Lecture 12 Problems

advertisement

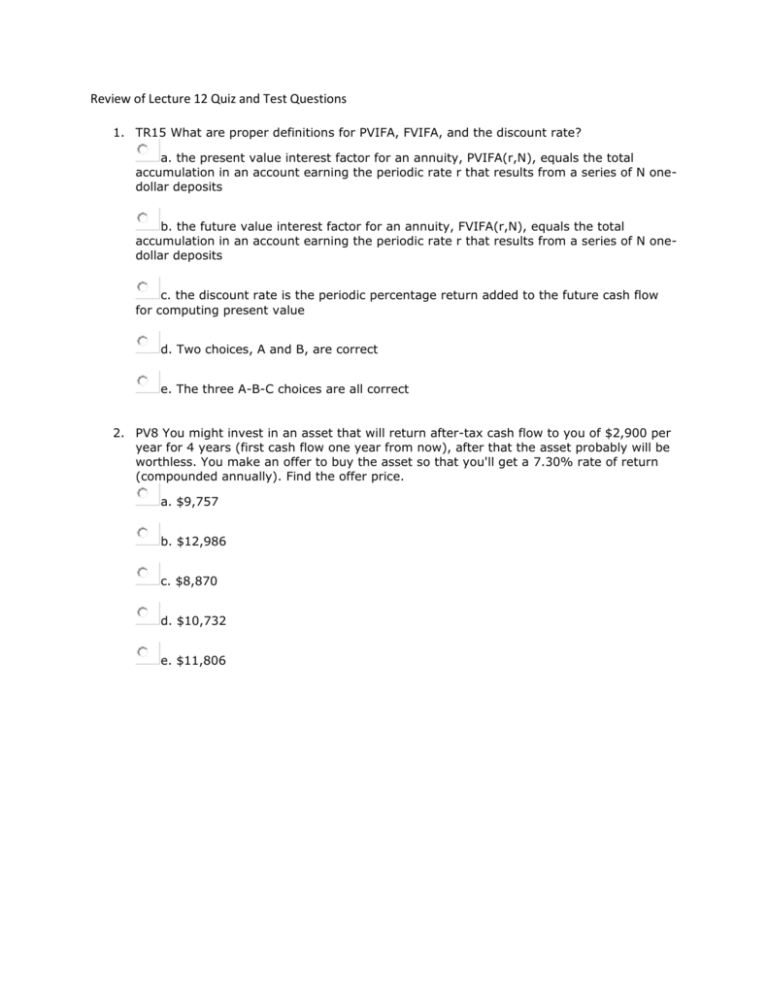

Review of Lecture 12 Quiz and Test Questions 1. TR15 What are proper definitions for PVIFA, FVIFA, and the discount rate? a. the present value interest factor for an annuity, PVIFA(r,N), equals the total accumulation in an account earning the periodic rate r that results from a series of N onedollar deposits b. the future value interest factor for an annuity, FVIFA(r,N), equals the total accumulation in an account earning the periodic rate r that results from a series of N onedollar deposits c. the discount rate is the periodic percentage return added to the future cash flow for computing present value d. Two choices, A and B, are correct e. The three A-B-C choices are all correct 2. PV8 You might invest in an asset that will return after-tax cash flow to you of $2,900 per year for 4 years (first cash flow one year from now), after that the asset probably will be worthless. You make an offer to buy the asset so that you'll get a 7.30% rate of return (compounded annually). Find the offer price. a. $9,757 b. $12,986 c. $8,870 d. $10,732 e. $11,806 3. PV3c You might invest in an asset that will return after-tax cash flow to you of $2,200 per quarter for 6 quarters (first payment one quarter from now), followed by $3,600 per quarter for 6 quarters . You make an offer to buy the asset so that you'll get your "target" annual rate of return of 17.6% (compounded quarterly ). Instead, however, the seller makes a counter-offer that is $1,650 higher than your offer. If you buy at the counter-offer price, and receive the expected cash flows, what is your annual rate of return? a. 15.2% b. 12.5% c. 13.8% d. 18.4% e. 16.7% 4. TR3 Suppose two alternative investments promise cash flow streams that possess equal lives. Further, suppose the simple sum of the cash flows for each investment is the same amount. Given a positive interest rate, which investment has the smallest present value? a. an investment which generates equal cash flows each period. b. there is no reliable relationship between the distribution of cash flows and present value. c. an investment that is being discounted by a small discount rate. d. an investment which generates most cash flows at the beginning of its life. e. an investment which generates most cash flows at the end of its life. 5. PV7 A friend received an inheritance 5 years ago and put all funds into an account earning 6.80% compounded quarterly. Exactly one quarter after establishing the account the friend started withdrawing $500 per quarter. Today she'll make another quarterly withdrawal, and quarterly interest will be credited to the account, and then the balance will be $15,372 . How much was the friend's inheritance? a. $25,808 b. $21,329 c. $19,390 d. $28,389 e. $23,462 6. PV9 You might invest in a security that will return after-tax cash flow to you of $2,000 per year for 3 years (first cash flow one year from now), after which the security likely can be sold immediately for $6,500 . You make an offer to buy the security so that you'll get a 7.80% rate of return (compounded annually). Find the offer price. a. $9,420 b. $12,537 c. $10,362 d. $13,791 e. $11,398 7. PV10b You might invest in an asset that will return after-tax cash flow to you of $1,500 per month for 20 months (first cash flow one month from now), and after receiving the last cash flow you'll immediately receive after-tax net proceeds from liquidation equal to $54,000 . You make an offer to buy the asset so that you'll get your "target" annual rate of return of 17.40% (compounded monthly). The seller makes a counteroffer that is $5,400 higher than your offer. Find your annual rate of return if you buy at the counteroffer price and receive the expected cash flows. a. 15.4% b. 16.9% c. 12.7% d. 14.0% e. 11.5% 8. FV17 Today you open an account with a $16,800 deposit that earns 12.10% compounded annually. You've set a target for the account so that in exactly 6 years its balance will be $25,300 . To reach the target you'll adjust the balance annually; each year's adjustment will be exactly the same amount and the first adjustment occurs exactly one year from now. After the last annual adjustment in exactly 6 years, and crediting of that year's interest, the account balance exactly equals the target. Describe the annual adjustment that you make each year. a. Each year you make a withdrawal of $859 . b. Each year you make a withdrawal of $747 . c. Each year you make a withdrawal of $988 . d. Each year you make a deposit of $747 . e. Each year you make a deposit of $859 9. TR4 Suppose two alternative investments promise cash flow streams that possess equal lives. Further, suppose the simple sum of the cash flows for each investment is the same amount. Given a positive interest rate, which investment has the biggest present value? a. an investment which generates equal cash flows each period. b. there is no reliable relationship between the distribution of cash flows and present value. c. an investment which generates most cash flows at the beginning of its life. d. an investment that is being discounted by a large discount rate. e. an investment which generates most cash flows at the end of its life. 10. TR5 Suppose two equal-cost alternative investments promise cash flow streams that possess equal lives. Further, suppose the simple sum of the after-tax cash flows for each investment is the same amount. Given a positive interest rate, which investment has the biggest present value? a. an investment that has relatively high sales revenues. b. an investment which generates most cash flows at the beginning of its service life. c. there is no reliable relationship between the distribution of cash flows and present value. d. an investment that is being discounted by a large discount rate. e. an investment which generates equal cash flows each period.