Revenue Decoupling and Electric Distribution Companies

advertisement

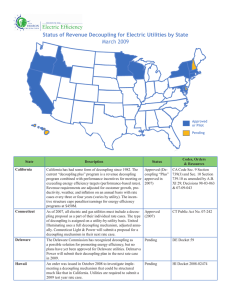

MSEIA comments on Revenue Decoupling Revenue Decoupling and Electric Distribution Companies – Time for a change in New Jersey The regulation of electric utilities has served New Jersey and the United States very well until recent years. Since the early 1900s it allowed utilities to invest sufficient capital to bring electricity to all those who desired it, with the confidence their rates could be adjusted to provide their allowed rate of return. Regulation provided safety to utilities and their shareholders and allowed utilities to raise capital as needed to serve the customers in their service territory. This approach worked reasonably well when electric usage was growing, producing increased electric revenue, while providing a measure of safety to utility shareholders during economic downturns that decreased electric sales. The oil price shocks of the 1970s forced change on the electric generating industry, and produced a major expansion of the construction of natural gas generation by independent electric generation companies during the 1980s and 1990s. This large increase in the demand for natural gas drove up prices to 3-4 times prior levels, resulting in natural gas generation that could not afford to run in many places, leading to losses and corporate reorganizations by independent power producers. The deregulation of the electric industry in some states during the late 1990s separated the ownership of generation and distribution, under the theory that competition in electric generation would bring down the cost of electricity. Unfortunately the theory was just that, a theory, and did not result in lowering the cost of generating electricity. Some states froze electric rates for years as a part of their deregulation process, only to see major rate hikes when the freeze expired. Declining EDC Sales Recent economic downturns have produced declining electric sales in many states, and more efficient end use equipment has also dampened sales growth in recent years. Technology, in the form of onsite solar generation of electricity, with Net Energy Metering the law of the land in over 40 states, now threatens to erode the sale and transport of electricity at an increasing pace. Greater efficiency in lighting technology and Heating and Cooling equipment threatens to reduce electric sales further, adding to the expected decline in utility revenues from the transport of electricity to their customers. EDCs are now faced with a future of declining revenues from an increasing adoption of onsite generation. Climate Change It is now apparent to most that human activities are largely the cause of climate change, with more severe weather and the rising of sea levels threatening to disrupt many coastal regions. Our electric generation industry, along with our transportation and building sectors, need to wean themselves away from fossil fuels by dramatically growing the amount of renewable energy sources, and using energy much more efficiently than done in the past. Some of the newest buildings being erected are known as “Net Zero Energy” because they are highly efficient and produce enough energy onsite to meet their annual needs. Many existing homes and virtually all warehouses have enough roof space to produce all their annual electric needs from solar systems. The large decrease in the cost of solar generated electricity from reduced solar equipment costs and readily available financing is producing strong growth in the residential, commercial and large scale grid supply sectors of the solar industry. Utility Revenue Decoupling Faced with the prospect of declining electric sales and the need to aggressively address Climate Change, New Jersey needs to develop new thinking about utility regulation, and craft new rules that encourage EDCs to embrace distributed generation and maximum efficiency in the use of energy, while providing EDCs sufficient revenue to make those investments necessary to maintain (and enhance) the reliability of the electric distribution system. Twenty five states have instituted revenue decoupling for electric and gas utilities and the results are very encouraging. Some states allow monthly adjustments in electric rates while others allow semi-annual, annual, or as needed adjustments. The vast majority of rate adjustments have been plus or minus by 2% or less of retail rates. Revenue Decoupling can be simply described as a regulatory mechanism that adjusts rates periodically to ensure that the amount a utility books as revenue for fixed cost recovery is no more and no less than the amount of revenue authorized by the regulator for that cost coverage. A decoupling mechanism causes a rate adjustment to ensure that customers, in effect, receive refunds or pay surcharges based on whether the revenues the utility actually received from customers were less or greater than the mechanism calculates. The difference typically occurs from weather, economic conditions, energy efficiency programs and incentives, onsite generation and customer behavior. Revenue Decoupling of regulated utilities in New Jersey needs to include directives to the utilities to develop and implement programs that support New Jersey in achieving the Global Warming Response Act, support the strong growth of renewable energy, both onsite and grid supply, support the adoption of all commercially available energy efficiency technologies, support the adoption of measures that reduce peak demand such as thermal and electric storage, and support utility and customer investment in measures that enhance the reliability of the grid on a local and statewide level. Revenue Decoupling should include at least the following features: 1. The ability to of utilities to recover all expenditures that increase the efficient use of electricity and natural gas at customer sites. 2. The mandate that all efficiency, load shift, energy storage and load reductions are given higher priority for implementation than increasing investment in the transmission and distribution infrastructure. This may include targeted demand reduction, load shifting, onsite generation and storage and aggressive energy efficiency programs in service areas that would otherwise need an expansion in distribution (substation) or transmission capacity. 3. The ongoing monitoring of all substations to identify their spare capacity, and the need for more capacity, early enough to implement targeted programs referenced in No. 2 to avoid the needed for additional transmission or distribution investments for that substation. 4. The ability of EDCs to invest capital on utility property that enhances grid reliability as the amount of distributed generation increases. 5. The ability of EDCs to purchase electricity from renewable resources under long term contracts and pass through those costs in the same manner as energy procured through the BGS process. 6. Authorization for the BPU to set firm targets for each EDC to achieve in increased customer energy efficiency, increased renewable energy as a percentage of total energy consumed, energy storage and load shift to minimize peak demand. Each utility’s success in meeting these targets will affect the utility’s allowed rate of return. 7. Utility programs that may be considered under Revenue decoupling may also include utility investment in measures that are located on customer premises that enhance the reliability of the grid as onsite distribution increases. 8. Revenue decoupling legislation should also include a removal of the cap on Net Metering because utilities will now be able to adjust rates as necessary to maintain a reliable electric grid. 9. In developing the programs and targets that utilities are directed to achieve, all direct and indirect benefits needed to be included in evaluating what programs and the size and pace of achievement required. These benefits need to include not only direct offsets to traditional utility investment to expand the capacity of the grid, but also environmental and health benefits that result from reduced carbon and other pollutant emissions. In conclusion, other states have shown that Revenue Decoupling does not necessarily increase average electric rates. The reduced need for utilities to invest capital to increase grid capacity can offset the cost of more aggressive energy use and demand reduction programs, while enhancing individual customer and grid reliability. New Jersey should proceed boldly into the land of Revenue Decoupling and learn from the other 25 states that already have some form of revenue decoupling. Energy generation, energy management and energy efficiency technology has advanced more rapidly than utility regulation and it is time for electric utilities are regulated in a manner that addresses Climate Change, increased distributed generation, reduces peak electric demand while providing sufficient utility revenue to make the investments necessary to keep the electric grid reliable. The history of revenue decoupling in other states have shown that it does not significantly increase average electric rates, if there is any increase. The history of electric prices in New Jersey during the past ten years has shown that retail electric rates can increase rapidly (over thirty percent over three years) and decrease a similar amount, as they are affected by wholesale electric price swings resulting from fossil fuel prices. It is time to embrace all those energy efficiency and renewable energy measures that reduce New Jersey’s vulnerability to fossil fuel price changes while moving the state to securing a high percentage of its energy needs from renewable energy and energy efficiency.