Pre-quiz Number Five

advertisement

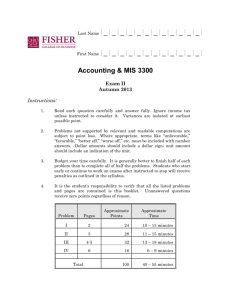

PRE-QUIZ NUMBER FIVE – CHAPTERS 21 AND 22 Name ________________________ ACCT. 102 - PROFESSOR FARINA Chapter 21 True-false: The following statements are either true or false. Place a (T) in the parentheses before each true statement and an (F) before each false statement. 1. ( ) A fixed budget performance report always compares actual costs with budgeted amounts based on the actual operating level. 2. ( ) The same costs are fixed or variable in all businesses. For example, office supply costs are always variable. 3. ( ) A flexible budget performance report always compares actual costs with budgeted amounts based on the actual operating level. 4. ( ) Standard costs are determined by averaging historical costs that occurred when the company operated within a normal operating range. 5. ( ) A variance is favorable if actual cost is below standard cost. 6. ( ) A variance is favorable if actual revenue is below standard revenue. 7. ( ) A company's standard direct material cost for producing 10 units of a product is $200 but the actual direct material cost was $180. We can safely conclude that the $20 variance must have resulted because the materials price was lower than standard. 8. ( ) An unfavorable overhead volume variance is caused by the fact that the plant did not reach the operating level that was expected when the predetermined overhead application rate was selected. 9. ( ) A general journal entry to record a standard material cost in the Goods in Process Inventory account and an unfavorable material quantity variance would include a debit to Direct Material Quantity Variance. 10. ( ) When variances are recorded in separate accounts, they are closed directly to the Cost of Goods Sold account at the end of the accounting period only if their balances are immaterial. Multiple-choice: You are given several words, phrases or numbers to choose from in completing each of the following statements or in answering the following questions. In each case, select the one that best completes the statement or answers the question and place its letter in the answer space provided. ________ 1. Bubbling Waters Company manufactures and sells hot tubs. Which one of the following costs is likely to be fixed? a. b. c. d. e. Fiberglass materials. Installation costs. Direct labor. Monthly rent expense for the factory building. None of the above. 1 ________ 2. This information describes the results experienced by a manufacturing company: Standard direct materials (10 lbs. @ $4/lb.) ... Actual direct materials used............................ Direct materials cost variance (favorable) ...... Actual finished units manufactured ................ $40/unit 11,340 lbs. $2,400 1,080 What is the actual cost of direct materials for the period? a. b. c. d. e. ________3. $40,800. $42,960. $43,200. $45,600. $47,760. Lyle Inc. produced 3,700 units of finished product, using 15,000 pounds of raw material. Lyle purchased 16,000 pounds for $158,400. The material standards for the product are 4 pounds at $10 per pound. What are the materials quantity variance and materials price variance, respectively? a. $2,000 F; $1,500 F b. $2,000 U; $1,500 F c. $2,000 F; $1,500 J d. $2,000 U; $1,500 U e. None of the above. 2 Short Problem Beck Company set the following standard unit costs for its single product. Direct materials (28 Ibs. @ $3 per Ib.) $ 84.00 Direct labor (6 hrs. @ $6 per hr.) 36.00 Factory overhead—Variable (6 hrs. @ $4 per hr.) 24.00 Factory overhead—Fixed (6 hrs. @ $5 per hr.) 30.00 Total standard cost $ 174.00 The predetermined overhead rate is based on a planned operating volume of 60% of the productive capacity of 50,000 units per quarter. The following flexible budget information is available. Operating Levels 50% Production in units Standard direct labor hours 60% 70% 25,000 30,000 35,000 150,000 180,000 210,000 Budgeted overhead Fixed factory overhead $ 900,000 $ 900,000 $ 900,000 Variable factory overhead $ 600,000 $ 720,000 $ 840,000 During the current quarter, the company operated at 70% of capacity and produced 35,000 units of product; actual direct labor totaled 148,800 hours. Actual costs incurred during the current quarter follow: Direct materials (975,000 Ibs. @ $3.1) $ 3,022,500 Direct labor (148,800 hrs. @ $5.75) 855,600 Fixed factory overhead costs 1,319,547 Variable factory overhead costs 1,235,321 Total actual costs $ 6,432,968 Required: Compute the following variances: (1) direct materials price variance; (2) direct materials quantity variance; (3) direct labor rate variance; (4) direct labor efficiency variance; (5) variable overhead spending variance; (6) variable overhead efficiency variance; (7) fixed overhead spending variance; (8) fixed overhead volume variance. Attach your solution to this pre-quiz using a separate piece of paper. 3 Chapter 22 True-false: The following statements are either true or false. Place a (T) in the parentheses before each true statement and an (F) before each false statement. 1. ( ) Controllable costs and expenses are always the same as direct costs and expenses. 2. ( ) Costs incurred by service departments in support of selling departments are direct expenses of the selling departments. 3. ( ) Depending on the circumstances, employees' wages can be either a direct or an indirect expense. 4. ( ) A department's contribution to overhead is the excess of its revenues over its direct expenses. 5. ( ) Joint costs must be allocated among products when preparing internal managerial accounting reports. 6. ( ) A direct expense should not be allocated among more than one department. 7. ( ) Accounting information can be used to evaluate (a) managers who are responsible for controlling costs and expenses and (b) each department's profitability or cost effectiveness. 8. ( ) An advertising department is both a service department and a cost center. 9. ( ) The maintenance department is an example of a profit center. 10. ( ) It is the responsibility of the manager of an investment center to use the resources of the center to generate profits for the firm. Multiple-choice: You are given several words, phrases or numbers to choose from in completing each of the following statements or in answering the following questions. In each case, select the one that best completes the statement or answers the question and place its letter in the answer space provided. ________ 1. A supervisor works some of the time in Department A (which has 10 employees) and the rest of the time in Department B (which has 6 employees). In square feet of area, Department A is only half the size of Department B. If the supervisor's primary task is managing people, how and in what amounts would the supervisor's $24,000 annual salary be most logically allocated between Departments A and B? a. Based on the number of employees in each department, $15,000 to Department A and $9,000 to Department B. b. Based on a combined statistic of square footage and number of employees in each department, $10,909 to Department A and $13,091 to Department B. c. Based on the number of departments supervised, $12,000 to Department A and $12,000 to Department B d. Based on the square footage in each department, $8,000 to Department A and $16,000 to Department B. e. Based on the number of employees in each department, $9,000 to Department A and $15,000 to Department B. 4 ________ 2. Townsend Building Company purchased a partially completed four-story building and turned it into 24 condominiums of three different categories. Five 3-bedroom units are expected to sell for $150,000 each, twelve 2-bedroom units are expected to sell for $75,000 each, and seven 1-bedroom units are expected to sell for $50,000 each. The company spent $400,000 to purchase the building and $800,000 on common construction costs. How much of these two joint costs would be assigned to each condominium in each price category? a. b. c. d. e. 3-Bedroom 2-Bedroom Units Units $50,000 $50,000 $78,261 $52,174 $80,000 $33,333 $90,000 $45,000 None of the above. 1-Bedroom Units $50,000 $26,087 $57,143 $30,000 Short Problem Off-Road Cycle Shop has two service departments (advertising and administration) and two operating departments (cycles and clothing). During 2009, the departments had the following direct expenses and occupied the following amount of floor space. Department Advertising Direct Expenses Square Feet $ 15,000 1,086 Administrative 18,300 1,153 Cycles 101,500 6,338 Clothing 12,100 4,223 The advertising department developed and distributed 100 advertisements during the year. Of these, 72 promoted cycles and 28 promoted clothing. The store sold $300,000 of merchandise during the year. Of this amount, $225,000 is from the cycles department, and $75,000 is from the clothing department. The utilities expense of $63,000 is an indirect expense to all departments. Prepare a departmental expense allocation spreadsheet for OffRoad Cycle Shop. The spreadsheet should assign (1) direct expenses to each of the four departments, (2) the $63,000 of utilities expense to the four departments on the basis of floor space occupied, (3) the advertising department's expenses to the two operating departments on the basis of the number of ads placed that promoted a department's products, and (4) the administrative department's expenses to the two operating departments based on the amount of sales. Hint: format your answers using the spreadsheet solution for Exercise 22-3 done in class. Attach your spreadsheet to this pre-quiz. 5 Short Essay Larry Simmons manages the Sporting Goods division of All-Sports Inc. All Sports Inc. tracks the return on investment of each division. All Sports Inc. rewards its managers with a $3,000 bonus for each percentage point their return on investment exceeds a target rate of 8%. The Sporting Goods division reported the following departmental income last year: Sales $8,490,000 Cost of goods sold 4,250,000 Gross profit 4,240,000 Operating expenses 3,040,000 Net income $1,200,000 The average invested assets for the Sporting Goods division are $8,000,000 Due to Larry’s outstanding performance, the top management of All-Sports Inc. have decided Larry should also manage a new division, Sportswear. The Sportswear division will require average invested assets of $2,000,000, and is projected to earn net income of $100,000. Required: 1. Compute Larry’s bonus from managing the Sporting Goods division. 2. Compute Larry’s bonus if he manages both the Sporting Goods and Sportswear divisions. 3. How do you think Larry will react when assigned the Sportswear division, after computing his expected bonus from managing both the Sporting Goods and Sportswear divisions? 6