Assessment of 301 This document represents an inventory of the

advertisement

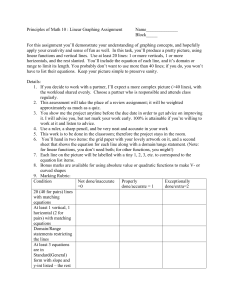

Assessment of 301 This document represents an inventory of the economic and mathematical concepts Rider covers in ECON 301 from a chronological perspective. I. Course Description: Intermediate Microeconomic Theory I – Examines the economic decisions made by individuals as consumers. Subject matter includes consumer behavior, demand theory, choice under uncertainty, game theory, welfare economics, general equilibrium analysis, public goods, and externalities. Enrollment requirement: MATH 132 or 160, ECON 201 and 202. II. Review of ECON 201 – Perloff chapters 1,2,3: 44-59,9: 269-284, 292 – 298; 3 weeks a. Economic concepts: i. Simple optimization; marginal benefit and cost (FDA case); MB = MC; distinguish totals from margins ii. Demand and supply; No tax incidence analysis 1. Equilibrium; dynamics of equilibrating process 2. Summation of demand and supply functions; distinguishing P(Q) from Q(P) 3. Interpreting graphs 4. Welfare economics (Consumer and producer surpluses, deadweight loss); double-oral auction experiment; price controls 5. Elasticity – relationship to revenues and profits; deriving a linear approximation to demand from elasticity b. Mathematical concepts: Review of linear equations i. Slope ii. Point slope formula iii. Linear approximations using elasticity iv. Precise graphing v. Basic geometry of welfare measures (areas of triangles and rectangles) vi. Solving simultaneous equations; basic algebra Consumer choice model – Perloff chapter 4, 5:111 -127, 134-151; 6 weeks a. Economic concepts: i. Opportunity sets; relative prices and real income ii. Preferences; MRS; indifference curves; utility representation iii. Optimization III. IV. 1. Understanding the why of the tangency for interior solution (assume a non-tangency and reason with economic logic that it is not optimal) 2. Graphical and numerical iv. Fundamentals of demand functions (only Marshallian although I allude to Hicksian) v. Price and income consumption curves; Engel curves vi. Income and substitution effects (strong emphasis) 1. Graphical 2. Numerical vii. Labor-leisure choice application; Tax Reform Act of 1986 1. Graphical 2. Numerical viii. Consumer surplus using indifference curves (brief) b. Mathematical concepts i. Basic calculus (derivative: power function and constant function rules; partial derivative only mentioned not required); no integrals ii. Simultaneous equations – simplification of constrained optimization (tangency and budget line) (no Lagrangian methods) iii. Slope iv. Linear equations v. Basic Cobb-Douglas function vi. Precise graphing Altering the consumer choice model assumptions – Perloff chapter 17: 572-592, 595-600; 3 weeks a. Strategic dimensions: I don’t cover game theory anymore; insufficient time b. Economic concepts of risk i. Distinguish risk from uncertainty; used to give a simple numerical illustration of uncertainty (case from Economist ) but haven’t done so recently ii. Expected utility hypothesis (using St. Petersburg paradox; Bernoulli hypothesis) iii. von Neumann- Morgenstern utility (not indifference curve analysis); square root function is the particular function used iv. Expected value v. Expected utility V. vi. Certain wealth equivalent vii. Risk (maximum) premium viii. Graphical ix. Numerical c. Economic concepts for asymmetric information (brief) i. Moral hazard – numerical illustration using utility ii. Adverse selection – numerical illustration using utility or Akerloff’s lemons model (supply and demand) d. Mathematical concepts i. Slope (marginal utility of wealth) ii. Precise graphing iii. Basic probability (only basics) 1. Expected value 2. Variance; standard deviation 3. Law of large numbers 4. Probability distribution General equilibrium and welfare economics – Perloff chapters 10: 309-324, 331340; 18: 605-618, 625-631; 2 - 3 weeks; there is not enough time to cover all of these topics in depth a. Economic concepts i. General equilibrium – example: effects of the minimum wage in the covered and uncovered labor market ii. Equilibrium analysis iii. Efficiency in exchange (not production) 1. First Fundamental Welfare theorem (already covered in supply and demand section, now using the Edgeworth box) 2. Second Fundamental Welfare theorem (very brief) 3. Edgeworth box 4. Pareto principle 5. Social welfare function 6. Utility possibilities frontier 7. Condorcet’s paradox (social choice) iv. Distinguish between efficiency and equity v. Externalities – definitions, basic graph, implications; very brief vi. Public Goods – definitions and implications; very brief b. Mathematical concepts i. Linear equations VI. VII. VIII. ii. Summation of linear equations iii. Simultaneous equations iv. Precise graphing Student Learning Objectives covered a. Display command of and interpret existing economic knowledge i. Understand and precisely explain key economic concepts ii. Describe how economic concepts can be used iii. Evaluate how economic concepts are used in economic analysis published in the media (popular and scholarly) iv. Summarize an economic argument b. Apply existing economic knowledge i. Formulate meaningful questions ii. Understand and effectively employ relevant analytical and logical skills to solve problems iii. Reason systematically and understand the use of models iv. Reason quantitatively v. Communicate effectively (writing primarily) c. Develop lifelong learning skills i. Development an appreciation for using economic concepts, skills and ways of thinking to answer questions one has about the world Assignments a. Three in-class exams – emphasizing problem solving (400 points); writing and problem solving b. Problem sets (3-4) – case analysis using mathematics (100 points) c. Homework not collected (assigned from text, my own); approx. 60-70 each semester d. Practice exam before each in-class exam (4-6 problems each) Concepts not covered a. No tax incidence using supply and demand functions b. No trade problems with supply and demand c. Only if time permits can behavioral economics be introduced (e.g. Kahneman- Tversky, Simon, prospect theory value functions); I have done it only once since Perloff incorporated it into his text d. No game theory