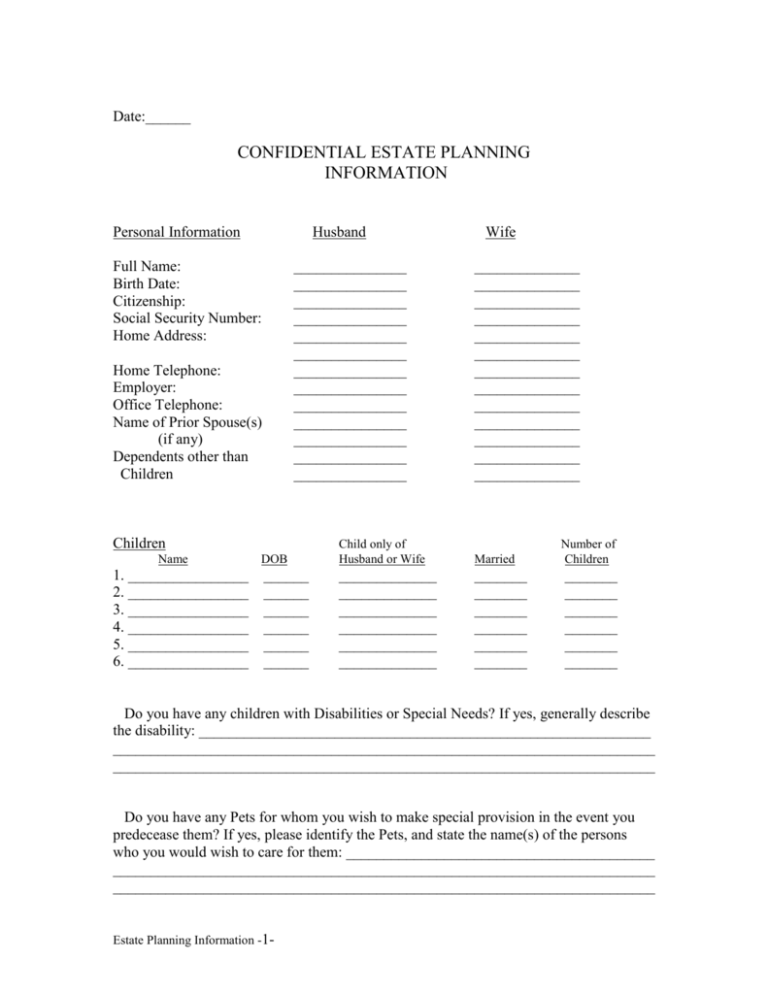

Children Child only of Number of

advertisement

Date:______ CONFIDENTIAL ESTATE PLANNING INFORMATION Personal Information Husband Full Name: Birth Date: Citizenship: Social Security Number: Home Address: Home Telephone: Employer: Office Telephone: Name of Prior Spouse(s) (if any) Dependents other than Children _______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________ _______________ Children Name DOB 1. ________________ ______ 2. ________________ ______ 3. ________________ ______ 4. ________________ ______ 5. ________________ ______ 6. ________________ ______ Wife ______________ ______________ ______________ ______________ ______________ ______________ ______________ ______________ ______________ ______________ ______________ ______________ ______________ Child only of Husband or Wife Married _____________ _____________ _____________ _____________ _____________ _____________ _______ _______ _______ _______ _______ _______ Number of Children _______ _______ _______ _______ _______ _______ Do you have any children with Disabilities or Special Needs? If yes, generally describe the disability: ____________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ Do you have any Pets for whom you wish to make special provision in the event you predecease them? If yes, please identify the Pets, and state the name(s) of the persons who you would wish to care for them: _________________________________________ ________________________________________________________________________ ________________________________________________________________________ Estate Planning Information -1- Last Will and Testament A. Personal Representative, Guardian, Trustee 1. Personal Representative. The personal representative is the person you designate to identify and collect assets of your estate, pay claims and obligations of the estate, and distribute the estate assets according to your Will. Spouses often serve for each other; you will also want to name a successor if the primary nominee cannot serve. Name of Person to serve as: Husband Wife Personal Representative (PR) _________________ ________________ Successor PR _________________ ________________ 2. Guardian. The Guardian is the individual who will take custody of your minor children (under age 18) when there is no surviving parent. The Guardian’s role is parental in nature rather than financial (typically you would appoint a Trustee to administer the assets you leave to your children). The guardian and trustee will coordinate with each other, and can be the same person (although, it is generally a better idea to have separate persons serve in these roles). You should also name a successor guardian in the event the primary nominee is unable or unwilling to serve. You should discuss this decision thoroughly with the persons you choose prior to naming them in your Wills. Choosing wisely in this matter is the most important decision you will make in your Will. Name of Individual(s) to serve as: Guardian ________________________ Successor Guardian ________________________ 3. Trustee. The Trustee is the individual or entity designated to hold, manage, and distribute assets placed in any trust(s) established in your Will. The trustee is guided by State law, and may obtain and rely on the advice of professionals regarding the management of the assets. Where the trust is for the benefit of your minor children, it is often a good idea to name the primary trustee as successor guardian and visa versa. There are also many other types of trusts, however, and you should weigh this choice very carefully. Obvious things to consider include honesty and ability to handle investment and management of assets. Name of Individual(s), Entity to serve as: Trustee _________________________ Successor Trustee _________________________ Estate Planning Information -2- B. Dispositive Provisions in Will (Who do you want to get your assets) 1. If Married: (a) Outright to Spouse? Most spouses desire to leave their share of the estate to their spouse free and clear; however, you are not required to do this, and there may be circumstances where it is wise not to do so. For example, if you have a taxable estate you may want to leave assets to your spouse in trust. Also, if you have children from a prior marriage for whom you wish to provide, you can do this by a trust (or other means), whereby you can both provide for the needs of your spouse during life, and increase the likelihood that your children will get something (either on your death or on the death of your spouse). Please consider your thoughts in this regard and we can discuss this issue at our consultation. ________________________________ ______________________________________________________________________________ ______________________________________________________________________________ (b) Trust for Minor Children. If you have minor children it is a good idea to establish a trust in your Will to hold your estate for their benefit if both parents die when the children are still young. The provisions of the trust would generally allow the trustee to make payments for the health, support, and education of the children. At some point, a child’s share is usually distributed to him/her outright and the trust terminates. The termination should be at the age or ages at which the child can be expected to manage the funds independently. For example, ½ of a child’s share could be distributed to the child at age 25 with the balance 5 years later. If you would like a trust for your children, at what ages would you like to see final distribution; and do you have thoughts about special provisions in the trust (i.e., a greater amount going to a child with greater needs, etc.). _________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ (c) Gifts to Individuals other than Spouse or Descendants. Do either of you wish to make gifts in your Will to individuals (i.e., parents, siblings, pets, etc.) or entities (such as charities) other than to your spouse or descendants (children and grandchildren)? ______. If yes, please specify names and amounts (or percentages). _________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ (d) Neither Spouse Nor Descendant Survive. In the event neither your spouse nor any of your descendants survive the complete distribution of your estate, please name the individual(s) or charities to whom you would like to leave such remaining estate. _______________________ ______________________________________________________________________________ ______________________________________________________________________________ 2. If Single. Please state your wishes as to which individuals, charities, etc., for whom you would like to provide, indicating the approximate amount or percentage interest each would receive from your estate (also include addresses)._______________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ Estate Planning Information -3- 3. Special Concerns. Are there any additional concerns or questions about disposition of your estate that are not discussed above? ___________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ Other Documents A. General Financial Durable Power of Attorney. This document allows you to appoint an individual to make decisions and take actions regarding your financial affairs in the event you ever become incapacitated. Typically, this document does not take effect until or unless you become incapacitated (written evidence from your doctor is required to establish this), and is a very effective way to avoid a very costly and lengthy guardianship process (which would be required in the event you become incapacitated and do not have a power of attorney). Name of Individual to serve as: Husband Wife Primary Attorney-in-Fact (Phone Number) Alternate Attorney-in-Fact (Phone Number) _________________ _________________ _________________ _________________ _________________ _________________ _________________ _________________ NOTE: The issue of Medicaid Planning often arises in preparing this Power of Attorney. This is particularly important if you are older and/or have a history in your family of dementia, strokes, or other problems that can lead to long-term disability. Please make any notes if this issue is of concern to you, and we will discuss it at our meeting. ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ B. Medical Power of Attorney. A medical power of attorney allows your nominee to make decisions regarding your medical treatment and related issues. It is a good idea to make this effective upon signing; however, as long as you are competent or are conscious, a physician will look only to you for decisions regarding treatment. You should give a copy of this document to your physician after it has been executed. Name of Individual to serve as: Husband Wife Primary Medical Attorney-if-Fact (Phone Number) Alternate Medical Nominee (Phone Number) ________________ ________________ ________________ ________________ ___________________ ___________________ ___________________ ___________________ C. Health Care Directive. This document (also referred to as a “living will”) is a statutory form designed to provide for the withdrawal of artificial life support systems (such as feeding tubes) if you are diagnosed to be in a “terminal condition” or in a “permanently unconscious condition. This document is only effective in situations where you are (1) unconscious, (2) where death is immanent, and (3) with where there is no chance of recovery). Would you be interested in such a document? ________________________________________ Estate Planning Information -4- D. Community Property Agreement. This is an Agreement between spouses that will provide that all of the couples’ property will pass to the survivor upon the death of the first spouse. This primary benefit of this document is that it will avoid the need for a probate upon the death of the first spouse; and it should be seriously consider where there is a stable, long-term marriage and you want all your property to pass to your spouse upon your death. This document is often not a good idea in some situations, including the following: where there are large estates with tax issues, where yours is a second marriage and you have children from a prior marriage for whom you wish to provide, for relatively short-term marriages or where the marriage is unstable. We will discuss this document at our consultation. Existing Documents. Please provide me with copies of any existing estate planning documents, including Wills, Powers of Attorney, Community Property Agreements, Prenuptial Agreements, Living Wills, and other documents about which you have questions. Advisors: Investments: _________________________________________________ Accountant: __________________________________________________ Insurance: __________________________________________________ ASSETS AND LIABILITIES A. Assets Separate Property Wife Community Property - Checking & Saving Account $______________ _______________ ____________ - Shortterm Investments (CD’s, Money Market, etc.) $______________ _______________ ____________ - Stocks and Bonds $______________ ________________ _____________ - Annuities $______________ _________________ _____________ - Principal Residence (address) $______________ _________________ _____________ - Vacation Property (address) $_______________ _________________ _____________ - Other real estate (addresses) $______________ _________________ _____________ - Debts owed to you $______________ _________________ _____________ Estate Planning Information -5- Separate Property Husband Husband Wife Community - Face Value of Life Insurance _______________ _________________ (List Policies by amount, beneficiary, name of insurer) 1. 2. 3. _____________ - Retirement Benefits _______________ (List each IRA/401K etc., including amounts, name of beneficiary, and holder of account) 1. 2. 3. _________________ _____________ - Valuable Furishings/Jewelry ________________ _________________ (List only items such as jewelry, antiques, etc., that are worth at least $1,000) _____________ - Automobiles & Boats ________________ _________________ _____________ - Other (specify) ________________ _________________ _____________ ________________ _________________ _____________ Total Assets B. Liabilities (List only significant debts, such as mortgages, major credit card debt, etc.) ________________ __________________ _____________ ________________ __________________ _____________ Total Liabilities ________________ __________________ _____________ The reason we ask for information about assets is partly to determine if you have any issues regarding estate tax; and partly to ensure that the beneficiary’s in your Wills are the same persons that would get the asset under any beneficiary designations in things such as life insurance contract, money and/or investment accounts. It is very important that the Will and specific beneficiary designations be in accord. Estate Planning Information -6- General Information Husband Wife 1. Estimate size of future inheritance _____________ _______________ 2. Are you currently a Trustee or beneficiary of any trust? Specify. _____________ _______________ 3. Have you ever made any gifts in _____________ excess of $10,000 to any individual in any one year? Specify. _______________ 4. Do you own any property outside the State of Washington? Specify. _______________ _____________ Questions That You Have. In this space you should make a list of any questions you may have, and we can discuss them at our initial consultation. - Upon Completion call Jon Clark at (206) 675-0803 for appointment, and bring this completed form with you. Law Office of Jon A. Clark 5413 Meridian Ave. N. Suite A Seattle, WA 98103 Estate Planning Information -7-