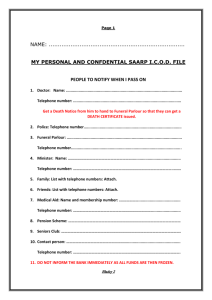

Personal Affairs Workbook - barksdale afb retiree activites office

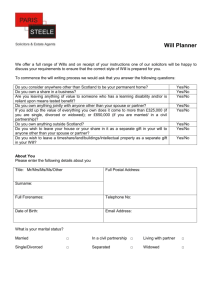

advertisement