Information for Providers * Key features of VET Funding Contracts

advertisement

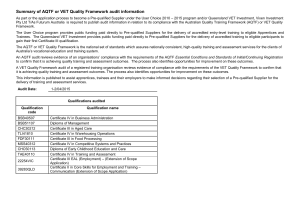

Information for Providers Key features of VET Funding Contracts VET Funding Contracts The Government has issued five types of VET Funding Contract for registered training organisations to deliver training under the Victorian Training Guarantee: 2014-16 VET Funding Contract 2014-16 VET Funding Contract (TAFE) 2014-16 VET Funding Contract (Dual Sector) 2014 VET Funding Contract 2014 VET Funding Contract (Non-Victorian based RTO delivering to a National Enterprise) The purpose of this document is to provide an overview of some of the common key features of the VET Funding Contracts. A snapshot of these items is at the end of this document. Key Features Foundation Skills A Foundation Skills Approved Provider List is being introduced, to come into effect during the course of 2014. Further information on the process for providers to apply to be on the Approved Provider List will be issued by the Department shortly. Providers with relevant scope of registration and funded scope will be able to deliver Foundation Skills courses whilst the process is being conducted. To ensure that the Pre-Training Review process is being used to direct students into the best type of training for them, providers will now be required to document and retain auditable evidence that demonstrates how it determined which qualifications the student is enrolled in and why this was the most appropriate training option for that student. For Foundation Skills training, these changes will mean that students are only enrolled in courses that are relevant and provide the additional basic skills they need to undertake further study or do their jobs well. Eligibility of students enrolled in school for the Victorian Training Guarantee The Government is placing renewed emphasis on school students accessing vocational education and training that is undertaken as part of the education program approved by the school through the VET in Schools program and funding for school-based apprentices and trainees. Key features of VET Funding Contracts - 15 November 2013 As a consequence, from 1 January 2014 funding through the Victorian Training Guarantee (VTG) will not be available for enrolments by school students outside the program of study approved by their school. This includes students enrolled in any government, non-government, independent, Catholic or home school. The availability of funding under the VTG for school-based apprentices and trainees will not change. Regional Loading increased Recognising the importance of training delivery in regional areas, the regional loading has been increased from 5 per cent to 10 per cent for all new and continuing commencements in 2014. The loading continues to apply at the unit level to training reported as being delivered in designated postcodes set out in the Regional Postcodes Report. Fee Concession Contribution increased From 1 January 2014, Government will increase its contribution to a provider’s forgone fee revenue for concession students, which will mean in most cases there will be no gap for providers. The Government is increasing the contribution it pays providers towards revenue forgone from 90 per cent to 100 per cent (up to a maximum value). Concession contributions continue to be calculated on the basis of reported hourly student tuition fees, up to a maximum concession contribution rate for each course. For courses where this maximum rate was previously lower than $2 per hour, it has now been increased to $2 per hour. Course subsidies The Government, including the Market Monitoring Unit, is continuing to monitor the training market and has made changes to subsidies in response to behaviours in the market. Course subsidies for 2014 have been confirmed by the Government and have been published on the ‘2014 Funded Courses Report’ in the Documents section of SVTS. These course subsidies will apply from 1 January 2014 for both new commencements in 2014 and students continuing into 2014 from previous years. Subcontracting Subcontracting and third party arrangements involving the delivery of training and assessment continue to be a point of focus for the Department, regulators and the National Skills Standards Council. Risks to quality and compliance have been identified at a State and national level where training and assessment is delivered by a non-registered training organisation. In order to continue to drive quality professional and organisational practice in the government subsidised training market, from 2014 providers will be required to seek the prior written approval of the Department before subcontracting training and assessment (as distinct from 2 Key features of VET Funding Contracts - 15 November 2013 administrative or operational matters) to any third party that is not a contracted RTO, including RTO and non-RTO entities. Introduction of monetary amounts You will note that the Contract includes reference to the Department’s power to require payment of a ‘monetary amount’ in relation to Evidence of Participation, Evidence of Eligibility and Evidence of Concession audit outcomes as set out in the Program Specifications. Amendments to the Education and Training Reform Act 2006 made late last year conferred a broad power on the Department to require the payment of monetary amounts in the event of material breach of the Contract. In considering the appropriate application of this power the Department has taken a conservative, proportional and considered approach. The requirement to pay a monetary amount will be exercised in the context of the Victorian Training Guarantee Compliance Framework as one of a range of compliance and enforcement activities, taking into consideration the nature and the scale of the identified non-compliance. Please refer to the fact sheet ‘Monetary Amounts for Contract Breaches’, published in the Documents section of SVTS, for further information on the Department’s approach to applying and calculating monetary amounts. Reduced reporting burden Recognising the administrative effort involved in meeting hardwired reporting requirements under the current Agreement, the 2014-16 VET Funding Contract has rebalanced the reporting burden. In particular, you will note that providers are no longer required to notify the Department of any Brokering Arrangements as they occur, but may be asked to provide this information on written request by the Department. Tuition Fees Providers are no longer required to calculate and publish tuition fees at an hourly rate, for hours undertaken in the calendar year. Instead, you are now able to calculate tuition fees according to the needs of your organisation. Tuition fees for each course must be published in a prominent place on your website. Please note, for the purpose of reporting tuition fees to the Department through SVTS, providers must continue to report the tuition fee expressed as an hourly rate. Who can I contact if I require further information? If you have a question regarding your VET Funding Contract please submit it to the Department using the Enquiry function of SVTS under the appropriate category. 3 Key features of VET Funding Contracts - 15 November 2013 Snapshot of key features of VET Funding Contracts Feature Key points Clause ref Funded Scope Updated definition, Department continues to reserve right to determine an RTO’s funded scope. Terms & Conditions Clause 1 Foundation Skills Approved Provider List Must be an Approved Foundation Skills Provider to deliver foundation skills courses under government subsidy effective from date of notification by Department. Terms & Conditions Clause 4 RTOs must seek the prior written approval of the Department before subcontracting training and assessment (as distinct from administrative or operational matters) to any third party that is not a contracted RTO. Terms & Conditions Clause 5 Subcontracting Reporting Fee for Service training activity The COAG Standing Council on Tertiary Education, Skills, and Employment has mandated that all RTOs must report Total VET Activity (including fee for service training delivery) from 1 January 2014. Variation of Funds Department can vary Funds with 10 business days’ notice. Department may require payment of a ‘monetary amount’ in relation to certain contract breaches. Introduction of monetary amounts Publication of registration audit report Please refer to the fact sheet ‘Monetary Amounts for Contract Breaches’ published in the Documents section of SVTS for further information on the Department’s approach to applying and calculating monetary amounts. No longer be required to publish registration audit report on website. Instead, RTOs must publish a summary of this information as specified in the Contract. Eligibility for VTG School students not eligible for the VTG outside of school curriculum i.e. not eligible except as a School Based Apprentice/Trainee. Pre-Training Review Must retain evidence of Pre-Training Review. Training Plans Clarification that the Training Plan, RTO endorsement and student endorsement can be in electronic format. Terms & Conditions Clause 6 Program Specifications Clause 11 Terms & Conditions Clause 7.2c Terms & Conditions Clause 16.2(e) Program Specifications Clause 13 Program Specifications Clause 1.2 Program Specifications Clause 2.1 Program Specifications Clause 4.5 Program Specifications Clauses 6.4 and 6.5 4 Key features of VET Funding Contracts - 15 November 2013 Snapshot of key features of VET Funding Contracts Feature Reporting of trainer qualifications Third party arrangements Regional Loading Concession contribution Tuition fees Key points Must submit information on the number of trainers and assessors with Diploma level or above qualifications related to teaching and training, and the title of the highest qualification held and indicate whether the trainer or assessor is involved in the delivery of foundation skills. No longer required to notify the Department of any Brokering Arrangements as they occur. May be required to provide details of all third party arrangements for the delivery of Training Services on the RTO’s behalf. This may include but is not limited to: determination of eligibility and enrolment processes, Pre-Training Reviews, marketing, and Brokering Services. Increased from 5 per cent to 10 per cent for new and continuing students. Increased from 90 per cent contribution toward revenue forgone to 100 per cent contribution up to a maximum value. For courses where the maximum contribution value was previously lower than $2 per hour, it has now been increased to $2 per hour. No longer required to charge fees on an hourly basis. No longer required to publish fees at an hourly rate but must publish fees in a prominent place on the website. Now able to charge fees across calendar years. Must, however, continue to report tuition fee expressed as an hourly rate through SVTS. Clause ref Program Specifications Clause 11.3 Program Specifications Clause 11.7 Program specifications Clause 12.6(b) Program Specifications Clause 12.12 2014 Guidelines about Fees 5