risk, rents and regressivity

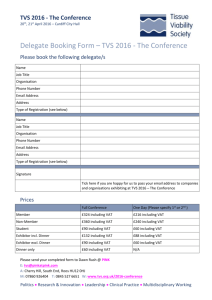

advertisement