Project-Risk

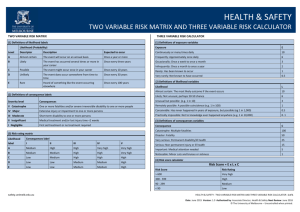

advertisement

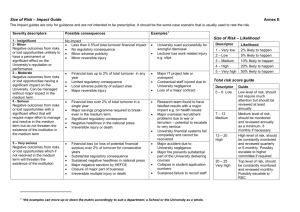

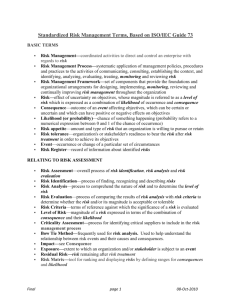

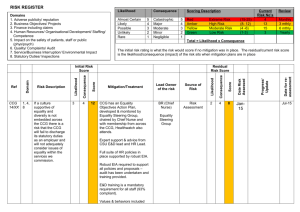

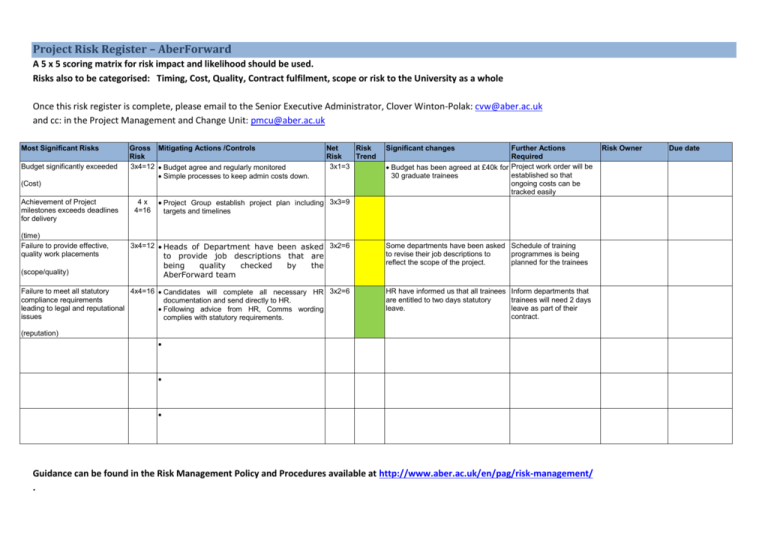

Project Risk Register – AberForward A 5 x 5 scoring matrix for risk impact and likelihood should be used. Risks also to be categorised: Timing, Cost, Quality, Contract fulfilment, scope or risk to the University as a whole Once this risk register is complete, please email to the Senior Executive Administrator, Clover Winton-Polak: cvw@aber.ac.uk and cc: in the Project Management and Change Unit: pmcu@aber.ac.uk Most Significant Risks Budget significantly exceeded Gross Mitigating Actions /Controls Risk 3x4=12 Budget agree and regularly monitored Simple processes to keep admin costs down. Net Risk Risk Trend 3x1=3 (Cost) Achievement of Project milestones exceeds deadlines for delivery (time) Failure to provide effective, quality work placements 4x 4=16 Significant changes Further Actions Required Budget has been agreed at £40k for Project work order will be established so that 30 graduate trainees ongoing costs can be tracked easily Project Group establish project plan including 3x3=9 targets and timelines 3x4=12 Heads of Department have been asked 3x2=6 to provide job descriptions that are being quality checked by the AberForward team (scope/quality) Failure to meet all statutory 4x4=16 Candidates will complete all necessary HR 3x2=6 compliance requirements documentation and send directly to HR. leading to legal and reputational Following advice from HR, Comms wording issues complies with statutory requirements. Some departments have been asked Schedule of training to revise their job descriptions to programmes is being reflect the scope of the project. planned for the trainees HR have informed us that all trainees Inform departments that are entitled to two days statutory trainees will need 2 days leave. leave as part of their contract. (reputation) Guidance can be found in the Risk Management Policy and Procedures available at http://www.aber.ac.uk/en/pag/risk-management/ . Risk Owner Due date Appendix A - Matrix of definitions to assist in assessment of impact and likelihood risk levels. For Institutes and Service Departments, the definitions of Insignificant, Minor, Moderate, Serious and Very Serious financial impact at local level are <£50K, <50K to £100K, <£100K to <500K, and <£500K; or as per the University level measures if the risk being assessed is a university wide risk, for example, the impact of an incorrect statutory return does not just affect the Planning Department, but is a university wide hit. Size of Risk – Likelihood Severity descriptors Possible consequences 1 - Insignificant 2 - Minor Negative outcomes from risks or lost opportunities unlikely to have a permanent or significant effect on the University’s reputation or performance No impact Less than 0.5%of total turnover financial impact No regulatory consequence Minor adverse publicity Minor reversible injury No more than10 days if senior staff time 3 – Moderate Negative outcomes from risks or lost opportunities having a significant impact on the University. Can be managed without major impact in the medium term 4 - Serious Negative outcomes from risks or lost opportunities with a significant effect that will require major effort to manage and resolve in the medium term but do not threaten the existence of the institution in the medium term 5 – Very serious Negative outcomes from risks or lost opportunities which if not resolved in the medium term will threaten the existence of the institution Financial loss up to 2% of total turnover in any year Limited regulatory consequence Local adverse publicity of subject area Major reversible injury No more than 25 days of senior staff time Examples1 University sued successfully for wrongful dismissal Lecturer has work related injury e.g. slips Major IT project late or overspent Contractual staff injured due to University negligence Loss of a major contract Descriptor Likelihood 1 – Very low 2% likely to happen 2 – Low 5% likely to happen 3 – Medium 10% likely to happen 4 – High 20% likely to happen 5 – Very high 50% likely to happen Total risk score guide Financial loss over 2% of total turnover in a single year Major savings programme required to break-even in the medium term Significant regulatory consequence Negative headlines in the national press Irreversible injury or death No more than 45 days of senior staff time Financial loss (or loss of potential financial surplus) over 2% of turnover for consecutive years or over 5% in a single year Substantial regulatory consequence Sustained negative headlines in national press Major negative sanction by HEFCW Closure of major part of business Irreversible multiple injury or death Over 45 days of senior staff time Research team found to have falsified results with a major impact e.g. on health issues Major overseas recruitment problems due to war or terrorism – potential to escalate to very serious University financial systems fail completely and cannot be recovered Major accident due to University negligence Major fire prevents substantial part of the University delivering courses Collapse in student application numbers Sustained failure to recruit staff Descriptor Guide 0 – 6 Low Low level of risk, should not require much attention but should be reviewed at least annually 7 – 12 Medium Medium level of risk, should be monitored and reviewed annually as a minimum, 6 monthly if necessary 13 – 19 High High level of risk, should be constantly monitored and reviewed quarterly or 6 monthly. Possibly escalate to higher committee if required 20 – 25 Very High Top level of risk, should be constantly monitored and reviewed monthly.