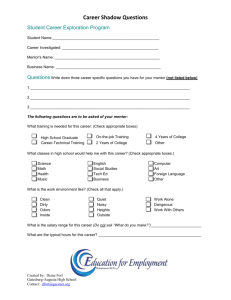

cost-benefit analysis, incentives, and infrastructure

advertisement