Useful organisations for

advertisement

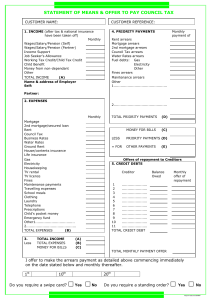

Useful organisations for Information and advice This page gives you details of organisations that can provide advice and/or information about mortgage and debt problems. Cambridge City Council Housing Options & Advice Team Mandela House 4 Regent Street Cambridge CB2 1BY Tel : 01223 457918 Offers advice advocacy on housing rights and options and preventing homelessness. Cambridge Citizens Advice Bureaux (CAB) 72-74 Newmarket Road Cambridge CB5 8DZ Tel : 0844 8487979 Help to resolve any legal, money, welfare benefits issues or other problems. Cambridge Law Centre 41 Mill Road Cambridge CB1 2AW Tel : 01223 712222 Specialist help with housing problems Consumer Credit Counselling Service Offers assistance in resolving multiple debts on 0800 138 1111 , or visit www.cccs.co.uk Council of Mortgage Lenders Represents the interests of most mortgage providers. It does not provide advice but has useful information on mortgages: www.cml.org.uk Financial Services Ombudsman Aims to settle unresolved disputes between customers and mortgage providers. For information call 0845 080 1800 or visit www.financial-ombudsman.org.uk Financial Services Authority (FSA) Operates a consumer helpline 0845 606 1234, and produces a series of guides on ow to manage money: www.moneymadeclear.fsa.gov.uk Land registry Has details of the ownership of registered land and property. For a small fee you can find out who is the owner of a property at www.landregister.gov.uk National Debtline Help on how to deal with debt problems from 0808 808 4000, or visit www.nationaldebtline.co.uk Payplan Debt solutions and debt advice on 0800 91 7 7823, or visit www.payplan.com Shelter Free housing advice helpline 0808 800 4444*, open 8am–8pm, seven days a week and includes help on related mortgage debt or welfare benefits issues. Alternatively visit www.shelter.org.uk/adviceonline *note: some mobile phone networks may charge for calls to this number. Mortgage arrears Checklist Make a decision Are you able to pay your monthly instalment and an amount towards the arrears? If not, are your financial circumstances likely to improve? If so, when? Do you want to remain in the home or sell it? Prepare a budget Prepare a budget showing all your income and expenditure. What items do you have to pay for? What are non-essential items? Do you have other loans? Options available to you? Pay current instalment plus an amount towards the arrears. Clear the arrears with a lump sum. Capitalise the arrears – arrears are added to the mortgage and are then paid over the remaining term of your mortgage. Extend the term of your mortgage. Switch mortgage – for example, switch from a repayment mortgage to an interest-only mortgage, which may have lower monthly instalments. Payment holiday – ask for a temporary suspension of payments. Contact your lender Have you contacted your lender? Have you made any arrangements to clear the arrears? Have you been able to keep to any agreements agreed? Are the payments agreed realistic? Have you discussed the options available to you (listed above)? Notification of court hearing If you are unable to make an arrangement to clear the arrears, it is likely that the lender will take possession action. You should receive a letter from the lender explaining what will happen if the arrears are not paid off. If the arrears remain outstanding then a claim form and particulars of claim will be sent to you by the court. This will contain details of the lender’s case and the date of the court hearing. Preparing for court You need to be able to explain: Why you are in arrears. If you are in temporary difficulties, why and when will your financial circumstances improve? What contact you have had with the lender? How you plan to repay the arrears, together with your monthly instalments. The value of your property If you have other loans secured on your property. If your property is for sale, how long has it been on the market? If there a potential buyer. If so, what stage has the sale reached? The hearing It is important that you attend the hearing. When at court you may want to check whether there is an adviser or solicitor on a court duty desk who could assist you with representing your case. At the hearing the court will decide whether to: grant outright possession, postpone or suspend possession on certain conditions, adjourn the case to a later date, or dismiss the case,