The Reporting Entity and Consolidated Financial

advertisement

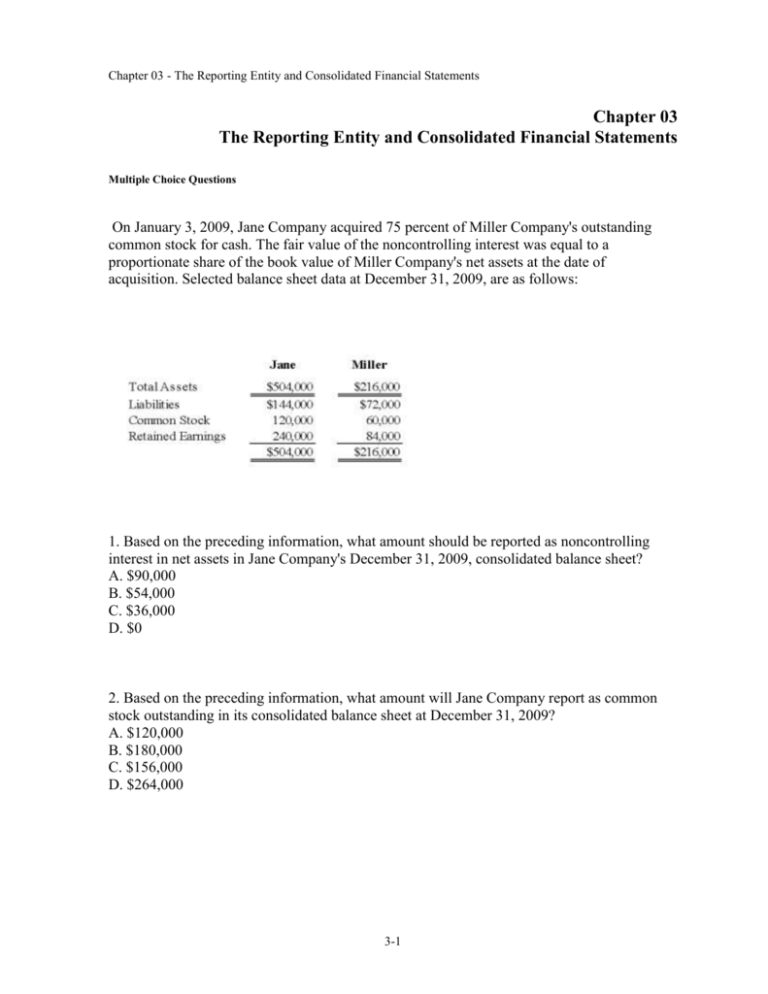

Chapter 03 - The Reporting Entity and Consolidated Financial Statements Chapter 03 The Reporting Entity and Consolidated Financial Statements Multiple Choice Questions On January 3, 2009, Jane Company acquired 75 percent of Miller Company's outstanding common stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Miller Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 2009, are as follows: 1. Based on the preceding information, what amount should be reported as noncontrolling interest in net assets in Jane Company's December 31, 2009, consolidated balance sheet? A. $90,000 B. $54,000 C. $36,000 D. $0 2. Based on the preceding information, what amount will Jane Company report as common stock outstanding in its consolidated balance sheet at December 31, 2009? A. $120,000 B. $180,000 C. $156,000 D. $264,000 3-1 Chapter 03 - The Reporting Entity and Consolidated Financial Statements Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable. 3. Based on the preceding information, what amount of total assets did Beta report in its balance sheet immediately after the acquisition? A. $500,000 B. $650,000 C. $750,000 D. $900,000 4. Based on the preceding information, what amount of total assets was reported in the consolidated balance sheet immediately after acquisition? A. $650,000 B. $880,000 C. $920,000 D. $750,000 5. Based on the preceding information, what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition? A. $500,000 B. $530,000 C. $280,000 D. $660,000 3-2 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 6. Based on the preceding information, what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition? A. $220,000 B. $150,000 C. $370,000 D. $350,000 7. Company Pea owns 90 percent of Company Essone which in turn owns 80 percent of Company Esstwo. Company Esstwo owns 100 percent of Company Essthree. Consolidated financial statements should be prepared to report the financial status and results of operations for: A. Pea. B. Pea plus Essone. C. Pea plus Essone plus Esstwo. D. Pea plus Essone plus Esstwo plus Essthree. 8. Xing Corporation owns 80 percent of the voting common shares of Adams Corporation. Noncontrolling interest was assigned $24,000 of income in the 2009 consolidated income statement. What amount of net income did Adams Corporation report for the year? A. $150,000 B. $96,000 C. $120,000 D. $30,000 9. On December 31, 2009, Rudd Company acquired 80 percent of the common stock of Wilton Company. At the time, Rudd held land with a book value of $100,000 and a fair value of $260,000; Wilton held land with a book value of $50,000 and fair value of $600,000. Using the parent company theory, at what amount would land be reported in a consolidated balance sheet prepared immediately after the combination? A. $550,000 B. $590,000 C. $700,000 D. $860,000 3-3 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 10. Princeton Company acquired 75 percent of the common stock of Sheffield Corporation on December 31, 2009. On the date of acquisition, Princeton held land with a book value of $150,000 and a fair value of $300,000; Sheffield held land with a book value of $100,000 and fair value of $500,000. Using the entity theory, at what amount would land be reported in a consolidated balance sheet prepared immediately after the combination? A. $650,000 B. $500,000 C. $550,000 D. $375,000 11. If Push Company owned 51 percent of the outstanding common stock of Shove Company, which reporting method would be appropriate? A. Cost method B. Consolidation C. Equity method D. Merger method 12. Under FASB 141R, consolidation follows largely which theory approach? A. Proprietary B. Parent company C. Entity D. Variable 3-4 Chapter 03 - The Reporting Entity and Consolidated Financial Statements On January 3, 2009, Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 in cash. At the acquisition date, the book values and fair values of Frazer's assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 20 percent of the total book value of Frazer. The stockholders' equity accounts of the two companies at the acquisition date are: Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009. 13. Based on the preceding information, what amount will be assigned to the noncontrolling interest on January 3, 2009, in the consolidated balance sheet? A. $86,000 B. $44,000 C. $68,800 D. $50,000 14. Based on the preceding information, what will be the total stockholders' equity in the consolidated balance sheet as of January 3, 2009? A. $1,580,000 B. $1,064,000 C. $1,150,000 D. $1,236,000 3-5 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 15. Based on the preceding information, what will be the amount of net income reported by Frazer Corporation in 2009? A. $44,000 B. $55,000 C. $66,000 D. $36,000 16. Goodwill under the parent theory: A. exceeds goodwill under the proprietary theory. B. exceeds goodwill under the entity theory. C. is less than goodwill under the entity theory. D. is less than goodwill under the proprietary theory. Small-Town Retail owns 70 percent of Supplier Corporation's common stock. For the current financial year, Small-Town and Supplier reported sales of $450,000 and $300,000 and expenses of $290,000 and $240,000, respectively. 17. Based on the preceding information, what is the amount of net income to be reported in the consolidated income statement for the year under the parent company theory approach? A. $220,000 B. $202,000 C. $160,000 D. $200,000 18. Based on the preceding information, what is the amount of net income to be reported in the consolidated income statement for the year under the proprietary theory approach? A. $210,000 B. $202,000 C. $160,000 D. $200,000 3-6 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 19. Based on the preceding information, what is the amount of net income to be reported in the consolidated income statement for the year under the entity theory approach? A. $210,000 B. $202,000 C. $160,000 D. $220,000 20. Quid Corporation acquired 75 percent of Pro Company's common stock on December 31, 2006. Goodwill (attributable to Quid's acquisition of Pro shares) of $300,000 was reported in the consolidated financial statements at December 31, 2006. Parent company approach was used in determining this amount. What is the amount of goodwill to be reported under proprietary theory approach? A. $300,000 B. $400,000 C. $150,000 D. $100,000 21. Quid Corporation acquired 60 percent of Pro Company's common stock on December 31, 2004. Goodwill (attributable to Quid's acquisition of Pro shares) of $150,000 was reported in the consolidated financial statements at December 31, 2004. Proprietary theory approach was used in determining this amount. What is the amount of goodwill to be reported under entity theory approach? A. $150,000 B. $200,000 C. $250,000 D. $100,000 22. Blue Company owns 80 percent of the common stock of White Corporation. During the year, Blue reported sales of $1,000,000, and White reported sales of $500,000, including sales to Blue of $80,000. The amount of sales that should be reported in the consolidated income statement for the year is: A. $500,000. B. $1,300,000. C. $1,420,000. D. $1,500,000. 3-7 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 23. In which of the following cases would consolidation be inappropriate? A. The subsidiary is in bankruptcy. B. Subsidiary's operations are dissimilar from those of the parent. C. The parent owns 90 percent of the subsidiary's common stock, but all of the subsidiary's nonvoting preferred stock is held by a single investor. D. Subsidiary is foreign. 24. Consolidated financial statements tend to be most useful for: A. Creditors of a consolidated subsidiary. B. Investors and long-term creditors of the parent company. C. Short-term creditors of the parent company. D. Stockholders of a consolidated subsidiary. On January 1, 2009, Heathcliff Corporation acquired 80 percent of Garfield Corporation's voting common stock. Garfield's buildings and equipment had a book value of $300,000 and a fair value of $350,000 at the time of acquisition. 25. Based on the preceding information, what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the parent company approach? A. $350,000 B. $340,000 C. $280,000 D. $300,000 26. Based on the preceding information, what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the current accounting practice? A. $350,000 B. $340,000 C. $280,000 D. $300,000 3-8 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 27. On January 1, 2009, Gold Rush Company acquires 80 percent ownership in California Corporation for $200,000. The fair value of the noncontrolling interest at that time is determined to be $50,000. It reports net assets with a book value of $200,000 and fair value of $230,000. Gold Rush Company reports net assets with a book value of $600,000 and a fair value of $650,000 at that time, excluding its investment in California. What will be the amount of goodwill that would be reported immediately after the combination under current accounting practice? A. $50,000 B. $30,000 C. $40,000 D. $20,000 28. Roland Company acquired 100 percent of Garros Company's voting shares in 2007. During 2008, Garros purchased tennis equipment for $30,000 and sold them to Roland for $55,000. Roland continues to hold the items in inventory on December 31, 2008. Sales for the two companies during 2008 totaled $655,000, and total cost of goods sold was $420,000. Which of the following observations will be true if no adjustment is made to eliminate the intercorporate sale when a consolidated income statement is prepared for 2008? A. Sales would be overstated by $30,000. B. Cost of goods sold will be understated by $25,000. C. Net income will be overstated by $25,000. D. Consolidated net income will be unaffected. 29. Zeta Corporation and its subsidiary reported consolidated net income of $320,000 for the year ended December 31, 2008. Zeta owns 80 percent of the common shares of its subsidiary, acquired at book value. Noncontrolling interest was assigned income of $30,000 in the consolidated income statement for 2008. What is the amount of separate operating income reported by Zeta for the year? A. $170,000 B. $150,000 C. $120,000 D. $200,000 3-9 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 30. Rohan Corporation holds assets with a fair value of $150,000 and a book value of $125,000 and liabilities with a book value and fair value of $50,000. What balance will be assigned to the noncontrolling interest in the consolidated balance sheet if Helms Company pays $90,000 to acquire 75 percent ownership in Rohan and goodwill of $20,000 is reported? A. $50,000 B. $30,000 C. $40,000 D. $20,000 Elbonia Corporation, a 100 percent subsidiary of Atomic Corporation, caters to its parent's entire inventory requirements. In 2007, Elbonia produced inventory at a cost of $36,000 and sold it to Atomic for $75,000. Atomic held all the items in inventory on January 1, 2008. During 2008, Atomic sold all the units for $98,000. Assume that the companies had no other transactions during 2007 and 2008. 31. Based on the preceding information, what amount would be reported in the consolidated financial statements for inventory on January 1, 2008? A. $39,000 B. $36,000 C. $75,000 D. $0 32. Based on the preceding information, what amount would be reported in the consolidated financial statements for cost of goods sold for 2007? A. $39,000 B. $36,000 C. $75,000 D. $0 3-10 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 33. Based on the preceding information, what amount would be reported in the consolidated financial statements for cost of goods sold for 2008? A. $0 B. $39,000 C. $36,000 D. $98,000 34. Based on the preceding information, what amount would be reported in the consolidated financial statements for sales for 2007? A. $0 B. $39,000 C. $36,000 D. $75,000 35. When a primary beneficiary's consolidation of a variable interest entity (VIE) is appropriate, the amounts of the VIE to be consolidated are: I. Book values for assets and liabilities transferred by the primary beneficiary. II. Fair values when the primary beneficiary relationship became established. A. I B. II C. Both I and II D. Neither I nor II 36. Which of the following usually does not represent a variable interest? A. Common stock, with no special features or provisions B. Senior debt C. Subordinated debt D. Loan or asset guarantees Essay Questions 3-11 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 37. Consolidated financial statements are required by GAAP in certain circumstances. This information can be very useful to stockholders and creditors. Yet, there are limitations to these financial statements for which the users must be aware. What are at least three (3) limitations of consolidated financial statements? 38. In reading a set of consolidated financial statements you are surprised to see the term noncontrolling interest not reported under the Stockholders' Equity section of the Balance Sheet. a. What is a non-controlling interest? b. Why must it be reported in the financial statements as an element of equity rather than a liability? 39. FASB issued Interpretation No. 46 R related to the Consolidation of Variable Interest Entities. Why does FASB have difficulty in prescribing when these entities are consolidated? 3-12 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 40. Dish Corporation acquired 100 percent of the common stock of Toll Company by issuing 10,000 shares of $10 par common stock with a market value of $60 per share. Summarized balance sheet data for the two companies immediately preceding the acquisition are as follows: Required: Determine the dollar amounts to be presented in the consolidated balance sheet for (1) total assets, (2) total liabilities, and (3) total stockholders' equity. 3-13 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 41. The Hamilton Company acquired 100 percent of the stock of Hudson Company on January 1, 2010, for $308,000 cash. Summarized balance sheet data for the companies on December 31, 2009, are as follows: The book values of Hudson's assets and liabilities are equal to their fair values, except as indicated. On January 1, 2010, Hudson owed Hamilton $14,000 on account. Required: Prepare a consolidated balance sheet immediately following the acquisition. 3-14 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 42. Barnes Company acquired 80 percent of the outstanding voting stock of Dean Company on January 1, 2008. During 2008 Dean Company sold inventory costing $50,000 to Barnes Company for $80,000. Barnes Company continued to hold the inventory at December 31, 2008. Also during 2008, Barnes Company sold merchandise costing $400,000 to nonaffiliates for $600,000, and on its separate balance sheet reported total inventory at year end of $140,000. In its separate financial statements, Dean Company reported total sales and cost of goods sold of $350,000 and $220,000, respectively, for 2008 and ending inventory of $150,000. Required: Based on the above information, compute the amounts that should appear in the consolidated financial statements prepared for Barnes Company and it subsidiary, Dean Company, at year end for the following items: 1) sales; 2) cost of goods sold; 3) gross profit on sales; 4) inventory. 3-15 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 43. On January 1, 2009, Field Corporation, a retail outlet chain, acquired 100 percent of the common stock of Palouse Company by issuing 14,000 shares of Field's $5 par value common stock. The market price of Field's common stock was $20 per share on the eve of December 31, 2008. Summarized balance sheet data at December 31, 2008, are as follows: Additional Information: The book values of Palouse's assets approximated their respective fair values, except for inventory (included in current assets), which had a fair value $20,000 more than book value, and land, which had a market value of $200,000 on the date of combination. At that date, Field owed Palouse $34,000 on account. Required: Prepare a consolidated balance sheet immediately following the acquisition. 3-16 Chapter 03 - The Reporting Entity and Consolidated Financial Statements Chapter 03 The Reporting Entity and Consolidated Financial Statements Answer Key Multiple Choice Questions On January 3, 2009, Jane Company acquired 75 percent of Miller Company's outstanding common stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Miller Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 2009, are as follows: 1. Based on the preceding information, what amount should be reported as noncontrolling interest in net assets in Jane Company's December 31, 2009, consolidated balance sheet? A. $90,000 B. $54,000 C. $36,000 D. $0 AACSB: Analytic AICPA: Measurement 3-17 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 2. Based on the preceding information, what amount will Jane Company report as common stock outstanding in its consolidated balance sheet at December 31, 2009? A. $120,000 B. $180,000 C. $156,000 D. $264,000 AACSB: Analytic AICPA: Measurement Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable. 3. Based on the preceding information, what amount of total assets did Beta report in its balance sheet immediately after the acquisition? A. $500,000 B. $650,000 C. $750,000 D. $900,000 AACSB: Analytic AICPA: Measurement 4. Based on the preceding information, what amount of total assets was reported in the consolidated balance sheet immediately after acquisition? A. $650,000 B. $880,000 C. $920,000 D. $750,000 AACSB: Analytic AICPA: Measurement 3-18 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 5. Based on the preceding information, what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition? A. $500,000 B. $530,000 C. $280,000 D. $660,000 AACSB: Analytic AICPA: Measurement 6. Based on the preceding information, what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition? A. $220,000 B. $150,000 C. $370,000 D. $350,000 AACSB: Analytic AICPA: Measurement 7. Company Pea owns 90 percent of Company Essone which in turn owns 80 percent of Company Esstwo. Company Esstwo owns 100 percent of Company Essthree. Consolidated financial statements should be prepared to report the financial status and results of operations for: A. Pea. B. Pea plus Essone. C. Pea plus Essone plus Esstwo. D. Pea plus Essone plus Esstwo plus Essthree. AACSB: Analytic AICPA: Decision Making 3-19 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 8. Xing Corporation owns 80 percent of the voting common shares of Adams Corporation. Noncontrolling interest was assigned $24,000 of income in the 2009 consolidated income statement. What amount of net income did Adams Corporation report for the year? A. $150,000 B. $96,000 C. $120,000 D. $30,000 AACSB: Analytic AICPA: Measurement 9. On December 31, 2009, Rudd Company acquired 80 percent of the common stock of Wilton Company. At the time, Rudd held land with a book value of $100,000 and a fair value of $260,000; Wilton held land with a book value of $50,000 and fair value of $600,000. Using the parent company theory, at what amount would land be reported in a consolidated balance sheet prepared immediately after the combination? A. $550,000 B. $590,000 C. $700,000 D. $860,000 AACSB: Analytic AICPA: Measurement 10. Princeton Company acquired 75 percent of the common stock of Sheffield Corporation on December 31, 2009. On the date of acquisition, Princeton held land with a book value of $150,000 and a fair value of $300,000; Sheffield held land with a book value of $100,000 and fair value of $500,000. Using the entity theory, at what amount would land be reported in a consolidated balance sheet prepared immediately after the combination? A. $650,000 B. $500,000 C. $550,000 D. $375,000 AACSB: Analytic AICPA: Measurement 3-20 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 11. If Push Company owned 51 percent of the outstanding common stock of Shove Company, which reporting method would be appropriate? A. Cost method B. Consolidation C. Equity method D. Merger method AACSB: Reflective Thinking AICPA: Reporting 12. Under FASB 141R, consolidation follows largely which theory approach? A. Proprietary B. Parent company C. Entity D. Variable AACSB: Reflective Thinking AICPA: Reporting On January 3, 2009, Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 in cash. At the acquisition date, the book values and fair values of Frazer's assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 20 percent of the total book value of Frazer. The stockholders' equity accounts of the two companies at the acquisition date are: Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009. 3-21 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 13. Based on the preceding information, what amount will be assigned to the noncontrolling interest on January 3, 2009, in the consolidated balance sheet? A. $86,000 B. $44,000 C. $68,800 D. $50,000 AACSB: Analytic AICPA: Measurement 14. Based on the preceding information, what will be the total stockholders' equity in the consolidated balance sheet as of January 3, 2009? A. $1,580,000 B. $1,064,000 C. $1,150,000 D. $1,236,000 AACSB: Analytic AICPA: Measurement 15. Based on the preceding information, what will be the amount of net income reported by Frazer Corporation in 2009? A. $44,000 B. $55,000 C. $66,000 D. $36,000 AACSB: Analytic AICPA: Measurement 3-22 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 16. Goodwill under the parent theory: A. exceeds goodwill under the proprietary theory. B. exceeds goodwill under the entity theory. C. is less than goodwill under the entity theory. D. is less than goodwill under the proprietary theory. AACSB: Reflective Thinking AICPA: Reporting Small-Town Retail owns 70 percent of Supplier Corporation's common stock. For the current financial year, Small-Town and Supplier reported sales of $450,000 and $300,000 and expenses of $290,000 and $240,000, respectively. 17. Based on the preceding information, what is the amount of net income to be reported in the consolidated income statement for the year under the parent company theory approach? A. $220,000 B. $202,000 C. $160,000 D. $200,000 AACSB: Analytic AICPA: Measurement 18. Based on the preceding information, what is the amount of net income to be reported in the consolidated income statement for the year under the proprietary theory approach? A. $210,000 B. $202,000 C. $160,000 D. $200,000 AACSB: Analytic AICPA: Measurement 3-23 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 19. Based on the preceding information, what is the amount of net income to be reported in the consolidated income statement for the year under the entity theory approach? A. $210,000 B. $202,000 C. $160,000 D. $220,000 AACSB: Analytic AICPA: Measurement 20. Quid Corporation acquired 75 percent of Pro Company's common stock on December 31, 2006. Goodwill (attributable to Quid's acquisition of Pro shares) of $300,000 was reported in the consolidated financial statements at December 31, 2006. Parent company approach was used in determining this amount. What is the amount of goodwill to be reported under proprietary theory approach? A. $300,000 B. $400,000 C. $150,000 D. $100,000 AACSB: Analytic AICPA: Measurement 21. Quid Corporation acquired 60 percent of Pro Company's common stock on December 31, 2004. Goodwill (attributable to Quid's acquisition of Pro shares) of $150,000 was reported in the consolidated financial statements at December 31, 2004. Proprietary theory approach was used in determining this amount. What is the amount of goodwill to be reported under entity theory approach? A. $150,000 B. $200,000 C. $250,000 D. $100,000 AACSB: Analytic AICPA: Measurement 3-24 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 22. Blue Company owns 80 percent of the common stock of White Corporation. During the year, Blue reported sales of $1,000,000, and White reported sales of $500,000, including sales to Blue of $80,000. The amount of sales that should be reported in the consolidated income statement for the year is: A. $500,000. B. $1,300,000. C. $1,420,000. D. $1,500,000. AACSB: Analytic AICPA: Measurement 23. In which of the following cases would consolidation be inappropriate? A. The subsidiary is in bankruptcy. B. Subsidiary's operations are dissimilar from those of the parent. C. The parent owns 90 percent of the subsidiary's common stock, but all of the subsidiary's nonvoting preferred stock is held by a single investor. D. Subsidiary is foreign. AACSB: Reflective Thinking AICPA: Reporting 24. Consolidated financial statements tend to be most useful for: A. Creditors of a consolidated subsidiary. B. Investors and long-term creditors of the parent company. C. Short-term creditors of the parent company. D. Stockholders of a consolidated subsidiary. AACSB: Reflective Thinking AICPA: Reporting On January 1, 2009, Heathcliff Corporation acquired 80 percent of Garfield Corporation's voting common stock. Garfield's buildings and equipment had a book value of $300,000 and a fair value of $350,000 at the time of acquisition. 3-25 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 25. Based on the preceding information, what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the parent company approach? A. $350,000 B. $340,000 C. $280,000 D. $300,000 AACSB: Analytic AICPA: Measurement 26. Based on the preceding information, what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the current accounting practice? A. $350,000 B. $340,000 C. $280,000 D. $300,000 AACSB: Analytic AICPA: Measurement 27. On January 1, 2009, Gold Rush Company acquires 80 percent ownership in California Corporation for $200,000. The fair value of the noncontrolling interest at that time is determined to be $50,000. It reports net assets with a book value of $200,000 and fair value of $230,000. Gold Rush Company reports net assets with a book value of $600,000 and a fair value of $650,000 at that time, excluding its investment in California. What will be the amount of goodwill that would be reported immediately after the combination under current accounting practice? A. $50,000 B. $30,000 C. $40,000 D. $20,000 AACSB: Analytic AICPA: Measurement 3-26 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 28. Roland Company acquired 100 percent of Garros Company's voting shares in 2007. During 2008, Garros purchased tennis equipment for $30,000 and sold them to Roland for $55,000. Roland continues to hold the items in inventory on December 31, 2008. Sales for the two companies during 2008 totaled $655,000, and total cost of goods sold was $420,000. Which of the following observations will be true if no adjustment is made to eliminate the intercorporate sale when a consolidated income statement is prepared for 2008? A. Sales would be overstated by $30,000. B. Cost of goods sold will be understated by $25,000. C. Net income will be overstated by $25,000. D. Consolidated net income will be unaffected. AACSB: Analytic AICPA: Measurement 29. Zeta Corporation and its subsidiary reported consolidated net income of $320,000 for the year ended December 31, 2008. Zeta owns 80 percent of the common shares of its subsidiary, acquired at book value. Noncontrolling interest was assigned income of $30,000 in the consolidated income statement for 2008. What is the amount of separate operating income reported by Zeta for the year? A. $170,000 B. $150,000 C. $120,000 D. $200,000 AACSB: Analytic AICPA: Measurement 30. Rohan Corporation holds assets with a fair value of $150,000 and a book value of $125,000 and liabilities with a book value and fair value of $50,000. What balance will be assigned to the noncontrolling interest in the consolidated balance sheet if Helms Company pays $90,000 to acquire 75 percent ownership in Rohan and goodwill of $20,000 is reported? A. $50,000 B. $30,000 C. $40,000 D. $20,000 AACSB: Analytic AICPA: Measurement 3-27 Chapter 03 - The Reporting Entity and Consolidated Financial Statements Elbonia Corporation, a 100 percent subsidiary of Atomic Corporation, caters to its parent's entire inventory requirements. In 2007, Elbonia produced inventory at a cost of $36,000 and sold it to Atomic for $75,000. Atomic held all the items in inventory on January 1, 2008. During 2008, Atomic sold all the units for $98,000. Assume that the companies had no other transactions during 2007 and 2008. 31. Based on the preceding information, what amount would be reported in the consolidated financial statements for inventory on January 1, 2008? A. $39,000 B. $36,000 C. $75,000 D. $0 AACSB: Analytic AICPA: Measurement 32. Based on the preceding information, what amount would be reported in the consolidated financial statements for cost of goods sold for 2007? A. $39,000 B. $36,000 C. $75,000 D. $0 AACSB: Analytic AICPA: Measurement 33. Based on the preceding information, what amount would be reported in the consolidated financial statements for cost of goods sold for 2008? A. $0 B. $39,000 C. $36,000 D. $98,000 AACSB: Analytic AICPA: Measurement 3-28 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 34. Based on the preceding information, what amount would be reported in the consolidated financial statements for sales for 2007? A. $0 B. $39,000 C. $36,000 D. $75,000 AACSB: Analytic AICPA: Measurement 35. When a primary beneficiary's consolidation of a variable interest entity (VIE) is appropriate, the amounts of the VIE to be consolidated are: I. Book values for assets and liabilities transferred by the primary beneficiary. II. Fair values when the primary beneficiary relationship became established. A. I B. II C. Both I and II D. Neither I nor II AACSB: Analytic AICPA: Reporting 36. Which of the following usually does not represent a variable interest? A. Common stock, with no special features or provisions B. Senior debt C. Subordinated debt D. Loan or asset guarantees AACSB: Reflective Thinking AICPA: Reporting Essay Questions 3-29 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 37. Consolidated financial statements are required by GAAP in certain circumstances. This information can be very useful to stockholders and creditors. Yet, there are limitations to these financial statements for which the users must be aware. What are at least three (3) limitations of consolidated financial statements? Limitations to consolidated financial statements include: 1) The operating results and financial position of individual companies included in the consolidation are not disclosed. Therefore, the poor performance or position of one or more companies may be hidden by the good performance and position of others. 2) The consolidated statements include the subsidiary's assets, not all assets shown are available to dividend distributions of the parent company. 3) Financial ratios are based upon the aggregated consolidated information; therefore, these ratios may not be representative of any single company in the consolidation, including the parent. 4) Similar accounts of different companies that are consolidated may not be entirely comparable. For example, the length of operating cycles of different subsidiaries may vary, causing receivables of similar length to be classified differently. 5) Additional information about individual companies or groups of companies that have been consolidated may be necessary for fair presentation, resulting in voluminous footnote disclosures. AACSB: Communication AICPA: Reporting 3-30 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 38. In reading a set of consolidated financial statements you are surprised to see the term noncontrolling interest not reported under the Stockholders' Equity section of the Balance Sheet. a. What is a non-controlling interest? b. Why must it be reported in the financial statements as an element of equity rather than a liability? a. Noncontrolling interest occurs when less than 100 percent equity is acquired in a subsidiary. It represents the fact that the parent may control but not own the entire subsidiary. The noncontrolling shareholders have a claim on the subsidiary's assets and earnings through their percentage ownership of the stock. b. Noncontrolling interest clearly does not meet the definition of a liability. FASB 160 makes clear that the noncontrolling interest's claim on net assets is an element of equity, not a liability. It requires reporting the noncontrolling interest in equity. AACSB: Communication AICPA: Reporting 39. FASB issued Interpretation No. 46 R related to the Consolidation of Variable Interest Entities. Why does FASB have difficulty in prescribing when these entities are consolidated? A Variable Interest Entity (VIE) is a legal structure used for business purposes that either: 1. Does not have equity investors that: a. have voting rights or b. doesn't share in all of the entity's profits or losses. 2. Has equity investors that do not provide sufficient financial resources to support the entity's activities. Therefore, FASB has been trying to define the Primary Beneficiary and from this lead to consolidation not just control as presumed under FASB 141. AACSB: Communication AICPA: Reporting 3-31 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 40. Dish Corporation acquired 100 percent of the common stock of Toll Company by issuing 10,000 shares of $10 par common stock with a market value of $60 per share. Summarized balance sheet data for the two companies immediately preceding the acquisition are as follows: Required: Determine the dollar amounts to be presented in the consolidated balance sheet for (1) total assets, (2) total liabilities, and (3) total stockholders' equity. Total assets = $2,550,000 ($1,200,000 + $1,300,000 + $50,000 GW) Total liabilities = $1,550,000 ($800,000 + $750,000) Total stockholders' equity = $1,000,000 [$400,000 + ($60 x 10,000 shares)] AACSB: Analytic AICPA: Measurement 3-32 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 41. The Hamilton Company acquired 100 percent of the stock of Hudson Company on January 1, 2010, for $308,000 cash. Summarized balance sheet data for the companies on December 31, 2009, are as follows: The book values of Hudson's assets and liabilities are equal to their fair values, except as indicated. On January 1, 2010, Hudson owed Hamilton $14,000 on account. Required: Prepare a consolidated balance sheet immediately following the acquisition. 3-33 Chapter 03 - The Reporting Entity and Consolidated Financial Statements AACSB: Analytic AICPA: Measurement 3-34 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 42. Barnes Company acquired 80 percent of the outstanding voting stock of Dean Company on January 1, 2008. During 2008 Dean Company sold inventory costing $50,000 to Barnes Company for $80,000. Barnes Company continued to hold the inventory at December 31, 2008. Also during 2008, Barnes Company sold merchandise costing $400,000 to nonaffiliates for $600,000, and on its separate balance sheet reported total inventory at year end of $140,000. In its separate financial statements, Dean Company reported total sales and cost of goods sold of $350,000 and $220,000, respectively, for 2008 and ending inventory of $150,000. Required: Based on the above information, compute the amounts that should appear in the consolidated financial statements prepared for Barnes Company and it subsidiary, Dean Company, at year end for the following items: 1) sales; 2) cost of goods sold; 3) gross profit on sales; 4) inventory. 1) Sales = $870,000 ($600,000 + $350,000 - $80,000) 2) Cost of Goods Sold = $570,000 ($400,000 + $220,000 - $50,000) 3) Gross Profit on Sales = $300,000 ($870,000 - $570,000) 4) Inventory = $260,000 ($140,000 + $150,000 - $30,000) AACSB: Analytic AICPA: Measurement 3-35 Chapter 03 - The Reporting Entity and Consolidated Financial Statements 43. On January 1, 2009, Field Corporation, a retail outlet chain, acquired 100 percent of the common stock of Palouse Company by issuing 14,000 shares of Field's $5 par value common stock. The market price of Field's common stock was $20 per share on the eve of December 31, 2008. Summarized balance sheet data at December 31, 2008, are as follows: Additional Information: The book values of Palouse's assets approximated their respective fair values, except for inventory (included in current assets), which had a fair value $20,000 more than book value, and land, which had a market value of $200,000 on the date of combination. At that date, Field owed Palouse $34,000 on account. Required: Prepare a consolidated balance sheet immediately following the acquisition. 3-36 Chapter 03 - The Reporting Entity and Consolidated Financial Statements AACSB: Analytic AICPA: Measurement 3-37