Software Requirement Specification Document

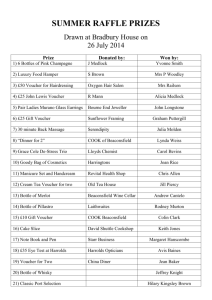

advertisement