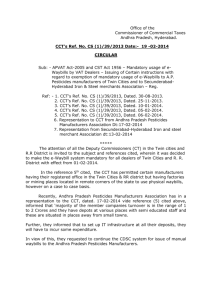

Circular_TrptrDecl_GovtDepts_14102015

advertisement

1 GOVERNMENT OF ANDHRA PRADESH COMMERCIAL TAXES DEPARTMENT Office of the Commissioner (CT) Andhra Pradesh, Hyderabad CCT’s Ref: AI(1)/45/2014 Dated: 14 - 10-2015 CIRCULAR Sub:- A.P.VAT Act & CST Act- Inter-State movement of goods- Goods purchased by Government Departments and consumers for their own use- Insistence to obtain transport declarations at border check Posts/ICPs–Certain complaints received – Issuance of certain instructions – Regarding. Ref:- 1) G.O.Ms.No.26 Rev.CT Dept. Dt.05.02.2015. 2) Circular of the Commissioner(CT), A.P., Hyderabad communicated by JC(CT) Enft.I through e.mail dt.26.02.2015. 3) Circular in CCT’S Ref.No.A.I(1)/45/2014 dt.18.03.2015. 4) Circular in CCT’S Ref.No.Enft/E3/422/2015 dt.06.05.2015. 5) Circular in CCT’S Ref.No.A.I(1)/45/2014 dt.02.04.2015. 6) Circular in CCT’S Ref.No.A.I(1)/45/2014 dt.22.05.2015. 7) Circular in CCT’S Ref.No.Enft/E3/329/2015 dt.04.06.2015. 8) Circular in CCT’S Ref.No.A.I(1)/45/2014 dt.06.06.2015. 9) Circular in CCT’S Ref.No.A.I(1)/45/2014 dt.15.09.2015. **** It is to inform that certain representations were received from transporters that the check post officials detaining the goodsvehicles and insisting for payment of tax, penalty and C.Fee on the movement of goods purchased from sellers of outside the State by the Government Departments of Andhra Pradesh and consumers for their own use on the premise that the said consignment have not been covered by e.way bills and transport declarations as prescribed in the relevant Act and Rules and circulars issued thereby. In this regard, as per Rules 55(1) & 55(2) of the APVAT Rules 2005, issue of way bill shall not be necessary where a person who is not a dealer transports house hold goods or other articles intended for their own use from one place to another and also in the case of dealers in Schedule.I goods. Hence the Government Departments and other persons cannot furnish eWay bill. Therefore, facility is not provided in VATIS for the transporter to generate electronically, a declaration in Form 650 to those goods, where the buyer/ consignor is not a dealer in Andhra Pradesh and a consumer. Under these circumstances, transport declaration also cannot be insisted. In cases where, goods are obtained by Government Departments/ persons for own consumption, these goods vehicles shall be allowed to pass through, if they are covered by proper 2 invoice and also a certificate/ declaration from the authorized official of the Government Department/ sufficient documentary evidence in support of own use about the procurement and transportation of the relevant goods. In cases, where goods are purchased by other than dealer or person for personal use, these goods vehicles may be allowed to pass through, if they are covered by proper invoices and also after conducting proper inquiries and ascertaining that the goods are obtained by buyer/ consignee only for own use but not for resale or in the course of business. Hence all the check post authorities and other field officers are instructed to follow the above instructions scrupulously. Sd/- J.Syamala Rao, Commissioner of Commercial Taxes, A.P. To All the Deputy Commissioners (CT) in the state All the Assistant Commissioners (CT)in the state All the Commercial Tax Officers in the state All the A.O.s of the Check Posts in the state Copy to all the Senior Officers in the office of Commissioner (CT) //f.b.o.// Sd/- T. Ramesh Babu, Joint Commissioner (CT)(Computers)