense? [3.1.4] Do you plan to provide your own connections soon? If not, why not? [3.1.5] For the same type of connection and the same duration, please compare the costs of an own connection and a leased line purchased from another operator? What variations are caused by length and speed? 3.2. The following questions deal with the sale of your own terminating segments [3.2.1] What is your appreciation of the economics of direct connection to an end-user’s site? What do you estimate to be the cost of your own connection to the end-user’s site? What is the weight of investment costs and operating costs? Please explain your general hypotheses, particularly in terms of investment depreciation time and the cost of capital. [3.2.2] What are your customers’ configurations (provide a classification in terms of speed)? In particular, what is the average distance between your PoPs and customer sites? Please give, where relevant, differences between geographic areas. 3.3. The following questions deal with the terminating segments you buy from third party operators [3.3.1] What types of leased lines do you purchase? For what types of need (break down terminating segment purchases by the major retail service categories sold (voice, Internet access, generally point-to-point retail leased lines, switched data transmission services))? In which geographic areas? Which operators are your providers ? [3.3.2] What is the corresponding expense level? [3.3.3] How competitive is this market (price levels, quality of service)? Are there alternative offers which compete with France Telecom’s offer? Are there enough of them? In which geographic areas? In what way do they or do they not meet your needs? 12 [3.3.4] In your opinion, is the price level of leased lines in France higher / lower than that of other comparable countries? Do you have any studies on this point that you would be willing to share with ART? Specific questions on substitutability between France Telecom’s retail leased lines (Transfix) and partial private circuits (“LPT”) from the interconnection catalogue [3.3.5] Of the leased lines you purchase from France Telecom to connect customer sites, what percentage are Transfix leased lines and what percentage are PPCs (“LPT”)? [3.3.6] What is your appreciation of the interconnection offer, in terms of technical architecture, pricing architecture, quality of service, migration conditions, delivery times? [3.3.7] Besides these technical considerations, and from the point of view of the economics of an operator’s network, is it more economical to continue to use Transfix lines rather than the interconnection offer? What discounts do you receive on Transfix contracts? Please give the respective discounts for duration and volume. [3.3.8] If you do not use the leased lines interconnection offer, do you plan to do so? If yes, why and when? If not, why not? 3.4. The following questions are intended for operators providing terminating segments to third parties [3.4.1] What are the main offers you sell? What types of need do they meet? What is their geographic coverage? Who are your customers? What are their main technical (speeds, length) and pricing (price level and structure) characteristics? What are the corresponding global sales? [3.4.2] Who are your competitors on this market? [3.4.3] In your opinion, is the price level in France on the wholesale terminating segment market greater than that of other comparable countries (European Union member states, United States)? Do you have any studies on this point that you would be willing to share with ART? [3.4.4] How competitive is this market? Are there any alternative offers which compete with France Telecom’s offers? In what geographic areas? Do they or do they not meet your needs? 13 4. WHOLESALE TRUNK SEGMENT MARKET As stated above, the following are included in this review: - leased lines purchased from third parties by an operator wishing to create its own network, regardless of the type of network (fixed, mobile, Internet); we call these services "backbone leased lines" - leased lines connecting points between two networks of different operators; we call these services "operator connectivity services" The aim of this review is to clearly define this second segment, and in particular to understand how it is different from the first and for what reasons. 4.1. Means and strategies of entry: own provision or buying leased lines from a third party As above, the questions in this part aim to understand how you choose between own provision and purchasing trunk segments from third party operators. [4.1.1] What is your strategy for connecting sites on your network? In connecting your sites to those of third party operators? What are your needs (for speed and average distance) and how are they met? [4.1.2] What are the respective proportions of leased lines you build yourself / that you purchase from third party operators, as a number of leased lines and level of expense (please respond separately for backbone leased lines and operator connectivity services, and if appropriate, for geographic area). [4.1.3] What are the main elements used in choosing between own provision and purchases from third parties (economic conditions, quality of service, independence, availability of dark fibre, other?) Is this a global or case-by-case decision, based on geographic location or market conditions (opportunity)? Does this decision depend on whether it is for backbone leased lines or connectivity between operators? [4.1.4] If you do not provide your own infrastructures, do you plan to do so in the near future? If not, why not? [4.1.5] For the same type of connection and the same duration, please compare the costs of your own connection and a leased line purchased from another operator. What variations are caused by length and speed? [4.1.6] Do you provide trunk segments to third parties? What are their characteristics? Who are your customers? Of these, which of your customers purchase backbone leased lines / connectivity services? Please answer using the table below: Number of lines and sales Backbone leased lines Connectivity services Mobile operators Fixed-network operators excluding WLL WLL operators Cable operators ISPs Other [4.1.7] 4.2. In your opinion, is the price level of leased lines on these two segments greater or less than that of other comparable countries? Do you have any studies on this point that you would be willing to share with ART? Backbone leased lines [4.2.1] Do you use a third-party operator to connect sites in view of creating your own backbone? Which operator(s)? What is the corresponding level of expense? 14 [4.2.2] If you build your own, what do you estimate to be the average cost of building transmission links between two backbone switching sites? What is the weight of the various investment costs and operating costs? Please explain your general hypotheses, particularly in terms of investment depreciation time and the cost of capital. [4.2.3] Does the dark fibre offer meet operators’ backbone deployment needs? What is the impact of price changes for dark fibre? What are the differences by geographic area? [4.2.4] For mobile operators: what is the average distance of lines between BTSs and POPs? [4.2.5] How competitive is this market? Are there any alternative offers which compete with France Telecom’s offers? Are there enough of them? In what geographic areas? Do they or do they not meet your needs 4.3. Operator connectivity services [4.3.1] Do you use a third-party operator to connect your sites those of a third-party operator? To what operator(s)? For what types of connection (PoP to the closest operator connection point, PoP to the closest local switch, PoP to the main distribution frame, PoP to the ATM switch)? What is the corresponding level of expense? [4.3.2] If you build your own infrastructure, what is your evaluation of the economics of building connection links for connectivity between networks? Please respond for each type of connection. What is the weight of investment costs and operating costs? Please explain your general hypotheses, particularly in terms of investment depreciation time and the cost of capital. [4.3.3] What is the average distance for each type of connection? [4.3.4] How competitive is this market? Are there any alternative offers which compete with France Telecom’s offers? In what geographic areas? Do they or do they not meet your needs? ___________________________________________________________________ © Autorité de régulation des télécommunications - September 2003 7, Square Max Hymans - 75730 PARIS Cedex 15 Téléphone : +33 1 40 47 70 00 - Télécopie : +33 1 40 47 71 98

![013—BD Global [DOC 117KB]](http://s3.studylib.net/store/data/005892885_1-a45a410358e3d741161b3db5a319267b-300x300.png)