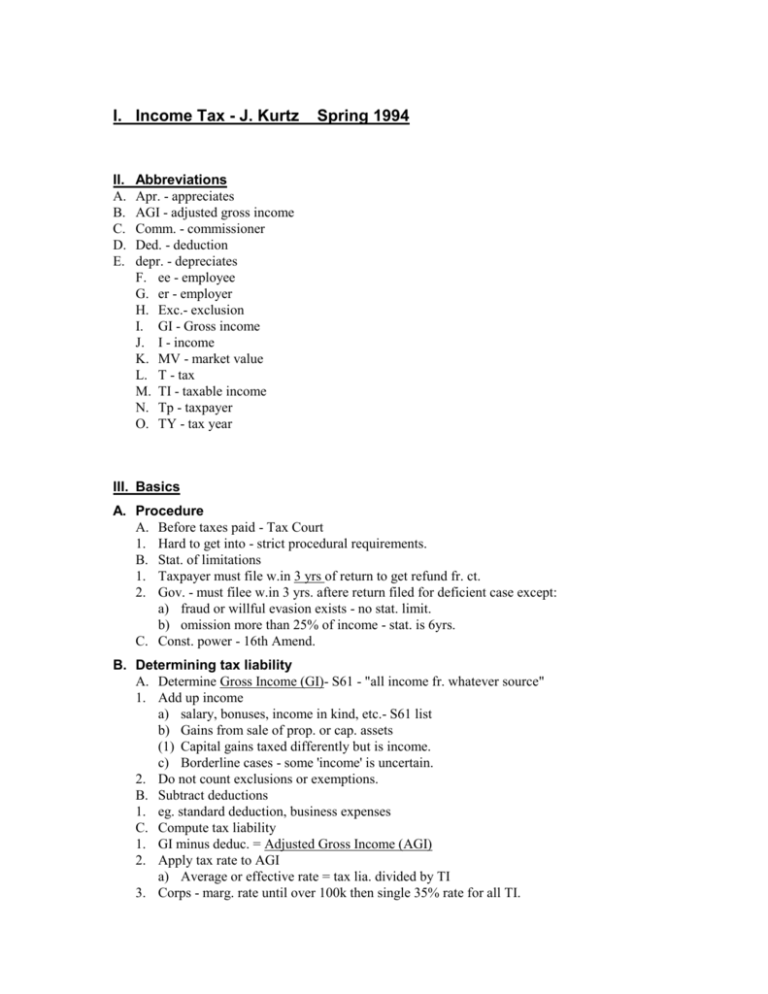

I. Income Tax - J. Kurtz Spring 1994

advertisement