CSTAI(3)_94_9505-07

advertisement

Circular No : Date : Subject : Ref: AI(3)/94/95 05/07/1995 Levy of tax on VAT basis - Information regarding stock inventories to be obtained from the dealers - Certain instructions issued - Further instructions 1) CCT`s Ref. AI(3)/94/95, dt.4.4.95 (Clarification on new provisions). 2) CCT`s Ref. AI(3)/94/95, dt.4.4.95 (Collection of information on stock inventories) 3) CCT`s Ref. AI(3)/94/95, dt.15.5.95 (Further instructions on collection of stock inventories etc). 4) G.O.Ms.No.244, Rev (CT-II) Dept., dt.17.5.95 (APGST Rules) In the references cited above, instructions were issued regarding the procedure to be followed for calculation of tax on VAT basis, obtaining of information regarding stock inventories etc. Vide G.O. 4th cited, the Government have issued amended APGST Rules to the relevant provisions of Act No.22 of 1995. Pursuant to these Rules, the following instructions are issued regarding collection of tax from the dealers dealing in VAT commodities. A2 Returns Procedure for calculation of VAT has been simplified. There is no need to verify the value addition invoice wise for every transaction. It appears some officers have issued notices to the dealers requiring them to furnish invoice wise correlation of a particular commodity and its sales and the value addition thereon. This is not required. In the A2 Returns filed by every dealer, the sales turnovers are reported by them under different commodities sold by them. The dealer furnishes the details of purchases effected by him under different categories of commodities. In case of commodities which are liable to tax under VAT the dealer is required to deduct the tax due on the value of the purchases from tax due on the sale value of the same commodity during that month and pay only the balance amount towards tax due on value addition during that month. In case the tax due on purchase value is more than tax due on the sale value, the tax due on sales value shall be deducted from the tax due on purchase value and the balance amount shall be carried forward to the next month as a tax credit in the account of the dealer. This amount can be set off against the tax due to be paid by the same dealer on the sales turnover for the subsequent months. It seems some officers issued notices requiring the dealers to mention in A2 returns transaction wise details of sale value and tax collected thereon separately. This is not required. It is sufficient if the dealer indicates the value of purchases and sales for that month in that commodity. If in A2 return tax levied on purchase is not shown separately the amount of tax levied on such purchases shall be arrived at by applying the formula given in proviso to Sixth Schedule. The proforma of A2 return is amended and in the `Statement of Commodity wise tax and turnover details` the following 4 columns have been added. Turnover of purchases during the month. Tax levied at the preceding point of saleTax due Tax paid Therefore the assessing authorities are hereby instructed not to insist upon invoice-to-invoice verification of value addition on the sales transactions. It is sufficient if the dealers furnish the difference between tax due on sales value and tax due on purchases value and pay the differential tax. The above instructions shall be followed scrupulously and no scope shall be given for any complaints from the dealers. The receipt of the above instructions shall be acknowledged immediately to the next higher authority. References: 1. THE CENTRAL SALES TAX ACT, 1956 Section 3 2. THE CENTRAL SALES TAX ACT, 1956 Section 5

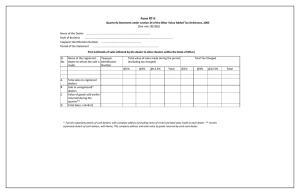

![FORM VAT 240 [See rule 34(3)] AUDITED STATEMENT OF](http://s3.studylib.net/store/data/006634819_1-8030c8deabf85e90daaf66565251c7fe-300x300.png)