Outside the Market - The University of North Carolina at Chapel Hill

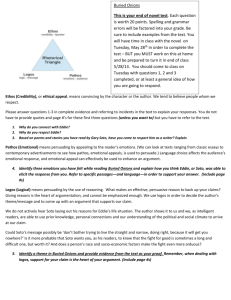

advertisement