2014-15 Catastrophic Reimbursement FAQs

advertisement

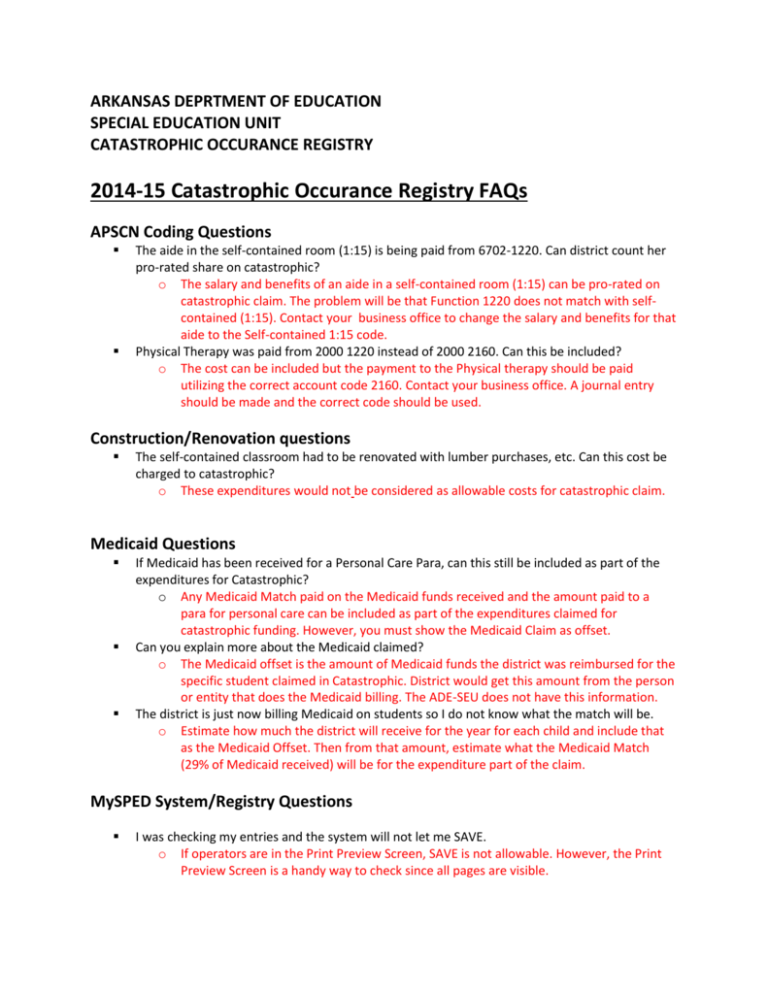

ARKANSAS DEPRTMENT OF EDUCATION SPECIAL EDUCATION UNIT CATASTROPHIC OCCURANCE REGISTRY 2014-15 Catastrophic Occurance Registry FAQs APSCN Coding Questions The aide in the self-contained room (1:15) is being paid from 6702-1220. Can district count her pro-rated share on catastrophic? o The salary and benefits of an aide in a self-contained room (1:15) can be pro-rated on catastrophic claim. The problem will be that Function 1220 does not match with selfcontained (1:15). Contact your business office to change the salary and benefits for that aide to the Self-contained 1:15 code. Physical Therapy was paid from 2000 1220 instead of 2000 2160. Can this be included? o The cost can be included but the payment to the Physical therapy should be paid utilizing the correct account code 2160. Contact your business office. A journal entry should be made and the correct code should be used. Construction/Renovation questions The self-contained classroom had to be renovated with lumber purchases, etc. Can this cost be charged to catastrophic? o These expenditures would not be considered as allowable costs for catastrophic claim. Medicaid Questions If Medicaid has been received for a Personal Care Para, can this still be included as part of the expenditures for Catastrophic? o Any Medicaid Match paid on the Medicaid funds received and the amount paid to a para for personal care can be included as part of the expenditures claimed for catastrophic funding. However, you must show the Medicaid Claim as offset. Can you explain more about the Medicaid claimed? o The Medicaid offset is the amount of Medicaid funds the district was reimbursed for the specific student claimed in Catastrophic. District would get this amount from the person or entity that does the Medicaid billing. The ADE-SEU does not have this information. The district is just now billing Medicaid on students so I do not know what the match will be. o Estimate how much the district will receive for the year for each child and include that as the Medicaid Offset. Then from that amount, estimate what the Medicaid Match (29% of Medicaid received) will be for the expenditure part of the claim. MySPED System/Registry Questions I was checking my entries and the system will not let me SAVE. o If operators are in the Print Preview Screen, SAVE is not allowable. However, the Print Preview Screen is a handy way to check since all pages are visible. The district is applying for catastrophic funds for 4 students in a private day school. District pays for this under a purchased service code. On the registry for Catastrophic Funding under the name, do we place “XXXX Day School” under Other Costs? What about Bus Driver? o Yes the private day treatment would belong under Other Costs. . If there is a pro-rata share for a bus driver, it would go under the Related Services section, in row J. The explanation and calculation of the driver’s pro-rata share would be in the comment box on that page. The district pays a parent to transport their child to and from a day treatment facility. District pays for mileage and a daily rate of $30 for time. Is this an allowable expense for Catastrophic? o This is an allowable expense. Be sure to explain the situation in the comment box when entered in the system. Is it a problem if student totals entered into the MySPED system are not yet over the $15,000 mark by the February 2 deadline? o Districts can enter students with as much information as possible by February 2, even if the totals do not reach $15,000. Where do I put speech therapy if it is a purchased service? o Speech Therapy can be included in either the Instruction section (line b) or Related Service (line a), but not likely in both. Staff Questions Can a district request reimbursement for a nurse or para paid through ARMAC 6752? Yes, if established in the IEPs. Can a district request reimbursement for an interpreter who is assigned to a resource student? Yes, if written in the IEP. How do I claim a Para when she is assigned to a number of students? o A district can only claim the pro-rata share of the para serving the student being claimed in Catastrophic. The IEP should specify how much time the para is serving the student directly (eg. One to one all day, 3 hrs per day, 70 minutes per day while in pull-outs, etc.). For example, maybe the para spends four hours per day with the student filing for Catastrophic claim (per IEP) and then spends one hour each with two other students each day. Please refer to the IEP and the IEP should be specific as to time and/or services. The aide in the self-contained room (1:15) is being paid from 6702-1220. Can district count her pro-rated share on catastrophic? o The salary and benefits of an aide in a self-contained room (1:15) can be pro-rated on catatrophic claim. The problem will be that Function 1220 does not match with selfcontained (1:15). Contact your business office to change the salary and benefits for that aide to the Self-contained 1:15 code. The district has a 1:6 CBI medically fragile classroom. There are 4 paras in the class that all support the 6 students. There is not one particular para assigned to any one student. All 6 receive personal care. What can I claim? o The first thing is that a para is required for a 1:6 class so one of the para’s salary/benefits cannot be counted. This person is part of the usual and customary staffing for that class configuration. For the remaining three paras, the pro-rata share of the salaries/benefits can only be claimed if the services are listed on specific student’s IEP. If this is so for all students in this class, take the amount of time shown on the IEP for that service and calculate how much that equates to the para’s(that is providing the service) compensation . EXAMPLE: If Student A received one hour of personal care services and that service is listed on the student’s IEP and Para X is the para in the class who generally provides this service, a district could potentially claim a proportionate share of Para X compensation. For personal care, Para X must have completed the required training in order for the district to bill Medicaid for the personal services and district must attempt to bill for these services. If all of this is in order, calculate the hourly compensation for para X (hourly breakdown including salary and benefits) and claim that hourly rate times one hour per day, times the total number of days in attendance. The teacher’s classroom is designated as a 1:15 classroom but she only has 11 students. Do I divide the teacher’s salary by 11 or 15? o Divide by the classroom configuration of 1:15. It does not matter how many seats are filled. Superintendent Certification Questions May I print the Superintendent’s Certification before all students are submitted in the system and have the Superintendent sign, then mail? o No. The Certification form has a list of all students entered in the Catastrophic Registry. It also lists beside each student name if the student claim was indeed submitted in the system. The Superintendent’s Certification should be signed only after all intended student claims have been submitted. Transportation Questions The district has 4 students that are bused out of town daily to and from a Day Treatment facility. Can we pro-rate the driver for catastrophic claim? o For the bus that the district provides to transport the four students to/from day school, a district may claim the pro-rata share of the driver’s compensation for that route (how much the driver is paid for the route hours divided by the total number of students on that bus route), IF specialized transportation is a service listed on those 4 students’ IEPs. Districts CANNOT claim the mileage cost of the bus, any fuel, maintenance or other customary expenses for running the bus.