Tariff-Scheme_The-Indian-Reprographic-Rights-Organisation

advertisement

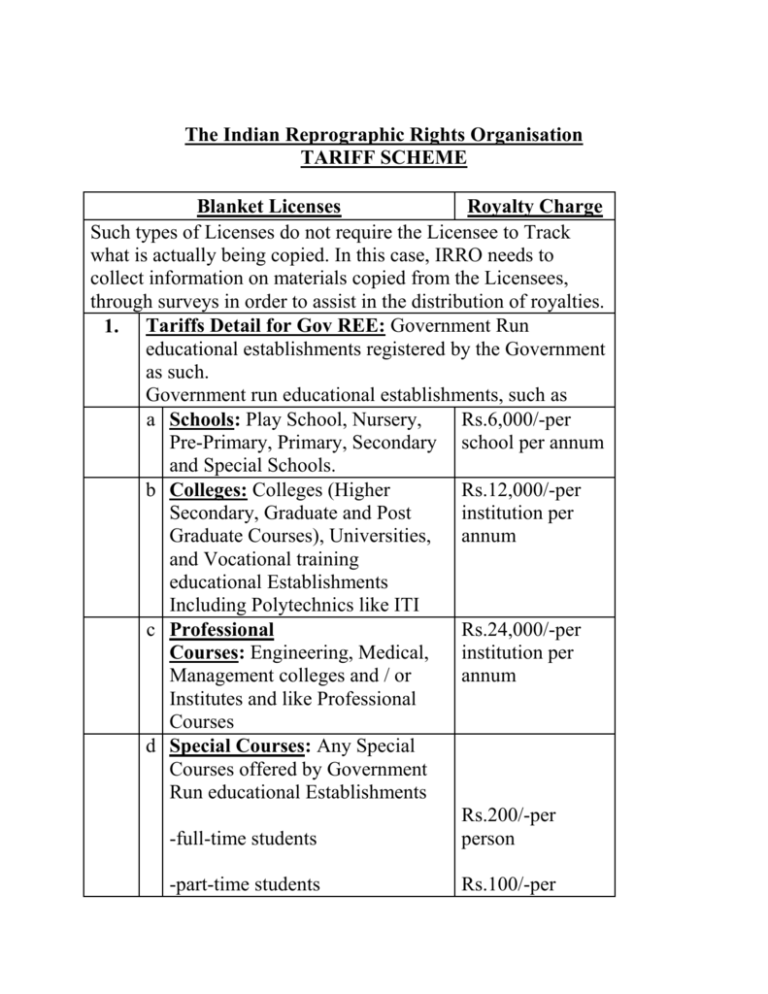

The Indian Reprographic Rights Organisation TARIFF SCHEME Blanket Licenses Royalty Charge Such types of Licenses do not require the Licensee to Track what is actually being copied. In this case, IRRO needs to collect information on materials copied from the Licensees, through surveys in order to assist in the distribution of royalties. 1. Tariffs Detail for Gov REE: Government Run educational establishments registered by the Government as such. Government run educational establishments, such as a Schools: Play School, Nursery, Rs.6,000/-per Pre-Primary, Primary, Secondary school per annum and Special Schools. b Colleges: Colleges (Higher Rs.12,000/-per Secondary, Graduate and Post institution per Graduate Courses), Universities, annum and Vocational training educational Establishments Including Polytechnics like ITI c Professional Rs.24,000/-per Courses: Engineering, Medical, institution per Management colleges and / or annum Institutes and like Professional Courses d Special Courses: Any Special Courses offered by Government Run educational Establishments Rs.200/-per -full-time students person -part-time students Rs.100/-per person -full-time teachers -part-time teachers Rs.400/-per person Rs.200/-per person e Course packs 2. Rs.0.50 per page Tariffs detail for Gov AEE: Government Financially Aided educational establishments registered by the Government, such as a Schools: Play School, Nursery, Rs.12,000/-per Pre-Primary, Primary, Secondary school per annum and Special Schools b Colleges: Colleges (Higher Rs.24,000/-per Secondary, Graduate and Post institution per Graduate Courses), Universities, annum and Vocational training educational Establishments Including Polytechnics like ITI c Professional Courses: Rs.48,000/-per Engineering, Management, institution per Medical Colleges or Institutes and annum the like Professional Courses such as IITs d Special Courses: Any Special Courses offered by Government Financially Aided educational Establishments Rs.400/-per -full-time students person -part-time students Rs.200/-per person -full-time teachers -part-time teachers e Course packs 3. Rs.800/-per person Rs.400/-per person Rs.0.50 per page Tariff Detail for PS EE: Private Sector (Proprietorship/ Pvt. Ltd./ Ltd. / Trust) whether Non – Profit and / or For-profit Educational Establishments registered as such by the Government / not registered by the Government; including but not limited to, Autonomous Establishments ; AICTE Approved or Approved by any other Government and / or Non Government Establishments ; Affiliated to Government University and/ or Government Approved University; Affiliated to Foreign University and / or Institution; Establishments offering Certificate Courses; or any other than 1 or 2 above a Schools: (per school per annum) -Play School, Nursery, PrePrimary, Primary Rs.48,000/and Special Schools -Secondary Schools Rs.64,000/- -Higher Secondary Schools Rs.96,000/- b Colleges: Colleges (Higher Secondary, Graduate and Post Graduate Courses), Universities, Rs.1,44,000/-per institution per annum and Vocational training educational Establishments Including Polytechnics like ITI c Professional Courses: Engineering, Management, Medical Colleges or Institutes and the like Professional Courses such as IIMs d Special Courses: Any Special Courses offered by educational Establishments under this heading or any other than 1 or 2 above -full-time students Rs.2,88,000/-per institution per annum Rs.1600/-per person Rs.800/-per person -part-time students -full-time teachers. -part-time teachers e Course packs 4. Rs.3200/-per person Rs.1600/-per person Rs.0.50 per page Government departments or Public Rs.40/- per bodies; Public sector Units like HAL person per annum / ONGC etc; Semi Government Establishments and / or Autonomous Establishments under Government Ministries / Department like QCI / NRBPT etc 8. Not-for-profit business support organizations like Charitable Organizations and / or NGOs Corporate bodies, Offices, Private Tuition Classes or Associations including but not limited to industry / commerce / Indo-Foreign Chambers or Associations News Monitoring Services Organizations like PTI, UNI, NDTV etc Libraries & Copy Shops 8.1 Photocopy / Reprography Shops 5. 6. 7. Option 1- Blanket Annual Royalty Option 2- Blanket Annual Royalty Based On annual revenue Rs.60/-per person per annum Rs.240/-per person per annum Rs.3.00 per page Rs.960 per person per annum Rs.3,00,000/- per Shop annum 40% of Turnover 8.2 Manufactures / Sales Agents / Service Establishments offering Operation AMC to Photocopy shops 10% of Total copies charged from shops / establishments @ Rs.1.00/- per copy 8.3 Govt. Run Public Libraries Rs.20/- per member per annum 8.4 Libraries like British Library etc. (excluding Govt. libraries; Educational Establishments Libraries) like British Library etc. Rs.200/- per member per annum 8.5 Libraries (Run by Associations/ Chambers of Commerce/ Councils/ Autonomous establishments and paying Blanket License Royalty) like CII / FICCI / Departments of Embassies etc. Rs.120/- per person per annum + (plus) Rs.1000/- per Corporate member per annum 8.6 Libraries ( Run by Gov REE paying Blanket License Royalty) Schools: Colleges: Professional Courses: 8.7 Libraries ( Run by Gov AEE paying Blanket License Royalty) Schools: Colleges: Professional Courses: 8.8 Libraries ( Run by PS EE paying Blanket License Royalty) Schools: Rs.5/- per student per annum Rs.10/- per student per annum Rs.20/- per student per annum Rs.10/- per student per annum Rs.20/- per student per annum Rs.40/- per student per annum Colleges: Professional Courses: Rs.50/- per student per annum Rs.100/- per student per annum Rs.200/- per student per annum Transactional Licenses Royalty Charge Such type of Licenses provide convenient permissions for onetime or infrequent copying and require the Licensee to obtain permission in advance of copying Royalties are calculated on a per-page basis Rs.0.75 per page TL1. All Education establishments (Government Run or Government Aided), Government Departments or Public Bodies, Not-for-profit business Support organizations like Charitable Organizations Rs.3.00 per page TL2. Private Sector and/or For-profit Educational Establishments, Corporate bodies, Offices or Associations, News monitoring Services organizations Rs.1.00 per page TL3. Libraries & Copy Shops TERMS & CONDITIONS: 1) Royalty must be paid in the 1st quarter of the next financial year i.e. between April 1st to June 30th every year. Late payment will attract a penalty of 10% every quarter or part thereof. 2) All payments are to be made only by way of demand draft, pay order, or crossed cheque in favor of “Indian Reprographic Rights Organisation” only. 3) The royalty payable for this year will be calculated on pro rata basis from date of effect to March 31st irrespective of the date of payment notice. 4) The authorized associates of IRRO are authorized to send notice for payment and collect the royalty against temporary receipt. Final receipt will be issued only after receipt of clear payment from IRRO Head Office only. 5) VAT @ 4% shall be payable extra as applicable in each territory. 6) Royalty rates above are applicable strictly for one campus only. For each campus royalty calculation as well as royalty payments shall be made individually and separately. This shall be irrespective of parent establishment or affiliation or its head office having paid for itself. 7) All royalty rates calculated on per employee basis shall always include employees on contract, employees through service provider and / or employees working at / for the offices of the said establishment. Exemption shall be provided only in cases where the services provider / contractor produces written or electronic proof showing that royalty has already been paid for employees working through his payroll. 8) All of the above copyright royalty payments for “Reprographic Rights” are payable irrespective of the fact, whether the establishment has a photocopy / Xerox machine or not. For more details, queries, clarifications, etc. please contact on above contact detail or visit www.irro.org.in 9) Receipt of IRRO tariff scheme constitutes “Notice” under law. Failure to procure valid license(s) shall be prosecutable under various civil and criminal laws and procedures.