CHAPTER 6: Solutions to Selected Exercises

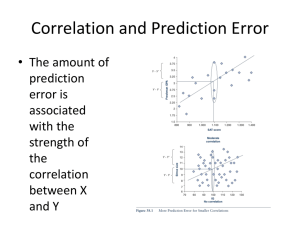

advertisement

CHAPTER 6: Solutions to Selected Exercises 6.1 a. The data plot suggests that there is no long-run growth or decline in the time series. Thus the no trend model yt 0 t is reasonable. b. yˆ t y 35,404 36,762 ... 37,153 35,651.9 30 The 95% prediction interval is 1 [ y t .30 025 s 1 1 ] n = [ 35651.9 2.045 (2037.35993) 1 1 ] 30 = [31416.2, 39887.6] 6.2 c. No, the residual plot does not display any well-defined cyclical or alternating pattern. a. The data plot suggests that there is a long-run straight-line growth. Therefore, the linear trend model yt 0 1t t is reasonable. b. We can reject H 0 : 1 0 because p-value = .000 < .001. We have very strong evidence 1 0. Since r 2 .853 , 84.5% of the variation in the watch sales can be explained by this linear trend model. c./d. ŷ 21 = 290.089474 + 8.667669 (21) = 472.1 ŷ 22 = 290.089474 + 8.667669 (22) = 480.8 ŷ 23 = 290.089474 + 8.667669 (23) = 489.4 95% prediction intervals are e. For y 21 : [421.5, 522.7] For y 22 : [429.5, 532.1] For y 23 : [437.4, 541.5] d = 1.367 is between d L ,.05 1.20 and d U ,.05 1.41 Thus the test is inconclusive. The residual plot is also inconclusive – it could have a vague cyclical pattern. 6.3 a. The trend appears to be linear. b. The seasonal variation appears to be constant. No transformation is required. c. All of the independent variables in the model seem to be important. This is because the p-values associated with Time, Q2, Q3, and Q4 are all much less than .05 or .01. 45 d. 1 if time period for sales quarter is 2 0 otherwise Q2 = 1 if time period for sales quarter is 3 0 otherwise Q3 = 1 if time period for sales quarter is 4 0 otherwise Q4 = e. yˆ17 17.250, yˆ18 38.750, yˆ19 51.750, yˆ 20 23.250 f. yˆ t 8.75 .5t 21Q2 33.5Q3 4.5Q4 yˆ17 8.75 .5(17) 210 33.50 4.50 17.25 yˆ18 8.75 .5(18) 211 33.50 4.50 38.750 g. 95% P.I. for y17 : [15.395, 19.105] We are 95% confident that sales of the TRK-50 Mountain Bike in the first quarter of year 5 will be between 15.395 and 19.105 (15 to 19 bikes) 95% P.I. for y18 : [36.895, 40.605] 95% P.I. for y19 : [49.895, 53.605] 95% P.I. for y 20 : [21.395, 25.105] h. n p 1 = number of parameters –1 = number of independent variables = 4 d 2.20 d U ,.05 1.93. Hence, there is no evidence of positive correlation at .05. 6.4 a. Quadratic trend. b. Constant seasonal variation. No transformation required. c. 1. 2. 1 if time period for energy bill is quarter 1 Q1 0 otherwise 1 if time period for energy bill is quarter 2 Q2 0 otherwise 1 if time period for energy bill is quarter 3 Q3 0 otherwise All independent variables except Q2 seem to be important because their associated p-values are less than .05. The p-value for testing 4 is .1713. However, since at least one quarter is important, we will keep Q2 , Q3 , and Q4 in the model. 46 3. yˆ t 276.636 7.458t .301t 2 65.771Q1 37.870Q 127.611Q3 2 yˆ 41 276.646 7.45841 .30141 65.7711 37.8700 127.6110 = 542.61 (Use more decimal places for greater accuracy.) 2 yˆ 42 276.646 7.458 42 .30142 65.7710 37.8701 127.6110 = 456.49 4. 95% P.I. for y 41 : [400.94, 685.03] 95% P.I. for y 42 : [312.33, 601.45] 95% P.I. for y 43 : [237.91, 532.68] 95% P.I. for y 44 : [381.15, 682.16] 5. np 1 6 1 5 d .84 d L ,.05 1.23. We have evidence of positive autocorrelation at .05 d. 1. 1 .59408. Yes, p-value = .0003 < .001 (Very strong evidence) 2. p-value = .1011 for 1 . However, if t 2 is important, we keep t in model. p-value = .0787 for 4 . However if Q1 and Q3 are important, we keep Q2 . The associated p-values for t 2 , Q1 , and Q3 are less than .05. 3. Point Forecasts yˆ 41 605.33 yˆ 42 505.67 yˆ 43 426.94 yˆ 44 569.97 95% P.I. for y 41 : [506.84, 703.82] 95% P.I. for y42 : [391.11, 620.23] 95% P.I. for y 43 : [307.22, 546.66] 95% P.I. for y44 : [448.49, 691.46] 4. 2 yˆ 40 ˆ ˆ1ˆ40 1 283.949 9.22040 .35340 70.107Q1 35.429Q2 127.525Q3 .594ˆ40 1 where for 1 ˆ40 y 40 ˆ 40 y 40 [283.949 9.220(40) .353(40) 2 ] and for 1 ˆ40 1 yˆ 40 1 ˆ 40 1 yˆ 40 1 [283.949 9.220(40 1) .353(40 1) 2 +70.107 Q1 35.429 Q2 127.525 Q3 ] = .594 ˆ40 2 47 5. For period 41, y 41 41 41 41 1 40 a41 Thus, the predicted energy bill for period 41 is yˆ 41 ˆ 41 ˆ1ˆ40 where ˆ40 y 40 ˆ 40 Here ˆ40 539.78 [283.94906 9.21968(40) .35348(40) 2 70.10688(0) 35.42856(0) 126.52509 (0)] 539.78 - 480.72986 59.05014 and yˆ 41 ˆ 41 ˆ1ˆ40 = [283.94906 – 9.21968 (41) + .35348 (41) 2 + 70.10688 (1) – 35.42856 (0) 126.52509 (0)] + .59408 (59.05014) = 570.24894 + .59408 (59.05014) = 605.3285 An approximate 95% prediction interval of y 41 is 6 [ yˆ 41 t.40 025 s ] = [605.3285 1.96 (50.2513211)] = [506.8380, 703.8191] For time period 42 y42 42 42 42 (1 41 a42 ) Therefore, the predicted energy bill for period 42 is y 42 ˆ 42 ˆ1 41 where ˆ41 yˆ 41 ˆ 41 Here, ˆ41 yˆ 41 ˆ 41 = 605.3285 – 570.24894 = 35.07956 and yˆ 42 ˆ 42 ˆ1ˆ41 = [283.94906 – 9.21968 (42) + .35348 (42) 2 + 70.10688 (0) – 35.42856 (1) – 126.52509 (0)] + .59408 (35.07956) = 484.83266 + .59408 (35.07956) 48 = 505.6717 An approximate 95% prediction interval for y 42 is 6 ˆ [ yˆ 42 t .40 025 s 1 1 2 ] = [505.6717 1.96 (50.2513211) = [505.6717 1.96 (58.4502)] = [391.1116, 620.2318] 1 .59408 ] 2 In a similar fashion we find that a point prediction of y 43 is yˆ 43 426.9411 and that an approximate 95% prediction interval for y 43 is ˆ [ yˆ 43 1.96 s 1 ˆ1 2 4 1 ] [426.9411 1.96 (50.2513211) 1 .59408 .59408 ] 2 4 [307.2235, 546.6588] Finally, we find that a point prediction of y44 is yˆ 44 569.9732 and that an approximate 95% prediction interval for y 44 is [ yˆ 44 1.96 s 1 1 1 1 ] 2 4 6 [569.9732 1.96(50.2513211) ( 1 (.59408) 2 (.59408) 4 (.59408) 6 ) ] [448.4875, 691.4589] 6.5 a. b. Yes, all the associated p-values are less the .05 * yˆ169 5.3489 * yˆ170 5.2641 c. yˆ t* 4.80732 .00352t .05247 M 1 .14079M 2 .10710M 3 .04988MM 4 .02542M 5 .19017M 6 .38245M 7 .41377M 8 .07142M 9 .05064M 10 .14194M 11 * yˆ169 4.80732 .00352(169) .05247 5.3497 (round-off error) * yˆ170 4.80732 .00352(170) .14079 5.2649 (roundoff error) 49 d. 5.3489 * yˆ169 yˆ169 4 4 818.5739 (819 rooms) 95% P.I.: [(5.2913) 4 , 5.4065 ] [783.8799, 854.4071] 4 e. 5.2641 * yˆ170 yˆ170 4 4 767.8856 768 rooms 95% P.I. [(5.2065) 4 , (5.3217) 4 ] = [734.8243, 802.0502] f. d =1.262 n p -1 = 13-1=12 n = 168 Table A5 does not provide d L , .05 for these values. However, from the values in the table it appears likely that there is positive autocorrelation. 6.6 a. The use of a growth curve model seems appropriate since it appears that the data might be described by the model y t 0 1t t (see Figure 6.22) b. Yes c. y t 0 1t t lny t ln 0 tln ( 1 ) ln t lny t 0 1t u t where 0 ln ( 0 ), d. 1 ln 1 , and u t ln t 1. ˆ 0 .54334 and ˆ1 .38997 2. A point estimate of 1 is ˆ1 eˆ e .38997 1.4769 1 Growth rate = 100 ( 1 ˆ1 ) 100(1 1.4769) 47.69 % 3. The point prediction of ln y 12 is ln yˆ12 4.1363 Thus, the point forecast of y12 is yˆ12 e 4.1363 62.5709 4. The 95% prediction interval for ln y12 is [3.8303, 4.4423]. Thus, a 95% Prediction interval for y12 is [e 3.8303, e 4.4423 ] = [46.0764, 84.9701]. We can be 95% confident that the number of reported cased of the disease in Month 12 will be at least 46.0764 (or roughly 46) cases and will be at most 84.9701 (or roughly 85) cases. 50