benefits to volunteering

advertisement

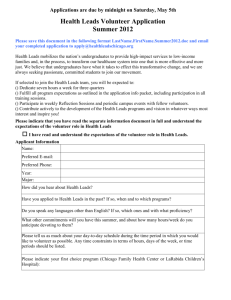

CAAS Community Action Agency of Somerville, Inc. 66-70 Union Square, Suite 104 Somerville, MA 02143 People Achieving More By Working Together Phone 617 623 7370 Voice mail 617 623 1392 Fax 617 628 2512 BECOME A VITA VOLUNTEER TAX PREPARER! CONTACT INFORMATION: Name: Glenna Wyman Title: Volunteer Income Tax Assistance (VITA) Site Coordinator Address: Community Action Agency of Somerville, Inc. (CAAS) 66-70 Union Square, Suite 104, Union Square in Somerville, MA 02143 Phone: 617-623-1392, x. 157 Fax: 617-628-2512 Email: gwyman@caasomerville.org Website: www.caasomerville.org LOCATION 66-70 Union Square (former police station) in Somerville, MA 02143. Accessible by MBTA Orange Line to Sullivan Station (Charlestown), then bus CT2, 86, or 91 to Union Square; also by Green Line to Lechmere Station, then bus 87. VOLUNTEER POSITION DESCRIPTION CAAS seeks volunteer tax preparers to help low-income households prepare simple federal and state income tax returns for FREE, using an-online tax preparation software. The program seeks to ensure that low-income people receive tax credits for which they are entitled and offers an alternative to costly services that encourage filers to take out high-interest loans against anticipated refunds. Volunteer preparers provide the assistance in accordance with IRS guidelines and applicable CAAS policies. VOLUNTEER TAX PREPARER RESPONSIBILITIES Become IRS-Certified in tax preparation by completing the on-line “Link & Learn” course. Course may be accessed from IRS website www.irs.gov (type “Link and Learn Taxes” in search box). Volunteers must complete at least the Basic skill level and pass certification test (next level of Intermediate skill certification is desirable). Total time to complete training for the first time is about 20 hours. Test takes about 1-2 hours to complete. Print Basic and Intermediate (if applicable) test certificates with score and give to CAAS VITA Coordinator. Complete on-line Volunteer Agreement Form, and print copy for CAAS Site Coordinator. Submit completed form electronically to the IRS. Participate in a volunteer orientation at CAAS that includes training on using the tax preparation software (estimated 4 hours). Provide high quality tax assistance to all clients. Answer tax-related questions and directly prepare clients’ returns based on information provided by clients. Interview client to determine that all income, deductions and allowable credits are claimed. Prepare only those tax returns for which training and certification were provided. Paul DiPasquale Board President Donna Cabral Head Start Director Jeffrey Karon Finance Director Kimberly Smith-Cofield Executive Director Dennis Fischman Planning Director Melissa McWhinney Advocacy Director Refer low-income clients with complex returns to the IRS web site or help number, to other VITA sites with volunteers trained in complex returns, or to legal services where appropriate. Complete quality reviews of returns completed by fellow volunteer tax preparers. Maintain confidentiality of client information. Ensure a copy of completed returns are provided to client. Adhere to Title VI by not denying service to anyone based on race, color, sex, age, national origin, or disability. Volunteers cannot accept pay or compensation for assistance provided. Volunteers cannot refer clients to any one particular for-profit tax preparation service. CAAS will be prescreening clients and maintains a list of appropriate referrals for individuals beyond the scope of CAAS’s VITA site. QUALIFICATIONS 1. 2. 3. 4. 5. 6. 7. 8. Ability to learn and apply basic tax knowledge. Training will be provided. Basic computer skills for inputting tax return information. Pride in performing tasks completely and accurately. Strong interpersonal skills and desire to help people; sense of humor helpful. Ability to maintain taxpayer confidentiality. Ability to work well with diverse populations. Dependability and flexibility. Bilingual skills, especially in Spanish, Portuguese, or French-Creole, are a plus! TIME COMMITMENT Prior to the start of tax season, volunteers successfully complete the IRS’s web-based tax law training and certification program Link and Learn (about 20 hours for new volunteers), and participate in a 4-hour orientation that includes software training. During CAAS’s VITA site season (February 9 through April 1), tax preparation will take place on Tuesday afternoons, Wednesday and Thursday evenings and two Saturdays (February 20 and March 27). Volunteers should commit 3-6 hours weekly for the duration of our tax season, with a minimum commitment of 12 hours/month. SUPERVISION AND VOLUNTEER LIABILITY Volunteers will be supervised while on site by the VITA Site Coordinator. The Coordinator will be available to provide support, guidance, and answer questions. An IRS tax specialist will be also volunteering at CAAS’s site. The Site Coordinator will ensure a quality check of all tax returns is completed and electronically files the completed tax returns. Under the Volunteer Protection Action of 1997 (see IRS Pub. 4299 available online at www.irs.gov), volunteers are not liable for mistakes, as long as the volunteer acts within the scope of the VITA Program and has been certified by the IRS as a Volunteer Tax Preparer. BENEFITS TO VOLUNTEERING 1. Rewarding volunteer experience, with the chance to help low-income people in the community claim eligible credits and maximize their income. 2. Opportunity to build skills and your resume regarding tax law and electronic tax preparation. 3. Chance to network and build camaraderie with other VITA volunteers.