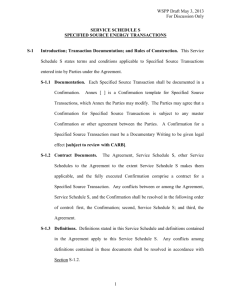

WSPP Ex C-SS Specified Source Initiative - Redline - 06-12-2013

advertisement

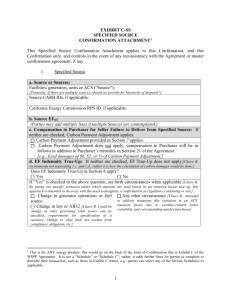

EXHIBIT C-SS SPECIFIED SOURCE CONFIRMATION ATTACHMENT1 This Specified Source Confirmation Attachment, entered into as of [ ] (the “Specified Source Confirmation Attachment”) applies to the Confirmation attached hereto by and between [ ] (“Purchaser”) and [ ] (“Seller”) dated as of [ ] (the “Applicable Confirmation”), and the Applicable Confirmation only, and controls in the event of any inconsistency with the WSPP Agreement, as amended and supplemented from time to time (the “WSPP Agreement”), and/or a master confirmation agreement between the parties hereto, if any. [Brookfield: A default for each category should be defined where possible and require a check box only when deal terms are different from the default. This would help facilitate trading. My traders found the existing format overly time consuming as currently when trading using Schedule A, B, C, they simply have to define the Schedule and the price. Also, if a default is identified only one check box should be required to eliminate duplication. For example in Section (f) it reads if neither is checked “no” applies. Instead the default should be set to Non Regulatory Continuing (this is what the group previously voted for) and there should be one box to check that specifies different from the default rather than the “Yes” “No” option provided. This is achieving the same goal as the current format but seems cleaner and easier. This is consistent in a number of places in the document. This document would be too time consuming for a trader to execute.] 1. Specified Source. a. Identity of Source or Sources: Facilities, generators, units or ACS (“Source”): [Transalta: if there are multiple sources, should we provide for hierarchy of dispatch?][TransAlta: But this should include a hierarchy of dispatch, in the case of a firm energy product.] Source CARB IDs, if applicable: California Energy Commission RPS ID, if applicable: [Exelon: Is this intended to be CEC #? WREGIS ID #?] b. Source EFsp: (Parties may add multiple lines if multiple Sources are contemplated.) [Brookfield: Rather than listing multiple source emissions factors list a single emissions factor that the seller is committed to guarantee less than or equal to. Anything above this rate would lead to the seller paying damages. This seems like a more simplified approach than specifying each resource carbon rate as it is unnecessary. This gives the seller to substitute the delivery of power from any of the sources they have listed in (a) and they will not pay damages unless carbon rate is higher than the agreed upon rate.] 1 This is for ANY energy product- this would go on the back of the form of Confirmation that is Exhibit C of the WSPP Agreement. It is not a “Schedule” or “Schedule C”; rather, it adds further lines for parties to complete to describe their transaction, such as those in Exhibit C where, e.g., parties can select any of the Service Schedules as applicable. 1 c.Carbon Adjustment: If neither is checked, Carbon Adjustment applies. [Brookfield: Make Carbon Payment Adjustment applies as the default and include only one check box if it does not apply.] Carbon Adjustment [below] applies. See Section 7. Carbon Adjustment does not apply. Compensation to Purchaser will be as follows in addition to Purchaser’s remedies in Section 21 of the Agreement: [e.g., fixed damages of $0, $2, or % of Carbon Adjustment.] d. EF True-Up: If neither are checked, EF True-Up does not apply.[Claire B. recommends not separating 1.c. and 1.d., rather it is how the calculation of carbon damages would be done.][PGE: I like separating them. Different issues.][Exelon: Tend to agree with Claire here.] [Brookfield: It seems the calculations for Carbon Payment Adjustment specified in Section 7 and Section 8 can be simplified to be the difference between the contract rate specified in (b) and the cost incurred for actual realized carbon rate priced at GHG index. It is not clear why multiple calculations are required as it seems this would cover the scenario where the carbon rate was known ahead of time and when it was not known ahead of time as well as the case where there are multiple sources as I describe above. Therefore it seems that Section 1c and 1d can be merged and only the calculation in Section 8 is necessary. We agree with Claire’s comments in this regard.] EF True-Up does not apply. EF True-up applies. See Section 8. PGE: If EF True-up applies, set forth circumstances when applicable: If none are checked, All circumstances applies.[Claire B: By laying out specific scenarios under which amounts are paid based on an emission factor true up, this approach is intended to do away with the need to designate a confirmation as regulatory continuing or not.][PGE: To me, regulatory continuing and EF True-up are two different things. I would delete this section. Remember: 1) we know that CARB will not determine the 2013 Specified Source EF until 2014, so if you buy 2013 SS power there is likely to be change in the EF – that is due to the normal cycle of how CARB calculates the EF retroactively and is not a function of Change in law. 2) we know that if in 2013 you buy ACS energy for 2014 delivery, CARB has not yet determined the EF so again, a potential trueup based on the timing of when CARB calculates the EF, not due to a change in law. Maybe this should be written from the perspective of EF True-up always applies, except when the following boxes checked: a) EF True-up never applies, b) change in law, c) change in generator operations or fuel source.] All circumstances. [Claire B.: Intended to address situations like variation in an ACS’ emission factor due to weather-related hydro variability and corresponding market purchases] Change in generator operations or fuel source. Change in law or AB32 [Claire B. Could be change in rules governing what power can be specified, requirements for specification of a resource, change to what fuels are exempt from compliance obligation, etc.] Exelon: If “Yes” is checked in the above question, the following circumstances, if checked, will require a payment from Seller to Purchaser pursuant to Section 8 in the event that such circumstance(s) occurs during the term of the Applicable Confirmation [I assume that’s what intended here?]:[Claire B: By laying out specific scenarios under which amounts are paid based on an emission factor true up, this approach is intended to do away with the need to designate a confirmation as regulatory continuing or not.] Change in generator operations or fuel source. [Change in law or AB32 – Better define? Leverage the definition of “Change in Law” found in Service Schedule R?] [Claire B. Any other circumstance [Seems broad. Narrow to something like “Any other circumstance that result in…” [Claire B.: Intended to address situations like variation in an ACS’ emission factor due to weather-related hydro variability and corresponding market purchases] 2 Could be change in rules governing what power can be specified, requirements for specification of a resource, change to what fuels are exempt from compliance obligation, etc.] e. RECs Creation and Retirement2: [think this through for daisy chain transactions. Expecting that CARB may proposes changes to their rules on this in July. Can this retirement, etc., obligation be daisy chainable? How do we know which RECs are to be retired from ACS resources?][Brookfield: Simply by making RECs not sold as the default. If RECs are not sold with deal than by default seller must be responsible for retirement. Only check box in case where RECs are sold and by default in this case the buyer would be responsible as they would hold title to the RECs.] Are RECs created for the electricity generated by the Source that is sold under this Confirmation? Yes No If “Yes” is checked in the above question, select the following “Responsible Party” for the retirement and verification of RECs under the Cap and Trade Regulations3: If neither are checked, Seller is responsible. Seller Buyer Retirement and verification: By Responsible Party (as selected above) in its Western Renewable Generation Information System retirement subaccount for the current calendar year and included in its [report] to CARB for the current calendar year Other: [Set forth different retirement and verification] f. Regulatorily Continuing: If neither is checked, “no” applies.[See Claire B. comment below in def.][TransAlta: As long as we have ongoing audit/verification inquiries addressed by the sellers, we don’t need this box.][Brookfield: As stated in comments above, create default and only check box if outside of default.] Is this transaction Regulatorily Continuing? No Yes g. E-Tag Scheduling Requirement: If neither is checked, “no” applies. [Brookfield: Decide on default and require GHG designation be provided by seller and noted on contract. Buyer should be held responsible for any e-tagging errors unless GHG designation is wrong. In that case seller should be responsible for damages.] Is Purchaser responsible for scheduling and populating NERC e-Tag with GHG designation or as otherwise designated in the Miscellaneous Token Field of the Market Path where the Seller is listed as the PSE; provided, however, that errors will not give rise to a Carbon Payment Adjustment or other damages? No [TransAlta: If this is used the industry Yes standard should be to use the ARB ID# of the source.] 2 If any part of this Section is not completed, each Party takes the risk of failing to meet CARB requirements with respect to RECs retirement and verification. 3 This attachment is not intended to enable an RPS transaction, only to provide that electricity is from a specified source. Therefore, one would add CPUC STCs or other REC transaction provisions in the Confirm if this is part of an RPS transaction. 3 2. Definitions. Initially capitalized terms used and not otherwise defined herein are defined in the Cap and Trade Regulations or the WSPP Agreement, as applicable. a. “AB32” means the California Global Warming Solutions Act of 2006 and the Cap and Trade Regulations. b. “ACS” means “asset-controlling supplier” as that term is defined in the Cap and Trade Regulations. c. “Cap and Trade Regulations” means the Mandatory Greenhouse Gas Emissions Reporting and California Cap on Greenhouse Gas Emissions and Market-Based Compliance Mechanisms regulations (California Code of Regulations Title 17, Subchapter 10, Articles 2 and 5 respectively) promulgated by CARB pursuant to the California Global Warming Solutions Act of 2006, in each case as may be amended or restated from time to time. d. “CARB” means the California Air Resources Board of the California Environmental Protection Agency. e. “EF” is the CO2e emissions factor equivalent to the default emission factor for unspecified power, pursuant to the Cap and Trade Regulations. f. “EFass” means the final emission rate assigned by CARB for the Specified Source energy delivered under this Confirmation. [This is used in the EF Indemnity True-Up and could be a different emission rate assigned for delivery from the specified resource, Claire B: In the event of non-delivery, where the power was to have been delivered at a point outside the CAISO, the EF ass would also apply to power delivered pursuant to Purchaser’s purchase of substitute power.][SCL: Consider changing “EFass” to “EFasg” or “EFasn” unless CARB or someone else actually uses “EFass”.] [TransAlta: We need to make sure we are distinguishing between specific alternative sources and substitute power. They are used differently.] g. “EFsp” means the Source emissions factor specified in Section 1.b hereof. h. “EFunsp” means the default emissions factor for unspecified electricity imports within the meaning of the Cap and Trade Regulations. [ref. 95111(b)] i. “GHGAP” is the average California ISO [Greenhouse Gas Allowance Price] for the next succeeding [fifteen] trading days. j. “Penalties” means any alternative compliance payments, penalties, fines or fees imposed or assessed against the performing Party by CARB or a governmental authority on account of the nonperforming Party’s failure to perform, as determined by the performing Party in a commercially reasonable manner; provided that any of the same that are imposed or assessed due to the performing Party’s pre-existing adverse compliance record shall not be included in such determination, and provided further that performing Party shall provide a statement of calculation and reasonable supporting documentation[, redacted to comply with any obligations of confidentiality,] fairly allocating such amounts if the same are imposed or assessed due to the failure of other persons or entities in addition to the failure of the non-performing Party. 4 k. “Regulatorily Continuing” means the transaction [what aspects?] [complies with [AB32][Cap and Trade Regulations] as amended from time to time] as of the [Transaction Date] and the Delivery Date. [Regulatorily Continuing, if adopted by the Contracts Committee for this document as a concept, means that whatever compliance is affected by the designation only applies as of the transaction date, the delivery date, and which other applicable dates, such as reporting and verification dates.] [Claire B.: I would suggest that the definition of regulatory continuing be limited to requirements around registration of the specified source (which currently only applies to ACS – otherwise the buyer/importer registers) and requirements for provision of data necessary for buyer/seller to document and claim a transaction as specified. I think the risks for other changes, and corresponding implications for carbon costs, are too big for most sellers to be able to accept regulatory continuing. Thus, I think those issues would be readily handled through optional carbon payment provisions.][TransAlta: TransAlta supports this suggested definition, inclusive of CB’s suggestion.] l. “SEQ” means the quantity of Substitute Energy. m. “Specified Source” means “specified source of electricity” or “specified source” as defined in the Cap and Trade Regulations. [ref. 95102(a)(432).] n. “Specified Source Transaction” means agreement between a seller and a buyer to transact electricity that both parties agree may be claimed as a specified source under the Cap and Trade Program. [ Claire B.: I think it would be useful to add this definition and refer to the confirmation as a specified source transaction confirmation, rather than specified source confirmation. My rationale is two fold. First, reference to a ‘specified source’ in this confirmation will not make it so in CARB eyes – it’s only one component and whether or not a CARB verifier recognizes an import pursuant to this confirmation as specified is not determined by what the confirmation says. Second, I strongly feel that intent is key from CARB’s perspective. An ACS or owner of a resource has the ability to sell that power as specified or non-specified. CARB is already dealing with parties who purchased power from a particular ACS or resource and want to claim it as specified, even where the seller did not intend to sell it as specified. What parties are doing through this confirmation is making their intention to sell power as specified explicit, and agree to additional provisions to facilitate claiming of the power as specified under CARB’s rules.][TransAlta: Agree] o. “Substitute Energy” includes “substitute power” or “substitute electricity” as defined in the Cap and Trade Regulations [ref. 95102(a)(442)] and any other energy that is not from the Source delivered or otherwise acquired by Purchaser in the event of Seller’s failure to deliver electricity from the Source. p. “TL” means the transmission loss correction factor, if applicable, = 1.00 or 1.02 (MWh of power delivered to California must include transmission loss factor (*1.02) if not measured at busbar for a specified source, at first point of receipt within the balancing area of the applicable ACS, or unspecified or if supplied by such ACS). [Loss factor for EFunsp is 1.02 so we need the 2% adder] q. Rules of Interpretation. Unless otherwise required by the context in which any term appears, (i) the singular includes the plural and vice versa; (ii) all references to a particular entity include a reference to such entity’s successors and permitted assigns; and (iii) the word “or” is not necessarily exclusive. 3. Specified Source Transaction. [Claire B.: I strongly feel that intent is key from CARB’s perspective. An ACS or owner of a resource has the ability to sell that power as specified or non-specified. CARB is already dealing with parties who purchased power from a particular ACS or resource and want to claim it as specified, even where the seller did not intend to sell it as specified. What parties are doing through this 5 confirmation is making their intention to sell power as specified explicit, and agree to additional provisions to facilitate claiming of the power as specified under CARB’s rules.] This is a transaction for the purchase and sale of generation from a particular resource or ACS with the intent that the buyer or downstream purchaser may claim any energy delivered from this generation into California as being from a Specified Source. Seller agrees to provide the electric energy from the designated Source set forth in Section 1 above and not to provide Substitute Energy instead unless required in order to [comply with the service schedule – What’s this intended to capture?]. [refs. 95111(a)(4); 95102(a)(351)] Purchaser may disclose to any potential purchasers from it of all or any part of [Product] that it has engaged in this transaction for a Specified Source from Seller, but any such disclosure shall redact price terms. This right of disclosure is transferrable by Purchaser or any purchaser from Purchaser. Seller agrees to provide to Purchaser, within a reasonable time after request, (a) proof that it either owns the Source or has the right to sell the energy and capacity sold in this Confirmation as energy and capacity from the Source as a Specified Source or ACS, and (b) unless Seller is an ACS, Source meter data or its equivalent. [Claire B.: meter data or equivalent is not required for specified ACS sales. The ‘equivalent’ part is meant to encompass the MID-C hourly allocations.’] [What happens if Lehman is in the chain? Claire B.: The provision of meter data on a monthly basis, and a Confirmation of Disclosure would protect downstream buyers from a Lehman situation. Ultimate source is designated in 1.a., but what if ultimate source is not in privity with the entity being audited by CARB? Claire B.: Unless source is an ACS, source will not be audited by CARB. CARB will only audit the importer. If importer does not have records documenting source generation and contract terms, importer may lose right to claim import as specified.] 4. Representations. Seller warrants and represents: (a) EFsp is the Source’s emissions factor assigned by CARB as reported by CARB of the date hereof; provided however, that for a non-ACS Source, such emissions factor will be based on last year’s emissions characteristics and is not necessarily the actual factor that CARB will assign in the future; and provided further than if an emissions factor is not assigned by CARB, EFsp is estimated by Seller in good faith; (b) it is the ACS, the owner or operator of the Source or is selling or remarketing electricity procured pursuant to a Specified Source Transaction [ref. 95111(a)(4)] ; and (c) if this transaction is for a resale of electricity by Seller, Seller warrants and represents that the energy it is reselling herein was procured pursuant to a transaction that both parties thereto agreed was a Specified Source Transaction and in which the seller in such up-stream transaction agreed to provide data to facilitate reporting and auditing.4 [Claire B.: A reseller cannot warrant that its original contract is in contract is in accordance with the cap and trade regulation – it can only warrant that it has done the best it can. I therefore think that what we need here is warranty that a resellers upstream contract meets the same Wade McCartney: discussion … should emphasize that a Schedule S must be fully functional for resale transactions. The working illustration for the discussion should be some sort of daisy chain transaction involving at least one specified or ACS source, one marketer, and a first deliverer as the importer like an LSE, where Marketer #1 contracts with the Specified Source for Specified Source power. Marketer #1 then resells the specified source power to an LSE who then imports the power to California. In this resale transaction, Marketer #1 represented the product for sale as specified source power which was verbally confirmed with the LSE, where the LSE has assumed that Marketer #1 did in fact properly contract with the generator for specified source power. Marketer #1 needs to bring (or should be prepared to bring) some written document to the table that unequivocally shows that it has the right to resell the specified source power in question. For this daisy chain transaction, how will [the document] ensure that Marketer #1 has in fact secured the right to resell specified source power to the LSE? Does [the document] rely only on documentary writing (possible verbal only) to establish the claim that Marketer #1 has the authority to resell specified source power? It seems that a new paragraph should be added … whereby the seller warrants that they are in fact re-marketing specified source power that was acquired in conformance with ARB rules. --Wade 4 6 conditions as this contract, i.e. both buyer and seller agreed that it was a specified source transaction and seller agreed to provide data to facilitate reporting and auditing..][TransAlta: Agree.] 5. Service Schedules Unchanged. Nothing in this Specified Source Confirmation Attachment limits the obligation of either Party to deliver or receive energy as provided in the Applicable Confirmation. In addition, the Parties hereby acknowledge and agree that, except as specifically amended hereby, the WSPP Agreement and the Applicable Confirmation shall remain in full force and effect in accordance with its terms. [Claire B:. The concept for schedule C specified, is that if the power delivered is not from the designated source, 1.c./1.d. is needed.] 6. Further Covenants. [Brookfield: Would like to see more assurances language here.] a. Seller shall maintain its records and data and make the same reasonably available to Purchaser or Purchaser’s verifier in connection with any present or future reporting, verification, transfer, registration, or retirement requirements associated with this transaction. Nothing herein limits or waives any obligations of Seller or Purchaser to keep records or provide attestations provided in AB32 to the extent such requirements are binding on such party. Nothing in this Specified Source Confirmation Attachment limits the rights or obligations of either Party under Section 9.6 of the Agreement. b. [should or can there be notice of changes to the Source that may cause the current or estimated EFsp in the current year to be meaningfully different in the future?] c. [should parties agree to procedure of notifying each other of delivery of Substitute Energy? Claire B.: I think this is covered by provision for sharing of meter data or equivalent.] d. Seller is under no obligation to attribute or include a value on account of EFsp in determining Replacement Price. e. For any RECs created for the electricity generated by the Source that is sold under the Applicable Confirmation, Seller represents and covenants that it has not sold and will not sell any such RECs to any person or entity other than Purchaser unless otherwise specifically provided herein. If a Party has failed to retire or verify RECs in the manner it has agreed in this Specified Source Confirmation Attachment, it shall pay the other Party that Party’s direct actual damages, as reasonably determined by such other Party. f. If Seller or Purchaser has intentionally provided written false information to the other Party or CARB with respect to any the Source or deliveries under the Confirmation, such Party shall pay the other any Penalties it thereby incurs. [very unpopular with group. what are the scenarios that could in fact give rise to penalties? Selling as specified when you know it’s unspecified? Middleman could be unregulated by carb and not incur any penalties. So can that be daisy chained? Members may not like concept of penalties at all in the WSPP agreement.] 7. [Brookfield: Eliminate this Section as it seems we only need Section 8 to capture the different between the rate incurred versus the rate promised.] Carbon Adjustment. Compensates Purchaser if Seller fails to Deliver from the Specified Source. If Carbon Adjustment applies, without limiting 7 Purchaser’s remedies for Seller’s failure to deliver pursuant to Section 21 of the WSPP Agreement: a. If Purchaser has purchased substitute energy or capacity [PGE: I don’t like this reference to California – it assumes no damages occur if purchased within CA and that may be true currently (but who knows what will change later), but if there are no damages the formula will determine that – so we don’t need the CA reference.] Seller shall pay Purchaser for failure to deliver any part of the energy to Buyer from the Source, or failing to provide the records and data it has agreed hereunder to provide even if delivery has been from the Source and failure to provide such records or data is reasonably anticipated by Purchaser to prevent Purchaser from being able to claim the Source’s EFsp, even if any such failure is on account of an Uncontrollable Force or the requirements of [the Product], a payment equal to: SEQ * TL * (EFunsp 5- EFsp) * GHGAP. b. “Economic benefit” and “economic loss” as those terms are used in Section 22.3(g)(i) and 22.3(g)(ii) of the Agreement include consideration of anticipated Carbon Payment Adjustment as if the Terminated Transaction will be replaced with one for Substitute Energy with EFunsp. 8. EF True Up. [PGE: The word “Indemnity” does not add value as a defined term and just makes it hard to say in the course of normal conversation. “EF True Up” is short and sweet.] Without limiting Purchaser’s other remedies under the Agreement or this Confirmation, if EF True-Up applies, Seller shall pay Purchaser, without excuse for Uncontrollable Force or meeting the requirements of [the Product], for the circumstances indicated in Section 1.d. above: [SEQ *TL *] (EFass - EFsp)*GHGAP provided, however, that if in such case EFass is less than EFsp, then Purchaser shall pay Seller: [SEQ *TL *] (EFsp - EFass)*GHGAP 9. Choice of Law. Notwithstanding Section 24 of the Agreement, the construction and interpretation of [AB32][and the Cap and Trade Regulations] shall be determined in accordance with the laws of the State of California. [need to verify application under Utah conflicts of laws law.] 10. This Specified Source Confirmation Attachment may be executed in counterparts, each of which taken together shall constitute one and the same instrument. 5 Prior draft provided for the greater of specified source or unspecified, this has been deleted in this draft for discussion purposes on the assumption that purchaser should be able to mitigate through purchase of unspecified power if there is a non-delivery. Is there a risk that should be addressed of a GPE “putting” high factor specified source power to purchaser? 8 IN WITNESS WHEREOF, Purchaser and Seller, by their respective authorized representatives, have executed this Specified Source Confirmation Attachment effective as of the date first set forth above. ___________________________ Purchaser ___________________________ Seller ___________________________ Authorized Signature for Purchaser ___________________________ Authorized Signature for Seller 9