KEARNEY MEMORANDUM AND ARGUMENT

advertisement

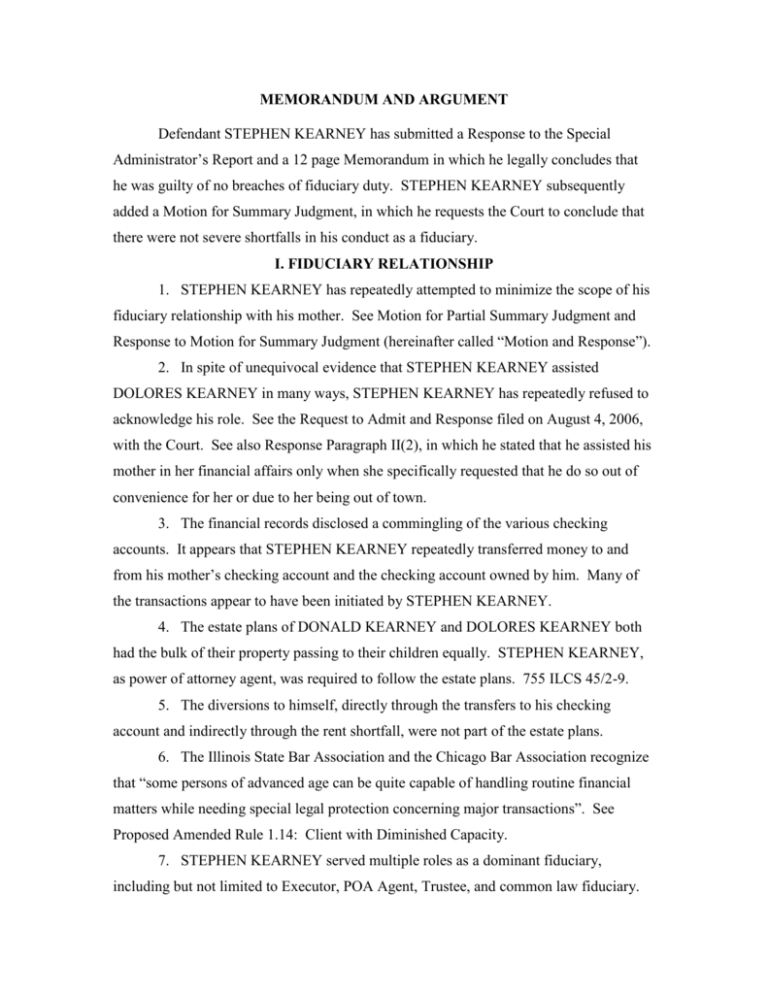

MEMORANDUM AND ARGUMENT Defendant STEPHEN KEARNEY has submitted a Response to the Special Administrator’s Report and a 12 page Memorandum in which he legally concludes that he was guilty of no breaches of fiduciary duty. STEPHEN KEARNEY subsequently added a Motion for Summary Judgment, in which he requests the Court to conclude that there were not severe shortfalls in his conduct as a fiduciary. I. FIDUCIARY RELATIONSHIP 1. STEPHEN KEARNEY has repeatedly attempted to minimize the scope of his fiduciary relationship with his mother. See Motion for Partial Summary Judgment and Response to Motion for Summary Judgment (hereinafter called “Motion and Response”). 2. In spite of unequivocal evidence that STEPHEN KEARNEY assisted DOLORES KEARNEY in many ways, STEPHEN KEARNEY has repeatedly refused to acknowledge his role. See the Request to Admit and Response filed on August 4, 2006, with the Court. See also Response Paragraph II(2), in which he stated that he assisted his mother in her financial affairs only when she specifically requested that he do so out of convenience for her or due to her being out of town. 3. The financial records disclosed a commingling of the various checking accounts. It appears that STEPHEN KEARNEY repeatedly transferred money to and from his mother’s checking account and the checking account owned by him. Many of the transactions appear to have been initiated by STEPHEN KEARNEY. 4. The estate plans of DONALD KEARNEY and DOLORES KEARNEY both had the bulk of their property passing to their children equally. STEPHEN KEARNEY, as power of attorney agent, was required to follow the estate plans. 755 ILCS 45/2-9. 5. The diversions to himself, directly through the transfers to his checking account and indirectly through the rent shortfall, were not part of the estate plans. 6. The Illinois State Bar Association and the Chicago Bar Association recognize that “some persons of advanced age can be quite capable of handling routine financial matters while needing special legal protection concerning major transactions”. See Proposed Amended Rule 1.14: Client with Diminished Capacity. 7. STEPHEN KEARNEY served multiple roles as a dominant fiduciary, including but not limited to Executor, POA Agent, Trustee, and common law fiduciary. Numerous cases cited below refer only to one or two areas of fiduciary relationships; since the concepts generally apply to all fiduciary relationships the burden should be on STEPHEN KEARNEY to appropriately distinguish the applicability of the cases to other fiduciary positions. II. DUTY TO ACCOUNT 1. STEPHEN KEARNEY repeatedly stated in his response that his only duty to respond was to turnover records in his possession from Commerce Bank. That is not an accurate summation of the law. 2. Even within his alleged limited scope, STEPHEN KEARNEY failed miserably. He did not even retain full Commerce Bank records for the Certificates of Deposit transactions that he was involved in. STEPHEN KEARNEY has reluctantly produced a few selective years of “Journal Records” from his mother well after litigation commenced. 3. TIMOTHY KEARNEY, DIANNE KEARNEY and counsel were entitled to review all books and accounts of DOLORES KEARNEY at all times, not just when STEPHEN KEARNEY decided to produce them. 755 ILCS 5/19-13 4. There is no comprehensive compilation of the Certificates of Deposit. The compilation had to be re-created by Daniel G. Deneen. This required a meticulous review of the Commerce Bank records that were produced by STEPHEN KEARNEY. 5. All fiduciary representatives must keep full, complete and accurate accounts of the fiduciary estate. The following statutes are applicable: a. Ward’s Estates: 755 ILCS 5/24-11; b. PPOA: 755 ILCS 45/2-7; and c. Trusts: 760 ILCS 5/11. 6. A trustee or executor is bound to keep clear, distinct and accurate accounts. If he does not, all presumptions are against him, and all obscurities and doubts are to be taken adversely to him. Nonnast v. Northern Trust Co. (1940), 374 Ill. 248, 29 N.E.2d 251. 7. “An administratrix or a trustee is a fiduciary and bound to keep clear, distinct and accurate records of all dealings with the estate or trust assets put in her possession, and her failure to do so creates a strong presumption against the propriety of such dealings. Matter of Estate of Winston (1st. Dist. 1981), 99 Ill.App.3d 278, 54 Ill.Dec. 756, 425 N.E.2d 973. 8. When STEPHEN KEARNEY accepted the role of Power of Attorney agent he was required to accept the responsibilities. This included the statutory duty to account. 9. As noted in the Motion and Response, all shortcomings in the reporting of the transfers to himself and the Certificate of Deposit transactions should be assessed against STEPHEN KEARNEY. III. PRESUMPTIONS AND BURDEN OF PROOF 1. One hundred and sixty years ago attorney Abraham Lincoln attempted to exculpate a fiduciary from a breach of fiduciary duty, and was unsuccessful. See Casey v. Casey (1842), 14 Ill. 112. The law remains stringent to this day when a fiduciary is involved in a transaction in which the fiduciary benefits. 2. Only a few decades later the Illinois Supreme Court spoke again: “The doctrine is a familiar one that every presumption is indulged against the trustee who has personal dealings with the trust. Where the conduct of the trustee in relation to the trust property is fraudulent in its tendency as well as in its nature, its consequences, if injurious, are imputed to the trustee personally, and the estate will be held liable therefore.” White v. Sherman (1897), 168 Ill. 589, 605. 3. Once the petitioner has shown that a fiduciary relationship exists, the presumption is that a transaction between the dominant and servient parties which profits the dominant party is fraudulent. The dominant party then has the burden of proving by clear and convincing evidence that the transaction was fair and equitable and did not result from his undue influence over the servient party. Lemp v. Hauptmann (5th Dist. 1988), 170 Ill.App.3d 753, 525 N.E.2d 203; 121 Ill.Dec. 397. 4. When this duty (utmost fidelity and good faith with respect to the administration of the trust) is breached, the presumption arises that the transaction at issue was fraudulent. Obermaier v. Obermaier (1st Dist. 1984), 128 Ill.App.3d 602, 470 N.E.2d 1047, 83 Ill.Dec. 627. It is then the trustee's burden to prove, by clear and convincing evidence, that the transaction was fair and that the trustee did not breach its duty of loyalty. Curtis v. Fisher (1950), 406 Ill. 102, 92 N.E.2d 327 (1950). NC Illinois Trust Co. v. First Illini Bankcorp, Inc. (3d Dist. 2001), 323 Ill.App.3d 254; 752 N.E.2d 1167; 256 Ill.Dec. 925. 5. Clear and convincing evidence is that which leaves no reasonable doubt in the mind of the trier of fact as to the truth of the proposition in question. In re Estate of Clements (5th Dist. 1987), 152 Ill.App.3d 890, 505 N.E.2d 7. 6. STEPHEN KEARNEY was a fiduciary. STEPHEN KEARNEY dealt with the property of DOLORES KEARNEY, both in trust and as her agent. For STEPHEN KEARNEY to evade liability the Court must have no reasonable doubt that STEPHEN KEARNEY acted fairly, in good faith, and not to his own advantage in dealing with the property of DOLORES KEARNEY. IV. FAIR FARM RENT 1. STEPHEN KEARNEY is correct in that his father sanctioned the conflicting roles of trustee, Power of Attorney agent, and tenant. The Halas case, 209 Ill. App. 3d 333, 568 N.E.2d 170, commented upon recently in the case of Benak v. Duffy, 3-05-0570 (June 2006) discusses situations in which “conflicting interests” are sanctioned. In such a case, the presumption of fraud is not automatically applied. 2. Accordingly, on the Fair Farm Rent Question, there was no per se violation of the fiduciary proscription on self-dealing. However, even with a conflict of interest, the duty to handle the property of the servient party appropriately, and not to take advantage of the fiduciary relationship remains. The transaction still must be fair. Further, the fiduciary cannot act with reckless indifference to the situation of the beneficiary. 3. A trustee owes a fiduciary duty to a trust's beneficiaries and is obligated to carry out the trust according to its terms and to act with the highest degrees of fidelity and utmost good faith. Giagnorio v. Emmett C. Torkelson Trust (2d Dist. 1997), 292 Ill.App.3d 318, 226 Ill.Dec. 693, 686 N.E.2d 42. 4. The fiduciary is liable if he acted dishonestly or in bad faith, or has abused his discretion. In Halas, the Court found a breach of fiduciary duty. 5. District Judge Lindley reviewed Illinois law and concluded “A ‘breach of trust’ has broader meaning than willful and fraudulent acts, and every violation by trustee of duty which equity lays upon him, whether willful or fraudulent or done through neglect or arising through oversight or forgetfulness, is ‘breach of trust’.” Grodsky v. Sipe (E.D.Ill. 1940), 30 F. Supp. 656. 6. As Trustee, STEPHEN KEARNEY could not ignore the financial circumstances of his mother. His mother appeared to be “land rich and cash poor”, a common situation for agricultural families. As early as 1996 he was aware of cash flow problems for his mother. This continued, and on several occasions he “loaned” funds to his mother. 7. The cash flow of STEPHEN KEARNEY was such that he needed additional funds in December and January of 1997-1998 and January of 1999. Not less than $39,000 was transferred from assets of DOLORES KEARNEY, of which $8000 and $6000 was repaid. The delay in rent payments could also be considered a “loan”. 8. As Trustee, STEPHEN KEARNEY should have maximized, within reasonable standards, the income for the trust to assist his mother. As power of attorney agent, STEPHEN KEARNEY should have conceptually required the Trustee, and the tenant of his mother’s property, to provide reasonable rent. 9. To fail to maximize the assets of an elderly woman who was going through money faster than she was bringing it in was an abuse of discretion, at best. 10. Medicaid will pay for nursing home services, but not private care. It was fortunate for DOLORES KEARNEY that she was not one of the unfortunate elderly persons who could live somewhat independently with specialized assistance but had to live in a nursing home since she had no assets and Medicaid would not pay to keep her out of a nursing home. 11. The attempt to rationalize the rent amount by stating “it was OK with Dad” fails in that following the death of Donald Kearney, STEPHEN KEARNEY had to make an independent determination, as the substitute decision-maker for DOLORES KEARNEY, as to a fair and appropriate rent amount for 1996 and future years. 12. The attempts by STEPHEN KEARNEY to evade liability by stating “it was OK with Mom” also fail miserably. The Affidavits of the siblings aligned with STEPHEN KEARNEY do not remedy the situation. Their affidavits do nothing to attain the level of disclosure, knowledge and approval required for a fiduciary. 13. Justice Cardozo wrote on the subject: “If dual interests are to be served, the disclosure to be effective must lay bare the truth, without ambiguity, or reservation, in all its stark significance.” Wendt v. Fischer, 243 N.Y. 439, 443. See also St. Paul Trust Co. v. Strong, 85 Minn. 1, 11. “Imperfect and incomplete information is insufficient.” 14. The Schallaberger case is inapposite. It appears that the Schallaberger case involved a disinterested trustee, not a party involved in a situation involving a conflict of interest. 15. The case of Frazier v. Merchant’s National Bank, 329 Ill. App. 191 (2nd Dist. 1946) is more to the point. To quote at length (emphasis added): Appellant was a trustee. In order to bind a cestui que trust by acquiescence in a breach of trust by the trustee, it must appear that the cestui que trust knew all the facts, and was apprised of his legal rights, and was under no disability to assert them. Such proof must be full and satisfactory. The cestui que trust must be shown, in such case, to have acted freely, deliberately and advisedly, with the intention of confirming a transaction which he knew, or might or ought, with reasonable or proper diligence, to have known to be impeachable. His acquiescence amounts to nothing if his right to impeach is concealed from him, or if a free disclosure is not made to him of every circumstance which it is material for him to know. He cannot be held to have recognized the validity of a particular investment, unless the question as to such validity appears to have come before him. The trustee cannot escape the liability merely by informing the cestui que trust, that he has committed a breach of trust. The trustee is bound to know what his own duty is, and cannot cast upon the cestui que trust the obligation of telling him what such duty is. Imperfect information will be regarded as equivalent to concealment. 16. There is nothing in the record to indicate that DOLORES KEARNEY was fully aware that she should have been receiving $5,000 additional income each year from STEPHEN KEARNEY. STEPHEN KEARNEY has admitted that there are no documents (at least in several categories) to support his position (Special Administrator Exhibit F-1). 17. The Affidavits’ claim that DOLORES K. KEARNEY made inquiry as to rent don’t meet the burden of proof for STEPHEN KEARNEY. 18. Further, the inquiry couldn’t have been too “advised”. STEPHEN KEARNEY and Aunt Helen Kearney determined that $135 was a fair cash rent, which STEPHEN KEARNEY regularly paid in January of the year. 19. Tom Moyer placed his opinion of fair cash rent at $120-$130 per acre for the acreage, which TIMOTHY KEARNEY and DIANNE KEARNEY reluctantly appear to accept. See also Special Administrator’s Exhibit F-4, for “B” ground. 20. STEPHEN KEARNEY has provided insufficient support for his claim that he is absolved from liability for the deficiency in rent. STEPHEN KEARNEY has failed to properly substantiate a full disclosure of all facts to his mother, full knowledge by DOLORES K. KEARNEY of the circumstances, and a freely made, voluntary and advised decision to subsidize STEPHEN KEARNEY by $5,000.00 or so per year. 21. STEPHEN KEARNEY must not just substantiate the above matters; he must remove all doubts in the mind of the trier of fact. 22. Would the Estate of DOLORES KEARNEY have a claim against an independent Trustee if it failed to analyze the financial circumstances of DOLORES KEARNEY and only charged a tenant $100? Without a doubt, yes. 23. The Motion for Summary Judgment appears to only concern the Trust property. The Special Administrator, if necessary, will file appropriate pleadings to allow the Estate of DOLORES KEARNEY to recover rent from STEPHEN KEARNEY for the Estate instead of the Trust, and to “demand” that the Trustee charge himself additional rent. 24. The Estate of DOLORES KEARNEY decreased by approximately $5,000 per year because of the breach of fiduciary duty by STEPHEN KEARNEY. STEPHEN KEARNEY was recklessly indifferent to this, as he used the extra $5000 to pay his own bills, in his interest and against the interest of his mother. V. TRANSFERS OF FUNDS 1. Unlike the farm tenancy matter, there is no sanctioning of gifts under the Power of Attorney document. The transfers of funds to STEPHEN KEARNEY, allegedly for his children, are clearly a conflict of interest, with self-dealing being the species of conflict of interest. 2. “We conclude the facts here require strong evidence to overcome the presumption of fraud. As more of our population become aged, more will need financial assistance. Unfortunately, greed and the temptation to benefit oneself will exist.” In Re Estate of Rybolt, 258 Ill. App.3d 886 (4th Dist. 1994). See also Boyce v. Fernandes, 77 F.3d 946 (7th Cir. 1996). 3. STEPHEN KEARNEY acknowledges that there were numerous transfers of funds between his account and his mother’s account. There was no comprehensive documentation of the transfers. Some were loans from STEPHEN KEARNEY to DOLORES K. KEARNEY, and others went the other way. These transfers were so common and convoluted that Daniel G. Deneen could only come up with a “close” number of the net effect of the transfers. 4. In September of 2005 Daniel G. Deneen tendered an accounting he had prepared showing transfers to and from STEPHEN KEARNEY through the checking account of DOLORES K. KEARNEY. The accounting appeared to show a net deficit of approximately $14,000. STEPHEN KEARNEY’s explanation was that this was a gift of $20,000 and a refund of $6,000. See Report to the Court, Motion and Response. 5. A closer examination of the financial records of DOLORES KEARNEY showed an additional transfer of $11,000 in December of 1997. The transfer came about when a Certificate of Deposit was cashed, and the proceeds went directly to the STEPHEN KEARNEY farm account, bypassing the checking account of DOLORES K. KEARNEY. 6. Information on this transfer, whether a gift or loan, was not made to Daniel G. Deneen by STEPHEN KEARNEY or his attorney. A recreation of financial records in December of 1997 and January of 1998 was necessary to verify that this additional transfer was in fact result in a decrease in the net worth of DOLORES KEARNEY. 7. If the $11,000 transfer was a gift, why was this transfer not referenced when STEPHEN KEARNEY communicated the statement that the $20,000 transfer was a gift? Similarly, there is no explanation as to why there were $8000 transfers to and from the account of STEPHEN KEARNEY within a month period. $5000 transfers, obviously loans, took place in 1997. 8. The unreimbursed transfers total $25,000. It appears that the transfers to DOLORES KEARNEY’s bank account from STEPHEN KEARNEY’s farm account may have been $4,000 greater prior to December of 1997. At the least, STEPHEN KEARNEY should be required to reimburse his mother’s estate $21,000. 9. STEPHEN KEARNEY has fallen far short in trying to explain these transfers, as set forth in the Motion and Response. A statement that “Mom was generous, and these were gifts to help pay for my child’s education”, without support through objective parties and documentation, does not meet any burden of proof, much less one of clear and convincing evidence. 10. It is obvious that there was a great deal of commingling of the funds. STEPHEN KEARNEY has refused to say what has happened, and has not kept proper records, so we can only guess. As emphasized, since we can only guess, all presumptions are against STEPHEN KEARNEY.