Ch 8 Update

advertisement

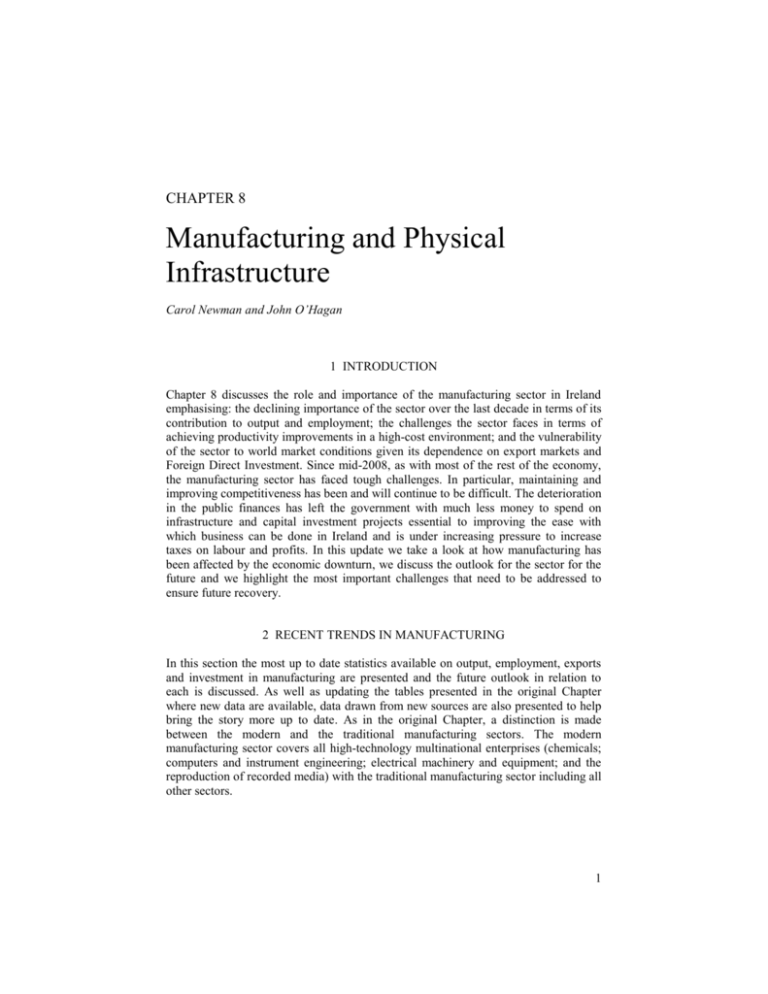

CHAPTER 8 Manufacturing and Physical Infrastructure Carol Newman and John O’Hagan 1 INTRODUCTION Chapter 8 discusses the role and importance of the manufacturing sector in Ireland emphasising: the declining importance of the sector over the last decade in terms of its contribution to output and employment; the challenges the sector faces in terms of achieving productivity improvements in a high-cost environment; and the vulnerability of the sector to world market conditions given its dependence on export markets and Foreign Direct Investment. Since mid-2008, as with most of the rest of the economy, the manufacturing sector has faced tough challenges. In particular, maintaining and improving competitiveness has been and will continue to be difficult. The deterioration in the public finances has left the government with much less money to spend on infrastructure and capital investment projects essential to improving the ease with which business can be done in Ireland and is under increasing pressure to increase taxes on labour and profits. In this update we take a look at how manufacturing has been affected by the economic downturn, we discuss the outlook for the sector for the future and we highlight the most important challenges that need to be addressed to ensure future recovery. 2 RECENT TRENDS IN MANUFACTURING In this section the most up to date statistics available on output, employment, exports and investment in manufacturing are presented and the future outlook in relation to each is discussed. As well as updating the tables presented in the original Chapter where new data are available, data drawn from new sources are also presented to help bring the story more up to date. As in the original Chapter, a distinction is made between the modern and the traditional manufacturing sectors. The modern manufacturing sector covers all high-technology multinational enterprises (chemicals; computers and instrument engineering; electrical machinery and equipment; and the reproduction of recorded media) with the traditional manufacturing sector including all other sectors. 1 THE ECONOMY OF IRELAND Employment, Output and Productivity Table 8.1 of Chapter 8 highlighted the declining numbers employed in the manufacturing sector between 1995 and 2005 and a dramatic slowdown in the pace of growth in output. In 2006, the most recent year for which comparable figures are available, both output and employment in manufacturing have stagnated. Of particular note is the slight decline in the output of the modern manufacturing sector coupled with a slight increase in the numbers employed suggesting that labour productivity growth in this sector has stagnated. This is in contrast to labour productivity growth of an average of 7.4 per cent per annum between 1995 and 2005 for the manufacturing sector as a whole and growth of 9.4 per cent per annum in the modern manufacturing sector.1 Using OECD data Forfás Annual Competitiveness Report 2009 confirms the downward trend in productivity growth in Ireland between 2005 and 2008.2 Table 8.1 Net Output and Employment in the Manufacturing Sector in Ireland, 1995,2000, 2005 and 2006 Net Output (€ billions) Employment (‘000s) 1995 2000 20052 2006 1995 2000 2005 2006 Manufacturing 19.0 52.7 57.9 58.4 221 255 218 220 Modern1 9.4 32.4 34.0 33.3 78 107 89 90 Traditional 9.6 20.3 23.9 25.1 142 148 129 130 Source: CSO, Census of Industrial Production (local units), Database Direct. See www.cso.ie. Value figures are in 2000 prices adjusted using producer price indices. 1 This excludes NACE 224 for which this disaggregation was not available. 2 Revised since previous edition. As discussed in the update to Chapter 5, statistics from the Quarterly National Household Survey reveal that the greatest job losses of the last year have occurred in the construction sector (see Table. 5.12). Manufacturing, however, has also suffered with a fall in the numbers employed of 8.6 per cent compared with an overall contraction in employment numbers of 7 per cent. The ESRI predict that the unemployment rate in Ireland will increase from 10.2 per cent in the first quarter of 2009 to 16 per cent in 2010 and so the situation is expected to worsen.3 To gain some more detailed insights into the trends in employment since 2005 Table 8.10 presents the numbers in full-time permanent employment by sector as published in Forfás’ Annual Employment Survey 2008. The downward trend highlighted in the original Chapter is also evident in these statistics. Of particular note, however, is the very sharp decline in employment between 2007 and 2008 following what appeared to be a stabilisation in levels. Overall employment in manufacturing fell by 7 per cent between 2006 and 2008. Most of this is due to a decline in traditional manufacturing of almost 11 per cent mirroring the poor performance of traditional manufacturing in the output figures. Also of note is the fact that the decline for Irish-owned enterprises is higher than for foreign-owned enterprises. 2 MANUFACTURING AND PHYSICAL INFRASTRUCTURE Table 8.10 Recent Trend in Employment 2000-2008 2000 2002 2004 2006 2007 2008 Manufacturing 188.6 170.1 161.5 163.5 161.9 152.4 Traditional 101.7 92.0 83.3 81.3 79.5 72.1 Irish 68.6 63.6 59.1 59.1 58.7 52.4 Foreign 33.1 28.4 24.2 22.2 20.8 19.7 Modern 86.9 78.1 78.2 82.2 82.4 80.3 Irish 15.2 14.7 14.6 16.4 16.6 15.8 Foreign 71.7 63.4 63.6 65.8 65.8 64.5 Source: Forfás, Annual Employment Survey 2008, Forfás, Dublin, March 2009 (available at http://www.forfas.ie/media/forfas090306_annual_employment_survey_2008.pdf). These figures are for permanent full-time employment in agency-assisted companies. Recent trends in output reveal a more muddled picture. The ESRI’s Quarterly Economic Commentary for Summer 2009 highlights very large swings in output of the manufacturing sector in the latter half of 2008 and the first half of 2009. In the last quarter of 2008 manufacturing output fell by 12.9 per cent but grew by 11.3 per cent in the first quarter of 2009. This upswing was entirely due to the modern sector where output grew by 9 per cent. The poor performance of traditional manufacturing is evidenced in the fact that the level of output in this sector was 15 per cent lower in the first quarter of 2009 compared with 2008. The ESRI predict that output of the manufacturing sector as a whole will contract by 0.5 per cent in volume terms in 2009. With a 9 per cent contraction predicted for the economy as a whole this can be seen as a very strong performance. Exports and Investment This story can in part be explained by looking at recent export data. Table 8.2 illustrates the proportion of total gross output attributable to exports of manufacturing firms in Ireland, disaggregated by modern and traditional sectors and updated to include data from 2006. Between 2005 and 2006 there was a slight increase in the proportion of exporting manufacturing firms in both the modern and traditional sectors, however, there was a decline in the proportion of output exported, although, for modern manufacturing, the proportion of output exports remains extremely high at 95 per cent. In 2006, 81 per cent of output in the manufacturing sector was exported. In terms of the destination of exports, the share going to the UK has continued to decline in all sectors. The UK still remains an important destination for exports for the traditional manufacturing sector with one quarter of all exports going to the UK market. The weakness of sterling over the last year will have made exporting to the UK very difficult, in particular for traditional manufacturers who continue to struggle to compete on the UK market. Between 2005 and 2006 there was a sharp increase in the importance of USA as a destination for exports of modern manufacturing firms. 3 THE ECONOMY OF IRELAND Table 8.2 Percentage Contribution of Manufacturing to Exports and Export Destinations for Ireland, 2000, 2005 and 2006 Firms Output UK Manufacturing Modern1 Traditional 62.7 75.6 60.0 79.0 93.9 59.2 Other EU 2000 19.0 50.4 15.6 49.5 27.8 52.2 Manufacturing Modern1 Traditional 49.2 72.6 43.8 82.8 96.2 64.0 17.2 13.3 26.4 USA Elsewhere 13.9 17.2 5.6 16.7 17.7 14.2 13.5 15.8 8.6 15.4 16.2 13.6 2005 53.9 54.6 52.2 2006 Manufacturing 49.6 81.3 17.1 51.1 17.8 13.7 Modern1 73.3 94.8 13.1 51.2 22.1 13.6 Traditional 44.3 63.2 25.3 52.0 8.9 13.8 Source: CSO, Census of Industrial Production, Stationery Office, Dublin 2000, 2005 and 2006. 1 This excludes NACE 224 for which this disaggregation was not available Since 2006, the major contraction in world trade has placed significant pressure on Irish exporters. Depressed demand on export markets due to global economic recession coupled with the high costs associated with producing in Ireland place many firms located in Ireland at a competitive disadvantage. As reported in the ESRI’s Quarterly Economic Commentary for Summer 2009, the OECD estimate that world trade fell at an annualised rate of 32 per cent between the fourth quarter of 2008 and the first quarter of 2009 with some stabilisation since. This has left the manufacturing sector very exposed. Merchandise exports experienced a contraction of almost 1 per cent during 2008 predicted to rise to 3 per cent for 2009. Irish manufacturing, however, has performed better than many of our trading partners due to the composition of the sector. In the early part of 2009 over half of total merchandise exports were chemicals and chemical products (which form part of the modern manufacturing sector) where exports grew despite the downturn. Internationallytraded services have not fared so well. Chapter 8 highlighted the growing importance of this sector and emphasised its potential for growth in the future (see Chapter 9). The international banking crisis, however, has had a very significant effect on the export of internationally-traded services from Ireland, due to the important role played by financial services within the sector. The ESRI predict a fall in the volume exports of internationally-traded services of 5 per cent in 2009. Thus, the exporting manufacturing sector represents a real opportunity for Irish recovery. Crucial for the continued success of the sector is that firms can remain competitive on world export markets. As discussed in Chapter 8, Ireland has the most FDI-intensive manufacturing sector of all countries in Europe but in recent years there is some evidence to suggest that Ireland is losing out as a location for investment to more low cost locations in Asia and Central and Eastern Europe. Chapter 8 also suggested that positive inflows 4 MANUFACTURING AND PHYSICAL INFRASTRUCTURE may have returned in more recent times due to the increasing number of investments in higher-tech manufacturing sectors and services. Up to date figures comparable to those presented in Table 8.3 are not available, however, Ernst and Young’s most recent Attractiveness Survey confirms this trend showing that FDI into Ireland grew at a faster pace in 2008 than in recent years previous.4 The most important sectors attracting investment continue to be in high value-added manufacturing such as electronics and pharmaceuticals as well as services such as business services and software. Since these sectors are the most export-intensive it further emphasises the need to reduce the cost of doing business in Ireland to allow these firms, old and new, to excel on world export markets. 3 FUTURE CHALLENGES Ireland continues to rank 7th in the world in the World Bank’s 2009 Doing Business survey just behind Denmark and the UK, however, Ireland remains an expensive place to do business.5 Chapter 8 called for the future competitiveness of all sectors of the economy to be pushed to the forefront of the policy agenda and highlighted, in particular, the need to strengthen the competitive advantages of Ireland’s industrial base by creating a more competitive business environment. Given the current economic situation and the outlook for the manufacturing sector, rising to this challenge is all the more pertinent. There are some signs to suggest that Ireland is doing just that. While Ireland continues to lag behind the European average in terms of R&D expenditures, 2007 saw an increase in the level of R&D expenditure by Irish enterprises (all sectors) from €1.3 million in 2005 to €1.6 million in 2007. 6 Despite the downturn expenditure on R&D is predicted to increase again in 2008, although by a small amount. The recent introduction of the tax credit scheme for R&D expenditures is a welcome development in this regard. The Forfás Annual Competitiveness Report 2009 highlights other competitive strengths including our young well educated work force and our history of attracting FDI into Ireland. 7 The importance of export-led sectors, both in manufacturing and services, in driving Ireland’s economic recovery remains paramount.8 The need to keep labour costs low, to effectively up-skill and re-skill displaced workers from the construction and other manufacturing sectors, to continue to support third-level education to produce highly qualified graduates, and to ensure enterprises continue to have access to affordable credit will all be important steps in achieving this. Moreover, reducing the cost of doing business in Ireland, in terms of improving competition in locally traded markets (discussed further in Chapter 9), delivering on core infrastructure projects and reducing the cost of key business services such as electricity supply will be a crucial part of this process. Chapter 8 provided a detailed overview of the state of national infrastructure in Ireland highlighting many of the key bottlenecks in the transport, energy and information and communication technology sectors. Since the publication of the 10th edition the situation has not changed, however, government funds to deliver on targets set out in the National Development Plan 2007-2013 are much more limited. With scarcer resources, bringing public infrastructure up to the standards of 5 THE ECONOMY OF IRELAND Northern European countries will be an even greater challenge, although the falling cost of infrastructural projects associated with the collapse in the construction sector will help to ease some of this burden. Endnotes 1 2 3 4 5 6 7 8 6 See C. Newman and J. O’Hagan, in J. O’Hagan and C. Newman (editors), Economy of Ireland, Chapter 5, Gill & Macmillan, Dublin 2008, for further discussion and references. National Competitiveness Council, Annual Competitiveness Report 2009, Forfás, Dublin, August 2009 (available at: http://www.forfas.ie/publications/index.html). Barrett, A., Kearney, I. and Goggin, J., Quarterly Economic Commentary, Summer 2009, ESRI, Dublin 2009. Ernst & Young, Reinventing Everything We Do: Ernst & Young’s 2009 European Attractiveness Survey. Ernst & Young, June 2009. World Bank, Doing Business 2009, World Bank, International Finance Corporation and Palgrave MacMillan, 2008. Central Statistics Office, Business Expenditure on Research and Development 2007/2008, Central Statistics Office, Dublin, National Competitiveness Council, Annual Competitiveness Report 2009, Forfás, Dublin, August 2009 (available at: http://www.forfas.ie/publications/index.html). National Competitiveness Council, Annual Competitiveness Report 2008, Forfás, Dublin, January 2009 (available at: http://www.forfas.ie/publications/index.html).