The agency costs of free cash flow

advertisement

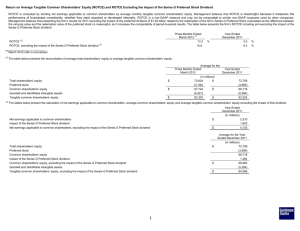

Karl R. Knapp – Article Summary Mann, S. V. & Sicherman, N. W. (1991). The agency costs of free cash flow: acquisition activity and equity issues. Journal of Business, 64, 213-227. Hypothesis / Relevant Factors Discussed / Conclusion / Your Take H0: Shareholder response to potential free cash-flow-increasing events measured as equity issue announcements is conditioned on management’s recent acquisition track record. Agency conflict: Arise when managers of a firm own less than 100% of the stock. Managers pursuing activities in their best interest, not in the shareholders interest. Agency costs – Costs borne by shareholders to encourage managers to maximize shareholder wealth rather than act in their own interest (Jenson & Meckling, 1976 – seminar article on this issue). (Look at employee travel, education, overhead, …) Free cash flows – excess funds that are not required to fund investment projects. Agency cost of free cash flows – The costs that shareholders endure to address the issue of managers having funds with no viable purpose. Equity issues – getting free cash flow by issuing stock. Acquisition activity – acquiring other companies with free cash flow. New title: The cost that shareholders incur as a result of the free cash flow from issuing stock in order to acquire other businesses. Bonding – New equity issues are not bonded, not required to pay back like debt. Managers past experience – can signal whether they will abuse free cash flows. Study grouped into two groups, with and without prior acquisition activity. For those with acquisition activity, broke it down into related, unrelated and at least one unrelated categories. Results Firms with no acquisition activity – shareholders had negative reaction to issue stock Firms with unrelated acquisition activity – shareholders had negative reaction to issue Firms with at least one unrelated – shareholders had negative reaction to issue Firms with related acquisition activity – shareholders reacted less negatively Indicates that the bonding of cash flows alleviates some of shareholders concerns about management’s misuse of funds.