Mid-term #2 Answers (007)

advertisement

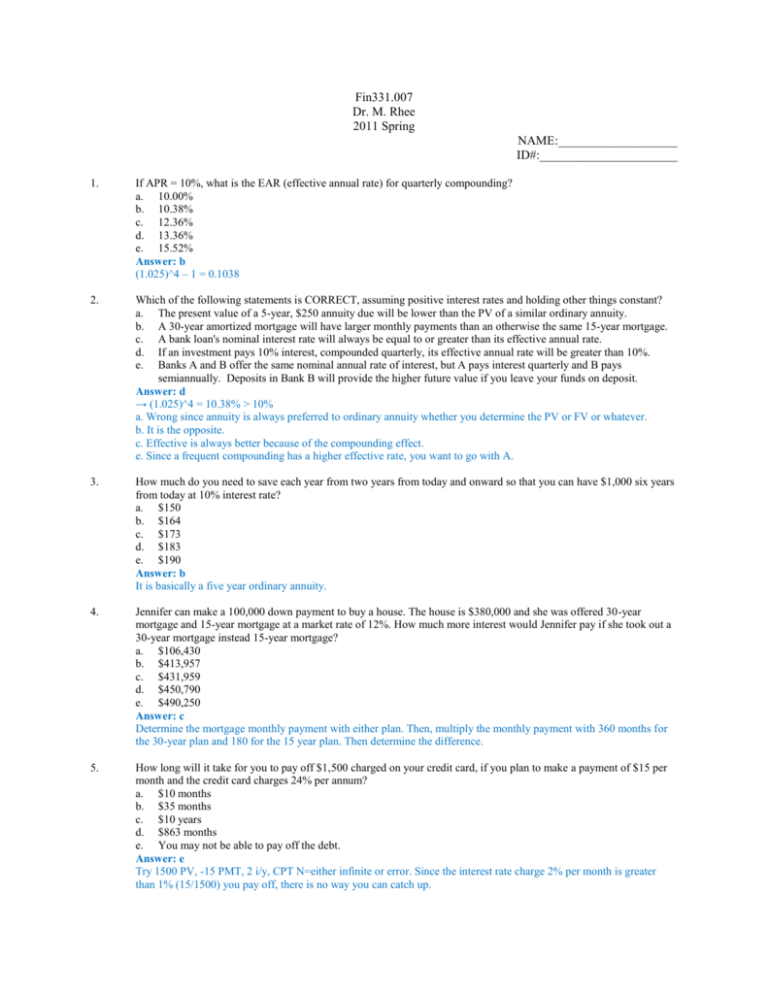

Fin331.007 Dr. M. Rhee 2011 Spring NAME:___________________ ID#:______________________ 1. If APR = 10%, what is the EAR (effective annual rate) for quarterly compounding? a. 10.00% b. 10.38% c. 12.36% d. 13.36% e. 15.52% Answer: b (1.025)^4 – 1 = 0.1038 2. Which of the following statements is CORRECT, assuming positive interest rates and holding other things constant? a. The present value of a 5-year, $250 annuity due will be lower than the PV of a similar ordinary annuity. b. A 30-year amortized mortgage will have larger monthly payments than an otherwise the same 15-year mortgage. c. A bank loan's nominal interest rate will always be equal to or greater than its effective annual rate. d. If an investment pays 10% interest, compounded quarterly, its effective annual rate will be greater than 10%. e. Banks A and B offer the same nominal annual rate of interest, but A pays interest quarterly and B pays semiannually. Deposits in Bank B will provide the higher future value if you leave your funds on deposit. Answer: d → (1.025)^4 = 10.38% > 10% a. Wrong since annuity is always preferred to ordinary annuity whether you determine the PV or FV or whatever. b. It is the opposite. c. Effective is always better because of the compounding effect. e. Since a frequent compounding has a higher effective rate, you want to go with A. 3. How much do you need to save each year from two years from today and onward so that you can have $1,000 six years from today at 10% interest rate? a. $150 b. $164 c. $173 d. $183 e. $190 Answer: b It is basically a five year ordinary annuity. 4. Jennifer can make a 100,000 down payment to buy a house. The house is $380,000 and she was offered 30-year mortgage and 15-year mortgage at a market rate of 12%. How much more interest would Jennifer pay if she took out a 30-year mortgage instead 15-year mortgage? a. $106,430 b. $413,957 c. $431,959 d. $450,790 e. $490,250 Answer: c Determine the mortgage monthly payment with either plan. Then, multiply the monthly payment with 360 months for the 30-year plan and 180 for the 15 year plan. Then determine the difference. 5. How long will it take for you to pay off $1,500 charged on your credit card, if you plan to make a payment of $15 per month and the credit card charges 24% per annum? a. $10 months b. $35 months c. $10 years d. $863 months e. You may not be able to pay off the debt. Answer: e Try 1500 PV, -15 PMT, 2 i/y, CPT N=either infinite or error. Since the interest rate charge 2% per month is greater than 1% (15/1500) you pay off, there is no way you can catch up. 6. 5-year Treasury bonds yield 5.5%. The inflation premium (IP) is 1.9%, and the maturity risk premium (MRP) on 5year T-bonds is 0.4%. There is no liquidity premium on these bonds. What is the real risk-free rate, r*? a. 2.59% b. 2.88% c. 3.20% d. 3.52% e. 3.87% Answer: c 5.5 – 0.4 – 1.9 = 3.2% 7. Suppose the interest rate on a 1-year T-bond is 5.0% and that on a 2-year T-bond is 7.0%. Assuming the pure expectations theory is correct, what is the market's forecast for 1-year rates 1 year from now? a. 7.36% b. 7.75% c. 8.16% d. 8.59% e. 9.04% Answer: e 7+7=5+x 8. Which of the following statements is CORRECT? a. The yield on a 2-year corporate bond should always exceed the yield on a 2-year Treasury bond. b. The yield on a 3-year corporate bond should always exceed the yield on a 2-year corporate bond. c. The yield on a 3-year Treasury bond should always exceed the yield on a 2-year Treasury bond. d. If inflation is expected to increase, then the yield on a 2-year bond should exceed that on a 3-year bond. e. The real risk-free rate should increase if people expect inflation to increase. Answer: a a The corporate bond is riskier. b and c. You may have inverted yield curves. d. Probably the opposite. e. The “nominal” interest rate should increase, not the real. 9. Crockett Corporation's 5-year bonds yield 6.35%, and 5-year T-bonds yield 4.75%. The real risk-free rate is r* = 3.60%, the default risk premium for Crockett's bonds is DRP = 1.00% versus zero for T-bonds, the liquidity premium on Crockett's bonds is LP = 0.90% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP = (t – 1) × 0.1%, where t = number of years to maturity. What inflation premium (IP) is built into 5year bond yields? a. 0.68% b. 0.75% c. 0.83% d. 0.91% e. 1.00% Answer: b 4.75 = 3.60 + IP +0 + 0 + 0.4 => 0.75%. If you use the corporate bond, however, it becomes 6.35=3.6+IP+1+0.9+0.4 => 0.45%. The question should be then revised to produce the same yields. 10. Bonds sell at a premium from par value when market rates for similar bonds (=opportunity costs) are a. Less than the bond’s coupon rate. b. Greater than the bond’s coupon rate. c. Equal to the bond’s coupon rate. d. Both lower than and equal to the bond’s coupon rate. e. Market rates are irrelevant in determining a bond’s price. Answer: a Premium bonds are those priced higher than $1,000. Thus, there is capital loss resulting in the smaller YTM than coupon rate 11. What is the relationship between PVIFA(r%, N) and PVIF(r%, N)? a. PVIFA is greater than or equal to PVIF b. PVIF is a sum of PVIFA from n=1 to n=N c. PVIF is an inverse of PVIFA d. PVIF is used for an annuity e. None of the above Answer: a PVIFA (FVIFA) is a sum of individual PVIFs (FVIF). Therefore, the former is greater than (or equal to) the latter. 12. Ryngaert Inc. recently issued noncallable bonds that mature in 15 years. They have a par value of $1,000 and an annual coupon of 5.7%. If the current market interest rate is 7.0%, at what price should the bonds sell? a. $817.12 b. $838.07 c. $859.56 d. $881.60 e. $903.64 Answer: d 57 PMT, 15 N, 1,000 FV, 7 i/y CPT PV 13. Sadik Inc.'s bonds currently sell for $1,180 and have a par value of $1,000. They pay a $105 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,100. What is their yield to call (YTC)? a. 6.63% b. 6.98% c. 7.35% d. 7.74% e. 8.12% Answer: d 105 PMT, 5 N, 1,100 FV, -1,180 PM, CPT i/y 14. In calculating the current price of a bond paying semiannual coupons, one needs to a. Use double the number of payments. b. Use half the annual coupon. c. Use double the annual market rate as the discount rate. d. All of the above need to be done. e. Only a and b are true. Answer: d The correct answer is e. d could be the answer if you half the discount rate, however. 15. A portfolio with a level of systematic risk less than that of the market has a beta that is a. equal to zero. b. greater than zero but less than one. c. less than the beta of the risk-free asset. d. less than zero. e. equal to infinity. Answer: b Beta=1 is the market portfolio risk. 16. Cooley Company's stock has a beta of 1.40, the risk-free rate is 4.25%, and the market risk premium is 5.50%. What is the firm's required rate of return? a. 11.36% b. 11.65% c. 11.95% d. 12.25% e. 12.55% Answer: c 4.25+5.5*1.4 17. Consider the following information and then calculate the required rate of return for the Global Investment Fund, which holds 4 stocks. The market’s required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund's assets are as follows: Stock Investment Beta A $200,000 1.50 B $300,000 -0.50 C $500,000 1.25 D $1,000,000 0.75 a. 9.58% b. 10.09% c. 10.62% d. 11.18% e. 11.77% Answer: e Investment weight average Beta = 0.7625. 7+(13.25-7)*.7625 18. Stock A has a beta of 0.8 and Stock B has a beta of 1.2. 50% of Portfolio P is invested in Stock A and 50% is invested in Stock B. If the market risk premium (rM − rRF) were to increase but the risk-free rate (rRF) remained constant, which of the following would occur? a. The required return would increase for both stocks but the increase would be greater for Stock B. b. The required return would decrease by the same amount for both Stock A and Stock B. c. The required return would increase for Stock A but decrease for Stock B. d. The required return on Portfolio P would remain unchanged. e. The required return would increase for Stock B but decrease for Stock A. Answer: a You can make up a numerical example like the risk free rate is say 2% and the market risk premium is say 3% previously and the new market premium is now 4%. Using the CAPM, determine the required returns for A & B before and after. 19. Consider the following information and then calculate the projected expected rate of return for the Global Investment Fund, which holds 3 stocks. Stock A B C Investment Projected Expected Return for each security $200,000 15% $300,000 -5% $500,000 10% a. 5.9% b. 6.5% c. 7.8% d. 8.7% e. 9.5% Answer: b 0.2*15 + 0.3*(-5) + 0.5*10 = 6.5% 20. What is the coefficient of variation for security b? Probability Ra(State=?) Rb(S=?) Boom 0.35 0.30 0.05 Average 0.40 0.10 0.05 Recession 0.25 -0.15 -0.05 a. 1.72 b. 1.89 c. 2.01 d. 2.35 e. 3.01 Answer: a See the Excel Exercises on my homepage (Taken from the Excel Exercises on the web) END