Lecture 6

advertisement

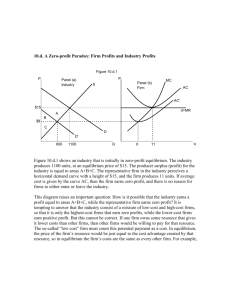

Updated: 21 Feb. 2007 MICRO ECONOMICS (ECON 601) Lecture 6 Topics to be covered: a- Pricing under homogeneous oligopoly b- Quasi-competitive model c- Cartel model d- Cournot solution e- Conjectural variation models f- Price leadership model g- Cournot’s natural spring duopoly h- Product differentiation i- Entry and monopolistic competition j- Contestable markets and industry structure Traditional Models of Imperfect Competition Nicholson Chapter 14 These models fall between the extremes of perfect competition and monopoly. Three types of market situations to be studied: (1) Pricing of homogeneous goods in markets in which there are relatively few firms (2) Product differentiation and advertising in such markets (3) The effect that entry and exit possibilities have on long-run outcomes in imperfectly competitive markets. In the analysis we use the competitive model as a useful benchmark. Criteria (1) Are prices under imperfect competition equal to marginal costs? (2) In the long-run does production occur at minimum average costs. Pricing under homogeneous oligopoly Output of each firm in the model is denoted by qi (i = 1,...,n) Firms are all identical; hence output of each firm is the same. Inverse demand function: P = f (Q) = f (q1 + q2 + ...+ qn) Total cost of each firm is TCi (qi) i = Pqi – TCi (qi) = f (Q) qi – TCi (qi) i = f (q1 + q2 + ...+ qn) qi – TCi (qi) Central question is how firms make profit maximizing output choice. Key issue is how firm assumes other firms react to its decisions. Four of the many possible models are examined here: 1. Quasi-competitive model: Assumes price-taking behavior by all firms (P is treated as fixed). 2. Cartel model: Assumes firms can collude perfectly in choosing industry output. 3. Cournot model: Assumes that firm i treats firm j’s output as fixed in its decision can (∂qj/ ∂qi) = 0. 4. Conjectural variations model: Assumes that firm j’s output will respond to variations in firm i’s output (∂qj/ ∂qi 0). 1 Quasi-Competitive Model Each firm assumes that it is a price taker and that its decisions will not affect the market. First order conditions for a maximum from profit function i = Pqi – TCi (qi) or, ∂Пi/∂qi = P – ∂ [TCi (qi)]/∂qi= 0 P = MCi (qi) (i = 1,...,n) These n supply equations together with the market clearing demand equation, P = f (Q) = f (q1 + q2 + ...+ qn) will ensure that market arrives at the short-run competitive solution, with constant marginal costs of MC. The condition that each firm as a price taker gives us the competitive equilibrium of C below with Pc and Qc. D C PC MC D MR QC Cartel Model Alternative assumption is that each firm recognizes that its decisions have an effect on price. The firms as a group recognize that they can affect price and coordinate their decisions to achieve monopoly profits. The cartel operates as a multi plant monopoly. 2 = PQ – [TC1 (q1) + TC2 (q2) +... + TCn (qn)] = f (q1 + q2 + ...+ qn) (q1 + q2 + ...+ qn) – n TCi (qi) i 1 ∂Пi/∂qi = P + (q1 + q2 + .......+ qn) – ∂P/∂qi - MCi (qi) = 0 = MR (Q) – MCi (qi) = 0 MR can be written as a function of the combined output of all firms, since its value is the same no matter which firm’s output level is changed. If MC’s are equal and constant for all firms, the output choice is indicated by point M in figure below. Price D Pm M MC PC D MR Qm Quantity by per period This coordinated plan requires a specific output level for each firm. Aggregate profits will be as large as possible given market demand and the industry's cost structure. Profits will be shared according to the output level of each firm. 1. 2. Cartel solution requires a considerable amount of information available to directors of the cartel. (a) market demand function and (b) each firm’s marginal cost function. Cartel solution is fundamentally unstable since each cartel member will produce an output level for which P>MCi. Hence, each will have an incentive to expand output. If director's of cartel can not stop such over production, the monopolistic situation will collapse eq. OPEC in 1980’s. 3 Cournot Solution Assumes that firm recognizes its own decisions about qi affecting the price in the market ∂P/∂qi 0 but assumes, q j q i = 0, for j i. (1) ∂Пi/∂qi = P +qi*∂P/∂qi-MCi (qi) = 0 (for all i = (1,...,n) The n equations of the form of (1) together with market clearing demand equation P = f(Q) will give an equilibrium solutions for q1, q2,...,qn. As long as marginal costs are increasing, each firm’s output in the Cournot solution will exceed the cartel output, since the “firm-specific” marginal revenue is larger than the market marginal revenue shown in the cartel situation i.e. P + qi (∂P/∂qi)>P + Qm (∂P/∂qi) because qi < Q. The greater the number of firms in the industry the closer the equilibrium points will be to the competitive case. Price D P* MC D MR Q* Quantity by per period Conjectural Variations Models Need to allow for strategic interactions among firms. This is important when number of firms is small. One approach relies on game theory to examine strategic choices. 4 We introduce into the model assumptions that might be made by one firm about another firms behavior for each firm i we are concerned with the assumed value of the derivative q j q i for all firms j other than firm i itself. Because value of derivative is speculative, models based on various assumptions are termed “conjectural variations” models. To this point in our discussion of oligopoly, we have assumed q j q i = 0 for all j i, once we relax this assumption then first order condition for profit maximization becomes. ∂∏i/∂qi = P + qi [∂P/∂qi + n j i ∂P/∂qj q j ] – MCi (qi) = 0 q i Firm must now consider how variations in its own output will affect the market price through their effect on the other firms’ output decisions. Price Leadership Model Market is composed of a single price leader and a fringe of quasi – competitive competitors. The price leader has lower cost than that of the competitive suppliers, e.g. Saudi Arabia in OPEC. D Supply of quasi-competitive firms P1 D’ Excess demand curve PL D’ P2 MCL MR O Qc QL QT QL set by MR = MCL 5 D QT = QL + QC At the price set by price leader, the competitive firms all together will supply Qc. At prices above P1 the market will be supplied by competitive fringe. At prices below P2 there is no competitive Fringe. The price leader considers the excess demand function it faces D’D1, and equals its Marginal Revenue with its own MC curve. Consider a number of types of market organization using: Cournot’s Natural Spring Duopoly Two firms, no production costs, MC = 0 Demand Curve, Q = q1 + q2 = 120 – P P = 120 – Q Quasi Competitive Solution: Total output = 120 with price zero, and allocation between two firms indeterminate. Cartel Solution P = 120 – Q = P. Q – TC = 120 Q – Q2 – 0 ∂∏/∂Q = 120 – 2Q = 0 Q = 60 P = 60 = 3600 6 120 M 60 O 60 MR 120 Q Cournot Solution P=120-q1-q2 1 = P q1 = (120 – q1 – q2) q1 = 120q1 – q12 – q1q2 (where P = 120 – q1 – q2) 2 = P q2 = (120 – q1 – q2) q2 = 120q2 – q1q2 –q22 (1) (2) Assume, ∂q1/ ∂q2= ∂q2/ ∂q1 = 0 ∂∏1/∂q1 = 120 – 2q1 – q2 = 0 ∂∏2/∂q2 = 120 – 2q2 – q1 = 0 Solving for q1 and q2, From (2) q1=120-2q2 Solution (1) q2=120-2(120-2q2) q2=120-240+4q2 3q2=120 q2=40 q1 = q2 = 40 P = 120 – (q1 + q2) = 40 1 = (40) (40) = 1600 2 = (40) (40) = 1600 = 3200 Given that one spring owner’s output is 40 in the Cournot model why can’t the other one gain by lowering its price to sell more? 7 Stackelberg Leadership Model What are the consequences if firm 1 knows that firm 2 chooses q2 so that q2 = (120-q1)/2 The amount that firm 2 sells is equal to half of the difference between the max. amount demanded and the quantity supplied by firm 1. Demand: Q = q1 + q2 = 120 – P, P=120-q1-q2 Profit, 2 = (120 – q1 – q2) q2 – TC Where TC and MC is assumed = 0 2 = 120q2 – q1q2 – q22 For profit maximization, ∂∏2/∂q2= 120 – q1 – 2q2 = 0 q2 = (120-q1)/2 Hence, ∂q2/∂q1 = – ½ is firm 1`s conjectural variation of the response of firm 2 to a change in q i`s output. Firm 2 reduces its output by ½ unit for each unit increase in output of firm 1, (q1) Firm 1 knows that Firm 2 reduces its output by ½ unit for every unit increase by q1. Profit maximization by firm 1 is now: 1 = P q1 = 120q1 – q12 – q1q2 ∂∏1/∂q1= 120 – 2q1 – q1 (∂q2/∂q1) – q2 = 0 As (∂q2/∂q1) = – 1/2 = 120 – 2q1 + ½ q1– q2 = 0 (1) =120 – (3/2)q1– q2 = 0 Solving (1) with q2 = (120-q1)/2 120 – (3/2) q1 – (120-q1)/2 = 0 60 – 3/2 q1 + q1/2 = 0 Gives, q1 = 60 and q2 = 30. P = 120 – (q1 + q2) = 30 1 = P q1 = 60 * 30 = 1800 2 = P q2 = 30 * 30 = 900 Problem to determine which firm is chosen as the leader. If each firm assumes that the other is a follower each will produce 60 and profits will fall to zero. If both acts as a follower than the Cournot solution is the result. 8 Product Differentiation Product Group The outputs of a set of firms constitute a product group if the substitutability in demand among the products (as measurable the cross-price elasticity) is very high relative to the substitutability between those firms` outputs and other goods generally. If there are n firms competing in a particular product groups. Each firm can choose the amount it spends (z) to differentiate its product from those of the competitors. Total Costs = TCi (qi, zi) Pi = g (qi, Pj, zi, zj) Presumably, ∂g/∂qi < 0 ∂g/∂Pj > 0 ∂g/∂zi > 0 ∂g/∂zj < 0 i = Pi qi – TCi (qi, zi) If, ∂zj/∂qi; ∂zj/∂zi ; ∂Pj/∂qi ; ∂Pj/∂zi are all assumed to be equal to zero. Then, (1) (2) ∂∏i/∂qi = Pi + qi ∂Pi/∂qi – ∂TCi/∂qi = 0 ∂∏i/∂zi = qi ∂Pi/∂zi – ∂TCi/∂zi = 0 This is saying from (1) that output should be produced up to the point where MR = MC. From (2) and additional differentiation will be pursued up to the point where the additional revenues they generate will be equal to their marginal costs. Entry and Monopolistic Competition Possibility of new firms entering the industry will lower prices and reduce profits. Zero profit equilibrium will take place in a competitive industry with free entry when P = MR = MC and P = AC. If entry is allowed this will also cause a monopolistic industry to have its profits reduced to zero. If firms can differentiate their product hence they will face a downward sloping demand curve. Before entry profits maximized at P0*Q0* where MC = MR0 (see figure). 9 Excess Capacity of Qm – Q1 MC AC A P*0 B C P1 D0 MR0 MR1 O Q1 Q*0 D1 Qm At the same time entry into the industry will cause the demand curve to shift to the left until it is just tangent to its average cost curve. At this point there will be zero profits but P > MC and MR1=MC. At P1, Q1 there will be zero profits but excess capacity. This zero-profit equilibrium was first described by Edward Chamberlin as monopolistic competition. In the equilibrium each firm has P1 = AC but P1 > MC. Each firm has diminishing average costs at its final equilibrium point. As there are zero profits the final equilibrium will be sustainable. What happened if price set by regulation and at the same time free entry? For example- Taxi cabs prices set by regulation but no restrictions in taxi cab licences. - The rate of “take” of casinos set by regulation but no restriction on entry of casinos. Contestable Markets and Industry Structure Monopolistic competition neglects the effects of potential entry on market equilibrium by focusing only on the behavior of actual entrants. Competition for the market provides a more appropriate perspective for analyzing the free entry assumption. 10 Perfectly Contestable Market A market is perfectly contestable if entry and exit are absolutely free. Equivalently, a perfectly contestable market is one in which no outside potential competitor can enter by cutting price and still make profits. Hence, even if the number of firms operating in a market is relatively small but the perfectly contestable assumption will ensure competitive behavior. The ability of potential entrants to seize any possible opportunities for profit constrains the types of behavior that are possible. Price MC1 MC2 AC1 MC3 AC2 MC4 AC3 AC4 D q* 2q* 3q* number of firms, n = Q*/q* Q* = total market demand, when P = min AC q* = size of firm at min AC. A Contestable Natural Monopoly Total cost of producing electric power: Q = megawatts of electricity Total Cost: TC = 100 Q + 8000 ∂TC/∂Q = MC = 100 Demand: QD=1,000-5P P = 1000/5 – QD/5 Total Revenue TR = PQ = 200 Q – QD2/5 ∂PQ/∂Q = MR = 200 – (2/5)Q MR = 200 – (2/5)Q = MC = 100 11 Q*=4q* Output Qm = 100 * (5/2) = 250 250 = 1000 – 5P 5P = 750 P = 750/5 = 150 Profits will be TR – TC = (150)(250)-[100(250)+8000]=37,500 – 33,000 = 4,500 A. Contestable Solution The only viable price under the threat of potential entry is average cost. The monopoly will set price when its profits =0 Q = 1000 – 5P = 1000 – 5 (AC) AC = TC/Q = 100 + 8000/Q AC=P QD=1000-5(100+8000/Q) QD=500-40000/Q Q2 – 500 Q + 40,000 = 0 (Q – 400) (Q – 100) = 0 P AC MC 100 400 Q = 400 solution is a sustainable entry deterrent. Therefore the market equilibrium is Q = 400. Therefore, with QD=1000-5P 400 = 1000 – 5P P = 600/5 = 120 Contestable solution is precisely what might be chosen by a regulatory commission interested in average cost pricing. 12 Price D 150 120 AC 100 MC D MR 250 400 Quantity Price is set by regulation with free entry Firm Market Efficiency loss in production Price Price s s P P q1 q0 Q1 Q0 Quantity P set competitively Q n0= 0 q0 At q0 P=Min AC=MC s set by regulation At q1 s=AC≠ MC n1= WC=[AC(q1)-AC(q0)]Q1+ ½(Q0-Q1)(AC(q1)-AC(q0)) 13 Q1 q1 Quantity Efficiency loss in consumption Barriers to entry Product differentiation may raise entry barriers so that no room remains for would be entrants. Strategic pricing may deter entry some types of capital investments that may not be reversible. The End 14