Austrian Economics and Property Rights: An examination of Locus

advertisement

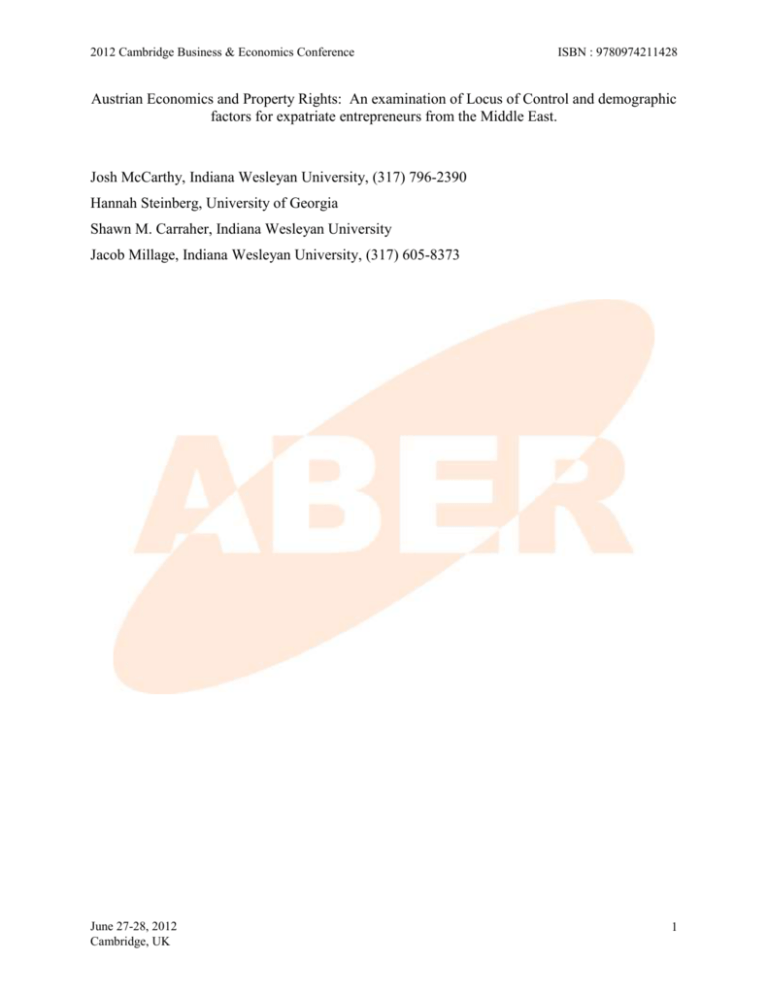

2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Austrian Economics and Property Rights: An examination of Locus of Control and demographic factors for expatriate entrepreneurs from the Middle East. Josh McCarthy, Indiana Wesleyan University, (317) 796-2390 Hannah Steinberg, University of Georgia Shawn M. Carraher, Indiana Wesleyan University Jacob Millage, Indiana Wesleyan University, (317) 605-8373 June 27-28, 2012 Cambridge, UK 1 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 AUSTRIAN ECONOMICS AND PROPERTY RIGHTS: AN EXAMINATION OF LOCUS OF CONTROL AND DEMOGRAPHIC FACTORS FOR EXPATRIATE ENTREPRENEURS FROM THE MIDDLE EAST ABSTRACT This paper discusses the data we found from interviewing 456 expatriate entrepreneurs from the Middle East. Our primary focus in this research is to determine the level of importance that these entrepreneurs place on having clearly defined individual property rights. The lens through which the authors see this subject of property rights is colored by the Austrian school of thought. Austrian Economics strongly supports individual property rights, along with a strong rule of law to enforce them. In turn, this endorsement of individual property rights is thought to positively influence entrepreneurs, who are more willing to risk their resources in such a context. To better understand our data we ran a multiple regression, using Rotter’s Locus of Control scale (internal and external locus of control), time as an expatriate, age, sex, and educational level on the importance of Property Rights. We are able to explain 26.7 % of the variance in Property Rights with these variables.Education level proved to be the most powerful independent variable, suggesting that, the more years of postgraduate education, the more an expatriate entrepreneur will value property rights. Curiously, age is negatively related to property rights, meaning that younger entrepreneurs value property rights more than their older counterparts. Entrepreneurs with a strong sense of internal or external locus of control tended to favor property rights. June 27-28, 2012 Cambridge, UK 2 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 INTRODUCTION Regardless of one’s profession or social class, it is understood thateconomics affects everyone. Scarcity is a reality of the world we live in. For aneconomy to prosper and reach its full potential, limited resources must be handled in the most efficient and productive way possible. There are several prominent schools of thought that debate how a country should go aboutmaking this happen. Whether it be a Neoclassical or a Keynesian approach, or a more steady and consistent Monetarist method, world leaders invariably want to implement the strategy that will cause their nation’s economy to flourish, thereby creating wealth. This paper examines the Austrian school of thought to economics. Three Austrians - Carl Menger, Friedrich von Wieser, and Eugen von Böhm-Bawerk -founded Austrian economics in the 19th Century. Being overshadowed by other philosophies after the death of its founders, Austrian economics is again rising in prominence. There are several distinct aspects of Austrian economics that separate them from other schools of thought.Austrians see economics as a subjective discipline, because value is subjective and ever changing. As Carl Menger wrote, “The value of goods arises from their relationship to our needs, and is not inherent in the goods themselves.” Those that view economics as an objective and exact science tend to accumulate large masses of large data sets, all trying to somehow determine “general equilibrium.” In contrast, Austrians prefer to emphasize human decisions and preferences, examining the resulting actions and the incentives that encourage them. If others are engrossed in the forecast of aggregates for the “macro” economy, Austrian economists are equally absorbed in their study of the individual, knowing that it is many individuals working together that form the whole, or “macro,” economy. June 27-28, 2012 Cambridge, UK 3 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 In his 1981 article Understanding“Austrian” Economics, Henry Hazlitt observed that Austrian economists rarely speak of market equilibrium, but [rather] about the market processes. Regardless of the school of thought that economists come from, most view this “market process” as a beautiful and fantastic phenomenon. Indeed, the market process causes the many thousands of individuals and entrepreneurs in a given economy to work in relative harmony with one another, all through the pricing signals and incentives provided in a freely functioning economy. It is Adam Smith’s “invisible hand” alive and well, with millions of individuals responding to the market and acting in their own self-interest, all the while advancing society and improving the general well-being of others. Austrian economists believe that the level at which the market process is able to function naturally and unconstrained is directly related to an economy’s ability to function at its greatest potential. This market process provides incentives to market participants, instructing them how to use their scarce resources in the most valuable manner possible. How can the resources of an economy be delegated to the place where they are most valuable and advance the macroeconomy? By individuals responding to incentives provided by a vibrant and dynamic market process. For Austrians, economics do not so much hinge on governmental data crunching as much as they do on determining the universal realities concerning how to create and/or preserve healthy incentives to the individuals participating in an economy. Because of their high regard for the market process and confidence in its ability to adequately direct economies, Austrians economists generally discourage public sector attempts to improve market process. Historically, they are reliably laissez-faire in their politics. June 27-28, 2012 Cambridge, UK 4 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 The implications of Austrian economics on public policy are that public policy should be minimized as much as possible. Governmental intervention in the market process (such as though transfer payments, increased taxes, price controls, etc.) result in distorted incentives in the marketplace, discouraging the individuals in an economy from using their resources in the most efficient and productive way. Despite the growing Austrian sentiments in much of the academic world, the United States currently employs public policy (as well as monetary policy) that does not logically follow from the Austrian school of thought. Political incentives, as well as opposing economic ideologies, have largely kept the Austrian way in the academic community alone. While the full consequences of current policy remain to be seen, the evidence suggests the results on the economy have not been positive. It appears that change is needed. Perhaps this is an opportunity for the Austrian renaissance to make its way to the governmental level? Locus of control refers to the perceived control over the events of one’s life. People with an internal locus of control believe that they are able to control what happens in their lives. On the other hand, people with an external locus of control tend to believe that most of the events in their lives result from being lucky, being in the right place at the right time, and the behaviours of powerful individuals. People’s beliefs in personal control over their lives influence their perception of important events, their attitude towards life, and their work behaviours (Rotter, 1966). Moreover, internal locus of control has been one of the most studied psychological traits in entrepreneurship research. An association between entrepreneurial behaviour and an internal June 27-28, 2012 Cambridge, UK 5 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 locus of control orientation has strong face validity. Entrepreneurs by most definitions are initiators, taking responsibility for their own welfare and not dependent on others (McClelland 1961). Furthermore, if one does not believe that the outcome of a business venture will be influenced by personal effort, then that individual is unlikely to risk exposure to the high penalties of failure. Since perception of both risk and ability to affect outcomes are crucial to the new venture formation decision, it follows that potential entrepreneurs are more likely to have an internal locus of control origination than an external one (Brockhaus & Horowitz, 1986). METHOD Sample We used a sample of 456 expatriate entrepreneurs from the Middle East (168 females and 288 males). Their average age was 35 and they had spent on average a total of 13 years as an expatriate and had an average of 4.35 years of higher education beyond high school. Results In Table 1 are shown the results of a multiple regression of Rotter’s Locus of Control scale (internal and external locus of control), time as an expatriate, age, sex, and educational level on the importance of Property Rights. We are able to explain 26.7% of the variance in Property Rights with these variables. June 27-28, 2012 Cambridge, UK 6 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Table 1 Model Summary Adjusted R Std. Error of Model R R Square Square the Estimate 1 .267 .37970 .517a .257 a. Predictors: (Constant), Gender, Internal Locus of Control, Edu.lev, Age, External Locus of Control, TimeExpat ANOVAb Sum of Model 1 Squares df Mean Square F Sig. Regression 23.569 6 3.928 .000a Residual 64.733 449 .144 Total 88.302 455 27.247 a. Predictors: (Constant), Gender, Internal Locus of Control, Edu.lev, Age, External Locus of Control, TimeExpat b. Dependent Variable: PropertyRights June 27-28, 2012 Cambridge, UK 7 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Coefficientsa Model 1 Unstandardized Standardized Coefficients Coefficients B Std. Error (Constant) 4.732 .215 External Locus of -.057 .020 -.058 TimeExpat Beta t Sig. 22.023 .000 -.130 -2.822 .005 .018 -.132 -3.154 .002 .006 .004 .120 1.538 .125 Edu.lev .087 .011 .337 8.091 .000 Age -.018 .004 -.311 -4.055 .000 Gender -.271 .043 -.297 -6.361 .000 Control Internal Locus of Control a. Dependent Variable: PropertyRights Property rights are defined as the authority to determine the allocation of one’s assets (Segal, Ilya and Whinston, Michael D., 2010). Property rights ensure the property owner control over his own resources, including his home, land, and business. When an entrepreneur starts a business, he essentially owns the rights to the business, controlling investments and everyday operations and reaping any ensuing revenue. The right to govern and manage his business is an entrepreneur’s incentive. Property rights are important to economics because they allow people June 27-28, 2012 Cambridge, UK 8 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 to maximize their utility and take stock in their environment. They entail complete ownership of a resource; any attempt from the government in prohibiting the use or sale of the resource is degrading the property rights of the individual. The Soviet Union was an extreme example of a socialist nation devoid of property rights. The resources of the country were commonly owned; however, the national government had complete control over the economy, assigning government officials delegation over its assets. Without the institution of property rights, business managers had no stock or investment in their companies, and therefore, no incentive. Before the collapse of the Union, many businesses failed and resources were overexploited. This process is called the tragedy of the commons: the overexploitation of resources due to individuals consulting their self interest and overlooking long term consequences (Hardin, G., 1968). Johnson, McMillan, and Woodruff (2002) found in their paper on property rights and finance that today, “reinvestment rates are lowest in Russia and Ukraine, where bribes for government services and licenses are common, firms make payments for protection, and the courts are least effective.” The financial state of a nation creates a subsequent effect on entrepreneurs and their willingness to invest. According to Stephen Knack and Philip Keefer (1995), Paolo Mauro (1995), Jakob Svensson (1998), and Daron Acemoglu (2001), “country-level studies consistently show that less secure property rights are correlated with lower aggregate investment and slower economic growth” (as cited in Johnson, McMillan, & Woodruff, 2002, p. 1335). Entrepreneurs will only invest if they feel secure in their venture and will reap the benefits, thus, the correlation between property rights and finance. June 27-28, 2012 Cambridge, UK 9 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Regression Analysis We tested our data at the .05 level. The coefficient of determination reveals that we can explain 26.7% (.267) of the variance in property rights from these variables. That is, 26.7% of the variance observed in our dependent variable, property rights, is explained by our independent variables. Our understanding of property rights, our dependent variable, needs to be further explained. We are attempting to measure the perception of property rights displayed by expatriates from the Middle East. Specifically, we want to determine what importance they place on having clearly defined property rights. Necessarily, for a country to establish a system that allows personal property rights, that country must endorse a strong rule of law that defends the integrity of these property rights. The Austrian school of thought would support a system that has a strong rule of law and defends property rights. The ANOVA table displays an F value of 27.247, at the .000000001 significance. For all practical purposes, these numbers mean that there is about a 1 in 1,000,000,000 chance of us coming across this data by chance. What does this mean? This means that these results are definitively not skewed by an abnormal sample. In contrast, these numbers tell us that there is something significant taking place with this data. Thus, we have reason to believe the correlation we find in the data is meaningful and accurate. While our preference would have been to be able to explain more than 26.7% of the variance in property rights, we are encouraged by the fact that our data is clearly statistically significant. Our independent variables do carry some influence in determining the dependent June 27-28, 2012 Cambridge, UK 10 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 variable. With this being the case, the question now becomes, what does the correlation within this data mean? Let us turn our attention to the figure that provides information about our independent variables. Looking down the significance column on the far right (entitled “Sig.”), we see that all variables except for TimeExpat are statistically significant. For this reason, we will not use this TimeExpat in our analysis. Nevertheless, the other values are quite useful, with the significance level being .005 or lower in every variable. We are left with five statistically significant variables: external and internal locus of control, education level (Edu.lev), age, and gender. The “t” column is a prominent statistic in this table. We see that education level represents the strongest correlation, with a“t” of 8.091. This high number means that we can definitively reason that education level plays a significant role in determining the level of importance that Middle East expatriates place on property rights. In this case, the more years of post high school education, the greater the importance the entrepreneurs tended to placed on property rights. The second largest “t” value is gender, with a negative correlation, -6.361. Rather than explaining how we coded this data, I will simply inform you that this figure strongly suggests that males place a greater importance on property rights than females. That is, males placed a greater importance on being able to have clearly defined and enforced property rights. The next strongest “t” value is age, another negative correlation, at -4.055. We found age to be significantly significant, with the younger expatriates viewing property rights as more important. The fact that younger entrepreneurs place greater emphasis on property rights is a curious finding. Actually, considering the education level variable, we would have expected the exact June 27-28, 2012 Cambridge, UK 11 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 opposite correlation. We would have expected older people to value property rights more than younger. This follows, because, the more years of education, the greater the importance placed on property rights. Younger people tend to have less years of education under their belt, making these results quite puzzling. What are the reasons for this? Why the seeming contradiction in the data? Unfortunately, from this study, we are not able to fully understand why the younger entrepreneurs valued property rights more than their elder counterparts. One coauthor perceptively theorizes that this finding could be due to the fact that the younger entrepreneurs have been (presumably) removed from their native context for less time than the older expatriates. Perhaps, the longer these entrepreneurs live in a place that staunchly enforces personal property rights – such as the United States – the less they are reminded of the significance of this type of rule of law. The importance of property rights is no longer “fresh” in their minds. Meanwhile, the importance of property rights is prominent in the minds of (young) expatriates, who have recently removed themselves from a Middle Eastern context that did not protect property rights as strictly. This is an interesting theory that deserves to be examined in greater detail. Such an undertaking is beyond the scope of this data and paper, but we are hopeful that someone will take the time to review this theory in greater detail. One final observation concerning the independent variable “age.” One may object that age should not be scrutinized so heavily, because its unstandardized coefficient “B” is only .018. The reason is its “t” value was high is largely because of a minimal level of standard error (.004). The authors agree that age only shows slight negative correlation to the dependent variable, property rights. Nevertheless, we believe that this finding is worth researching further for two primary reasons. First, a negative correlation in age is the complete opposite result that June 27-28, 2012 Cambridge, UK 12 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 was expected, particularly keeping the education level variable in mind. Second, both of these variables - age and education level - are statistically significant. Now to our final independent variables: internal and external locus of control. To review, internal locus of control involves having a sense of control over one’s own life. A person with a strong internal locus of control believes that they have the ability to determine their future. Entrepreneurs tend to have a strong internal locus of control, which contributes to their willingness to put time and resources into a business. They expect that their effort will produce fruitful results. External locus of control is just the opposite. Someone with a strong external locus of control believes that it is outside forces that primarily determine their future. They have limited (or no) control over their lives, but rather are acted upon by the forces that be. Often these forces comprise of some conception of a God, or the government. Individuals with an external locus of control largely believe in fate. We would expect individuals with this belief system to tend to be less entrepreneurial, believing that their business efforts have little or no impact on their future. For these two variables, the lower the “t” value, the higher the importance the entrepreneurs placed on property rights. In this case, we see that the “t” value for both locus of control variables are inversely related to property rights at a moderate level. This means that our expatriate entrepreneurs placed importance on property rights, regardless of which type (internal of external) of locus of control they scored high in. The finding that both variables show a similar correlation to property rights is puzzling. For reasons described earlier, it is expected that individuals with an internal locus of control would highly value property rights. Our data further confirms this theory. However, we would have expected that individuals with a strong external locus of control would have not placed June 27-28, 2012 Cambridge, UK 13 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 great value on property rights, as they presumably perceive that they have little control over the trajectory of their lives. Instead, our data shows that these individuals do place importance on property rights, just as those with an internal locus of control do. What are possible explanations for why those with an external locus of control also showed nearly the same valuation of property rights? One theory is that religious preferences, a variable for which our data does not account, played a role in influencing this outcome. This theory is particularly helpful in explaining why someone with an external locus of control would highly value property rights. We would expect an entrepreneur to believe strongly in personal property rights if they believe that 1) there is a deity that is active in the world and 2) that the deity is favorably disposed toward them. In this instance, that entrepreneur has an external locus of control because they believe that a deity is controlling their life. In turn, because they believe that the deity is actively influencing outcomes in their favor, they would value personal property rights. Note: This theory is crude and undeveloped. This subject could easily be examined in more detail and be the item of research for multiple papers. In our case, we are merely asserting this theory as one possible explanation for the reason our empirical data links external locus of control with strong property rights. In any case, our data suggests that when one has a strong proclivitytoward either external or internal locus of control, then that expatriate entrepreneur likely favors property rights. CONCLUSION Our sample included 456 expatriate entrepreneurs from the Middle East. The multivariate regression explains 26.7% of the variance in Property Rights with these variables. Education level proved to be the most powerfulindependent variable, suggesting that, the more years of June 27-28, 2012 Cambridge, UK 14 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 postgraduate education, the more an expatriate entrepreneur will value property rights. Curiously, age is negatively related to property rights, meaning that younger entrepreneurs value property rights more than their older counterparts. Entrepreneurs with a strong sense of internal or external locus of control tended to favor property rights. Related Research Unfortunately, due to the specific topic of this paper, there is little related research that directly relate to it. General consensus concerning expatriates says that they are successful individuals who have positive effects to the country that they reside in. Expatriates usually highly value education and most all expatriates have had some type of education. Evidence also suggests that society seems to accept male expatriates over women. Below are some possible areas of further research, along with a brief description of each topic. How external locus of control relates to religious views? External locus of control refers to individuals who believe an outside force controls and determines experiences in their life, which they have no control over. Now this outside force can be anything, but from the data we received, it would be interesting to study how religion is incorporated with external locus of control. Many individuals could have a positive outlook with life experiences while having an external locus of control that is incorporated with their own religion. Researching the most productive expatriates by determining their locus of control and how religion affects their perception of work would be another topic to look into. What type of economics do Middle Eastern people believe in? June 27-28, 2012 Cambridge, UK 15 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 What type of economics Middle Eastern people believe in would be another research idea. Would they prefer a free economic ideology such as Austrian economics? Or would these individuals want a Keynesian, Neoclassical, or Monetarist approach to the economy? From looking at the culture and beliefs in the Middle East, one may be able to determine what type of economy a person from the Middle East would prefer. Is education desirable in every culture and area of the world? The data from the article shows that education was the most important factor to individuals having a positive perception of property rights. It would be interesting to research how education is perceived through different individuals from around the world. Do some countries take education to an extreme? What countries do not believe that education is a top priority in society? Researching how desirable education is to countries around the world could show people what countries lack and benefit from proper education. Is the longer a person lives the less likely they believe in the importance of property right? From looking at the articles data, younger individuals seemed to perceive property rights as more important the older individuals. Does the longer a person live the less likely they will believe in the importance of property rights? It would be interesting to research how time correlates to the importance of property rights. Since older people have seen and experienced more than younger individuals, they may perceive property rights with little importance because property rights never helped them out. Older people may not believe property rights are important because they have seen more negative affects of property rights then younger individuals. June 27-28, 2012 Cambridge, UK 16 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Do all expatriates have a positive correlation with property rights? From the research that we have found, the expatriates believed that property rights were important, but some viewed property rights in a negative manner. Future research could figure out if most expatriates believed property rights to be of importance. If not, then what drives these individuals to believe that property rights are of no importance. Why do both internal and external individuals have a negative correlation with property right? From the results of the data both internal and external individuals had a negative correlation with property rights. Is this because internal individuals place importance on themselves? Do external individuals place importance on external factors? It is interesting to see that both internal and external people had a negative correlation. Future research could show why both types of people had such a negative correlation. Implications on Public Policy What are the implications of this research on public policy? It very much depends on if the government in question would like to encourage or discourage private property rights. From the perspective of Austrian economics, a central role of the government is to enforce and defend personal property rights. We support this position, believing that property rights and a strong rule of law encourage entrepreneurship and the creation of wealth. What actions can a government take that will encourage entrepreneurship? The authors of this research suggest that an Austrian approach will be helpful. A strong rule of law and clearly defined property rights are essential. Past these two vital responsibilities, a government should June 27-28, 2012 Cambridge, UK 17 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 largely defer to individual entrepreneurs, allowing the free market to run its natural course. We believe that this would encourage entrepreneurship and be in the best interest of the overall well being of the country in question. Economic growth will by maximized and the economic pie will grow, to the benefit of the citizens of the country. Reducing unnecessary red tape can drastically ease the entry of new firms. Ease of entry should encourage entrepreneurs and particularly benefit new businesses. Finally, another governmental action could be to reduce barriers to the buying and selling of personal property, most significantly, in the housing market. Indeed, tapping into this critical source of capital is key to an economy, and could particularly benefit two-thirds world countries that have a noteworthy amount of this capital in a unregulated or “black market” state (De Soto, 2000). References Ajaev, V., Klentzman, J., Sodtke, C., & Stephen, P. Mathematical modeling of moving contact lines in heat transfer applications. Microgravity – Science and Technology, 19 (3/4), 2326. Buckley, M.R., Carraher, S.M., Carraher, S.C., Ferris, G.R., & Carraher, C.E. (2008). Human resource issues in global entrepreneurial high technology firms: Do they differ? Journal of Applied Management & Entrepreneurship, 13 (1), 4-14. Buckley, M., Carraher, S.M., & Cote, J. (1992). Measurement issues concerning the use of inventories of job satisfaction. Educational and Psychological Measurement, 52 (3), 529542. Buckley, M.R., Carraher, S.M., Ferris, G., & Carraher, C. (2001). Human resource concerns in entrepreneurial multinational high technology firms. Journal of Applied Management and Entrepreneurship, 6 (1), 97-104. Buckley, M., Fedor, D., Veres, J., Wiese, D., & Carraher, S.M. (1998). Investigating newcomer expectations and job-related outcomes. Journal of Applied Psychology, 83, 452-461. June 27-28, 2012 Cambridge, UK 18 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Buckley, M., Mobbs, T., Mendoza, J., Novicevic, M., Carraher, S.M., & Beu, D. (2002). Implementing realistic job previews and expectation lowering procedures: A field experiment. Journal of Vocational Behavior, 61 (2), 263-278. Carland, J. & Carland, J. (1997). A model of potential entrepreneurship: Profiles and educational implications. Journal of Small Business Strategy, 8 (1), 1-13. Carland, J.A.C., & Carland, J.W. (1991). An empirical investigation into the distinctions between male and female entrepreneurs managers. International Small Business Journal. Carland, J.A., Carland, J.W., & Stewart, W.H. (1996). Seeing what’s not there: The enigma of entrepreneurship. Journal of Small Business Strategy 7 (1), 1-20. Carland, J.W., Carland, J.A.C., & Abhy, C.D. (1989). An assessment of the psychological determinants of planning in small businesses. International Small Business Journal. Carland, J.W., Carland, J.A., & Hoy, F. (1992). An entrepreneurship index: An empirical validation. Babson Entrepreneurship Conference, Fontainebleau, France. Carland, J.W., Carland, J.A., Hoy, F., & Boulton, W.R. (1988). Distinctions between entrepreneurial and small business ventures. International Journal of Management, 5 (1), 98-103. Carland, J.W. III, Carland, J.W., Carland, J.A., Pearce, J.W. (1995). Risk taking propensity among entrepreneurs, small business owners and managers. Journal of Business and Entrepreneurship, 7 (1), 12-23. Carland, J., Carland, J., & Carland, J. (1995). Self-actualization: The zenith of entrepreneurship. Journal of Small Business Strategy, 30-39. Carland, J.W., Hoy, F., Boulton, W.R., & Carland, J.A.C. (1984). Differentiating entrepreneurs from small business owners: A conceptualization. Academy of Management Review, 9 (2), 354-359. Carland, J.W., Hoy, F., & Carland, J.A.C. (1988). Who is an entrepreneur? is the wrong question. American Journal of Small Business 12 (4), 33-39. Carraher, S.M. (2005). An Examination of entrepreneurial orientation: A validation study in 68 countries in Africa, Asia, Europe, and North America. International Journal of Family Business, 2 (1), 95-100. Carraher, S.M. & Buckley, M. R. (1996). Cognitive complexity and the perceived dimensionality of pay satisfaction. Journal of Applied Psychology, 81 (1), 102-109. Carraher, S.M., Buckley, M.R., & Carraher, C. (2002). Cognitive complexity with employees from entrepreneurial financial information service organizations and educational June 27-28, 2012 Cambridge, UK 19 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 institutions: An extension & replication looking at pay, benefits, and leadership. Academy of Strategic Management Journal, 1, 43-56. Carraher, S.M., Buckley, M., Scott., C., Parnell, J., & Carraher, C. (2002). Customer service selection in a global entrepreneurial information services organization. Journal of Applied Management and Entrepreneurship, 7 (2), 45-55. Carraher, S.M. & Carraher, S.C. (2006). Human resource issues among SME’s in Eastern Europe: A 30 month study in Belarus, Poland, and Ukraine. International Journal of Entrepreneurship. 10, 97-108. Carraher, S.M., Carraher, S.C., & Mintu-Wimsatt, A. (2005). Customer service management in Western and Central Europe: A concurrent validation strategy in entrepreneurial financial information services organizations. Journal of Business Strategies, 22 (1), 4154. Carraher, S.M., Carraher, S.C., & Whitely, W. (2003). Global entrepreneurship, income, and work norms: A seven country study. Academy of Entrepreneurship Journal, 9 (1), 3142. Carraher, S.M., Franklin, G., Parnell, J., & Sullivan, S. (2006). Entrepreneurial service performance and technology management: A study of China and Japan. Journal of Technology Management in China, 1 (1), 107-117. Carraher, S.M., Gibson, J. W., & Buckley, M.R. (2006). Compensation satisfaction in the Baltics and the USA. Baltic Journal of Management, 1 (1), 7-23. Carraher, S.M., Mendoza, J., Buckley, M., Schoenfeldt, L., & Carraher, C. (1998). Validation of an instrument to measure service orientation. Journal of Quality Management, 3, 211224. Carraher, S.M., Mulvey, P., Scarpello, V., & Ash, R. (2004). Pay satisfaction, cognitive complexity, and global solutions: Is a single structure appropriate for everyone? Journal of Applied Management & Entrepreneurship, 9 (2), 18-33. Carraher, S.M. & Parnell, J. (2008). Customer service during peak (in season) and non-peak (off season) times: A multi-country (Austria, Switzerland, United Kingdom and United States) examination of entrepreneurial tourist focused core personnel. International Journal of Entrepreneurship, 12, 39-56. Carraher, S.M., Parnell, J., Carraher, S.C., Carraher, C., & Sullivan, S. (2006). Customer service, entrepreneurial orientation, and performance: A study in health care organizations in Hong Kong, Italy, New Zealand, the United Kingdom, and the USA. Journal of Applied Management & Entrepreneurship, 11 (4), 33-48. Carraher, S.M., Scott, C., & Carraher, S.C. (2004). A comparison of polychronicity levels among small business owners and non business owners in the U.S., China, Ukraine, Poland, Hungary, Bulgaria, and Mexico. International Journal of Family Business, 1 (1), 97-101. June 27-28, 2012 Cambridge, UK 20 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Carraher, S.M. & Sullivan, S. (2003). Employees’ contributions to quality: An examination of the Service Orientation Index within entrepreneurial organizations. Global Business & Finance Review, 8 (1) 103-110. Carraher, S.M., Sullivan, S. & Carraher, S.C. (2005). An examination of the stress experience by entrepreneurial expatriate health care professionals working in Benin, Bolivia, Burkina Faso, Ethiopia, Ghana, Niger, Nigeria, Paraguay, South Africa, and Zambia. International Journal of Entrepreneurship, 9 , 45-66. Carraher, S.M., Sullivan, S.E., & Crocitto, M. (2008). Mentoring across global boundaries: An empirical examination of home- and host-country mentors on expatriate career outcomes. Journal of International Business Studies, 39 (8), 1310-1326. Carraher, S.M. & Welsh, D.H.B. (2009). Global Entrepreneurship. Dubuque, IA: Kendall Hunt Publishing. Carraher, S.M. & Whitely, W.T. (1998). Motivations for work and their influence on pay across six countries. Global Business and Finance Review, 3, 49-56. Chait, H., Carraher, S.M., & Buckley, M. (2000). Measuring service orientation with biodata. Journal of Managerial Issues, 12, 109-120. Crocitto, M., Sullivan, S.E. & Carraher, S.M. (2005). Global mentoring as a means of career development and knowledge creation: A learning based framework and agenda for future research. Career Development International, 10 (6/7), 522-535. Hardin, G., "The Tragedy of the Commons," Science, 162(1968):1243-1248. Hart, D.E. & Carraher, S.M. (1995). The development of an instrument to measure attitudes towards benefits. Educational and Psychological Measurement, 55 (3), 498-502. Johnson, Simon, McMillan, John & Woodruff, Christoher (2002). Property Rights and Finance. American Economic Review, v92, 1335-1356. Klentzman, J., Ajaev, V., & Willis, D. (2008). Laser-induced liquid flow and phase change phenomena in thin metal films. Paper presented at the American Physics Society meeting McBride, A., Mendoza, J., & Carraher, S.M. (1997). Development of a biodata index to measure service-orientation. Psychological Reports, 81 (3 Pt 2), 1395-1407. Segal, Ilya, & Whinston, Michael D. (2010). Stanford Law and Economics Olin Working Paper No. 394. Available at SSRN: http://ssrn.com/abstract=1577382 or http://dx.doi.org/10.2139/ssrn.1577382 Scarpello, V. & Carraher, S. M. (2008). Are pay satisfaction and pay fairness the same construct? A cross country examination among the self-employed in Latvia, Germany, the U.K., and the U.S.A. Baltic Journal of Management, 3 (1), 23-39. June 27-28, 2012 Cambridge, UK 21 2012 Cambridge Business & Economics Conference ISBN : 9780974211428 Soto, H. D. (2000). The Mystery of Capital. New York, NY: Perseus Books Group. Sturman, M.C. & Carraher, S.M. (2007). Using a Random-effects model to test differing conceptualizations of multidimensional constructs. Organizational Research Methods, 10 (1), 108-135. Williams, M.L., Brower, H.H., Ford, L.R., Williams, L.J., & Carraher, S.M. (2008). A comprehensive model and measure of compensation satisfaction. Journal of Occupational and Organizational Psychology, 81 (4), 639-668. June 27-28, 2012 Cambridge, UK 22