3M swot

advertisement

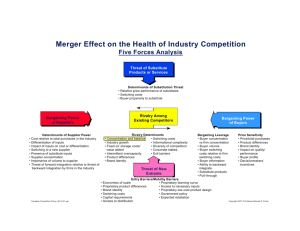

Section 3A: opportunities and threats in the specific environment High growth in global markets, Current Rivalry Opportunity: The current rivalry is the competition that 3M will face from other businesses in the same markets. Industry growth is a very important opportunity for 3M to keep rivalry low. Whenever the industry reaches it’s peak growing point the rivalry of competitors starts to increase dramatically. There can also be the situation where the industry never reaches its growing point and becomes obsolete completely. In either of these situations the increased stress level of competition between firms is a direct result of the lack of new markets to increase the corporations sales. There is an opportunity for 3M in the current rivalry sector of the five forces model because of the new markets that are available. Since there are still growing markets in the industry the company doesn’t face the rivalry pressures that it would in a market without growth. Growth is high in global markets such as China, Russia, Brazil, and Taiwan. These economies are forecasted to grow by 10% in the next seven years. 3M’s diversified product line provides opportunities for the company in most of the markets including the medical, housing, and electronic markets. Though the United States, England, and Japan have experienced some maturity in these same markets, 3M can expect to leverage it’s products in new markets that will make its business profitable. The medical segments of these markets are expected to grow from 17% in 2007 to 22% in 2020. (1) This is an ideal opportunity for 3M because of it’s large presence in the housing, and medical industry. This opportunity should also keep the stress level of competitors to a minimum. Low fixed costs, Current Rivalry Opportunity: Low fixed costs are another opportunity that 3M is able to take advantage of. Because of 3M’s conglomerate business model they produce many products creating economies of scale. For example 90 % of U.S. homes use tape that 3M manufacturers.(2) Because 3M manufacturers such widely used products the fixed costs are spread out over this mass number of merchandise. 3M also produces products such as optical lenses that are in most cameras today. Their mass production allows them to manufacture products at little cost. Major Entry Barriers, High Capital Requirements Opportunity: Barriers to entry are an important player in the five forces model because they also directly affect the level of competition in the industry of the company. A barrier to entry is any situation or instance that makes it difficult for another firm to enter the market and be successful. The threat of new entrants for 3M company is low. 3M possesses a high opportunity to dominate it’s markets because of the high capital requirements it creates to manufacture innovative products in each industry it competes in. For example the type of products that 3M manufactures in the medical industry require heavy capital spending in order to promote research and development. 3M spent $1,293 million in 2009 on research and development alone (3). If a firm does not have capital of this caliber it cannot enter the industry. They also require high expertise in each field due to the extremely refined subject matter. Often there is little room for error when dealing with products in the medical field. More money is spent as a direct result of these requirements. It costs more to hire top experts in the industry to ensure products are effective and differentiated enough to succeed. Major Entry Barriers, Government Policy Opportunity: FDA and SMDA regulation is another barrier to entry that creates and opportunity for 3M. This barrier is of medium importance because these if new companies want to enter the industry they have to comply with the safety standards provided. The FDA can recall products it thinks are at high risk, and it can also fine those who violate it standards. The Safe Medical Devices Act requires manufacturers to keep record of patients who have replacements and implanted devices. It also requires the manufacturer to provide a summary of accuracy and safety for each device that is manufactured. (3) This all creates a moderate barrier to entry for new firms because they have to make sure their products comply with these rules before they can be sold on the market. Bargaining Power of the Buyer, Differentiated Products Opportunity: The bargaining power of the buyer is the ability for customers to negotiate better prices in the market. The bargaining power of the buyer for 3M is low in most industries because of the innovative products that they make. For example 3M introduced the first electronic stethoscope with Bluetooth technology. A product that would be very hard for a buyer to duplicate due to its complicated structure and heavy capital requirements. 3M’s products cannot be manufactured by anyone else except for their innovative scientists and research team. This is a high opportunity for 3M because it increases their leverage in the market and lowers the buying power of their customers because they depend on such innovative items. These innovative items are not just in the medical industry but across the 3M product line. Adhesives that are pressure sensitive are very complicated to manufacture. Optical lenses for computer displays and military use are in highly specialized markets. Pharmaceutical products often require extensive testing and research before they can be approved by government regulation. 3M has also patented about 40,000 products making product duplication almost impossible.(2) Bargaining Power of the Buyer, Buyer Purchases Large Volumes Threat: One significant threat that increases the bargaining power of the buyer for 3M is the sheer amount of products that businesses and corporations purchase from 3M. This is a high threat because their buying power increases due to the significance of their sales adds to 3M’s balance sheet. 3M sells it’s products to major medical, technological, and housing networks. 90 % of homes use transparent tape manufactured by 3M.(2) It takes 1,000 layers of optical film made by 3M to produce a product like a window reflector. The customers of 3M are creating relationships that increase their negotiating power. Bargaining Power of the Supplier, Industry is an Important source of Revenue Opportunity: The size of 3M provides a high opportunity when it comes to supplier bargaining power. The company employs more than 74,800 people and is located in the US, Europe, Asia, Middle East, and Africa. (4) If a supplier will not negotiate with 3M they will usually vertically integrate into that supply category. They will buy all of the necessary materials to produce the supplies needed themselves. Therefore suppliers look at 3M as an important source of revenue for their company. They see the amount of product that 3M manufacturers and purchases from them and it only strengthens their relationship with the company. They cannot afford to lose the business of a company like 3M because it is often a significant portion of their market share. Bargaining Power of the Supplier, Supply is not an important input opportunity: The type of products that 3M purchases are usually raw materials. These raw materials are not as significant of an input as differentiated . If 3M doesn’t find the right business from one of it’s providers it can simply find another provider of raw materials to buy from. The significantly reduces the bargaining power of the suppliers because the supply is not differentiated. There are no switching costs of choosing a different supplier for raw materials. (needs strengthening) Threat of substitutes: This is what I have so far I’m having trboule with the suppliers and threat of subsititues.

![Labor Management Relations [Opens in New Window]](http://s3.studylib.net/store/data/006750373_1-d299a6861c58d67d0e98709a44e4f857-300x300.png)