Chapter 4 Instructor`s Manual

advertisement

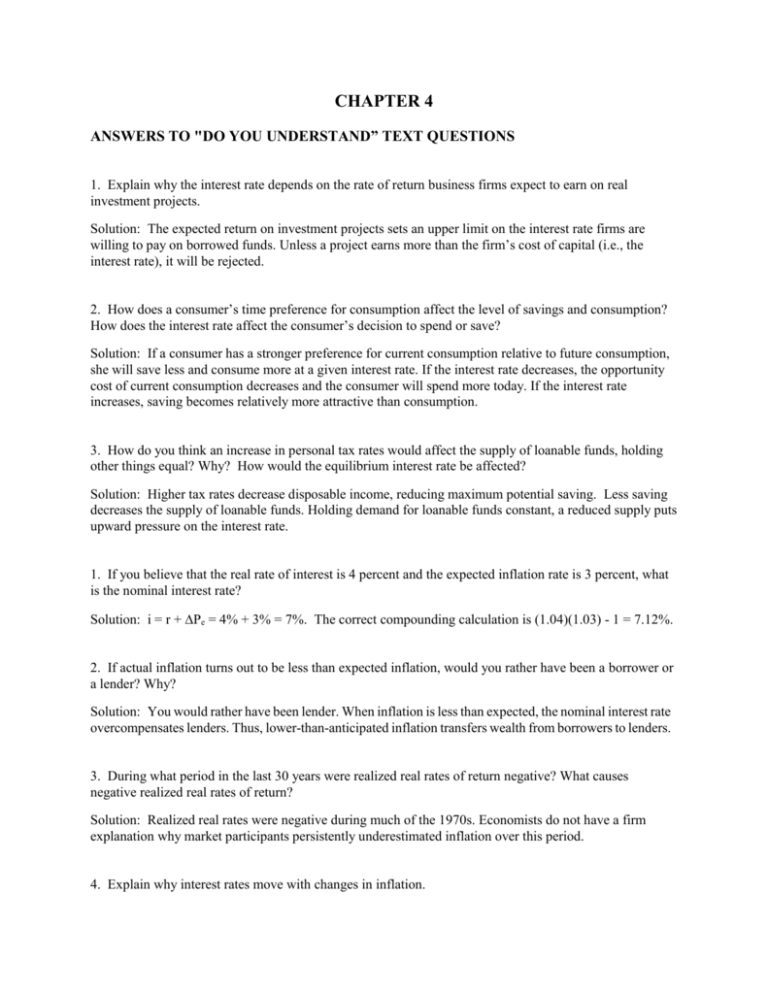

CHAPTER 4 ANSWERS TO "DO YOU UNDERSTAND” TEXT QUESTIONS 1. Explain why the interest rate depends on the rate of return business firms expect to earn on real investment projects. Solution: The expected return on investment projects sets an upper limit on the interest rate firms are willing to pay on borrowed funds. Unless a project earns more than the firm’s cost of capital (i.e., the interest rate), it will be rejected. 2. How does a consumer’s time preference for consumption affect the level of savings and consumption? How does the interest rate affect the consumer’s decision to spend or save? Solution: If a consumer has a stronger preference for current consumption relative to future consumption, she will save less and consume more at a given interest rate. If the interest rate decreases, the opportunity cost of current consumption decreases and the consumer will spend more today. If the interest rate increases, saving becomes relatively more attractive than consumption. 3. How do you think an increase in personal tax rates would affect the supply of loanable funds, holding other things equal? Why? How would the equilibrium interest rate be affected? Solution: Higher tax rates decrease disposable income, reducing maximum potential saving. Less saving decreases the supply of loanable funds. Holding demand for loanable funds constant, a reduced supply puts upward pressure on the interest rate. 1. If you believe that the real rate of interest is 4 percent and the expected inflation rate is 3 percent, what is the nominal interest rate? Solution: i = r + Pe = 4% + 3% = 7%. The correct compounding calculation is (1.04)(1.03) - 1 = 7.12%. 2. If actual inflation turns out to be less than expected inflation, would you rather have been a borrower or a lender? Why? Solution: You would rather have been lender. When inflation is less than expected, the nominal interest rate overcompensates lenders. Thus, lower-than-anticipated inflation transfers wealth from borrowers to lenders. 3. During what period in the last 30 years were realized real rates of return negative? What causes negative realized real rates of return? Solution: Realized real rates were negative during much of the 1970s. Economists do not have a firm explanation why market participants persistently underestimated inflation over this period. 4. Explain why interest rates move with changes in inflation. Solution: Interest rates change in response to changes in inflation because inflation is a primary component of nominal interest rates. Short-term rates respond more to monthly changes in inflation than long-term rates because the inflation component of a contract rate is for the rate of inflation expected across the life of the contract and accordingly, a monthly change has a larger effect on expectations across a short-term contract than a long-term contract.