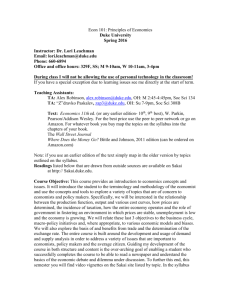

Econ 51D: Principles of Macroeconomics

Duke University

Spring 2010

Instructor: Dr. Lori Leachman

Email : Leachman@econ.duke.edu

Phone: 660-6894

Office and office hours: 329F, SS; MW 2-4pm, Tu 2-3pm

Teaching Assistants: Michiru.Sakane@duke.edu

Nujin.Prasertsom@duke.edu

Helpline for general questions at 51help@econ.duke.edu

Text: Economics 8th ed., W. Parkin, Pearson/Addison Wesley.

The Wall Street Journal

Where Does the Money Go? Bittle and Johnson (can be ordered on Amazon.com)

Readings listed below that are drawn from outside sources are available on Blackboard

at http:// courses.duke.edu.

Course Objective: This course provides an introduction to economics concepts and

issues. It will introduce the student to the terminology and methodology of the economist

and use the concepts and tools to explore a variety of topics that are of concern to

economists and policy makers. Specifically, we will be interested in the relationship

between the production function, output and various cost curves, how prices are

determined, the incidence of taxation, how the entire economy operates and the role of

government in fostering an environment in which prices are stable, unemployment is low

and the economy is growing. We will relate these last 3 objectives to the business cycle,

macro-policy initiatives and, where appropriate, to various economic models and biases.

We will also explore the basis of and benefits from trade and the determination of the

exchange rate. The entire course is built around the development and usage of demand

and supply analysis in order to address a variety of issues that are important to

economists, policy makers and the average citizen. Guiding my development of the

course in both structure and content is the over-arching goal of enabling a student who

successfully completes the course to be able to read a newspaper and understand the

basics of the economic debate and dilemma under discussion.

Weekly lunches with members of the class will be held on Wednesday starting Jan.20.

We will be meeting at 12 at the Faculty Commons (above Chick-filet). Students may sign

up through the Black Board course site under the “Course Information”. I have also

scheduled 4 dinners in order to create the opportunity for students that have class during

the regular lunch time to have an informal opportunity to dine with me. Those dates are

Jan. 26 (T), Feb. 15 (M), March 25 (TH) and April 12 (M). Please try to leave those slots

open for students who have legitimate conflicts with the Wed. day and time.

Class meets from 10:20-11:35 on MW and FRIDAY in Griffith Auditorium. Discussion

sections meet in their scheduled places and are used for office hours and extra help with

concepts and problems.

All exams will be returned in the class.

Grading: three regular exams 31% each plus 7% on homework (see below).

Optional Final-if we GRADE the final, we COUNT it! I will drop the lowest

grade and count the final in its place. You have the option of sitting for the final

and not having it graded!

If you miss an exam you automatically must take the final as NO make up exams

will be offered! If you miss more than 1 exam you will take a 0 on the additional

exams missed that exceed 1.

Homework: The homework is comprised of questions and problem sets designed to

illuminate the important concepts being discussed in class and PREPARE YOU FOR

THE EXAM. The homeworks are due on the due date at the START of class. Once the

homework deadline is passed there is NO ability to make up the missed work, so work

ahead if you think you have a conflict. For each assignment we will check the work to

ensure that you have attempted the assignment- however, we will NOT grade them for

correctness. You will earn 100% for 1% of your final grade for each homework that

is turned in completed. This amounts to 7% of your total grade.

If you miss a homework you can make up 2 missed assignments by turning in a 2 page

book report on Where Does the Money Go? directly to Dr. Leachman by April 9th. For

that report you need to cover a number of things outlined below:

1- 1 page (no more) summary of the key information in the book. (this will make up

for 1 missed homework)

2- Outline the current REVISED deficit and debt figures (here you will need to draw

from current news sources- this is a piece of a paragraph) and link these numbers

to a

3- Discussion of one proposal that you support that will help address (not totally

solve) the deficit and debt problem

(2+3 will make up for the 2nd missed assignment)

The graduate TAs will be conducting regular homework help sessions-the schedule can

be found under the “course information” on the Blackboard

Students who are found to be cheating or facilitating cheating are in violation

of the Duke Honor Code and will automatically fail the course.

Course Outline (8th edition)

W. Jan.13- course info and rules

1.) Introduction; Chapter 1 and appendix; F. Jan.15, W. Jan. 20

What is Economics? The issue of scarcity and choice

Economic thinking: efficiency, rationality, opportunity costs, marginal decisions

Macroeconomics vrs microeconomics; relevant components

Information, risk and leverage

Appendix to Ch. 1- graphing

*Alternative Economic Philosophies

*Krugman <http://www.nytimes.com/2009/09/06/magazine/06Economict.html?_r=2&partner=rss&emc=rss&pagewanted=all>?

*Michael Fitzgerald, Chicago Schooled

http://magazine.uchicago.edu/0910/features/chicago_schooled.shtml?msource=MAG200

9&tr=y&auid=5294896

*Rethinking the Role of Fiscal Policy, Martin Feldstein, AER Papers and

Proceedings, May 2009

2.) Chapters 2, 21 & 22; FM Jan 22-25

The production function (PF)

inputs vrs outputs

the production possibilities curve (PPC) and illustrations of opportunity costs

marginal decisions

specialization

efficiency

goals of government, measurement and their relation to the PPC

*GDP Fetishism, Stiglitz the Economist Voice Sept 2009

HW 1 due W Jan 27

3.) Chapters 9 & 10, 17; WF Jan 27-29, M Feb 1

Economic vrs. Accounting profit.

The production function

Total product curve

Marginal product and average product

The Law of Diminishing Returns

Relationship between output and cost

Total cost, marginal cost, average cost

Longrun vrs shortrun cost

Labor Demand (chapter 17, pp 387-394)

4. ) Chapter 11; W Feb.3

Equilibrium in a perfectly competitive setting

Comparisons to other market structures

“Rising Beer Prices Hint at Oligopoly” NYT 8/27/09

“Beer Makers Plan More Price Boosts” WSJ 8/26/09

“Heineken to Raise Prices, Trim Costs” WSJ 8/27/09

HW 2 due F Feb 5

EXAM 1- M Feb 8

5.) Chapters 3, 5(optional but helpful), 6(pp.124-131) F Feb 5, W Feb 10

Demand, law of demand

Supply, law of supply

Equilibrium- adjustment to and changes in

Price ceilings and floors

“In Hard Times Spam makes a Comeback” TimesDigest 11/15/08

Priceless- A Survey of Water, the Economist, 7/19/03, pp3-16

Need for Water Could Double in 50 Years…NYT, Aug 22, 06

What Price is Right?

6.) Chapter 4; FM Feb 12-15

price elasticity

cross price elasticity

income elasticity

tax incidence

theories of taxation/tax structure

“You Picked the Price, but who Gained? NYT

“San Francisco: the Butts Stop Here”

How Progressive is the U.S. Federal Tax System? A Historical and International

Perspective, J. of Econmomic Perspcetives, Winter 2007

Tax Revenue? It’s a Roll of the Dice, NTY July 16, 06

first Discussion of Where Does the Money Go?

HW 3 due W Feb 17

7.) Chapter 26; WFMW Feb 17-24

Exchange Rate Theory

Fixed vrs. Floating exchange rate regimes

Purchasing Power Parity

Interest Rate Parity

Unholy Trinity of Exchange Rate Systems

Balance of Payments Crisis

Application to China

8.) Chapter 32; FM Feb 26, Mar 1

Trade Theory- absolute vrs. Comparative advantage

Autarkic prices

Patterns of trade

Range of terms of trade

Importance of being unimportant

Flying with One Engine- a survey, the Economist, 9/20/03, pp3-32

Resolving the Global Imbalance: The Dollar and the US Saving Rate, Feldstein, J of

Economic Perspectives, Summer 2008

HW 4 due W Mar 3

9.) Chapter 27; WF March 3-5, M Mar 15

AD/AS model- the Classical model

AS – Classical, Keynesian and Intermediate range.

AD – wealth, interest rate and foreign price effects

Equilibrium

Classical vrs Keynesian debate and relationship to AS/AD

Assumptions and implications of each

Historical US Savings Profile, NYT-

10.) Chapter 29, WF Mar 17-19

The Business cycle

Relationship of BC to AS/AD equilibrium

Economic Goals- full employment, price stability, economic growth, optimal external

balance

EXAM 2- M Mar 22 (many students feel the exchange rate material is the hardest

material in the course).

11.) Chapters 25 & 31; WFMW Mar 24-31

The nature of money

Stocks and bonds

Bond pricing and interest rates

Money creation

The Federal Reserve

Tools of monetary policy and implementation

The loanable funds market (CHAPTER 23, PP 541-545)

HW 5 due F April 2

12.) Chapter 28; FMWF April 2-9

Total spending- the Keynesian framework

The consumption function

Multipliers

Taxation

Keynesian Equilibriums

Crowding In and Crowding Out

Derivation of Aggregate Demand

Sense and Nonsense about Federal Deficits and Debt, Boskin, The Economist’s

Voice, vol 1 2004

The Budget Outlook: Projections and Implications, Gale and Orszag, The

Economist’s Voice, vol 1 2004

What’s the real Federal Deficit? USA Today Aug 3, 06

The Public’s Deficit Fix…, NYT July 30, 06

Possible Macroeconomic Consequences of Large Future Federal Government

Deficits, Ray Fair, Cowles Foundation DP#1727

Optional Report on “Where does the Money Go? due F April 9.

13.) Chapters 30 & 31; MWF April 12-16

Aggregate supply

Monetary vrs fiscal policy

Classical vrs Keynesian debate

Short run vrs. long run equilbriums

Economic Ups and Downs…, Tregarthen, The Margin, Feb 1988

The Long Climb, the Economist, Oct. 3 2009

HW 6 due M April 19

EXAM 3- W April 21

14.) Chapter 24 and lecture; MFM Ap 19-26

Growth and development

The Solow growth model (lecture)

Macro-policy and growth

Trade and growth

The Dragon and the Eagle (a survey), the Economist, Oct. 2 2004, pp3-26

HW 7 due W Ap 28 (last day of class)

FINAL (optional) at scheduled day and time of