THE MORE MODEST REALITY FACING EQUITY INVESTORS

advertisement

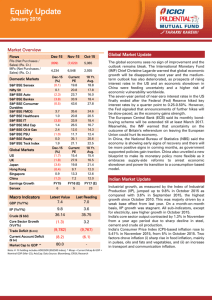

MORE DEMANDING INVESTMENT ENVIRONMENT By Jim Power For Irish investors in equity markets, the second half of the 1990s was a golden period that saw exceptional returns being earned. For those with a bias towards property, the past decade has been quite incredible, with very strong returns from almost all categories of property investment. Today however, the investment environment is considerably more challenging and there are no obvious or easy routes to earning a quick fortune. Consequently, the question about the investment options open to somebody with a lump sum to invest is one that is not terribly easy to answer with any degree of confidence at the moment. Interest rates are at the lowest level in 60 years and a decision to place money on deposit will at best match the expected rate of inflation over the next couple of years and at worst, one could suffer negative real returns. This would depend on the amount to be investment and the duration of that investment. For those with a predilection towards property, there is a growing sense that as far as the domestic market is concerned, the years of bumper returns are now behind us and the future could well see more modest gains. Capital growth in residential property is now undoubtedly slowing and rental income in many areas is under pressure and the rental yields on offer are not exactly attractive in many cases. For equity investors the past four years have been quite challenging and unless one has engaged in some very skilful stock selection, returns have been quite modest, uncertain and choppy. From the perspective of investors in equity markets the early months of 2005 are turning out to be quite like the early months of last year. Investors came into 2004 in high spirits, confident that global economic recovery and healthy corporate earnings would continue to propel markets higher and build on the strong momentum that characterised the final three quarters of 2003. In the event, markets struggled for much of the year and but for a late rally in the aftermath of the decisive Bush victory in the US presidential election, the year would have turned out to be a pretty disastrous one for beleaguered investors. The reality was that following the strong performance in 2003, equity market valuations had moved to pretty testing levels and it would have taken some positive surprises to build on the momentum. Such positive surprises did not really emerge and instead the markets had to cope with oil, currency and geo-political uncertainties for much of 2004. Investors came into this year in good spirits after a strong finish to 2004 and against a background of global economic optimism and ambitious corporate earnings expectations. However, as we approach the end of the first third of the year, global equity markets are struggling. US markets are in negative territory in the year to date and most European markets are now in modest positive territory. The technology sector in the US is in particular difficulty with the NASDAQ now down almost 12% so far this year. This is not how it was meant to have been. The Irish equity market is also looking distinctly unwell, largely due to the travails of Elan, which have undoubtedly cast a cloud over the overall Irish market, despite the fact that Elan should have no fundamental bearing on the rest of the market. 1 At a global level, market sentiment in general is being undermined by a combination of stubbornly high oil prices, a struggling Euro Zone economy, some concerns about prospects for the US economy, particularly in the context of the widening trade deficit and higher interest rates, some less positive signals from Corporate America concerning future earnings growth, and riots in China that may have more significance than currently appears to be the case. Any escalation of the ill feeling towards the Japanese in China could damage the international perception of China, thereby undermining what is one of the real bright spots in the global economy at the present time. It is not clear how concerned markets are about the developing unrest in China, but the suspicion is that it is somewhat of an issue for Asian markets, but is not yet a major issue for non-Asian markets. However, if it were to escalate further, then it must just become an issue of more concern for everybody. It is an issue well worth watching. So what are private investors to make of all this? They have been bombarded in recent weeks by domestic commentators presenting very upbeat assessments of domestic and global growth prospects, and must be wondering why equity markets are again in the doldrums. There is no doubt but that momentum in the Irish economy is very strong and is likely to remain so. It is also the case that while the global economy is slowing at the moment and is set to deliver lower growth than last year, the situation is still relatively good and global growth in 2005 will be well ahead of anything seen between 2001 and 2003. However, the problem for equity markets is that current valuations have discounted most of this background already and just as was the case last year, it will require some positive surprises to propel markets higher in any aggressive way from here. It is hard to figure out where such positive surprises are likely to come from. The likelihood is that with markets now looking fairly valued, it will be a grind higher from here rather than any strong upward momentum. In fact over the next couple of years returns from equity markets are likely to be roughly in line with profits growth, which in turn are likely to be roughly in line with nominal economic growth. What this means is that equity investors are caught in a more modest returns environment and careful stock/sector selection will be essential to enhance returns. With the Euro Zone economy struggling quite badly, there is little immediate prospect of any increase in interest rates, so putting money on deposit will remain a less than compelling prospect. As mentioned, the prospects for domestic property investment look much less of a one-way bet than in recent years, while equity markets look set to deliver a less than stellar performance. This all adds up to a very challenging environment, where careful and skilful investment attributes will be essential to enhance returns. However, investors should not lose sight of the fundamentals of investment when making any decisions. The criteria that should be assessed on an individual basis are factors such as appetite and tolerance for risk, the investment time horizon, and the existing investment portfolio. Diversification of assets is the best way to manage risk or in other worlds the old adage about not putting all one’s eggs in one basket. 2