Another Opportunity for Extra Credit

advertisement

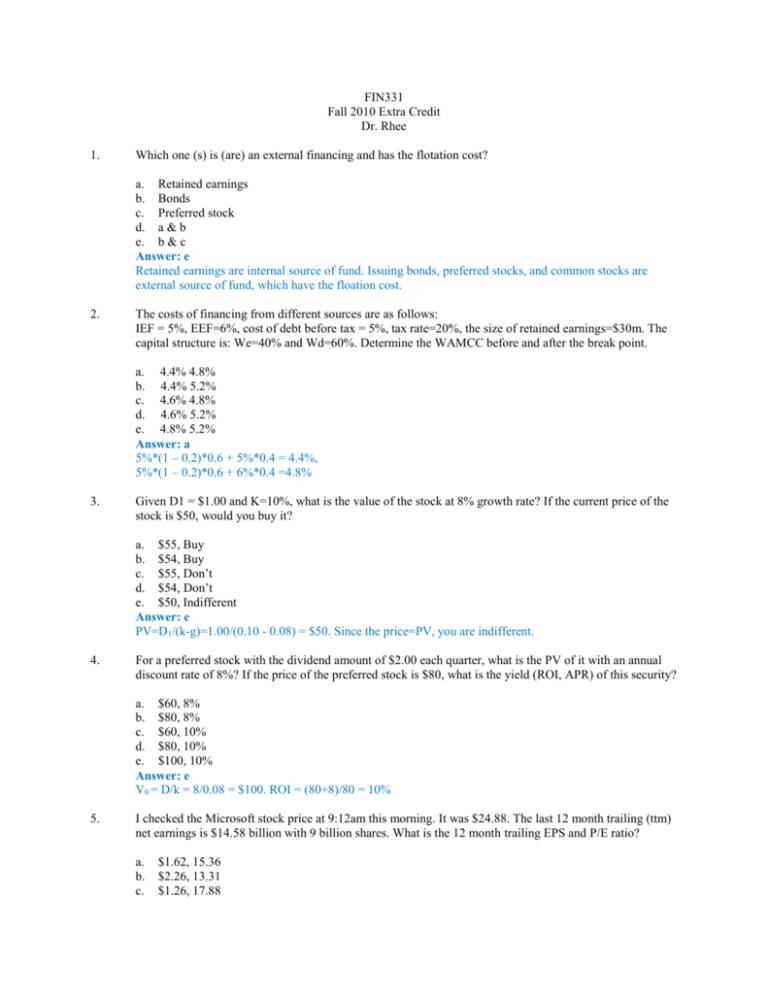

FIN331 Fall 2010 Extra Credit Dr. Rhee 1. Which one (s) is (are) an external financing and has the flotation cost? a. Retained earnings b. Bonds c. Preferred stock d. a & b e. b & c Answer: e Retained earnings are internal source of fund. Issuing bonds, preferred stocks, and common stocks are external source of fund, which have the floation cost. 2. The costs of financing from different sources are as follows: IEF = 5%, EEF=6%, cost of debt before tax = 5%, tax rate=20%, the size of retained earnings=$30m. The capital structure is: We=40% and Wd=60%. Determine the WAMCC before and after the break point. a. 4.4% 4.8% b. 4.4% 5.2% c. 4.6% 4.8% d. 4.6% 5.2% e. 4.8% 5.2% Answer: a 5%*(1 – 0.2)*0.6 + 5%*0.4 = 4.4%, 5%*(1 – 0.2)*0.6 + 6%*0.4 =4.8% 3. Given D1 = $1.00 and K=10%, what is the value of the stock at 8% growth rate? If the current price of the stock is $50, would you buy it? a. $55, Buy b. $54, Buy c. $55, Don’t d. $54, Don’t e. $50, Indifferent Answer: e PV=D1/(k-g)=1.00/(0.10 - 0.08) = $50. Since the price=PV, you are indifferent. 4. For a preferred stock with the dividend amount of $2.00 each quarter, what is the PV of it with an annual discount rate of 8%? If the price of the preferred stock is $80, what is the yield (ROI, APR) of this security? a. $60, 8% b. $80, 8% c. $60, 10% d. $80, 10% e. $100, 10% Answer: e V0 = D/k = 8/0.08 = $100. ROI = (80+8)/80 = 10% 5. I checked the Microsoft stock price at 9:12am this morning. It was $24.88. The last 12 month trailing (ttm) net earnings is $14.58 billion with 9 billion shares. What is the 12 month trailing EPS and P/E ratio? a. b. c. $1.62, 15.36 $2.26, 13.31 $1.26, 17.88 d. $2.32, 12.21 e. $1.18, 20.33 Answer: a EPS = NE/Shares Outstanding = $14.58/9 = $1.62 P/E = Price per share/Earnings per share = $24.88/$1.62 = 15.36 6. For a common stock with the current dividend amount of = $.70 (Do = .70), what is the (P)V of it with an annual discount rate of 12% and the dividend is expected to grow at the rate of 10% per annum forever? a. $33.5 b. $35.0 c. $38.5 d. $45.0 e. $37.5 Answer: c V0 = D1 / (k-g) = (0.70* 1.1)/(0.12-0.10) = 38.5 7. The preemptive right is important to shareholders because it a. allows managers to buy additional shares below the current market price. b. will result in higher dividends per share. c. is included in every corporate charter. d. protects the current shareholders against a dilution of their ownership interests. e. protects bondholders, and thus enables the firm to issue debt with a relatively low interest rate. Answer: d 8. Which of the following statements is CORRECT? a. The constant growth model takes into consideration the capital gains investors expect to earn on a stock. b. Two firms with the same expected dividend and growth rate must also have the same stock price. c. It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant. d. If a stock has a required rate of return rs = 12%, and if its dividend is expected to grow at a constant rate of 5%, this implies that the stock’s dividend yield is also 5%. e. The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. Answer: a Statement a is true, because the expected growth rate is also the expected capital gains yield. All the other statements are false. 9. The Francis Company is expected to pay a dividend of D1 = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 1.15, the market risk premium is 5.50%, and the risk-free rate is 4.00%. What is the company's current stock price? a. $28.90 b. $29.62 c. $30.36 d. $31.12 e. $31.90 Answer: a D1 b rRF RPM $1.25 1.15 4.00% 5.50% g rs = rRF + b(RPM) = P0 = D1/(rs − g) 10. 6.00% 10.33% $28.90 Goode Inc.'s stock has a required rate of return of 11.50%, and it sells for $25.00 per share. Goode's dividend is expected to grow at a constant rate of 7.00%. What was the last dividend, D0? a. $0.95 b. $1.05 c. $1.16 d. $1.27 e. $1.40 Answer: b Stock price Required return Growth rate P0 = D1/(rs − g), so D1 = P0(rs − g) = Last dividend = D0 = D1/(1 + g) 11. You must estimate the intrinsic value of Noe Technologies’ stock. The end-of-year free cash flow (FCF1) is expected to be $27.50 million, and it is expected to grow at a constant rate of 7.0% a year thereafter. The company’s WACC is 10.0%, it has $125.0 million of long-term debt plus preferred stock outstanding, and there are 15.0 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock? a. $48.64 b. $50.67 c. $52.78 d. $54.89 e. $57.08 Answer: c FCF1 Constant growth rate WACC Debt & preferred stock Shares outstanding Total firm value = FCF1/(WACC − g) = Less: Value of debt & preferred Value of equity Number of shares Value per share = Equity value/Shares = 12. $25.00 11.50% 7.00% $1.1250 $1.05 $27.50 7.0% 10.0% $125 15 $916.67 -$125.00 $791.67 15 $52.78 Carter's preferred stock pays a dividend of $1.00 per quarter. If the price of the stock is $45.00, what is its nominal (not effective) annual rate of return? a. 8.03% b. 8.24% c. 8.45% d. 8.67% e. 8.89% Answer: e Pref. quarterly dividend Annual dividend = Qtrly dividend × 4 = Preferred stock price Nom. required return = Annual dividend/Price = $1.00 $4.00 $45.00 8.89% 13. Capital structure refers to a. The types of projects a firm invests in. b. The mixture of short-term and long-term debt. c. The amount of debt and equity a firm has d. Short-term assets and short-term liabilities. e. The size, timing, and risk Answer: c 14. Which of the following statements is CORRECT? a. When calculating the cost of debt, a company needs to adjust for taxes, because interest payments are deductible by the paying corporation. b. When calculating the cost of preferred stock, companies must adjust for taxes, because dividends paid on preferred stock are deductible by the paying corporation. c. Because of tax effects, an increase in the risk-free rate will have a greater effect on the after-tax cost of debt than on the cost of common stock as measured by the CAPM. d. If a company’s beta increases, this will increase the cost of equity used to calculate the WACC, but only if the company does not have enough retained earnings to take care of its equity financing and hence must issue new stock. e. Higher flotation costs reduce investors' expected returns, and that leads to a reduction in a company’s WACC. Answer: a Statement “a” is true, because interest payments on debt are tax deductible. The other statements are false. 15. What is the % of total financing by equity if the total $12m funding include $7.5m from debt? a. 35% b. 37.5% c. 46.5% d. 50% e. 62.5% Answer: b Component of capital: (LT)debt, PFD stocks, and Common Equity. Therefore (12-7.5)/12 = 37.5% 16. The amount of retained earnings limit the size of internal equity financing. If the amount of retained earnings is $25m, where do you have a switch from the internal to external equity financing in terms of the size of the total funding when the equity financing accounts for 25% of the total funding and the remaining is from debt? a. $150m b. $100m c. $180m d. $130m e. $150m Answer: b 25m/.25=$100m 17. Long-term debt of Topstone Industries is currently selling for $1,045. Its face value is $1,000. The issue matures in 10 years and pays an annual coupon of 8% of face. What is the before-tax cost of debt for Topstone if the company is in 30% tax bracket? a. b. c. d. 6.75% 7.35% 6.85% 7.45% e. 8.35% Answer: b Find YTM. N=10, PV=-1045, PMT=80, FV=1000 => I/Y= 7.35% 18. Several years ago the Jakob Company sold a $1,000 par value, noncallable bond that now has 20 years to maturity and a 7.00% annual coupon that is paid semiannually. The bond currently sells for $925, and the company’s tax rate is 40%. What is the component cost of debt for use in the WACC calculation? a. 4.28% b. 4.46% c. 4.65% d. 4.83% e. 5.03% Answer: c Coupon rate Periods/year Maturity (yr) Bond price Par value Tax rate 7.00% 2 20 $925.00 $1,000 40% Calculator inputs: N = 2 × 20 PV = Bond's price PMT = Coupon rate × Par/2 FV = Par = Maturity value I/YR Times periods/yr = before-tax cost of debt = After-tax cost of debt (A-T rd) for use in WACC 19. 4.65% Weaver Chocolate Co. expects to earn $3.50 per share during the current year, its expected dividend payout ratio is 65%, its expected constant dividend growth rate is 6.0%, and its common stock currently sells for $32.50 per share. New stock can be sold to the public at the current price, but a flotation cost of 5% would be incurred. What would be the cost of equity from new common stock? a. 12.70% b. 13.37% c. 14.04% d. 14.74% e. 15.48% Answer: b Expected EPS1 Payout ratio Expected dividend, D1 = EPS × Payout Current stock price g F 20. 40 -$925.00 $35 $1,000 3.87% 7.74% $3.50 65% $2.275 $32.50 6.00% 5.00% re = D1/(P0 × (1 − F)) + g 13.37% Which of the following statements is CORRECT? a. b. c. d. A change in a company’s target capital structure cannot affect its WACC. WACC calculations should be based on the before-tax costs of all the individual capital components. Flotation costs associated with issuing new common stock normally reduce the WACC. If a company’s tax rate increases, then, all else equal, its weighted average cost of capital will decline. e. An increase in the risk-free rate will normally lower the marginal costs of both debt and equity financing. Answer: d Statement d is true, because the cost of debt for WACC purposes = r d(1 − T), so if T increases, then rd(1 − T) declines. 21. Which of the following statements is CORRECT? The WACC as used in capital budgeting is an estimate of a company’s before-tax cost of capital. The percentage flotation cost associated with issuing new common equity is typically smaller than the flotation cost for new debt. c. The WACC as used in capital budgeting is an estimate of the cost of all the capital a company has raised to acquire its assets. d. There is an “opportunity cost” associated with using retained earnings, hence they are not “free.” e. The WACC as used in capital budgeting would be simply the after-tax cost of debt if the firm plans to use only debt to finance its capital budget during the coming year. Answer: d a. b. 22. Rivoli Inc. hired you as a consultant to help estimate its cost of capital. You have been provided with the following data: D0 = $0.80; P0 = $22.50; and g = 8.00% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? a. 10.69% b. 11.25% c. 11.84% d. 12.43% e. 13.05% Answer: c D0 P0 g D1 = D0 × (1 + g) rs = D1/P0 + g 23. $0.80 $22.50 8.00% $0.864 11.84% Keys Printing plans to issue a $1,000 par value, 20-year noncallable bond with a 7.00% annual coupon, paid semiannually. The company's marginal tax rate is 40.00%, but Congress is considering a change in the corporate tax rate to 30.00%. By how much would the component cost of debt used to calculate the WACC change if the new tax rate was adopted? a. 0.57% b. 0.63% c. 0.70% d. 0.77% e. 0.85% Answer: c Coupon rate Periods/year Maturity (yr) Bond price = Par value Old and New tax rates Calculator inputs: N = 2 × 20 PV = Bond's price Tax Rate Old rate, 40% New rate 7.00% 7.00% 2 2 20 20 $1,000.00 $1,000.00 40% 30% 40 -$1,000.00 40 -$1,000.00 PMT = Coupon rate × Par/2 FV = Par = Maturity value I/YR Times periods/yr = before-tax cost of debt = After-tax cost of debt (A-T rd) for use in WACC Difference = Cost at new rate − Cost at old rate = 24. $35.00 -$1,000 3.50% 7.00% 4.20% 0.70% $35 -$1,000 3.50% 7.00% 4.90% S. Bouchard and Company hired you as a consultant to help estimate its cost of capital. You have obtained the following data: D0 = $0.85; P0 = $22.00; and g = 6.00% (constant). The CEO thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $40.00. Based on the DCF approach, by how much would the cost of equity from retained earnings change if the stock price changes as the CEO expects? a. -1.49% b. -1.66% c. -1.84% d. -2.03% e. -2.23% Answer: c D0 P0 g D1 = D0 × (1 + g) rs = D1/P0 + g Difference, rs0 − rs1 25. Old Price $0.85 $22.00 6.00% $0.901 10.10% -1.84% New Price $0.85 $40.00 6.00% $0.901 8.25% Sapp Trucking’s balance sheet shows a total of noncallable $45 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. This debt currently has a market value of $50 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. The current stock price is $22.50 per share; stockholders' required return, r s, is 14.00%; and the firm's tax rate is 40%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between these two WACCs? a. 1.55% b. 1.72% c. 1.91% d. 2.13% e. 2.36% Answer: e P0 Shares outstanding (millions) bond coupon rate (not used) YTM = rd rs Tax rate BV debt (millions) BV equity (millions) MV debt (millions) MV equity (millions) = # sh × P0 = AT cost of debt = rd(1−T) $22.50 10 7.00% 6.00% 14.00% 40% $45.00 $65.00 $50.00 $225.00 3.60% Book value weights-WRONG!!! Capital Weights Cost rates Product Debt $45.00 40.91% 3.60% 1.47% Equity $65.00 59.09% 14.00% 8.27% Total $110.00 100.00% WACC = 9.75% Market value weights--RIGHT!!! Capital Weights Cost rates Product Debt $50.00 18.18% 3.60% 0.65% Equity $225.00 81.82% 14.00% 11.45% Total $275.00 100.00%WACC = 12.11% Difference = 2.36% 26. What would you do for capital budgeting if you have limited resources? a. Focus on the projects the firm has already invested in b. Reduce short-term and long-term debt. c. Rank good looking projects and choose from the most “profitable” ones d. evaluate to determine good projects e. Determine the size, timing, and risk of a firm's future cash flows. Answer: c 27. What is the decision rule for IRR? a. Accept a project when IRR > 0 b. Accept a project if at the IRR the NPV is positive c. Reject any project if the IRR is below 10% d. Accept a project if the IRR exceeds the firm's bank borrowing rate e. Accept a project if the IRR exceeds the firm's required rate of return Answer: e 28. What is the % of total financing by common equity if the total $12m funding include $7.5m from debt assuming no preferred stocks are used? a. 35% b. 37.5% c. 46.5% d. 50% e. 62.5% Answer: b IRR decision rule: accept when IRR > WAMCC 29. You have only three investment opportunities as follows: Project A with 5% return, Project B with 7% return, Project C with 9% return. What should be the required rate of return when you consider for Project B? a. 5% b. 7% c. 9% d. 12% e. 14% Answer: a To accept B, required return should be less than the expected return of C, and higher or equal to the expected return of A 30. Lasik Vision Inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. Old WACC: 8.00% Year 0 Cash flows -$1,000 a. b. c. -$59.03 -$56.08 -$53.27 New WACC: 11.25% 1 2 $410 $410 3 $410 d. -$50.61 e. -$48.08 Answer: a Old WACC: 8.00% Year Cash flows 0 -$1,000 New WACC: 11.25% 1 2 $410 $410 3 $410 Old NPV = $56.61 New NPV = -$2.42 Change = -$59.03 31. Hindelang Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected. WACC: 12.25% Year Cash flows 0 -$850 1 $300 2 $320 3 $340 4 $360 0 -$850 1 $300 $424.31 2 $320 $403.20 3 $340 $381.65 4 $360 $360.00 a. 13.42% b. 14.91% c. 16.56% d. 18.22% e. 20.04% Answer: c WACC: 12.25% Year Cash flows Compounded values TV = Sum of comp'ed inflows: $1,569.16 MIRR = 16.56% Found as discount rate that equates PV of TV to cost, discounted back 4 years @ WACC MIRR = 16.56% Alternative calculation, using Excel's MIRR function 32. Stern Associates is considering a project that has the following cash flow data. What is the project's payback? Year Cash flows a. 2.31 years b. 2.56 years c. 2.85 years d. 3.16 years e. 3.52 years Answer: e Year Cash flows Cumulative CF Payback = 3.52 0 -$1,100 1 $300 2 $310 3 $320 4 $330 5 $340 0 -$1,100 -$1,100 1 $300 -$800 2 $310 -$490 3 $320 -$170 4 $330 $160 5 $340 $500 33. Which of the following statements is CORRECT? An NPV profile graph shows how a project’s payback varies as the cost of capital changes. The NPV profile graph for a normal project will generally have a positive (upward) slope as the life of the project increases. c. An NPV profile graph is designed to give decision makers an idea about how a project’s risk varies with its life. d. An NPV profile graph is designed to give decision makers an idea about how a project’s contribution to the firm’s value varies with the cost of capital. e. We cannot draw a project’s NPV profile unless we know the appropriate WACC for use in evaluating the project’s NPV. Answer: d a. b. 34. Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. A project’s NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV. b. The higher the WACC used to calculate the NPV, the lower the calculated NPV will be. c. If a project’s NPV is greater than zero, then its IRR must be less than the WACC. d. If a project’s NPV is greater than zero, then its IRR must be less than zero. e. The NPVs of relatively risky projects should be found using relatively low WACCs. Answer: b Datta Computer Systems is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. a. 35. Year Cash flows 0 -$1,100 1 $450 2 $470 3 $490 a. 9.70% b. 10.78% c. 11.98% d. 13.31% e. 14.64% Answer: d Year Cash flows 0 -$1,100 1 $450 2 $470 3 $490 IRR = 13.31% 36. Masulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.00% Year Cash flows 0 -$950 1 $525 2 $485 3 $445 4 $405 a. 1.61 years b. 1.79 years c. 1.99 years d. 2.22 years e. 2.44 years Answer: d WACC: 10.00% Year 0 1 2 3 4 Cash flows PV of CFs Cumulative CF Payback = 2.22 37. -$950 -$950 -$950 - $525 $477 -$473 - $485 $401 -$72 - $445 $334 $262 2.22 $405 $277 $539 - Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost. WACC: 7.50% Year CFS CFL 0 -$1,100 -$2,700 1 $550 $650 2 $600 $725 3 $100 $800 4 $100 $1,400 a. $138.10 b. $149.21 c. $160.31 d. $171.42 e. $182.52 Answer: a First, recognize that NPV makes theoretically correct capital budgeting decisions, so the highest NPV tells us how much value could be added. We calculate the two projects' NPVs, IRRs, and MIRRs, but the MIRR information is not needed for this problem. We then see what NPV would result if the decision were based on the IRR (and the MIRR). The difference between the NPV is the loss incurred if the IRR criterion is used. Of course, it's possible that IRR could choose the correct project. WACC: 7.5000% Year CFS Compounded CFs: CFL Compounded CFs: 0 -$1,100 -$2,700 MIRR, L = 9.67% MIRR, S = 9.55% MIRR Choice: L NPV using MIRR: $224.31 1 $550 673.77 $650 796.28 3 $100 107.00 $800 856.00 IRR, L = 10.71181% IRR, S = 12.24157% IRR Choice: S NPV using IRR: $86.20 Lost value using IRR versus MIRR: $138.10 Lost value using MIRR versus NPV: $0.00 Lost value using IRR versus NPV: $138.10 38. 2 $600 686.94 $725 830.05 4 TV MIRR $100 100.00 $1,567.71 9.5469% $1,400 1400.00 $3,882.33 9.6663% NPV, L = $224.3065 NPV, S = $86.2036 NPV Choice: L NPV using NPV: $224.31 Loss below: 7.9850% Loss below: 10.1638% Loss below: 10.1638% Yonan Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. WACC: 10.25% Year CFS CFL a. $24.14 0 -$950 -$2,100 1 $500 $400 2 $800 $800 3 $0 $800 4 $0 $1,000 b. $26.82 c. $29.80 d. $33.11 e. $36.42 Answer: d WACC: 10.250% Year CFS CFL Cumulative CF, S Cumulative CF, L Payback S = 1.56 Payback L = 3.10 NPV, L = NPV, S = Value lost 39. 0 -$950 -$2,100 -$950 -$2,100 - Crossover = 11.093% 1 2 $500 $800 $400 $800 -$450 $350 -$1,700 -$900 1.56 - 3 $0 $800 $350 -$100 - 4 $0 $1,000 $350 $900 3.10 $194.79 $161.68 $33.11 A company is considering a new project. The CFO plans to calculate the project’s NPV by estimating the relevant cash flows for each year of the project’s life (i.e., the initial investment cost, the annual operating cash flows, and the terminal cash flow), then discounting those cash flows at the company’s overall WACC. Which one of the following factors should the CFO be sure to INCLUDE in the cash flows when estimating the relevant cash flows? a. b. c. All sunk costs that have been incurred relating to the project. All interest expenses on debt used to help finance the project. The investment in working capital required to operate the project, even if that investment will be recovered at the end of the project’s life. d. Sunk costs that have been incurred relating to the project, but only if those costs were incurred prior to the current year. e. Effects of the project on other divisions of the firm, but only if those effects lower the project’s own direct cash flows. Answer: c 40. Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product? a. Using some of the firm's high-quality factory floor space that is currently unused to produce the proposed new product. This space could be used for other products if it is not used for the project under consideration. b. Revenues from an existing product would be lost as a result of customers switching to the new product. c. Shipping and installation costs associated with a machine that would be used to produce the new product. d. The cost of a study relating to the market for the new product that was completed last year. The results of this research were positive, and they led to the tentative decision to go ahead with the new product. The cost of the research was incurred and expensed for tax purposes last year. e. It is learned that land the company owns and would use for the new project, if it is accepted, could be sold to another firm. Answer: d 41. A company is considering a proposed new plant that would increase productive capacity. Which of the following statements is CORRECT? a. In calculating the project's operating cash flows, the firm should not deduct financing costs such as interest expense, because financing costs are accounted for by discounting at the WACC. If interest were deducted when estimating cash flows, this would, in effect, “double count” it. b. Since depreciation is a non-cash expense, the firm does not need to deal with depreciation when calculating the operating cash flows. c. When estimating the project’s operating cash flows, it is important to include both opportunity costs and sunk costs, but the firm should ignore the cash flow effects of externalities since they are accounted for in the discounting process. d. Capital budgeting decisions should be based on before-tax cash flows. e. The WACC used to discount cash flows in a capital budgeting analysis should be calculated on a before-tax basis. Answer: a 42. Fool Proof Software is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, and the allowed depreciation rates for such property are 33%, 45%, 15%, and 7% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected life. What is the Year 1 cash flow? Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. deprec.) Tax rate a. $30,258 b. $31,770 c. $33,359 d. $35,027 e. $36,778 Answer: a Equipment cost Depreciation rate Sales revenues − Operating costs (excl. deprec.) − Depreciation Operating income (EBIT) − Taxes Rate = 35% After-tax EBIT + Depreciation Cash flow, Year 1 43. $65,000 $60,000 $25,000 35.0% $65,000 33.0% $60,000 25,000 21,450 $13,550 4,743 $ 8,808 21,450 $30,258 Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Risk-adjusted WACC Net investment cost (depreciable basis) Straight-line deprec. rate Sales revenues, each year Operating costs (excl. deprec.), each year Tax rate a. b. c. $15,740 $16,569 $17,441 10.0% $65,000 33.3333% $65,500 $25,000 35.0% d. $18,359 e. $19,325 Answer: e WACC 10.0% Investment cost Sales revenues − Operating costs (excl. deprec.) − Depreciation rate = 33.333% Operating income (EBIT) − Taxes Rate = 35% After-tax EBIT + Depreciation Cash flow Years 0 -$65,000 -$65,000 NPV 44. 1 2 $65,500 $65,500 25,000 25,000 21,667 21,667 $18,833 $18,833 6,592 6,592 $12,242 $12,242 21,667 21,667 $33,908 $33,908 $19,325 3 $65,500 25,000 21,667 $18,833 6,592 $12,242 21,667 $33,908 Liberty Services is now at the end of the final year of a project. The equipment originally cost $22,500, of which 75% has been depreciated. The firm can sell the used equipment today for $6,000, and its tax rate is 40%. What is the equipment’s after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value, the firm will receive a tax credit as a result of the sale. a. $5,558 b. $5,850 c. $6,143 d. $6,450 e. $6,772 Answer: b % depreciated on equip. Tax rate 75% 40% Equipment cost $22,500 − Accumulated deprec. 16,875 Current book value of equipment $ 5,625 Market value of equipment 6,000 Gain (or loss): Market value − Book value $ 375 Taxes paid on gain (−) or credited (+) on loss -150 AT salvage value = market value +/− taxes $ 5,850 45. Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33%, 45%, 15%, and 7% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10year expected operating life. What is the project's Year 4 cash flow? Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. deprec.) Tax rate a. $11,814 b. $12,436 c. $13,090 d. $13,745 e. $14,432 Answer: c Equipment cost Depreciation rate, Year 4 $70,000 $42,500 $25,000 35.0% $70,000 7.0% Sales revenues − Operating costs (excl. deprec.) − Depreciation Operating income (EBIT) − Taxes Rate = 35% After-tax EBIT + Depreciation Cash flow, Year 4 $42,500 25,000 4,900 $12,600 4,410 $ 8,190 4,900 $13,090 46. A firm is considering a new project whose risk is greater than the risk of the firm’s average project, based on all methods for assessing risk. In evaluating this project, it would be reasonable for management to do which of the following? a. Increase the estimated IRR of the project to reflect its greater risk. b. Increase the estimated NPV of the project to reflect its greater risk. c. Reject the project, since its acceptance would increase the firm’s risk. d. Ignore the risk differential if the project would amount to only a small fraction of the firm’s total assets. e. Increase the cost of capital used to evaluate the project to reflect its higher-than-average risk. Answer: e 47. Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects: Project A B C D E Risk High Average High Low Low Expected Return 15% 12% 11% 9% 6% Which set of projects would maximize shareholder wealth? a. A and B. b. A, B, and C. c. A, B, and D. d. A, B, C, and D. e. A, B, C, D, and E. Answer: c Statement c is true; the others are false. The following table shows the required return for each project on the basis of its risk level. Project A B C D E 48. Risk High Average High Low Low Expected Return 15% 12% 11% 9% 6% Req'd return for this risk 12% 10% 12% 8% 8% Decision accept accept reject accept reject As a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a proposed project with the following data. What is the Year 1 cash flow? Sales revenues, each year $42,500 Depreciation Other operating costs Interest expense Tax rate $10,000 $17,000 $4,000 35.0% a. $16,351 b. $17,212 c. $18,118 d. $19,071 e. $20,075 Answer: e This problem is a bit harder than some of the earlier ones because it provides information on interest, and some students might incorrectly include it as an input. We like this wrinkle because it's important for students to know not to include financing costs in the cash flows. Sales revenues − Operating costs (excl. deprec.) − Depreciation Operating income (EBIT) − Taxes Rate = 35% After-tax EBIT + Depreciation Cash flow, Year 1 49. $42,500 17,000 10,000 $15,500 5,425 $10,075 10,000 $20,075 Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4? Year 1 2 3 4 5 6 a. b. c. d. e. Depreciation Rate 0.20 0.32 0.19 0.12 0.11 0.06 $8,878 $9,345 $9,837 $10,355 $10,900 Answer: e Year 1 2 3 4 5 6 Gross sales proceeds Book value, end of Year 4 Deprec. Rate 0.20 0.32 0.19 0.12 0.11 0.06 1.00 Basis $50,000 50,000 50,000 50,000 50,000 50,000 $12,500 8,500 Annual Deprec. $10,000 16,000 9,500 6,000 5,500 3,000 $50,000 Year-end Book Value $40,000 24,000 14,500 8,500 3,000 0 Profit Tax on profit Rate = 40% AT salvage value = market value +/− taxes 50. $ 4,000 1,600 $10,900 TexMex Food Company is considering a new salsa whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other TexMex products and would reduce their pre-tax annual cash flows. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.) WACC Pre-tax cash flow reduction for other products (cannibalization) Investment cost (depreciable basis) Straight-line deprec. rate Sales revenues, each year for 3 years Annual operating costs (excl. deprec.) Tax rate 10.0% -$5,000 $80,000 33.333% $67,500 -$25,000 35.0% a. $3,636 b. $3,828 c. $4,019 d. $4,220 e. $4,431 Answer: b Investment (Basis) WACC = 10% Sales revenues − Cannibalization cost − Operating costs (excl. deprec.) − Basis x rate = deprec. Rate = 33.33% Operating income (EBIT) − Taxes Rate = 35% After-tax EBIT + Depreciation Cash flow NPV $3,828 t=0 $80,000 -$80,000 t=1 $67,500 -5,000 -25,000 -26,667 $10,833 -3,792 $ 7,042 26,667 $33,708 t=2 $67,500 -5,000 -25,000 -26,667 $10,833 -3,792 $ 7,042 26,667 $33,708 t=3 $67,500 -5,000 -25,000 -26,667 $10,833 -3,792 $ 7,042 26,667 $33,708