ATUL TANWAR B.Com (H), ACA Contact No.9971737741

advertisement

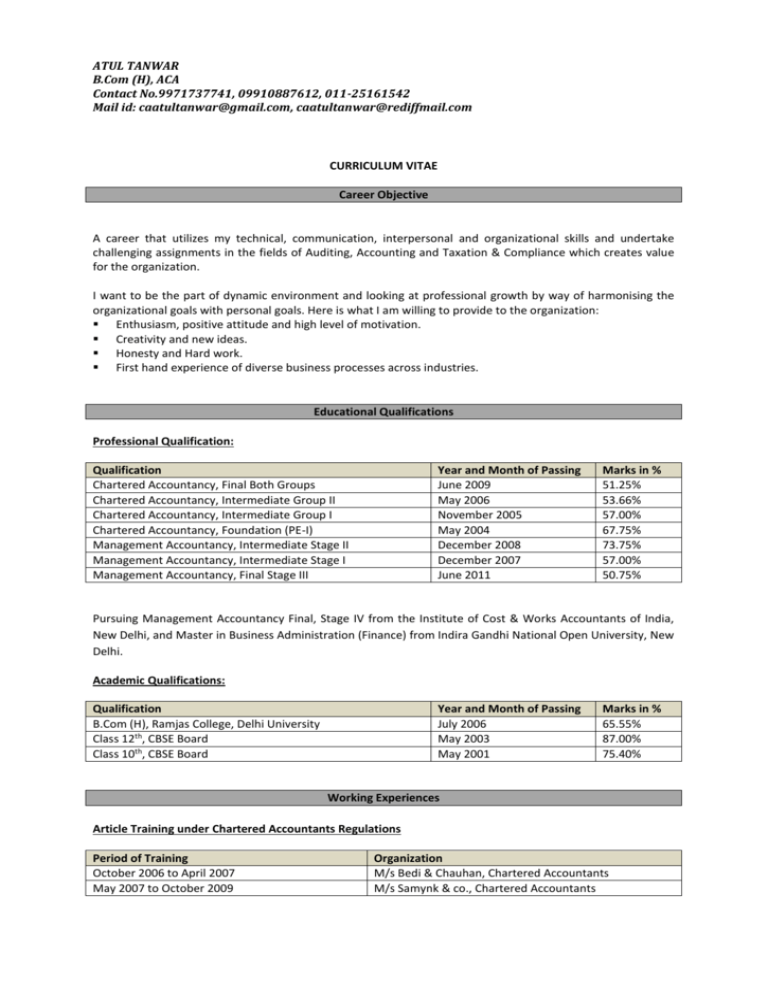

ATUL TANWAR B.Com (H), ACA Contact No.9971737741, 09910887612, 011-25161542 Mail id: caatultanwar@gmail.com, caatultanwar@rediffmail.com CURRICULUM VITAE Career Objective A career that utilizes my technical, communication, interpersonal and organizational skills and undertake challenging assignments in the fields of Auditing, Accounting and Taxation & Compliance which creates value for the organization. I want to be the part of dynamic environment and looking at professional growth by way of harmonising the organizational goals with personal goals. Here is what I am willing to provide to the organization: Enthusiasm, positive attitude and high level of motivation. Creativity and new ideas. Honesty and Hard work. First hand experience of diverse business processes across industries. Educational Qualifications Professional Qualification: Qualification Chartered Accountancy, Final Both Groups Chartered Accountancy, Intermediate Group II Chartered Accountancy, Intermediate Group I Chartered Accountancy, Foundation (PE-I) Management Accountancy, Intermediate Stage II Management Accountancy, Intermediate Stage I Management Accountancy, Final Stage III Year and Month of Passing June 2009 May 2006 November 2005 May 2004 December 2008 December 2007 June 2011 Marks in % 51.25% 53.66% 57.00% 67.75% 73.75% 57.00% 50.75% Pursuing Management Accountancy Final, Stage IV from the Institute of Cost & Works Accountants of India, New Delhi, and Master in Business Administration (Finance) from Indira Gandhi National Open University, New Delhi. Academic Qualifications: Qualification B.Com (H), Ramjas College, Delhi University Class 12th, CBSE Board Class 10th, CBSE Board Year and Month of Passing July 2006 May 2003 May 2001 Marks in % 65.55% 87.00% 75.40% Working Experiences Article Training under Chartered Accountants Regulations Period of Training October 2006 to April 2007 May 2007 to October 2009 Organization M/s Bedi & Chauhan, Chartered Accountants M/s Samynk & co., Chartered Accountants Area of Work Experience during Articles Audit & Assurance Taxation & Compliance Other Experiences Conducting Internal Audits, Statutory Audits, Concurrent Audits, Tax Audits, Stock Audits, special audit under Uttar Pradesh VAT Laws. Studying the client’s internal control system through audit process, discussing findings with the management and recommending appropriate corrective measures. Preparation of Audit programs, determining scope of audit work and delegation of work to team members. Preparation of various statements to be filed with Statutory Authorities such as Income Tax Returns, Service Tax Returns, TDS Returns, Sales Tax Return for Different states in India. Replying and complying with the requirements of various Taxation Departments including complying with notices, filing appeals etc. Preparation of various returns to be filed with the Ministry of Corporate Affairs such as annual returns of companies, filing of Balance Sheets and Profit & loss Accounts etc Attending regularly meeting & seminars on different subjects organized by Karol Bagh Westend CPE Study Circle of NIRC of the Institute of chartered Accountants of India. Attended workshops on VAT laws and Service Tax Laws organized by All India Chartered Accountants Society. Have been a part of Seminar Organizing Team for Karol Bagh Westend CPE Study Circle of the NIRC of the Institute of Chartered Accountants of India. Have attended The Course on General Management & Communication Skills conducted by The NIRC of The Institute of Chartered Accountants of India. Have undergone Computer Training for 250 Hours under Regulation 45 of The Chartered Accountants Regulation, 1988. Have done certificate course on Computing, Accounting and Finance at Intermediate level of Management Accountancy conducted by The NIRC of The Institute of Cost & Works Accountants of India. Have attended Group Discussion and Business Communication programs conducted by The Institute of Cost & Works Accountants of India. Brief about clients handled Audit & Assurance Taxation & Compliance Statutory Audits: Shree Agrasen Co-operative Urban Thrift & credit Society Limited, State bank of Bikaner & Jaipur, Chandigarh Branch, State Bank of Bikaner & Jaipur, Khari Baoli, New Delhi Branch, DV Packing Private Limited, Arrco Creations Private Limited, Sukhija Financial Service Private Limited, Hi-Tech Retail Marketing Private Limited. Internal Audit: NIRC of The Institute of chartered Accountants of India, Vindhya Telelinks Limited, Birla Ericsson Opticals Limited, Farsight Securities Limited, Asha Automobiles, Three N Products Private Limited under the brand name “Ayur Herbals”. Concurrent Audit: UCO Bank, Rajinder Nagar Branch, New Delhi, Oriental Bank of Commerce, Chandni Chowk Branch, New Delhi. Stock Audit & Physical Verification of Fixed assets: Hindustan Gums & Chemicals Limited, Bhiwani, Bentley Nevada, Three N Products Private Limited, under the brand name “Ayur Herbals”. Income Tax: Income Tax Returns and TDS Returns for Individuals, partnership firms and various companies. Sales Tax Laws: Sales Tax Returns for individuals, partnership firms, companies etc. VAT returns for Vindhya Telelinks Limited, Birla Ericsson Opticals Limited having business in almost 20 states in India. Service Tax Laws: Computation, deposition of Service Tax and filing of service Tax Returns with special consideration to latest CENVAT Credit Rules for Individuals, Partnership Firms, Companies, banks etc. Major Clients were the Bank of Nova Scotia, Professional Golf Tour of India. Excise Laws: Filing of Excise Returns for M/s Birla Ericsson Limited. ROC Compliance: DV Packing Private Limited, Arrco Creations Private Limited, Sukhija Financial Service Private Limited, Hi-Tech Retail Marketing Private Limited. Post Qualification Experience Presently working with M/s Galaxy Automobiles Private Limited under the trade name GALAXY TOYOTA, New Delhi, No. 1 Authorized Dealer in India for M/s Toyota Kirloskar Motors Private Limited from June 2010 till date under TSG, The Sachdev Group, with Group Companies M/s Harpreet Motors Private Limited under the Trade Name HARPREET FORD, M/s Charu Motors Private Limited under the Trade Name HANS HYUNDAI in New Delhi. Designated as Corporate Finance Executive, working as In-Charge Taxation & Compliance for the whole of The Sachdev Group. Key Areas of Responsibilities Core team member of the Corporate Planning Team headed by The General Manager-Finance of the Group. Compliance with all the taxation laws applicable to the Group, such as Income Tax Laws, Service Tax Laws, VAT Laws and Excise Laws including accounting, reconciliation, computation, deposition of different Taxes with the Government and filing of required returns and statements with the Government. Monitoring the whole of the accounting process for different types of transactions in the Group. Drafting Standard Operating Procedures for various operating and financial activities. Working with the Core Team drafting The Accounting & Compliance Manual for the Group. Coordinating with Internal Auditors and Statutory Auditors of the Group, solving their queries and suggesting alternate solutions to the problems. Handling departmental audits such as service tax audits, vat audits etc. Visiting different locations of the company and assisting staff members in accounting and compliance with various requirements, legal or otherwise. Educational Achievements Have been awarded the Prestigious “Indira Award” in the year 2001 for securing First Rank in Zone 16 in Delhi in 10th examinations. Have been awarded the Prestigious “K V Chandramouli Memorial Prize” for the Best Paper in Mathematics in Chartered Accountancy PE-I by the Institute of Chartered Accountants of India. Have been a consistent performer throughout my schoolings and have been awarded many awards for being a meritorious student. Computer Proficiency Knowledge of MS-Office i.e. MS-Word, MS-Excel and MS-Power point. Knowledge of Accounting packages such as Tally 4.5, Tally 5.4, Tally 6.3, Tally 7.0 and Tally 9. Good working knowledge of Internet as well. Knowledge of software like Zen-Spectrum, Zen-ROC for preparing Income Tax Returns, Service Tax Returns, TDS Returns and ROC Returns. Self Appraisal Honesty, dedication and willingness to walk an extra mile to achieve excellence. Strong will power to get the best possible results. Good team player, enjoy working in teams and if given an opportunity, can prove to be good team leader as well. Integrity Personal Information Father’s Name Sh. Vijender Singh Tanwar Date of Birth July 3rd, 1985 Residential Address WZ-45C, Rattan Park, Street No. 02, Near Ramesh Nagar Metro Station, New Delhi-110015. Nationality Indian Marital Status Single Languages Known Hindi, English ATUL TANWAR B.Com (H), ACA