Chapter 14

advertisement

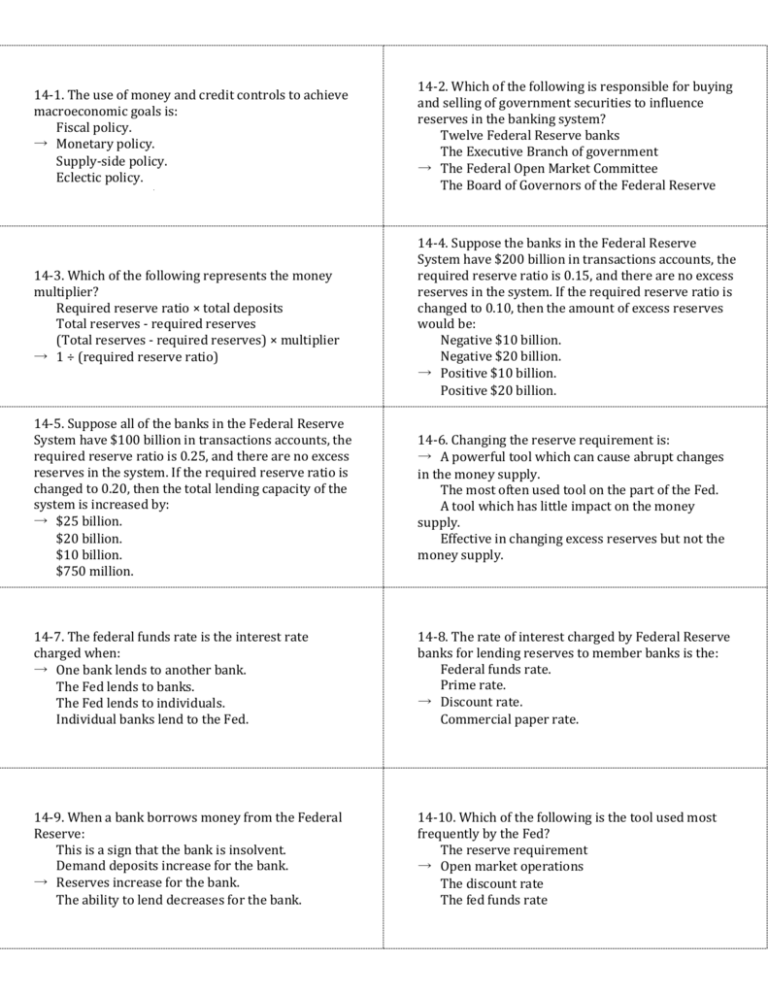

14-1. The use of money and credit controls to achieve macroeconomic goals is: Fiscal policy. → Monetary policy. Supply-side policy. Eclectic policy. 14-2. Which of the following is responsible for buying and selling of government securities to influence reserves in the banking system? Twelve Federal Reserve banks The Executive Branch of government → The Federal Open Market Committee The Board of Governors of the Federal Reserve 14-3. Which of the following represents the money multiplier? Required reserve ratio × total deposits Total reserves - required reserves (Total reserves - required reserves) × multiplier → 1 ÷ (required reserve ratio) 14-4. Suppose the banks in the Federal Reserve System have $200 billion in transactions accounts, the required reserve ratio is 0.15, and there are no excess reserves in the system. If the required reserve ratio is changed to 0.10, then the amount of excess reserves would be: Negative $10 billion. Negative $20 billion. → Positive $10 billion. Positive $20 billion. 14-5. Suppose all of the banks in the Federal Reserve System have $100 billion in transactions accounts, the required reserve ratio is 0.25, and there are no excess reserves in the system. If the required reserve ratio is changed to 0.20, then the total lending capacity of the system is increased by: → $25 billion. $20 billion. $10 billion. $750 million. 14-6. Changing the reserve requirement is: → A powerful tool which can cause abrupt changes in the money supply. The most often used tool on the part of the Fed. A tool which has little impact on the money supply. Effective in changing excess reserves but not the money supply. 14-7. The federal funds rate is the interest rate charged when: → One bank lends to another bank. The Fed lends to banks. The Fed lends to individuals. Individual banks lend to the Fed. 14-8. The rate of interest charged by Federal Reserve banks for lending reserves to member banks is the: Federal funds rate. Prime rate. → Discount rate. Commercial paper rate. 14-9. When a bank borrows money from the Federal Reserve: This is a sign that the bank is insolvent. Demand deposits increase for the bank. → Reserves increase for the bank. The ability to lend decreases for the bank. 14-10. Which of the following is the tool used most frequently by the Fed? The reserve requirement → Open market operations The discount rate The fed funds rate 14-2. The FOMC plays the very important role of setting short term interest rates and setting the level of reserves held by private banks. 14-1. Monetary policy allows the Federal Reserve to stabilize the macroeconomy somewhat. 14-4. If the reserve requirement is changed to 10 percent, the banking system will now only need $20 billion in reserves versus the $30 billion needed with a .15 required reserve ratio, so banks will have excess reserves of $10 billion. 14-3. The money multiplier tells us how much money creation will result from each dollar of deposits. 14-6. Changing the required reserve ratio changes the excess reserves immediately and can result in banks quickly trying to achieve the new required level of reserves which will impact the overall economy. 14-5. If the reserve requirement is changed to 20 percent, the banking system will now only need $20 billion in reserves versus the $25 billion needed with a 0.25 required reserve ratio, so banks will have excess reserves of $5 billion; this will allow for new loans of $25 billion, since the money multiplier is 5. 14-8. Traditionally, the Fed will lend to member banks at an interest rate known as the discount rate, which is an overnight loan allowing member banks to meet the minimum level of required reserves. 14-7. When a bank is deficient in reserves, it can go to the federal funds market to borrow what it needs from another bank. 14-10. The open market operations are conducted daily and do not have as large undesirable effects as altering the reserve requirement; as such, they are the Fed's favored tool. 14-9. When a bank borrows money from the Fed, the bank's balance sheet has an equal increase in liabilities which includes loans from the Fed and assets which includes the additional reserves. 14-11. When the Fed wishes to increase the reserves of the member banks, it: → Buys securities. Raises the reserve requirement. Raises the discount rate. Sells securities. 14-12. Tony buys a bond in the amount of $500 with a promised interest rate of 15 percent. If the market interest rate decreases to 5 percent, Tony can sell his bond for up to: $500. $250. → $1,500. $1,250. 14-13. The Fed can decrease the federal funds rate by: Selling bonds. → Buying bonds which causes market interest rates to fall. Simply announcing a lower rate since the Fed has direct control of this interest rate. Changing the money multiplier. 14-14. If the Fed wishes to increase the money supply it could: → Lower the discount rate. Raise the minimum reserve ratio. Sell securities on the open market. Issue more bonds. 14-15. In order to increase the money supply the Fed can: Raise the reserve requirement, increase the discount rate, or sell bonds. Raise the reserve requirement, increase the discount rate, or buy bonds. Lower the reserve requirement, increase the discount rate, or buy bonds. → Lower the reserve requirement, decrease the discount rate, or buy bonds. 14-16. If the Fed buys $150 billion of U.S. bonds in the open market and the reserve requirement is 5 percent, M1 will eventually: → Increase by $3,000 billion. Decrease by $3,000 billion. Increase by $300 billion. Decrease by $300 billion. 14-17. Suppose the required reserve ratio is 20 percent, and the Fed buys $1 million worth of bonds from the public. If the public deposits this amount into transactions accounts, the money supply will: Increase directly by $1 million and additional lending capacity of $3 million will be created for the banking system. → Increase directly by $1 million and additional lending capacity of $4 million will be created for the banking system. Not to be affected directly, but additional lending capacity of $5 million will be created for the banking system. Increase directly by $5 billion. 14-12. The market interest rate will be the yield or return that the purchaser of the bond can expect to earn. Using the yield formula and solving for the current price, one can determine the highest price an investor would be willing to pay for this existing bond. Since the buyer will earn a 5 percent return or yield and the annual interest payment will be $75, the bond will sell for up to $1500 (75/0.05). 14-11. When the Fed buys securities, reserves are injected directly into banks in exchange for their bonds, making more loans possible. 14-14. By lowering the discount rate, the Fed encourages banks to borrow more from the Fed, thereby increasing reserves and lending capacity. 14-13. Bond prices and yields move in opposite directions. If the Fed buys bonds, bond prices rise and yields (interest rates) fall. 14-16. The money multiplier is equal to 1 ÷ required reserve ratio, which allows a $150 billion injection to support $3,000 billion in additional deposits, which are included in M1. 14-15. The traditional tools of the Fed include changing the discount rate, the reserve requirement, and open market operations, with the last being the most popular. 14-17. The money multiplier is equal to 1 ÷ required reserve ratio, which allows a $1 million injection to support $5 million in additional deposits of which $4 million will be additional loans.