Third quarter Form 10Q

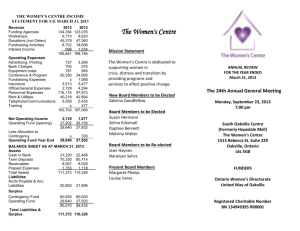

advertisement