Exam 2

advertisement

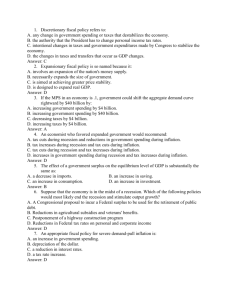

ECN202 Exam2a 1. The fact that Congress is dysfunctional means___. a. The recognition lag for fiscal policy is longer b. The recognition lag for monetary policy is longer c. The decision lag for fiscal policy is longer d. The decision lag for monetary policy is longer 2. Based on the differences between Classical and Keynesian economists, which of the following would be the true statement? a. The increased military spending is likely to increase the price level more in the Keynesian model b. Decrease in consumer confidence is likely to increase the output level more in the Keynesian model c. The increased military spending is likely to increase the output level more in the Keynesian model d. Decrease in consumer confidence is likely to decrease the output level more in the Classical model 120.00 3. The dashed line represents which component of aggregate demand? Components of GDP 100.00 80.00 a. b. c. d. e. Consumption Investment Government Exports Imports 60.00 40.00 20.00 0.00 1960 1970 1980 1990 2000 2010 4. "Construction teams still work around the clock in China's largest city...In a telling shift, however, construction workers are putting up fewer of the office and apartment buildings that had sprouted like weeds in the boom years...Instead they are working on municipal projects...part of China's enormous spending program aimed at preventing the economy from weakening too seriously." It is clear from this statement that the Chinese policy officials believe in ____. a. Crowding out b. Quantity Theory of Money c. Keynesian economics d. Hume’s Law 5. Here is the headline: “Ramen Noodle Sales Predict a Recession.” Here are the details: “In Thailand, ramen noodles have even been used as an indicator of overall economic health. The Mama Noodles Index tracks sales of a popular brand of ramen instant noodles. Because the demand for inferior goods increases when incomes go down, an increase in ramen sales could signal a downturn in incomes and an ongoing recession.” Using noodle sales as a leading indicator is an example of ___. a. econometric forecasting b. barometric forecasting c. time-series forecasting d. consensus forecasting 6. There are many parallels between what happened in the periods of time prior to the Great Depression and prior to the Great Recession. Which of the following would not be one of those parallels? a. Increasing concentration of wealth b. High rate of technological change c. Rise in manufacturing sector d. Increasing indebtedness of private sector e. High rates of immigration 7. The New Deal is the name given to the set of programs created by Roosevelt to deal with the Great Depression. Which of the following was not part of the New Deal? a. creation of the deposit insurance to increase people’s confidence in banks b. passage of the Glass-Steagall Act that forced a separation of commercial and investment banks c. passage of Social Security Act that provided elderly with supplemental retirement income d. adoption of the gold standard 8. We can be confident that when the Great Depression hit in 1930 the Federal Reserve wanted to help the economy, but they were also very worried about expanding the money supply and possibly creating inflation because they had seen the disastrous consequences of such a policy in the 1920s. Which country is the 'poster child' for hyperinflation in the 1920s? a. Canada b. UK c. Japan d. France e. Germany 9. In 2009 there was a partisan debate over the economic stimulus plan, which sounded, at least in some respects, similar to the debate of the early 1930s. One similarity is that both debates were ideological, with conservatives arguing for lower taxes and a smaller government and liberals asking for bigger government. The Classical economists aversion to government spending increase is clear in their view of the AS-AD model. Conservatives believe the only way to increase income would be to ____ a. shift the AD curve in b. shift the AS curve out c. shift the AS curve in d. shift the AD curve out 10. Let's put ourselves back in the world of the Classical economists, a world many Republican politicians and policy makers seem to be living in in 2012. In this world the US capital market, which is "captured" by this graph, plays a key role. What will happen in the US if the Republican’s austerity package is passed and the US government budget deficit decreases? a. The S curve will shift inwards and this will drive up the interest rate b. The S curve will shift outwards and this will drive down the interest rat c. The I curve will shift inwards and this will drive down the interest rate d. The I curve will shift outwards and this will drive up the interest rate 11. Which of the following was a theme in Eisenhower’s farewell speech? a. Rise of prison-industrial complex b. Focusing too much on short-term rather than long-term issues c. Media bias d. Rise of super wealthy 1% and their distortion of public policy 12. What was Krugman thinking of when he wrote “Cross of rubber?” What was the economic theory that was behind his concern? a. The multiplier b. Elasticity c. Fiscal policy d. Quantity Theory of Money 13. If in the late 1970s the US was on the gold standard, then which of the following would be a correct statement of what we would expect to see in the US based on the graph to the right? a. The US was running a trade deficit and this would result in an inflow of gold and a decrease in the money supply b. The US was running a trade surplus and this would result in an inflow of gold and an increase in the money supply c. The US was running a trade deficit and this would result in an outflow of gold and a decrease in the money supply d. The US was running a trade surplus and this would result in an outflow of gold and a decrease in the money supply 14. Imagine Greece in early 2012 with an economy in the midst of what looks like the beginning of a modern day depression something akin to the Great Depression in the US. If the Greeks follow the example of Americans back in the 1930s, then we can expect them to pull money out of the banking system, which reduces velocity. Assume you want the growth rate in the economy to be 3 percent and you expect inflation to be 1 percent and velocity to fall by 3 percent. What should you do with the money supply to reach your target growth rate for the economy? a. -1 percent b. 1 percent c. 2 percent d. 7 percent 15. Which of the following was a fiscal policy mentioned in the article “China outlines ambitious stimulus plan?” a. Lowering interest rates to stimulate the housing market b. Encouraging families to increase their savings c. Reduce spending on the social safety net d. Raise spending on infrastructure 16. As the financial crisis was spreading around the world in 2008 and 2009 there were repeated calls for governments to intervene and employ both monetary and fiscal policies to turn the countries' economies around. It is not a surprise that policy makers turned to the ideas of Keynes because his multiplier concept provided the theoretical basis for fiscal policies. If I were gauging the success of a $100 billion stimulus package on the size of the multiplier effect, the economic multiplier would be bigger if we calculated it for ____. a. England b. London c. US d. Providence 17. Based on these exchange rates, if I were interested in the cheapest price, which would I buy? a. a $1,000 computer b. a 800€ computer c. a 700£ computer d. a 80,000¥ computer Exchange rate $1.47 buys a British pound (£) $1.05 buys one Euro (€) $.008 buys one Japanese yen (¥) $.078 buys a Mexican peso 18. Which of the following would be a policy designed to move the Phillips curve inward? a. expansionary monetary policy b. a job retraining program c. raising personal income taxes d. increasing the money supply 19. Some of the policy proposals of Ron Paul, a Republican candidate for president in 2012, can be traced back to ideas contained in the Classical Model that dominated economic thinking and policy making in the 1920s. One thing he believes in is the Quantity Theory, which has him seeing serious inflation in the US in the near future. If Ron Paul wanted to show you the cause of his prediction of inflation, he would point you to ____. a. a table of GDP growth rates b. a table of money supply figures c. a table of unemployment rates d. a table of interest rates 20. Which of the following was not identified as an impact of student debt in the article “Ripple effects of student debt?” a. Decreased likelihood of new business formation b. Reduced home ownership c. Reduce likelihood of graduates choosing public service as a career d. Increase in students’ choice of business as a major 21. Would you expect a temporary tax cut to have a larger impact on consumption, investment, or import spending? a. consumption b. import c. investment d. it would make no difference a. b. c. d. 22. Which scatter diagram best represents the relationship between the inflation rate and the unemployment rate you would expect based on the Phillips Curve? a. A b. B c. C d. D 23. There was a lot of confidence among macropolicy makers in the 1960s including Arthur Okun, President Johnson's economic advisor who said "When recessions were a regular feature of the economic environment, they were often viewed as inevitable... [they] are now generally considered fundamentally preventable, like airplane crashes and hurricanes." If the economy were headed into an expansion that was too rapid and likely to produce inflation then you would expect to hear Keynesians propose which of the following expansionary fiscal policies. a. a decrease in the social security tax rate b. an decrease in interest rates c. a decrease in federal spending on defense d. an increase in the government's "Star Wars" spending e. a temporary tax cut aimed at middle income households 24. John F. Kennedy made macroeconomic policy a centerpiece of his presidential campaign in 1960. Which of the following was the policy proposed by Kennedy? a. increase in government spending b. decrease in taxes c. increase in taxes d. decrease in government spending e. reduction in interest rates 25. Which of the following would be the best explanation of the rise in the savings rate in 2008? a. b. c. d. A rise in interest rates A decline in interest rates The aging of the baby boomers Increased economic uncertainty 26. Based on what we know about aggregate demand, which of the following components of consumption demand is likely to be most volatile over the business cycle? a. household spending on services b. household spending on nondurables c. household spending on imports d. household spending on durables 27. When forecasting it is useful to decompose changes in macro variable. Which of the components of change would we gain insight into from the data in the above graph? a. b. c. d. cyclical seasonal trend intertemporal 28. Which diagram would best represent a situation that would show up as a movement down along the Phillips curve - lower inflation and higher unemployment? a. A b. B c. C d. D e. E UK Italy price of ounce of gold 10 £ 30 € price of shirt in terms of currency 15 £ 15 € 29. Above we have a table that contains the gold price of two currencies and the domestic prices of shirts in the two countries. Based on the information in this table, what would happen if the Italian government decided to raise the € price of gold to 20 €s an ounce? a. the price of shirts in terms of gold would fall in Italy and we would expect an outflow of gold from Italy b. the price of shirts in terms of gold would fall in Italy and we would expect an inflow of gold to Italy c. the price of shirts in terms of gold would rise in Italy and we would expect an outflow of gold from Italy d. the price of shirts in terms of gold would rise in Italy and we would expect an inflow of gold to Italy