The Growth Of Firms - The Good, the Bad and the Economist

advertisement

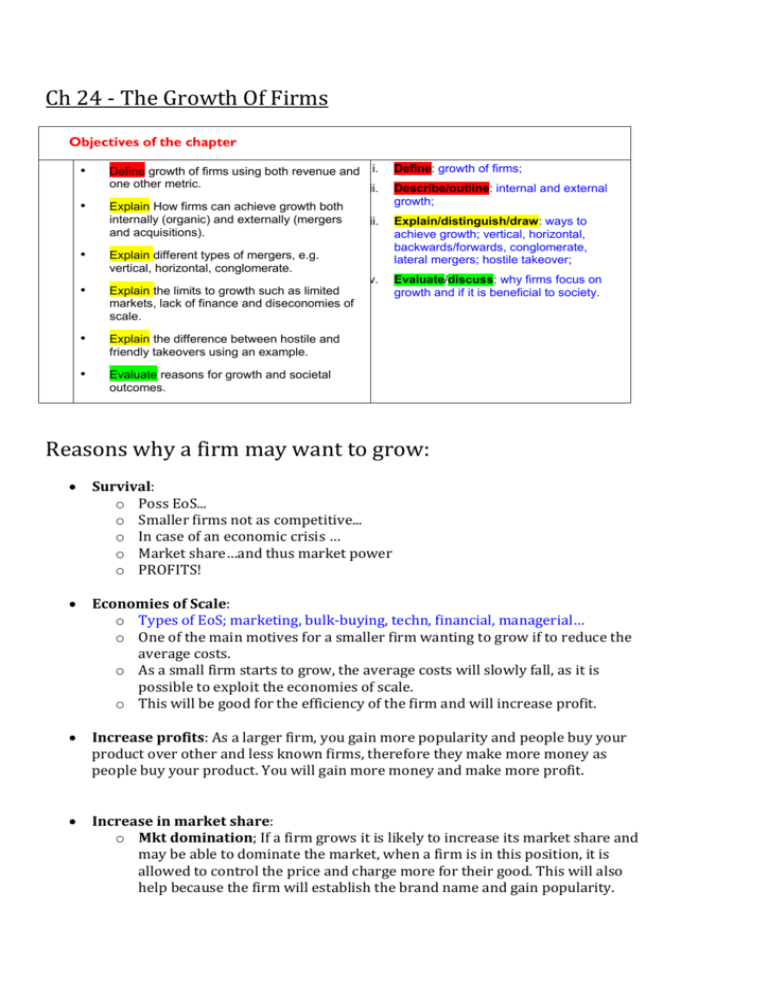

Ch 24 - The Growth Of Firms Objectives of the chapter • • Define growth of firms using both revenue and i. one other metric. ii. Explain How firms can achieve growth both internally (organic) and externally (mergers and acquisitions). • Explain different types of mergers, e.g. vertical, horizontal, conglomerate. • Explain the limits to growth such as limited markets, lack of finance and diseconomies of scale. • Explain the difference between hostile and friendly takeovers using an example. • Evaluate reasons for growth and societal outcomes. Define: growth of firms; Describe/outline: internal and external growth; iii. Explain/distinguish/draw: ways to achieve growth; vertical, horizontal, backwards/forwards, conglomerate, lateral mergers; hostile takeover; iv. Evaluate/discuss: why firms focus on growth and if it is beneficial to society. Reasons why a firm may want to grow: Survival: o Poss EoS... o Smaller firms not as competitive... o In case of an economic crisis … o Market share…and thus market power o PROFITS! Economies of Scale: o Types of EoS; marketing, bulk-buying, techn, financial, managerial… o One of the main motives for a smaller firm wanting to grow if to reduce the average costs. o As a small firm starts to grow, the average costs will slowly fall, as it is possible to exploit the economies of scale. o This will be good for the efficiency of the firm and will increase profit. Increase profits: As a larger firm, you gain more popularity and people buy your product over other and less known firms, therefore they make more money as people buy your product. You will gain more money and make more profit. Increase in market share: o Mkt domination; If a firm grows it is likely to increase its market share and may be able to dominate the market, when a firm is in this position, it is allowed to control the price and charge more for their good. This will also help because the firm will establish the brand name and gain popularity. o Oligopolies…does NOT mean “only four big firms” but “…four large firms with considerable mkt power (say 50% of mkt)….plus an additional 1,000 firms…” How can a firm grow? There are numerous methods such as one being Internal Growth or Organic Growth, o the firm increasing output and selling more in existing or new markets. o For example, a clothing line might grow organically if it opens up a new store each year. o This is a working method but is relatively slow and takes time. o It is financed by…. o External Growth. o faster way to grow and can be more effective o Takeover; o Acquisition; of other businesses or by o Merging. A takeover involves one company buying and then taking control of another company. And example of this is Kraft Foods taking over the chocolate company Cadbury Dairy Milk Chocolate. This meant that Kraft had taken over another company and has grown. A merger is when 2 firms agree to join and become one. En example is HBOS and Lloyds TSB merged together. There are different typed of merger or Integration. Methods Of Integration Horizontal Integration: o two firms who work in exactly the same industry o same stage of production join together o normally works well as workers feel safer in the same type of industry and company. Vertical Integration: o a firm joining with another firm that is operating at a different stage of production. o backward vertical integration involves a firm joining with one that operates in the previous stage of production; an example could be a petroleum company joining forces with an oil exploration company. benefit of this would be to guarantee and control different supplies of oil. o Forward vertical integration is exactly the same but different. there is one firm works at the stage with is after the one another firm is operating at. The example is the petroleum company joining with a petrol retailer, this guarantees an outlet for the petroleum company and remove the profit margin for retailers. Lateral integration: involves firms joining together who produce similarly related products but are not in competition with each other. An example of this may be a hotel and a disabled or old peoples homing place as they both offer accommodation yet are not exactly in competition with each other. Diversifying mergers: is when different firms operating in two completely different industries join together. An example could be a petting zoo and the other could be a bank merging together so if the bank goes out of business the owners can rely on the petting zoo to make profit. Some problems do occur, as there is a lack of understanding in that industry. Limitations to growth Sometimes the firm is limited to its growth a bit like midgets. Some reasons for their limitations may be the fact that there is A limited market: The market for some goods are small like ‘Rama-DamaDing-Dongs Ayam” which is in the middle of a rural area. Therefore the village has a limited amount of customers and the restaurant cant grow much more as it would be pointless due to the lack of customers. Only if this village grows, can the store. Lack of finance: maybe the owners of this “Rama-Dama-Ding-Dongs Ayam” is not very wealthy and does not have the financial capacity to fund the companies growth. Financial institutions are often afraid to lend money to firms that are very small, as they are considered too risky. Aim of the entrepreneur: in some cases the owner does not want to run a big company and just wants it to be small as he is content with the size, reasons for this may be that he is happy with the size or that he doesn’t want to hold a larger responsibility and they may just be happy with the current amount of profit. Diseconomies of scale: once a firm reaches a certain size any further growth may result in a diseconomy of scale. If a firm expands beyond the minimum efficient scale, average costs start to rise. A firm is not likely to grow any further if costs start to rise because it would have to charge more for the output or product.