File - St Mary Abbots

advertisement

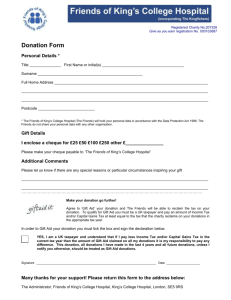

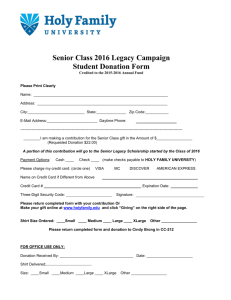

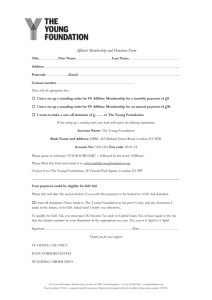

ST MARY ABBOTS Parish Church ∙ Kensington SUPPORTING OUR CHURCH REGULAR GIVING TO ST MARY ABBOTS – 2014 What is Regular Giving? Regular Giving is vital to St Mary Abbots, and is really the only way we can guarantee income. Only through regular contributions to the Church via standing orders is the Church able to budget for the repairs to the building and the wages of our stipends. Although we raise money in a number of ways, by far the most reliable, and most proper for our Christian community, is planned, pledged and regular giving. The work of the church continues day by day, week by week, month by month – and it has to be paid for on this basis. Facing the challenge for the future The challenge is that financially we only just get by. Maintaining the life and ministry of St Mary Abbots costs £10,000 each week yet we receive no subsidy whatsoever from the Government or other statutory bodies. Income has to come from other sources, which are often difficult to rely on. This includes renting out our hall and meeting rooms (meaning the church can’t use them!), fêtes and some interest from historic bequests. “As members of the congregation, your financial support is vital in keeping St Mary Abbots open and helping us to provide such a rich Church life. By far the best way of doing this is to become a Regular Giver.” Why Regular Giving is so important? All members of the congregation benefit from the money contributed by Regular Givers. This covers the upkeep of the church building, as well as day-to-day costs, from the wages of our stipends to the glue, sellotape and arts and crafts materials used by the children at the Sunday school crèche! Without this income, our Church would not survive. “Many give sacrificially, and we ask no more of them. But it is a good Christian principle to review year by year our financial commitments, and possibly there are many who have not considered their level of giving for some time or - particularly among the newer members of our congregation who do not yet give regularly.” Father Gillean What to do Please complete these pages and send to the Parish Secretary using the address below. Alternatively, hand in confidence to one of the Church Wardens If you are a UK taxpayer, please consider completing the Gift Aid form below: ST MARY ABBOTS CHURCH, KENSINGTON Charity Registration Number: 1132235 GIFT AID DECLARATION Please treat as Gift Aid donations all qualifying gifts of money made from the date of this declaration. I confirm I have paid or will pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April to 5 April) that is at least equal to the amount of tax that all the charities (including churches) and Community Amateur Sports Clubs that I donate to will reclaim on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qualify. I understand the charity will reclaim basic rate tax on every £1 that I donate. e.g. currently 25p on every £1 donated. (Please print) Full Name: Address: Post Code: Signed: Date: Notes: 1. Please notify the church/charity if you: want to cancel this declaration change your name or home address no longer pay sufficient tax on your income and/or capital gains. Gift Aid is linked to basic rate tax. Basic rate tax is currently 20%, which allows charities to reclaim 25p on the pound. 2. Higher rate taxpayers can claim back the difference between basic rate and higher rate or additional rate tax. If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your SelfAssessment tax return or ask HM Revenue and Customs to adjust your tax code. What to do Please complete these pages and send to the Parish Secretary using the address below. Alternatively, hand in confidence to one of the Church Wardens. Or, if you would prefer to instruct your bank to set up the standing order yourself, please use the details provided below, and let us know about your donation. BANK STANDING ORDER To: Bank: Branch & Address: Account No: Sort Code: Please pay to: National Westminster Bank, Royal Garden Branch, 55 Kensington High Street, London W8 5ZG. Sort Code: 50-30-10 Account No: 03411893 for the credit of St Mary Abbots P.C.C. the sum of (in words) £............................ monthly/quarterly/annually* (*Please delete as appropriate) until further notice, starting on: Signed: Date: (Please print) Mr/Mrs/Miss Address: Post Code: Why Gift Aid is also so important. If you are a UK tax payer, you can use Gift Aid to make your donations go further by completing the attached declaration. What is Gift Aid? By doing so, it enables the Church, as a registered charity, to reclaim a further 25% from the Government on your donation. Higher tax rate payers may also be able to reclaim tax on their donation via their self assessment.1 If you are a taxpayer, the Government adds 25% to your donation at no cost to you. I can’t give much. How can my money help? This means if you give £20, the Church receives £25. Any regular payment – however small - will make a real difference Anything you can give will be a tremendous help, and we can all make a difference. Here are some examples of what your money could do: £10 a month will pay for all the coloured pens and paper for the Children on Sunday groups £25 a month will pay for the beautiful church flowers for 2 months £50 a month will pay for the altar wine for a year £100 a month will pay for one of our Choir tenors for 6 months. How do I set up a regular giving payment? Please complete the forms and return them to the address below. Alternatively, hand in confidence to one of the Church staff. Parish Secretary: Mrs Susan Russell 020 7937 2419 susan.russell@stmaryabbotschurch.org Parish Office, St Mary Abbots Centre, Vicarage Gate, W8 4HN Stewardship Sectretary: Emma Porteous ejporteous@gmail.com “All those in our Congregation contribute to and benefit from the rich and diverse life of the Church. We ask you to give back by becoming a regular giver” 1 Higher rate tax payers If you are a higher rate tax payer then you can also claim tax relief via your Self Assessment tax return. This is because gift aid contributions provide you with a higher tax rate threshold before paying tax at the higher rate. This means you can benefit from tax relief as you can claim back the difference between the higher rate of tax at 40% (or 50%/45%) and the basic rate of tax at 20% on the total value of your donation. So if you give £100, the gross donation to the church would be £125, and you as the donor at the 40% tax rate could also claim £25 back (40% 20% = 20% of £125). The law may change meaning certain rules apply for those who donate over £50,000 a year (or 25% of their income) whichever is greater.