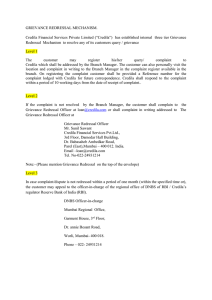

Fair Practice and Grievance Redressal Mechanism

advertisement

CORE VALUES OF MADURA MICROFINANCE LTD The Core Values of Madura Microfinance are; To provide low-income women and their families, an access to financial services that are designed to enhance their well-being, and are delivered in a manner that is ethical, dignified, transparent, equitable and cost effective. To ensure quality services to our members which are appropriate to their needs, and delivered efficiently in a convenient and timely manner. To maintain high standards of professionalism based on honesty, non-discrimination and customer centricity. To provide complete and accurate information to our members regarding all products and services offered. To create awareness and enable our members and all other stakeholders to understand the information provided with respect to financial services offered and availed. To ensure that our members are protected against fraud and misrepresentation, deception or unethical practices. To ensure that all practices related to lending and recovery of loans are fair and maintain respect for our member’s dignity and with an understanding of our member’s vulnerable situation. To safeguard personal information of our members, allowing disclosures and exchange of relevant information with authorized personnel only, and with the knowledge and consent of our members. To provide our members formal and informal channels for feedback and suggestions. To consistently assess the impact of services in order to enhance competencies and serve our members better. To provide a formal grievance redressal mechanism for our members. CODE OF CONDUCT WE FOLLOW Providing credit services to our members. Recovery of credit provided to our members. Providing insurance services, remittance services, or any other related products and services. Formation of any type of community collectives including self-help groups, joint liability groups and their federations. Business development services including marketing of products or services made or extended by the eligible our members or for any other purpose for the welfare and benefit of our members. TRANSPARENCY & FAIR PRACTICES We provide following details in transparent and understandable manner a) Interest Rate b) Processing fee c) Insurance Premium d) Any other charges or fees howsoever described e) All other terms and conditions of loan We maintain formal records of all transactions in accordance with all regulatory and statutory norms, and borrowers’ acknowledgment/acceptance of terms/conditions form a part of these records. For the benefit of our members we have monthly repayment cycle. None of our staff visit the members for collection; the members on rotation visit our branches to remit cash. Immediately after remittance, proper MMFL receipts are handed over to the members from the Branch Cash Point. Promptly remitting SHGs are eligible for interest Rebate @ 0.6% p.a. We circulate a monthly periodicals free of cost to groups, to generate awareness on relevant socio-economic and health related topics. WE ENDORSE Promotion and strengthening of Microfinance movement in the country by bringing our low -income members to the mainstream financial sector. Build progressive, sustainable, and member-centric systems and practices to provide a range of financial services (consistent with regulation) to our members. Cooperation and coordination among themselves and other agencies in order to achieve higher operating standards and avoid unethical competition in order to serve our members better. MEMBERS REDRESSAL MECHANISM In case of any complaints/ grievances/ disputes/ queries, the customers can make use of the following Grievance Redressal Mechanism within the organisation at various levels. Level - I Contact Cluster Manager, Regional Manager at field level and discuss the issue. The contact details of the concerned staff indicated above are made available to the members at the time of sanctioning of the loan as well as displayed in cluster offices. Level - II If the issues are not resolved, members can contact the Grievance Manager at Corporate Office. Normal time taken to resolve a complaint is 48 hours. Mr. Chandrashekaran Grievance Manager Contact # - 9047011358/ 044-42054369. Level - III If in case the issues are not resolved within 48 hours of the communication, write a letter or contact; Mr. M.Narayanan Chief Executive Officer Madura Microfinance Ltd # 36, 2nd main road, Kasturibai Nagar Adyar, Chennai – 600020. 044-42054369. At corporate office a grievance register is maintained by the Grievance Manger displaying the date, nature of complaint, member’s name, group details, mode of communication, action taken and date of settling the complaint. A statement of “Grievances received and action taken” statement along with pending complaints if any is placed before the Board for its review every quarter. Level - IV The members can also write to the contact person from Reserve Bank of India as below General Manager Department of Non-Banking Supervision, RBI, Fort Glacis, Rajaji Salai, Chennai – 600001. Phone no – 044 25393406 Fax no – 044 25393797 Email ID: dnbschennai@rbi.org.in As indicated by RBI we have also displayed contact details of GM RBI, at our branches.