AUSTIN COMMUNITY COLLEGE

advertisement

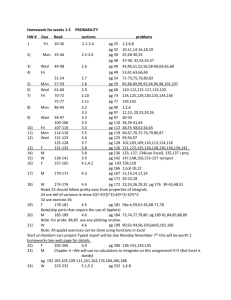

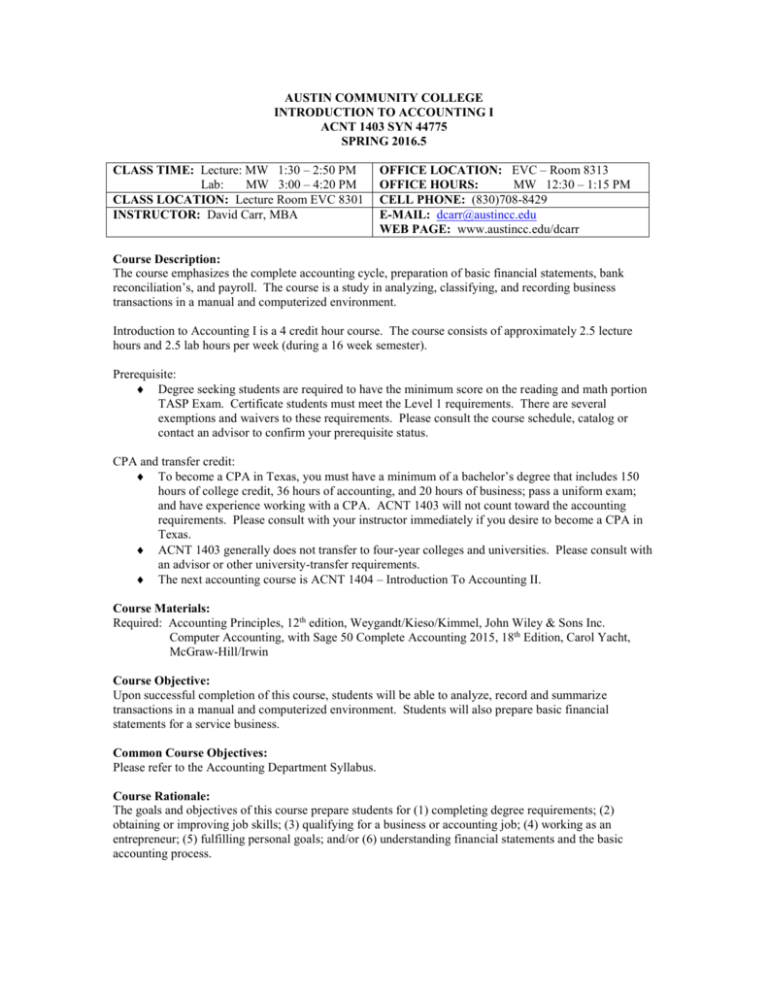

AUSTIN COMMUNITY COLLEGE INTRODUCTION TO ACCOUNTING I ACNT 1403 SYN 44775 SPRING 2016.5 CLASS TIME: Lecture: MW 1:30 – 2:50 PM Lab: MW 3:00 – 4:20 PM CLASS LOCATION: Lecture Room EVC 8301 INSTRUCTOR: David Carr, MBA OFFICE LOCATION: EVC – Room 8313 OFFICE HOURS: MW 12:30 – 1:15 PM CELL PHONE: (830)708-8429 E-MAIL: dcarr@austincc.edu WEB PAGE: www.austincc.edu/dcarr Course Description: The course emphasizes the complete accounting cycle, preparation of basic financial statements, bank reconciliation’s, and payroll. The course is a study in analyzing, classifying, and recording business transactions in a manual and computerized environment. Introduction to Accounting I is a 4 credit hour course. The course consists of approximately 2.5 lecture hours and 2.5 lab hours per week (during a 16 week semester). Prerequisite: Degree seeking students are required to have the minimum score on the reading and math portion TASP Exam. Certificate students must meet the Level 1 requirements. There are several exemptions and waivers to these requirements. Please consult the course schedule, catalog or contact an advisor to confirm your prerequisite status. CPA and transfer credit: To become a CPA in Texas, you must have a minimum of a bachelor’s degree that includes 150 hours of college credit, 36 hours of accounting, and 20 hours of business; pass a uniform exam; and have experience working with a CPA. ACNT 1403 will not count toward the accounting requirements. Please consult with your instructor immediately if you desire to become a CPA in Texas. ACNT 1403 generally does not transfer to four-year colleges and universities. Please consult with an advisor or other university-transfer requirements. The next accounting course is ACNT 1404 – Introduction To Accounting II. Course Materials: Required: Accounting Principles, 12th edition, Weygandt/Kieso/Kimmel, John Wiley & Sons Inc. Computer Accounting, with Sage 50 Complete Accounting 2015, 18th Edition, Carol Yacht, McGraw-Hill/Irwin Course Objective: Upon successful completion of this course, students will be able to analyze, record and summarize transactions in a manual and computerized environment. Students will also prepare basic financial statements for a service business. Common Course Objectives: Please refer to the Accounting Department Syllabus. Course Rationale: The goals and objectives of this course prepare students for (1) completing degree requirements; (2) obtaining or improving job skills; (3) qualifying for a business or accounting job; (4) working as an entrepreneur; (5) fulfilling personal goals; and/or (6) understanding financial statements and the basic accounting process. 2 Texas Education Coordinating Board SCANS Skills: Competency must be shown in the following three areas: 1. Manages time a. Uses class and lab time efficiently to accomplish required assignments b. Focuses efforts toward accomplishing class-related goals c. Prioritizes activities based on deadlines and level of importance d. Stays on target with class syllabus and planned activities 2. Uses computers to process information a. Uses lab computers and text to acquire and organize financial information for the completion of lab assignments using Microsoft Word and Excel and Peachtree software programs b. Analyzes information necessary to complete an accounting cycle and prepare statements using an automated system c. Communicates financial information through the process and production of financial statements 3. Students exhibit responsibility a. Meets established deadlines for homework and lab assignments b. Attends class/lab on a regular basis c. Takes exams on time d. Seeks assistance from instructor and/or tutors when necessary e. Prepares for class Class Preparation: Your attendance is expected at all lecture and lab classes. Portions of the course grade are based on inclass activities. Also, the exams are a reflection of the material covered in class. It is to your advantage to attend class and participate in the discussion of the material. Advance preparation is the key to completing the agenda items successful and in a timely fashion. If you have conflicts, which prohibit your regular attendance and/or preparation for class, please discuss these with either a counselor or your instructor. Attendance: Austin Community College does not have an established attendance police. The Business Studies Area has determined that absences in excess of 10 percent of the scheduled class periods are the basis for an instructor to withdraw a student from class. While I may withdraw a student for excessive absences, I have no obligation to do so. Withdrawals: April 25, 2016 is the last day to withdraw from this class and receive a grade of “W”. If you wish to withdraw, complete the withdrawal slip and turn it in to the admission’s office. Do not assume that I will withdraw you!! Incompletes: Incomplete grades are given only on rare occasions. The purpose of this grade is for an emergency, which occurs after the withdrawal date and prevents timely completion of the course. School Policies: The policies are outlined in the Austin Community College Student Handbook. Please obtain a copy from Student Services. These school policies are considered an integral part of this syllabus. Instructional Methodology: The objectives of this course will be met by incorporating a variety of instructional methods. These include lecture, group activities, student presentations, discussion papers, class quizzes, class exercises, spreadsheet and word processing activities, use of accounting software and online research. 3 Textbook Exams: The four Weygandt textbook exams will be a combination of problems and exercises. I retain the completed exams and keep them for one semester. Make-up exams – Please make every effort to take the exams on the scheduled dates. Otherwise, you will get behind on the new material and you will not do well on the later exams. The need for a make-up must be the result of an emergency situation. Make-up exams are not re-tests. You must visit with me no later than the next class after a missed exam to make arrangements to have a make-up exam placed in the testing center on this campus. You will have a maximum of one week from the date of the missed exam to take the make-up. Discussion Questions & Quizzes: One broad conceptual question per chapter will be assigned via Blackboard. Your responses using the Blackboard discussion board must be submitted for grading no later than the exam for the applicable textbook chapters. Your textbook and class notes may be used in composing your answers. Quizzes will consist solely of multiple choice questions. They will be assigned and taken in class after completion of the coverage of each chapter (generally at the beginning of the next following class). As with major exams, textbooks and class notes can not be used as aids. Make-ups for discussion questions and quizzes are on an emergency basis only. For your personal convenience is not an emergency. Textbook & Computer Assignments (Word, Excel & Peachtree): The working of exercises and problems is a critical part of any accounting course. Accounting concepts cannot be fully understood until they are applied in performing accounting functions. Completing the assignments is also a very good way to prepare for exams. Further, the assignments count as a significant part of your grade and also directly reflect the SCANS skills listed in this syllabus. Attendance and time management during your time on campus is critical for successful completion of these assignments. All textbook assignments (exclusive of ethics cases) must be submitted via Blackboard for grading on or before the exam date for the topic (early submittal is encouraged). Late assignments are accepted on an emergency basis only. As indicated in the assignment schedule of this syllabus, all assignments must be completed using the applicable computer program. Manually prepared solutions are not acceptable. Selected ethics cases from the textbook are reviewed and discussed in class as student group activities, with typed solutions submitted per group. SAGE 50 assignments from the Carol Yacht Computer Accounting manual are due no later than the date of the SAGE 50 Simulation Exam as listed in the enclosed activities schedule. Although, you are encouraged to complete and submit them for grading earlier. Grading: Activity Textbook Exams Textbook Quizzes Discussion Questions Problems & Exercises Ethics Cases SAGE 50 Assignments SAGE 50 Exam Assessment Quiz TOTAL Number 4 10 10 30 4 8 1 1 Pts Each 80 20 5 3 5 5 60 20 Total 320 200 50 90 20 40 60 20 800 Percent 40.0 25.0 6.2 11.3 2.5 5.0 7.5 2.5 100.0 720 640 560 480 Below Points to to to to 800 719 639 559 Grade A B C D 480 F 4 DAY Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed DATE 1/20 1/25 1/27 2/01 2/03 2/08 2/10 2/15 2/17 2/22 2/24 2/29 3/02 3/07 3/09 3/14 3/16 3/21 3/23 3/28 3/30 4/04 4/06 4/11 4/13 4/18 4/20 4/25 4/27 5/02 5/04 5/09 5/11 TOPIC Ch 1 – Accounting in Action Ch 1 – Accounting in Action Ch 2 – The Recording Process QUIZ CH 1 Ch 2 – The Recording Process Review and Group/Ethics QUIZ CH 2 EXAM (chapters 1 and 2) Ch 3 – Adjusting the Accounts Ch 3 – Adjusting the Accounts Ch 4 – Compl of the Acc’ting Cycle QUIZ CH 3 Ch 4 – Compl of the Acc’ting Cycle Review and Group/Ethics QUIZ CH 4 EXAM 2 (chapters 3 and 4) Ch 5 – Merchandise Operations Ch 5 – Merchandise Operations Ch 6 – Inventories QUIZ CH 5 Spring Break Spring Break Ch 6 – Inventories and Group/Ethics QUIZ CH 6 Ch 7 – Acc’ting Info Sys and Review QUIZ CH 7 EXAM 3 (chapters 5-7) Ch 8 – Internal Control and Cash Ch 9 – Receivables QUIZ CH 8 Ch 9 – Receivables Ch 10 – Plant Assets QUIZ CH 9 Ch 10 – Plant Assets Review and Group/Ethics QUIZ CH 10 EXAM 4 (CH’S 8-10) ASSESSMENT QUIZ SAGE 50 – Ch’s 1 & 2 SAGE 50 – Ch’s 3 & 4 SAGE 50 – Ch’s 5 & 6 SAGE 50 – Ch’s 7 & 8 SAGE 50 – Review for Exam and Catch Up SAGE Simulation Exam with Questions THIS SCHEDULE SUBJECT TO CHANGE ASSIGNMENTS P1-1A,P1-2A,P1-4A E2-9,P2-1A,P2-2A,P2-3A,P2-5A BYP 2-7 E3-5,P3-1A,P3-2A,P3-3A E4-7,E4-9,P4-1A BYP 3-7 E5-9,E5-10,P5-1A,P5-4A P6-1A,P6-3A,P6-8A, BYP 6-7 P7-4A E8-4,P8-4A P9-1A,P9-4A E10-10,P10-3A BYP 10-7 Ex’s 1-2, 2-2 Ex’s 3-1, 3-2, 4-2 Ex’s 5-2, 6-2 Ex 8-2