Practice Questions 1. When opening a restaurant you may need to

advertisement

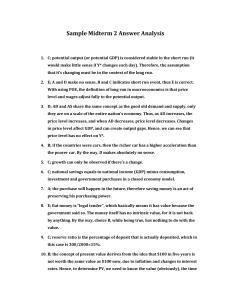

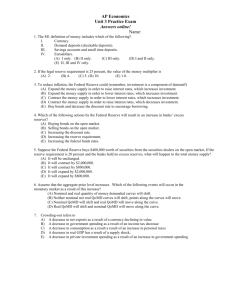

Practice Questions 1. When opening a restaurant you may need to buy ovens, freezers, tables, and cash registers. Economists call these expenditures a. capital investment. b. investment in human capital. c. business consumption expenditures. d. None of the above is correct. 2. When a country saves a larger portion of its GDP, it will have a. more capital and higher productivity. b. more capital and lower productivity. c. less capital and higher productivity. d. less capital and lower productivity. 3. Lekeisha's income exceeds her expenditures. Lekeisha is a a. saver who demands money from the financial system. b. saver who supplies money to the financial system. c. borrower who demands money from the financial system. d. borrower who demands money from the financial system. 4. Lucy starts her own psychiatric practice, but her expenditures to open the practice exceed her income. Lucy is a a. saver who demands money from the financial system. b. saver who supplies money to the financial system. c. borrower who demands money from the financial system. d. borrower who supplies money to the financial system. 5. A bond is a a. financial intermediary. b. certificate of indebtedness. c. certificate of partial ownership in an enterprise. d. None of the above is correct. 6. If the government's expenditures exceeded its receipts, it would likely a. lend money to a bank or other financial intermediary. b. borrow money from a bank or other financial intermediary. c. buy bonds directly from the public. d. sell bonds directly to the public. 7. Megasoft wants to finance the purchase of new equipment for developing security software called Doors, but they have limited internal funds. Megasoft will likely a. demand loanable funds by buying bonds. b. demand loanable funds by selling bonds. c. supply loanable funds by buying bonds. d. supply loanable funds by selling bonds. 8. Which of the following is a store of value? a. currency b. U.S. government bonds c. fine art d. All of the above are correct. 9. Which of the following best illustrates the unit of account function of money? a. You list prices for candy sold on your Web site, www.sweettooth.com, in dollars. b. You pay for your WNBA tickets with dollars. c. You keep $10 in your backpack for emergencies. d. None of the above is correct. 10. The “yardstick” people use to post prices and record debts is called a. a medium of exchange. b. a unit of account. c. a store of value. d. liquidity. 11. Mia puts money into a piggy bank so she can spend it later. What function of money does this illustrate? a. store of value b. medium of exchange c. unit of account d. None of the above is correct. 12. Treasury Bonds are a. liquid, but not a store of value. b. a store of value, but not liquid. c. both liquid and a store of value. d. neither liquid nor a store of value 13. Which of the following functions of money is also a common function of most other financial assets? a. a unit of account b. a store of value c. medium of exchange d. None of the above is correct. 14. Liquidity refers to a. the ease with which an asset is converted to the medium of exchange. b. a measurement of the intrinsic value of commodity money. c. the suitability of an asset to serve as a store of value. d. how many time a dollar circulates in a given year. 15. Which list ranks assets from most to least liquid? a. currency, fine art, stocks b. currency, stocks, fine art c. fine art, currency, stocks d. fine art, stocks, currency 16. Fiat money a. is worthless. b. has no intrinsic value. c. may be used as a medium of exchange, but is not legal tender. d. performs all the functions of money except providing a unit of account. 17. Which of the following is not included in M1? a. currency b. demand deposits c. savings deposits d. travelers' checks 18. Which of the following isn’t included in either M1 or M2? a. U.S. Treasury bills b. small time deposits c. demand deposits d. money market mutual funds 19. Credit cards a. are included in M1 but not M2. b. are included in M1 and M2. c. are included in M2 but not M1 d. are not included in any measure of the money supply. 20. The agency responsible for regulating the money supply in the United States is a. the Comptroller of the Currency. b. the U.S. Treasury. c. the Federal Reserve. d. the U.S. Bank. 21. Which of the following executes open-market operations? a. Board of Governors b. New York Federal Reserve Bank c. The FOMC d. None of the above is correct. 22. Which of the following is correct? a. The Federal Reserve has 14 regional banks. The Board of Governors has 12 members who serve 7-year terms. b. The Federal Reserve has 14 regional banks. The Board of Governors has 7 members who serve 14-year terms. c. The Federal Reserve has 12 regional banks. The Board of Governors has 12 members who serve 7-year terms. d. The Federal Reserve has 12 regional banks. The Board of Governors has 7 members who serve 14-year terms. 23. The Fed can influence unemployment in a. the short and long run. b. the short run, but not the long run. c. the long run, but not the short run. d. neither the short nor long run. 24. In a 100-percent-reserve banking system, a. banks can create money by issuing currency. b. banks can create money by lending out reserves. c. the Fed can increase the money supply with open-market sales. d. banks hold as many reserves as they hold deposits. 25. In a 100-percent reserve banking system, if people decided to decrease the amount of currency they held by increasing the amount they held in checkable deposits a. M1 would increase. b. M1 would decrease. c. M1 would not change. d. M1 might rise or fall. 26. On a bank's T-account, a. both deposits and reserves are assets. b. both deposits and reserves are liabilities. c. deposits are assets, reserves are liabilities. d. reserves are assets, deposits are liabilities. 27. A bank’s assets include a. both its reserves and the deposits of its customers. b. neither its reserves nor the deposits of its customers. c. its reserves, but not the deposits of its customers. d. the deposits of its customers, but not its reserves. 28. A bank’s liabilities include a. both its reserves and the deposits of its customers. b. neither its reserves nor the deposits of its customers. c. its reserves, but not the deposits of its customers. d. the deposits of its customers, but not its reserves. 29. A bank loans Zippo's Print Shop $350,000 to remodel a building near campus to use as a new store. On their balance sheets this loan is a. an asset for the bank and a liability for Zippo's. The loan increases the money supply. b. an asset for the bank and a liability for Zippo's. The loan does not increase the money supply. c. a liability for the bank and an asset for Zippo's. The loan increases the money supply. d. a liability for the bank and an asset for Zippo's. The loan does not increase the money supply. 30. If you deposit $100 of currency into a demand deposit at a bank, this action by itself a. does not change the money supply. b. increases the money supply. c. decreases the money supply. d. has an indeterminate effect on the money supply. 31. If the reserve ratio is 10 percent, banks do not hold excess reserves, and people do not hold currency, then when the Fed purchases $20 million of government bonds, bank reserves a. increase by $20 million and the money supply eventually increases by $200 million. b. decrease by $20 million and the money supply eventually increases by $200 million. c. increase by $20 million and the money supply eventually decreases by $200 million. d. decrease by $20 million and the money supply eventually decreases by $200 million. 32. If the reserve ratio is 20 percent, and banks do not hold excess reserves, and people hold only deposits and not currency, then when the Fed sells $40 million of bonds to the public, bank reserves a. increase by $40 million and the money supply eventually increases by $200 million. b. increase by $40 million and the money supply eventually increases by $800 million. c. decrease by $40 million and the money supply eventually decreases by $200 million. d. decrease by $40 million and the money supply eventually decreases by $800 million. 33. If the reserve ratio is 10 percent, banks do not hold excess reserves and people hold only deposits and not currency, when the Fed sells $10 million dollars of bonds to the public, bank reserves a. increase by $1 million and the money supply eventually increases by $10 million. b. increase by $10 million and the money supply eventually increases by $100 million. c. decrease by $1 million and the money supply eventually increases by $10 million. d. decrease by $10 million and the money supply eventually decreases by $100 million. 34. The classical dichotomy refers to the separation of a. variables that move with the business cycle and variables that do not. b. changes in money and changes in government expenditures. c. decisions made by the public and decisions made by the government. d. real and nominal variables. 35. Real and nominal variables are highly intertwined, and changes in the money supply change real GDP. Most economists would agree that this statement accurately describes a. both the short run and the long run. b. the short run, but not the long run. c. the long run, but not the short run. d. neither the long run nor the short run. 36. The quantity of money has no real impact on things people really care about like whether or not they have a job. Most economists would agree that this statement is appropriate concerning a. both the short run and the long run. b. the short run, but not the long run. c. the long run, but not the short run. d. neither the long run nor the short run. 34. The model of short-run economic fluctuations focuses on the price level and a. real GDP. b. economic growth. c. the neutrality of money. d. None of the above is correct. 35. The average price level is measured by a. any real variable. b. the rate of inflation. c. the level of the money supply. d. the CPI or the GDP deflator. 36. The model of aggregate demand and aggregate supply explains the relationship between a. the price and quantity of a particular good. b. unemployment and output. c. wages and employment. d. real GDP and the price level. 37. The variables on the vertical and horizontal axes of the aggregate demand and supply graph are a. the price level, real output. b. real output, employment. c. employment, the inflation rate. d. the value of money, the price level. 38. Which of the sentences concerning the aggregate demand and aggregate supply model is correct? a. The aggregate demand and supply model is nothing more than a large version of the model of market demand and supply. b. The price level and quantity of output adjust to bring aggregate demand and supply into balance. c. The aggregate supply curve shows the quantity of goods and services that households, firms, and the government want to buy at each price. d. All of the above are correct. 39. Other things the same, a fall in the economy's overall level of prices tends to a. raise both the quantity demanded and supplied of goods and services. b. raise the quantity demanded of goods and services, but lower the quantity supplied. c. lower the quantity demanded of goods and services, but raise the quantity supplied. d. lower both the quantity demanded and the quantity supplied of goods and services. 40. As the price level rises a. people will want to buy more bonds, so the interest rate rises. b. people will want to buy fewer bonds, so the interest rate falls. c. people will want to buy more bonds, so the interest rate falls. d. people will want to buy fewer bonds, so the interest rate rises. 41. The wealth effect, interest rate effect, and exchange rate effect are all explanations for a. the slope of short-run aggregate supply. b. the slope of long-run aggregate supply. c. the slope of the aggregate demand curve. d. everything that makes the aggregate demand curve shift. 42. Other things the same, as the price level rises, the real value of a dollar a. rises, and interest rates rise. b. rises, and interest rates fall. c. falls, and interest rates rise. d. falls, and interest rates fall. 43. Other things the same, a decrease in the price level makes the dollars people hold worth a. more, so they are willing to spend more. b. more, so they are willing to spend less. c. less, so they are willing to spend more. d. less, so they are willing to spend less. 44. Other things the same, the aggregate quantity of goods demanded in the U.S. increases if a. real wealth rises. b. the interest rate rises. c. the dollar appreciates. d. All of the above are correct. 45. When the dollar depreciates, U.S. a. exports and imports increase. b. exports increase, while imports decrease. c. exports decrease, while imports increase. d. exports and imports decrease. 46. Suppose a stock market crash makes people feel poorer. This decrease in wealth would induce people to a. decrease consumption, which shifts aggregate supply left. b. decrease consumption, which shifts aggregate demand left. c. increase consumption, which shifts aggregate supply right. d. increase consumption, which shifts aggregate demand right. 47. When the money supply decreases a. interest rates fall and so aggregate demand shifts right. b. interest rates fall and so aggregate demand shifts left. c. interest rates rise and so aggregate demand shifts right. d. interest rates rise and so aggregate demand shifts left. 48. According to the aggregate demand and aggregate supply model, in the long run an increase in the money supply leads to a. increases in both the price level and real GDP. b. an increase in real GDP but does not change the price level. c. an increase in the price level but does not change real GDP. d. no change in either the price level or real GDP. 49. Since the end of World War II, the U.S. has almost always had rising prices and an upward trend in real GDP. Toexplain this a. it is only necessary that long-run aggregate supply shifts right over time. b. it is only necessary that aggregate demand shifts right over time. c. both aggregate demand and long-run aggregate supply must be shifting right and aggregate demand must shift farther. d. None of the above cases would produce rising prices and growing real GDP over time. 50. The aggregate demand and aggregate supply model implies monetary neutrality a. only in the short run. b. only in the long run. c. in both the short run and the long run. d. in neither the short run nor long run. 51. In the short run Recessions in South Korea and Indonesia will cause a. the U.S. price level and real GDP to rise. b. the U.S. price level and real GDP to fall. c. the U.S. price level to rise and real GDP to fall. d. the U.S. price level to fall and real GDP to rise. 52. Which of the following would cause prices to rise and real GDP to fall in the short run? a. an increase in the expected price level b. an increase in the capital stock c. an increase in the quantity of labor available d. All of the above are correct. 1- aabcbbbdabacbabbcadcbdbdcdcda 30- aacddbcaddabbdccaabbdccbb 52- describes stagnation.. only created by a fall in AS. Possibly as a result of an increased cost of production for firms. Higher wages, rent, taxes.