171 - Commercial Taxes Department

advertisement

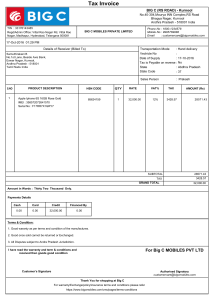

G.O. Ms. No. : 390, Revenue (CT-II), dated 06/12/2000 Gazette No : Andhra Pradesh Gazette, Extraordinary No.265, Pat I Publication Date : 14/06/2000 Subject : Exemption on sales of vehicles, office equipment and furniture to G.H.K. Consultants In Exercise of the powers conferred by sub-section (1) of Section 9 of the Andhra Pradesh General Sales Tax Act, 1957 (Act No. VI of 1957) the Governor of Andhra Pradesh hereby grants exemption on the local sales of vehicles, office equipment and office furniture to M/s. G.H.K. Consultants who have been engaged by Department for International Development (DFID) for implementation of Andhra Pradesh Urban Services for Poor Project for a period of 3 years (i.e.) upto 31-3-2003. The purchases of the above goods should be certified by the Commissioner and Director of Municipal Administration and the total amount should not exceed Rs.27.20 lakhs for vehicles and Rs.37.40 lakhs for office equipment and Rs.13.16 lakhs for office furniture. References: 1. THE A.P. GENERAL SALES TAX ACT, 1957 Section 9