An American put option allows the holder to

advertisement

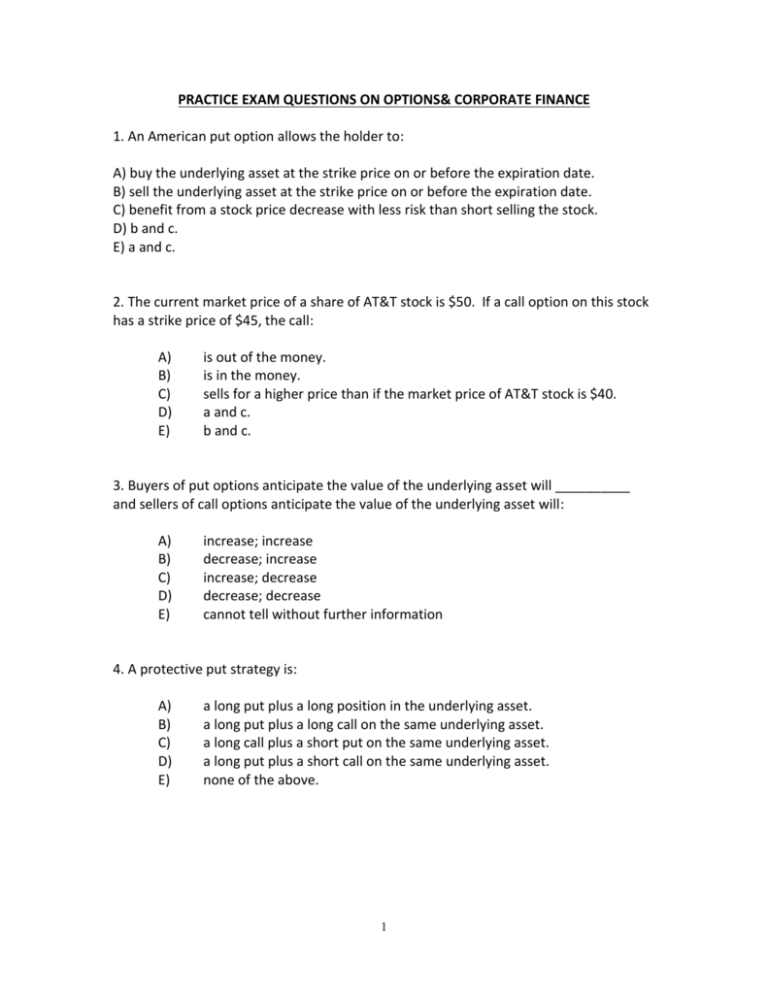

PRACTICE EXAM QUESTIONS ON OPTIONS& CORPORATE FINANCE 1. An American put option allows the holder to: A) buy the underlying asset at the strike price on or before the expiration date. B) sell the underlying asset at the strike price on or before the expiration date. C) benefit from a stock price decrease with less risk than short selling the stock. D) b and c. E) a and c. 2. The current market price of a share of AT&T stock is $50. If a call option on this stock has a strike price of $45, the call: A) B) C) D) E) is out of the money. is in the money. sells for a higher price than if the market price of AT&T stock is $40. a and c. b and c. 3. Buyers of put options anticipate the value of the underlying asset will __________ and sellers of call options anticipate the value of the underlying asset will: A) B) C) D) E) increase; increase decrease; increase increase; decrease decrease; decrease cannot tell without further information 4. A protective put strategy is: A) B) C) D) E) a long put plus a long position in the underlying asset. a long put plus a long call on the same underlying asset. a long call plus a short put on the same underlying asset. a long put plus a short call on the same underlying asset. none of the above. 1 5. You purchase one IBM March 100 put contract for a put premium of $6. What is the maximum profit that you could gain from this strategy? A) B) C) D) E) $10,000 $10,600 $9,400 $9,000 none of the above 6. You purchased a call option for $3.45 seventeen days ago. The call has a strike price of $45 and the stock is now trading for $51. If you exercise the call today, what will be your holding period return? If you do not exercise the call today and it expires, what will be your holding period return? A) B) C) D) E) 173.9%, -100% 73.9%, -100% 57.5%, -173.9% 73.9%, -57.5% 100%, -100% 7. To the option holder, put options are worth ______ when the exercise price is higher; call options are worth ______ when the exercise price is higher. A) more; more B) more; less C) less; more D) less; less E) It doesn't matter – they are too risky to be included in a reasonable person's portfolio. (SEE NEXT PAGE) 2 Questions 8-12 relates to the following information: Stock Price AP 52½ 52½ 52½ 52½ 52½ 52½ BSF 25⅝ 25⅝ 25⅝ Strike Price 40 45 50 60 70 80 90 15 20 25 30 May 12.50 7.75 3 .25 .05 a a 10.75 5.50 1.45 .20 Calls-Last Aug. Nov. 13 a 8.65 10.50 5.85 7.85 2.45 4.15 .85 b .45 b .10 b 11 10 6 7.50 3.35 4.50 1.50 1.50 May .05 .20 1.15 8.65 a a a .05 .05 .75 4.50 Puts-Last Aug. Nov. .70 1.50 1.75 3 3.75 5.25 9.90 10.40 18.75 b a b a b a a .40 a 1.65 2.15 a a 8. The BSF May call option has a premium of .20. What is the strike price of this option? A. B. C. D. 15 25 25.63 30 9. The BSF May 20 put option: A. B. C. D. Is in-the-money Is out-of-the-money Is on-the-money Will stop trading at 5:30 p.m. Eastern time on the third Friday of the month. 10. The AP May 40 call option: A. B. C. D. Is out-of-the-money Is in-the-money Is on-the-money Will expire on the third Friday of the month 3 11. What is the intrinsic value of the BSF August 20 call options? A. B. C. D. .37 5.63 6 The option has no intrinsic value. 12. What is the time value of the BSF August 20 call options? A. B. C. D. .37 5.63 6 The option has no time value. 13. Which of the following is TRUE regarding the purchaser of a call option? A. The yield on the purchaser’s portfolio would decrease by purchasing the option B. The purchaser would limit the amount of money he could lose if the underlying stock declined C. The purchaser would benefit if the underlying stock declined D. The purchaser would exercise the option if the stock declined Use the following information to answer questions 14-15. On October 25, Mr. Smith purchased 5 listed XYZ Corporation July 50 calls and paid a $3 premium on each call. The current market price of XYZ Corporation is $48 per share. 14. What would the breakeven point be for Mr. Smith per option? A. B. C. D. $45 $48 $53 $58 15. If the market price of XYZ Corporation was $45 and the calls expired, Mr. Smith would lose: A. B. C. D. $1,000 $1,500 $2,000 $4,000 4 16. What is the intrinsic value and the time value of the call if ABC is trading at 43 and the ABC April 40 call is trading at 4.50? A. B. C. D. Intrinsic value 3; time value 1.50 Intrinsic value 3; Time value 4.50 Intrinsic value 1.50; time value 3 Intrinsic value 4.50; time value 0 17. Which of the following will decrease the value of a call option? I. A decrease in the exercise price II. A decrease in the value of the underlying stock III. An increase in the risk-free rate IV. An increase in the time to expiration A. II only B. I and II only C. III and IV only D. I, II, and IV only E. I, II, and III only 5 18. Several rumors concerning Value Rite stock is causing the market price of the stock to be volatile. Given this situation, you decide to buy both a one-month European $25 put and a onemonth European $25 call on this stock. The call price per share is $0.60 and the put price per share is $2.10. What will be your net profit or loss on these option positions if the stock price is $18 on the day the options expire? (Ignore trading costs and taxes). A. -$210 B. -$150 C. -$60 D. $430 E. $490 19. Electronic Importers has a pure discount bond with a face value of $25,000 that matures in one year. The risk-free rate of return is 3.80%. The assets of the business are expected to be worth either $23,000 or $35,000 in one year. Currently, these assets are worth $27,500. What is the current value of the pure discount bond? A. $17,746 B. $19,207 C. $22,549 D. $23,048 20. Southern Shores is considering a project that has an initial cost today of $12,500. The project has a two-year life with cash inflows of $7,500 a year. Should the firm opt to wait one year to commence this project, the initial cost will increase by 5% and the cash inflows will increase to $8,500 a year. What is the value of the option to wait if the project discount rate is 14%? A. $615 B. $722 C. $914 D. $983 21. Kurt owns a convertible bond that matures in three years. The bond has a 7.50% coupon and pays interest semi-annually. The face value of the bond is $1,000 and the conversion price is $25. Similar bonds have a market return of 9.25%. The current price of the stock is $26.50 per share. What is the value of the conversion option? A. $105 B. $455 C. $955 D. $1060 6 Answer Key 1. D 2. E 3. D 4. A 5. C 6. B 7. B 8. D 9. B 10. B 11. B 12. A 13. B 14. C 15. B 16. A 17. A 18. D This is a long straddle. Net profit = [-$0.60 100] + [(-$2.10 + $25 - $18) 100] = $430 19. D n = .8333 $X= nS1Lower (.8333)($ 23,000) = = $18,464 (1 rf )t (1 .0380)1 C0 (Value of Equity) = (n)S0 - $ X = (.8333) ($27,500) – ($18,464) = $4452 Value of debt = Value of Assets – Value of Equity = $27,500 - $4,452 = $23,048 20. C NPV ( t=0) = -12,500 + [7500/ (1+14)1 ] + [7500/ (1+14)2] = -$150 7 NPV ( t=0) = 0 + [-13,125 / (1+.14)1] + [8500/ (1+14)2 ] + [8500/ (1+14)3] = $764 Value of option to wait = $764 + $150 = $914 21. A The Straight Bond value is $955.05. The conversion value is [$1000/$25 x $26.50 or $1060. The conversion value is thus equal to $1060 – 955 = $105. 8