Cost Considerations in Liquid Chemical Purity Trends

advertisement

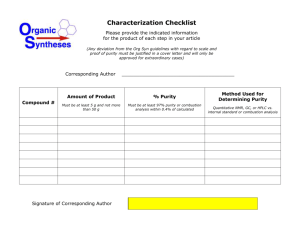

Cost Considerations in Liquid Chemical Purity Trends (1/7/2000) Future Fab Intl. Volume 9 By Elizabeth Schumann, SEMI Print this paper Send as email Contact author Despite warnings that wet cleaning technology would give way to dry cleaning[2] and current trends toward chemical use reduction, the worldwide wet chemicals market is expected to continue to grow, albeit at lower rates than over the past few decades. (The wet chemicals category includes acids, bases, and solvents used predominantly in cleaning, drying, and some etching processes.) Today, wet chemical cleaning technologies are favored because they are well understood – the RCA process was developed in the mid-Sixties – and because they work so well. Many of the “inherent properties of aqueous solutions facilitate the removal of metals (high solubility in liquid chemistries) and particles (zetapotential control, shear stress and efficient energy transfer by megasonics).” [3] For these reasons, wet chemicals are expected to enjoy a compound annual growth rate of about 3.5% through 2003 (see Figure1). Industrial chemicals are rated by a grading system that includes industrial, reagent, electronic, and semiconductor grades. Industrial, reagent, and electronic grades are generally too dirty for use in a semiconductor fab. Even within the semiconductor grade category there are varying levels of purity, which more or less can be linked with the semiconductor device generations in terms of minimum feature size. SEMI® Standards, working with the industry, publishes specifications (called “grades”) and guidelines (called “tiers”) for chemical purity that can also be correlated with device generations. Borrowing a chemical product classification system used by Honeywell Electronic Materials, Figure 2 describes the relationship between chemical classes, impurity specifications, device minimum feature size, and SEMI Standards grades and tiers. Figure 1. Worldwide Wet Chemical Market Forecast. Source: Rose Associates, EMCON 1999. In the past, semiconductor manufacturers – who of course tend to be very cautious where purity is concerned – followed a specification policy that could be termed “as pure as possible.” Lacking full understanding of the impact of specific impurities on device performance, wet chemicals were specified at the detection limit and future impurity requirements were estimated based on a linear extension of purity trends. Beginning in the early Nineties, however, things began to change. For one thing, advances in chemical instrumentation, from sequential analysis using atomic absorption (AA) or inductively coupled plasma (ICP) to simultaneous analysis using ICP or ICP mass spectrometry (ICP-MS), brought pressure to bear on the development of specifications. Because detection limits improved and analysis became simpler, customers began to set requirements for more elements at lower levels[4]. But some of the specifications were still based on conservative assumptions regarding defect reduction without full supporting scientific data, they continued to be non-discriminatory with regard to critical versus non-critical contaminants, and future predictions of purity needs were still extrapolated linearly. This approach was reflected in the US Semiconductor Industry Association’s National Technology Roadmap for Semiconductors (NTRS) as recently as 1994. Yet the roadmap that year did recognize a “need for fundamental studies of the impact of contaminants on device performance. Experimental validation of model-derived purity specifications is critical.”[5] The 1997 edition of the NTRS went even further, reflecting the growing concerns about rising costs for process chemicals. In most cases, chemical suppliers had found that improving product purity from the 100 ppb level (SEMI Grade 1) to 10 ppb (SEMI Grade 2) or even 1 ppb (SEMI Grade 3) could be achieved relatively easily. But reducing chemical impurities to the parts per trillion (ppt) range required a new approach: the ultra-high purity (UHP) manufacturing approach[6]. Essential features of this approach include UHP design of manufacturing equipment, employment of the cleanroom philosophy in laboratory and filling areas, and specially designed packaging and distribution. Thus, while providing outstanding quality and performance, products that adhere to the SEMI Grade 4 specifications (<1 ppb) also have significantly higher manufacturing and distribution costs, and therefore represent higher costs to device manufacturers. These cost pressures have helped to change the semiconductor industry mindset regarding liquid chemicals from “as pure as possible” to “just clean enough.” This sentiment was expressed in the Front End Processes section of the 1997 edition of the National Technology Roadmap for Semiconductors: Impurity specifications for critical materials in front end processes need to be linked to known fault mechanisms to achieve economic viability of raw materials. Yield modeling based on atomistic level impacts of trace contaminants and ultrasmall, widely distributed defects, and phenomenological data need to be coordinated and linked to raw material specifications and defect density requirements. Fundamental research will be required to discontinue detection limit-based specifications of raw materials[7]. Figure 2. Classification of chemicals and device generations The most significant changes implemented in the 1997 edition of the Roadmap with regard to liquid chemical purity included the differentiation between critical and non-critical materials, identification of specific critical metals and ions, a slower rate of change in purity requirements for critical chemicals, and no change in purity requirements for less critical chemicals. In 1999, the now International Technology Roadmap for Semiconductors (ITRS) was even more direct about the economic issues related to ultra-high purity chemicals: Low wafer defect levels after surface preparation depend on appropriate purity levels in chemicals and DI water. To minimize CoO (Cost of Ownership), however, aggressive purity targets should be adopted only where a technological justification exists. In all areas of surface preparation, a balance must be achieved between process and defect performance, cost, and environmental issues[8]. Figure 3 shows the 1999 ITRS technology requirements related to liquid chemicals. In the notes to the table, the ITRS specifies critical metals and ions to include calcium (Ca), cobalt (Co), copper (Cu), chromium (Cr), iron (Fe), molybdenum (Mo), manganese (Mn), sodium (Na), nickel (Ni), and tungsten (W). This specification reflects the results of ongoing research to determine how specific metallic contamination effects gate oxide integrity and device performance. Figure 3. Liquid Chemical Defect Prevention and Elimination Technology Requirements. The shift from “as pure as possible” to “just clean enough” is further reflected in the Book of SEMI Standards. A full range of products is available in Grade 1 (or equivalent Tier), fewer products in Grades 2 and 3, and even fewer in the Grade 4 category. As in the Roadmap, the tightest specifications are reserved for the chemicals that come into direct contact with bare silicon during pre-diffusion clean steps: HF, H2O2, and NH4OH. So far we have looked at Roadmap requirements and SEMI Standards related to liquid chemical purity. But where do the purity requirements apply? A note to the Defect Prevention and Elimination Technology Requirements Table indicates, “Particle targets apply at POU (point of use), not incoming chemical.”[9] Yet, because the chemical suppliers usually have little if any control over the semiconductor manufacturer’s chemical delivery system, suppliers generally guarantee adherence to SEMI specifications only at the point of fill or at the point of delivery to the customer. Recognizing, however, that chemical purity at POU is more critical than purity in the bottle, current SEMI Standards activity related to chemical purity is heavily focused on the distribution system. The current emphasis is on standardized test methodologies for characterizing chemical distribution systems. In the current environment, semiconductor manufacturers are focusing on their core competencies of product design and marketing and outsourcing more and more of the manufacturing and fab management processes. Total chemical management (TCM), which began to gain popularity in the mid-Nineties, shifts more of the responsibility for guaranteeing chemical purity all the way to the tool onto the chemical supplier or TCM provider. According to one chemical supplier, “Suppliers are going to have to offer packages that solve the overall benchdelivered purity issues to stay competitive.” One key trend that isn’t reflected in the current Roadmap is the focus on product consistency as opposed to overall purity. One chemical company executive described the situation, “As the levels of contamination in end products drops lower and lower, what is important to the customer is not whether a batch of products meets a specification, but what the product variability is over time.” [10] Fab engineers, when they first specified materials for their process, only required that certain parameters be below some level. It soon became obvious to some, however, that variations in contaminant levels had a negative effect on their process, whether the variation was up or down. Consequently, once the process parameters have been established, specifications now require that the inputs to the process not vary outside a particular range (usually defined as three-sigma from the mean for that particular parameter). So now the customers are increasingly requiring the supplier to keep the process “in control,” which can also be described as “don’t change anything.” As mentioned earlier, cost considerations have been the strongest drivers in the trend from “as pure as possible” to “just clean enough.” In the past, one chemical supplier told me, customers seemed willing to pay more for a higher purity chemical just because it was a better product. But the sluggish market conditions of the late Nineties coupled with rapidly rising manufacturing costs for leading edge facilities have led to a situation where the customers are demanding higher purity products at the same or lower overall costs. In order to meet customer needs and remain competitive, the chemical industry has had to continue to invest in upgraded facilities and systems. Some of the changes implemented by the chemical suppliers include: • investments in state-of-the-art, efficient fill plants, • improved quality systems to reduce scrap or re-work and continuously drive purity levels higher, • better inventory management systems, • improved supply chain management, including joint ventures or long term commitments with raw materials suppliers, • investments in state-of-the-art analytical equipment. In addition, chemical suppliers have found other innovative ways to improve product purity while controlling costs. For example, moving to larger container sizes (such as drums, totes and bulk vessels) improves cost of ownership for the customer, but can also result in an improvement in the absolute purity. This is because there is less handling of the product and therefore fewer opportunities for product contamination. In addition, the lower surface area-to-volume ratio of a larger container reduces contamination opportunities from the container itself. The same is true for particulate contaminants because of the lower surface area from which particles could be shed to volume[11]. Offering on-site purification, dilution, and blending systems also helps to lower the customer’s overall cost of ownership – shipping DI water is more expensive than purifying it on site. And these kinds of systems can often improve purity as well, again due to the advantage of less material handling and transportation. And finally, by offering on-site Total Chemical Management services, the chemical supplier is better able to recommend system or process improvements that could result in better overall purity of the chemicals at the tool. There is still a glaring need for better understanding on the part of the customer as to the specific anions or cations that are causes of concern. While work is progressing in this area by research organizations such as IMEC in Belgium and the Ohmi Lab at Tohoku University in Japan as well as by semiconductor manufacturers such as Texas Instruments, there is still a long way to go. According to a chemical supplier, many fab personnel still do not fully understand beyond five or ten key parameters what ions are critical to their process. But liquid chemicals are routinely measured for more than 35 different elements. Consequently, fab personnel are likely to assume that higher purity of those remaining parameters is better, and set their specifications based on composite data from multiple suppliers. This kind of specification setting can drive up the cost of the material with no scientific basis for doing so. Having a better understanding of the interactions of specific anions or cations allows the user and the supplier to best utilize their resources to get the most “bang for the buck.” On the other hand, a better understanding on the part of each customer as to the particular contaminants of concern, coupled with the trend toward “in-control” specification, can also increase materials costs if it leads to custom products or lot selection. For example, if Customer A wants a slight variation from the standard (eg, lower sodium), the manufacturer must either lot-select for that customer, or change his process, which other customers might not want since they require that the process remain “in-control.” And lot-selecting for Customer A from an in-control process changes the mean and the sigma for the remainder of the customers. The basic problem is that chemical manufacturing is generally a continuous process, and the final lot is a composite of several hours of production. The economics of continuous processing is one of the factors that makes most of the chemicals for semiconductor use so affordable. The only way to satisfy the requirements of both “in-control” and numerous variations in final product specifications is to custom-produce (or batch produce) for each variation. This would result in significantly higher costs for all. Acknowledgements The author gratefully acknowledges the contributions of the following in the preparation of this paper: Dr Murray Bullis, SEMI; Mr Herb Richardson and Mr Bart Pitcock, Ashland Chemical; Mr Brad Klock, General Chemical; Dr Wolfgang Sievert, Honeywell Electronic Materials; and Mr Dave Nachreiner, Kanto Chemical. References [1] R Allen et al, “MNST Wafer Cleaning,” Solid State Technology, January 1994, p. 61. [2] Peter Van Zant, Microchip Fabrication, 3rd edition, p. 179. [3] Semiconductor Industry Association (SIA), International Technology Roadmap for Semiconductors: 1999 (ITRS), 1999 edition, p. 118. [4] Wolfgang J Sievert, “A European Perspective on Electronic Chemicals,” Semiconductor Fabtech, 10th edition, pp. 200-1. [5] Semiconductor Industry Association, National Technology Roadmap for Semiconductors: 1994, 1994 edition, pp. 126-7. [6] Sievert, p. 202. [7] Semiconductor Industry Association, National Technology Roadmap for Semiconductors: 1997, 1997 edition, p. 79. [8] SIA, ITRS, 1999 edition, p. 118. [9] SIA, ITRS, 1999 edition, p. 284. [10] “Corporate Strategies,” Electronic Chemical News, vol. 14, no. 7, p. 3. [11] RT Talasek, “Optimized Methods for High-Volume Chemical Usage in the Semiconductor Industry,” Semiconductor Fabtech, 8th edition, p. 132.graphy Elizabeth Schumann is a senior market analyst in the SEMI Market Statistics Department and Manager, Materials Statistics Programs. Elizabeth tracks semiconductor equipment and materials markets for SEMI, and prepares articles and presentations on markets and trends. Ms Schumann received a BS in Business Administration from Duquesne University, Pittsburgh, PA, and an MA in International Economics from the University of San Francisco. She also attended the London School of Economics. If you would like more information regarding this organization's products or services please fill out a Request for Information. If you would like to help us improve our web site please fill out the Reader Satisfaction Survey below. Please send me information about this organization.