Video transcript

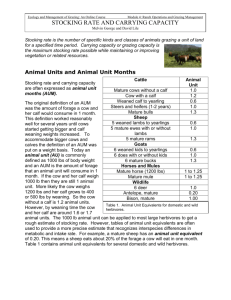

advertisement

25 Royal Tues 1600 1730 SASHA COURVILLE Thank you. Well, good afternoon, everyone. I'd like to do four things in this short few minutes. One is explain what exactly is natural capital. A second is explain why NAB cares about natural capital, and third, talk through the links between good management of natural capital and farm performance, and last, outline what is NAB doing to support customers in managing natural capital risks and in and taking advantage of opportunities. So to start off, what exactly is natural capital? Natural capital is everything that nature provides to us that we depend on for healthy economy, for healthy agribusinesses, but we don't necessarily pay for them. There's a whole range of ecosystem services that underpin the productivity of agriculture-- things like soil formation and erosion control, water purification and filtration processes. Broader services like climate regulation and carbon sequestration-- these are all ecosystem services. For Australian agriculture, one of the most significant limiting factors for us in terms of our productivity is water. Well, water is natural capital. Likewise, good soils are critical for the productivity of agribusinesses. Yet ABS estimates of the incremental effect of land degradation on the value of land and the lost profits from agriculture production are sobering. Over the past 10 years, the cost of land degradation has increased significantly, And in 2010-100, cost more than $600 million in lost profits. Another way to look at natural capital is to consider different kinds of capital. So we understand financial capital and built capital. We have good accounting frameworks and tools to bring them into decision-making structures. We have an understanding of human capital. We have a bit of a fuzzier understanding of social capital and natural capital. But these are all critical components of successful businesses, successful regions, successful countries and economies. So using the concept of natural capital, we can make visible the economic drivers and benefits of good environmental management. So why does NAB care about natural capital? So NAB is Australia's largest agribusiness bank. We've been around supporting customers for 155 years. And we want to be around to support customers for the next 155 years. Now, within the broader context of the discussions we've been happening around global population growth, climate variability issues, among other things, we're going to need to be able to do more with less. The only way to do that is off the back of a strong natural capital asset base. Good management of natural capital plays an important role, all else being equal, in farm productivity, profitability, and resilience. We already know that our customers are ahead of us in thinking about natural capital issues and what it means for their businesses. So we surveyed over 5,400 customers, and asked them questions around natural capital and what issues were important to them. And what we did find out was that the top three rated natural capital issues of concern were soil health, energy costs, and water scarcity, followed by runoff in biodiversity after that. Very significant numbers if you tend to look at it. I don't know if you can read it, but the yellow or the whites and blue, the yellow is people that rated it importance between a seven and eight of 10, and the blue is rated nine or 10, very important. So we have 89% of customers saying soil health is rated seven or more on that scale 10. 86% rated energy costs the same way, and 84% rated water scarcity as that critical issue. Interestingly-- we'll go to the next slide-- 74% of our customers in the survey had already made changes to their businesses as a result of natural resource sustainability constraints in the last two to three years. We found the fruit and vegetable growers were most likely to have made changes to their businesses, at around 88%. And the issues they were focusing on were water scarcity is 66%, soil health at 52%, reducing energy costs, 49%, minimising runoff, 36%, and managing waste at 32%. However, it's important to look beyond that and look at, well, there's 77% of crop growers and 76% of livestock producers who have made natural capital improvements as well in the past two to three years. Intentions to make changes in the near future are highest among those who have already made changes in the past and also business in a growth phase. Horticulture businesses were also most likely to intend to make changes in the near future. So we're listening to our customers and are supporting them in making investments that strengthen their own business models but also improve their natural capital base. So let's unpack this relationship between good management of natural capital and far performance. In terms of productiviy-- we'll play around with these concepts a little bit-- we can see from customer insights as well as industry research that things like sustainable grazing practises can result in significant increases in stocking rights off the back of reinvestment in natural capital assets, namely soil health and biodiversity. For example, customers-- the Agricultural Information and Monitoring Services, AIM-- ran plant trials of native grasses, so grazing trials of native grasses, across multiple properties in South Australia and New South Wales. They converted large paddocks into small paddocks through fencing and water investments and managed grazing and pasture recovery. They maintained vegetation cover and had higher water infiltration and fewer weeds. This all resulted in 47% increase in stocking rights and a 26% increase in pasture growth along with higher gross margins. Or another-- and this is an MLA case study of Gilgai Farms near Geurie, New South Wales. It shows similar results. So through a shift to cell grazing and pasture cropping, they tripled their carrying capacity through three drought years. They have all but mitigated herbicide drenching and fertiliser use through a focus on biological farming practises, and now have 182 species of grasses, forbs, and shrubs. Similarly, at Natalie Williams, a Nuffield Scholar who presented at ABARES here last year, who was a farm near Jericho in Queensland, significantly invested in their natural capital base and saw improvements over 15 years of pasture going from class D to class A, dramatically increasing their carrying capacity, just blitzing all their neighbours. They've also reduced their import costs through reduced mustering, chemicals, and lower methane emissions. So Natalie's case highlights that in addition to increased output, sustainable agriculture can also deliver reduced input costs that can contribute to profitability. And these can cut across, reduce fertiliser and pesticide use to energy, water costs, and even new revenue streams through turning waste into new products. So looking at the prospect of rising energy costs across Australia, there are significant opportunities to reduce bills through investing in energy efficiency upgrades. In 2011, Climate Works did some research on the dairy industry and found that the average dairy could cut costs by 19% through investments in refrigeration and water heating systems. More recently, Dairy Australia has been implementing an extensive energy efficiency project that including energy audits of 1,300 farms. Now, these audits have highlighted a number of savings opportunities, many including no or low cost, maintenance, or adjusting of running times through to significant upgrades in technology or machinery, like hot water systems or plate coolers. Likewise, the apple and pear industry's programme-- very cleverly named What's In Your Business-- found that the average producer could cut energy costs by 16% per annum. In the Wambiana grazing trial near Charters Towers in Queensland, which is actually being talked about in a parallel session, what we found-- this particular trial used five different grazing strategies that we were applied between 1997 and 2010, though I understand that this trial is ongoing. It's a 17-year old trial. What they found is that the medium density stocking rights showed the best results, profitable every year, with animals being 50 to 100 kilogrammes heavier and in better condition, fetching higher market prices. Compared with the average North Queensland property-- around 20,000 hectares-- this strategy was $2 million more profitable. It also correlated with improved biodiversity outcomes. So in contrast, the higher stocking rate strategy saw a decline in carrying capacity, two times faster runoff, leading to soil erosion and less infiltration. Now, a key lesson for this particular trial is that if you took that at any five-year period, you'd get a different result. So it's only by looking at the longer-term time horizon that you really get a true picture of that relationship. One of the most important concepts to understand in terms of link between natural capital and farm performance is resilience. So resilience-- what is it? It essentially is the ability to bounce back after a system shock. And the speed of recovery is important, and how far you dip down is important as well. What this means for farmers is you get more consistent returns across good years and bad. This consistency is critical to be able to plan, manage, and investment in one's business over time. It also enables the building of long-term, trusting relationships and loyalty with supply chain partners, because you can deliver consistently year on year. For example, as a result of no till control traffic and constant innovation in machinery and optimal use of inputs, one of our customers, a grains farmer in Western Victoria in the Wimmera has a strong record of consistent crops and higher yields compared to their neighbours even in dryer years. This is a result of improved soil condition, increased water retention, among other things, including amazing management. Another way to think about resilience is through one of our customers who's based on near Moree. Let's see if I have a slide of them. With reduced water allocations and with increased climate variability, Dick Estons wanted to diversify his cotton farming business, and looked at the best crop for the region which would provide the greatest return for the least amount of water as a limiting factor. And for him, that was oranges. So he's now building an export market for orange juice with the aim of establishing a sustainable citrus industry in Northwest New South Wales and Southern Queensland. In a similar vein, we've seen other customers strengthen their business models while also improving their natural capital base. So an example of co-generation. Mackay Sugar diversified their business model through the development of a co-generation plant using waste for gas to produce clean energy that cuts their energy bill, reduces their reliance on coal, reduces greenhouse gas emissions, and feeds back into the grid, enough to power a third of the energy to power Mackay. Now, this produces, at the peak of the season, 38 megawatts per day during the crushing season from June to November and surplus requirements of up to 27 megawatts feedback into the grid. A final example, cattle farmers Martin Royds and Trish Solomon and their Jillamatong property. The last three are featured in our agribusiness calendar that I think everybody has a copy of for this year, which features innovative customers doing fantastic stuff from a natural capital perspective. These guys are also featured in the Soils For Life case study, so there's a lot of information about them. They've taken a holistic approach to farm management, using rotational grazing, minimum till, direct sowing, planting trees, and slowing the flow of water on their land. Using a high concentration of native grasses for grazing, that's ensuring that the pasture is highly resistant to drought. They've dramatically increased soil organic carbon levels on their farm. So their average is around 2.4%, and that's up from less than 1% 12 years ago. They've increased the number of useful plants from five to 80, and dramatically cut input costs. They have no need for herbicides or other inputs, because the system is managing itself. As a result, their stock gained condition year round, even through drought years. They're more profitable in terms of output per unit of rainfall compared to the average farmer in the region by a significant multiplier, and they've seen productivity increases from 1.73 hectares per cow to 1.13 hectares per cow. So what is NAB doing to support customers in investing in their natural capital, in managing natural capital risks, and taking advantage of opportunities? The first thing is to really understand customer experiences, needs, and expectations, supporting customers, and exchanging water best practises, [? what are ?] the innovation, and what is our role to really support them in that. Second is building banking capability, banker capability, so that customers should be able to have conversations with their bankers. The bankers should know what's happening in the industry around best practises, sustainability tools, new opportunities for savings that generate real returns for their business. The third is the development of products and services to make it easier for customers to invest in their natural capital asset base while strengthening their business models. So we've just recently launched a solar panel finance. It's an asset finance product at discounted rates to support customers where it may be appropriate to reduce energy costs through solar power. Now, as a finance product, PV panels have about a lifespan of around 20 years. That's usually the guarantee. We see payback periods of anywhere between, on average, three to five years, depending upon where you are, levels of solar radiation, and how much energy you use in the daytime. Because we're not looking at storage in this particular product. We're also engaging with industry associations and research organisations to understand what are best practises, what are tools that already exist out there to support industries in improving their practises, managing their natural capital well, so that we're not reinventing the wheel, that we can just understand what the industries are doing and support them. We're partnering with research organisations to build up that long-term and multisite data sets to really understand those linkages in a much more comprehensive way. And we're also working to build natural capital into our credit risk assessment processes over the next three to five years off the back of engagements with industry associations, with research organisations, to build that understanding over time so that we're appropriately pricing natural capital into our risk assessments. But as a final point, while we think this is the right thing to do for Australian agribusiness and for Australian society, it's also smart for business. Thank you.